Additional Proxy Soliciting Materials (definitive) (defa14a)

May 31 2022 - 5:14PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| |

|

|

| ☐ |

|

Preliminary

Proxy Statement |

| |

|

| ☐ |

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

|

Definitive

Proxy Statement |

| |

|

| ☒ |

|

Definitive

Additional Materials |

| |

|

| ☐ |

|

Soliciting

Material Pursuant to §240.14a-12 |

SpartanNash Company

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| ☒ |

No

fee required |

| ☐ |

Fee

paid previously with preliminary materials |

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On

May 31, 2022, SpartanNash Company (the “Company”) published a communication to the Company’s Associates from Tony B.

Sarsam, the Company’s President and Chief Executive Officer. A copy of that communication can be found below.

***

Annual

Shareholders Meeting Update: May 31, 2022

As

we get closer to the shareholder vote at our Annual Meeting on June 9, I wanted to provide you with an update on where we are and what’s

ahead. I am pleased to share that today, we issued a press release announcing that proxy advisory firm Glass Lewis & Co issued a

recommendation that shareholders vote “FOR” ALL of SpartanNash’s highly qualified director nominees on the WHITE proxy card.

Glass

Lewis’ recommendation further validates the significant steps we have taken to drive change through the company’s transformation,

operating model and People First culture. We are pleased that Glass Lewis supports the election of all nine of our director nominees

and recognizes our Board’s proven track record of taking decisive, meaningful actions to transform SpartanNash.

In

the press release, we also noted that another advisory firm, Institutional Shareholder Services (ISS), issued a recommendation for shareholders,

advising them not to vote for all nine of our highly qualified director nominees. We are disappointed with this outcome and frankly,

we strongly believe ISS reached the wrong conclusion.

Firms

like Glass Lewis and ISS provide investors with research, data and recommendations on shareholder votes like this one. Members of our

Board had an opportunity to meet with Glass Lewis and ISS to share why we believe our director nominees are uniquely qualified to oversee

the Company’s continued positive momentum and deliver value for our shareholders.

It

is important to note that while SpartanNash shareholders may take into consideration the recommendation of Glass Lewis and ISS, it does

not control the outcome of a proxy contest – instead, it is up to shareholders to decide how to vote. If you are currently

a SpartanNash shareholder, we encourage you to support your Board and vote “FOR” our Board’s nominees on the WHITE proxy card. Every vote is important, regardless of how many shares you own.

As

a reminder, you can find all press releases and shareholder letters related to the Annual Meeting, presentations and voting information

at SpartanNashTransformation.com.

We

have so much to be proud of here at SpartanNash. Each of you has helped drive innovation and transform SpartanNash into the leading food

solutions company it is today. There is incredible momentum underway across the company, and I know that the best is yet to come.

Thank

you for your continued efforts and focus on serving our customers, store guests and fellow Associates. Let’s keep up the great

work and continue to deliver ingredients for a better life.

Forward-Looking

Statements

The

matters discussed in this communication include "forward-looking statements" about the plans, strategies, objectives, goals

or expectations of the Company. These forward-looking statements are identifiable by words or phrases indicating that the Company or

management “expects,” “anticipates,” “plans,” “believes,” or “estimates,”

or that a particular occurrence or event “may,” “could,” “should,” “will” or “will

likely” result, occur or be pursued or “continue” in the future, that the “outlook” or “trend”

is toward a particular result or occurrence, that a development is an “opportunity,” “priority,” “strategy,”

“focus,” that the Company is “positioned” for a particular result, or similarly stated expectations. Undue reliance

should not be placed on these forward-looking statements, which speak only as of the date made. There are many important factors that

could cause actual results to differ materially. These risks and uncertainties include the Company's ability to compete in the highly

competitive grocery distribution, retail grocery and military distribution industries; disruptions associated with the COVID-19 pandemic;

the Company's ability to manage its private brand program for U.S. military commissaries; the Company's ability to implement its growth

strategy; the ability of customers to fulfill their obligations to the Company; the Company's dependence on certain major customers,

suppliers and vendors; disruptions to the Company's information security network; instances of security threats, severe weather conditions

and natural disasters; impairment charges for goodwill and other long-lived assets; the Company’s ability to successfully manage

leadership transitions; the Company's ability to service its debt and to comply with debt covenants; interest rate fluctuations; changes

in the military commissary system, including its supply chain, or in the level of governmental funding; product recalls and other product-related

safety concerns; labor relations issues and rising labor costs; changes in government regulations; and other risks and uncertainties

listed under “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations”

in the Company's most recent Annual Report on Form 10-K and in subsequent filings with the Securities and Exchange Commission. Additional

risks and uncertainties not currently known to the Company or that the Company currently believes are immaterial also may impair its

business, operations, liquidity, financial condition and prospects. The Company undertakes no obligation to update or revise its forward-looking

statements to reflect developments that occur or information obtained after the date of this communication.

Important

Additional Information and Where to Find It

The

Company has filed a definitive proxy statement on Schedule 14A, an accompanying WHITE proxy card and other relevant documents with the

SEC in connection with such solicitation of proxies from the Company’s shareholders for the Company’s 2022 annual meeting

of shareholders. SHAREHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ THE COMPANY’S DEFINITIVE PROXY STATEMENT (INCLUDING

ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and shareholders may obtain a copy of the definitive proxy statement, an accompanying

WHITE proxy card, any amendments or supplements to the definitive proxy statement and other documents filed by the Company with the SEC

at no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge by clicking the “SEC Filings”

link in the “Investor Relations” section of our website, www.spartannash.com, or by contacting SpartanNashIR@icrinc.com as

soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC.

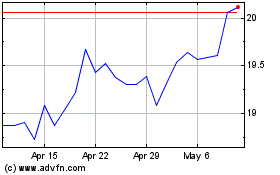

SpartanNash (NASDAQ:SPTN)

Historical Stock Chart

From Oct 2024 to Nov 2024

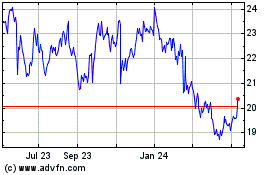

SpartanNash (NASDAQ:SPTN)

Historical Stock Chart

From Nov 2023 to Nov 2024