Tractor Supply Co. (TSCO) - Bull of the Day

April 18 2011 - 8:00PM

Zacks

On the back of strong same-store sales, improved merchandise mix,

prudent inventory management and effective cost control,

Tractor

Supply Co. (TSCO) posted better-than-expected fourth-quarter

2010 results. The quarterly earnings beat the Zacks Consensus

Estimate of $0.62. Furthermore, margins improved due to portfolio

expansion of private label brands and focus on direct sourcing of

merchandise.

The company has set a long-term target of generating 25% of

sales from private label brands and 13% from strategic direct

sourcing. Tractor is well positioned to capitalize on positive

long-term trends. The company is expecting sales in the range of

$4.0 billion to $4.07 billion in fiscal 2011.

Moreover, Tractor Supply's nearly debt-free balance sheet augurs

well for future operating performance. Currently we maintain our

Outperform recommendation on the stock.

TRACTOR SUPPLY (TSCO): Free Stock Analysis Report

Zacks Investment Research

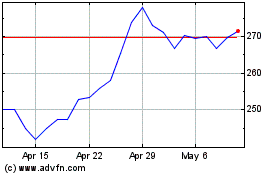

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From May 2024 to Jun 2024

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From Jun 2023 to Jun 2024