AMD to Cut 10% Workforce - Analyst Blog

November 07 2011 - 10:15AM

Zacks

Advanced Micro Devices Inc.(AMD) plans to

eliminate 10% of its workforce or about 1,400 jobs in order to

reduce operational costs. This layoff is an attempt by AMD to

optimize its cost structure and thereby improve its

competitiveness.

The workforce reduction is expected to be over by the first

quarter of 2012 and will be conducted globally across all its

divisions. Along with other unspecified operational changes, the

layoffs are expected to save $200 million in 2012.

Management is looking to reinvest some of the savings into newer

business areas, including chips for devices such as tablet-style

computers in emerging markets and Internet-related opportunities

(mainly cloud computing).

Advanced Micro has been suffering from the slowdown in the

global PC market plus the delay in important new chips due to

manufacturing hiccups this year. The company’s third-quarter sales

of $1.69 billion missed its guidance of a 10% sequential increase

after Globalfoundries Inc. couldn't supply enough of Advanced

Micro’s new laptop chips to meet demand.

Most of Advanced Micro’s business is in chips for PCs that don’t

have a meaningful presence in smartphones and tablets. We believe

that the weak computer market and the company’s failure to

penetrate the new mobile device market have forced it to refine its

cost structure.

The rise of mobile devices, meanwhile, is benefiting chip makers

such as Qualcomm Inc. (QCOM) and Texas

Instruments Inc. (TXN), processors of which are designed

to consume less power.

After a weak second quarter, Advanced Micro made a modest

comeback in the third quarter, with earnings of 13 cents a share

beating the Zacks Consensus Estimate by 3 cents. Worldwide PC sales

have been stagnant, while smartphones, tablets, and other mobile

devices experienced strong growth. In order to stay ahead of its

rivals like Intel Corp. (INTC) and NVIDIA

Corp(NVDA), we believe Advanced Micro would need to enter

these emerging markets.

Advanced Microshares currently carry a Zacks Rank of #3,

implying a Hold recommendation in the short term (1–3 months).

ADV MICRO DEV (AMD): Free Stock Analysis Report

INTEL CORP (INTC): Free Stock Analysis Report

NVIDIA CORP (NVDA): Free Stock Analysis Report

QUALCOMM INC (QCOM): Free Stock Analysis Report

TEXAS INSTRS (TXN): Free Stock Analysis Report

Zacks Investment Research

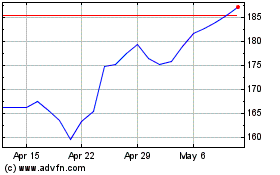

Texas Instruments (NASDAQ:TXN)

Historical Stock Chart

From May 2024 to Jun 2024

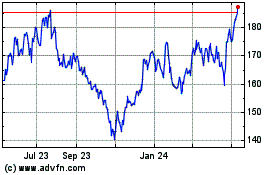

Texas Instruments (NASDAQ:TXN)

Historical Stock Chart

From Jun 2023 to Jun 2024