Competitive Strength of Retailers & Manufacturers in 2010 on the Rise

November 23 2010 - 9:00AM

Business Wire

The wRatings Corporation, an independent competitive research

firm, announced today the results of the annual Most Competitive

Retail & Manufacturers Study, which was sponsored by Fortna

Inc., a leader in designing, implementing and supporting complete

supply chain solutions. In the report, Coach (NYSE: COH) repeats

the most competitive large cap company, with Gildan Activewear

(NYSE: GIL) and Volcom (NASDAQ: VLCM) as most competitive for mid

and small cap firms. The report, available for free at both the

wRatings and Fortna websites, details the top 20 companies in each

market segment.

Covering 310 retailers and manufacturers, companies in apparel

and footwear are performing the best from both a customer and

financial perspective. Consumers are willing to pay a premium for

items that are “on display”, whereas “behind the scenes” products

like toiletries are open to the trade down syndrome seen throughout

the past recession. The key for pricing power though has shifted

from brand recognition to long-lasting products.

Gary A. Williams, CEO & founder of wRatings said, “Certain

retailers were smart enough to catch the safety and guarantee wave

when selling their products during the recession. With confidence

growing in the economy, consumers have moved beyond price/risk

decisions to look at price/preservation. Pricing power in this

holiday season will go to products that can prove their

durability.”

2010

RANK Large Caps Ticker Industry W

Score™ 1 Coach Inc. NYSE: COH Specialty Stores 96.5 2 Avon

Products Inc. NYSE: AVP Cosmetics & Toiletries 93.1 3 Nike Inc.

NYSE: NKE Footwear 92.1 4 Cemex SAB de CV NYSE: CX Machinery 89.0 5

AutoZone Inc. NYSE: AZO Automotive 88.4

2010 RANK

Mid Caps Ticker Industry W Score™ 1

Gildan Activewear Inc. NYSE: GIL Apparel 95.4 2 lululemon athletica

inc. NASDAQ: LULU Specialty Stores 94.5 3 Steven Madden Ltd NASDAQ:

SHOO Footwear 91.2 4 Copart Inc. NASDAQ: CPRT Automotive 90.3 5

Crocs Inc. NASDAQ: CROX Footwear 89.4

2010 RANK

Small Caps Ticker Industry W Score™ 1

Volcom Inc. NASDAQ: VLCM Apparel 91.9 2 Kenneth Cole Productions

Inc. NYSE: KCP Footwear 91.3 3 Brooks Automation Inc. NASDAQ: BRKS

Machinery 90.8 4 Blount International Inc. NYSE: BLT Machinery 85.5

5 Dorman Products Inc. NASDAQ: DORM Auto Parts 85.4

“Fortna is proud that our focus on defining and delivering our

client’s business case through our integrated supply chain

solutions and services has helped leading companies weather the

recent tough economic climate and prepare for recovery. This report

illustrates the importance of efficient supply chain practices and

highlights the business results achieved by our clients. We are

honored to have leading companies choose Fortna as their long-term

partner,” stated John A. White III, President at Fortna.

A W Score of 100 means the business built the highest customer

and economic advantages when compared to the 4,000+ companies in

the wRatings universe of coverage. To access a complimentary

version of the full report:

Fortna: http://www.fortna.com/wRatings:

http://www.wRatings.com/projections.php?s=2010

About wRatings Corporation

The wRatings Corporation is an independent competitive research

firm based in metro Washington DC. The company was founded by

research expert and Harvard Business Review author, Gary A.

Williams. He and his team continually study customer desires to

determine the sources of pricing power. Since 1999, their original

set of leading indicators uses a common framework to measure the

competitive strength of companies. For more information, visit

www.wRatings.com.

About Fortna - “Driving Supply Chain Results”

Fortna designs, implements and supports integrated solutions for

our clients through supply chain consulting, material handling

systems implementation and systems selection and implementation.

Our “no-silos” business approach ensures alignment strategically,

financially and operationally and brings our clients’ supply chain

strategy to life. Our integrated services and unmatched supply

chain design tools have provided long term and trust-based

relationships with clients in a wide range of industries including

multi-channel retail, consumer products, electronics, parts

distribution and third party logistics. www.fortna.com

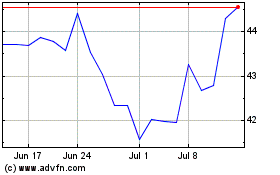

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Jun 2024 to Jul 2024

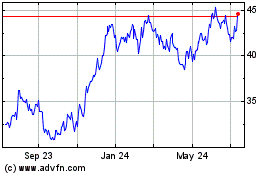

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Jul 2023 to Jul 2024