Macellum and Ancora Issue Supplemental Presentation Regarding SpartanNash

May 18 2022 - 8:00AM

Business Wire

Exposes and Refutes the Distortions in

SpartanNash’s May 16th Presentation

Reinforces the Urgent Need to Replace Three

Long-Tenured Directors who Chair the Board and Critical Committees

with Three New, Qualified and Independent Directors

Urges Shareholders to Vote for the Investor

Group’s Three-Member Slate on the BLUE

Proxy Card

Macellum Advisors GP, LLC and Ancora Holdings Group, LLC

(together with their affiliates, the “Investor Group” or “we”), who

beneficially own approximately 4.5% of the outstanding common

shares of SpartanNash Company (NYSE: SPTN) (“SpartanNash” or the

“Company”), today issued a rebuttal presentation to the Company's

May 16 presentation that highlights the incumbent Board of

Directors' (the "Board") apparent attempts to mislead shareholders

about its exceedingly poor capital allocation decisions, corporate

governance policies, financial and operating results, and

succession planning.

As a reminder, the Investor Group has nominated three highly

qualified and independent candidates for election to SpartanNash’s

Board of Directors at the 2022 Annual Meeting of Shareholders.

CLICK HERE TO DOWNLOAD

AND VIEW THE REBUTTAL PRESENTATION

Jonathan Duskin, Managing Partner of Macellum, and Fredrick D.

DiSanto, Chairman and Chief Executive Officer of Ancora,

commented:

"This contest at SpartanNash is about the need to replace three

extremely long-tenured directors who have collectively presided

over years of abysmal capital allocation, dismal shareholder

returns, poor governance, questionable succession planning and weak

strategic oversight.

We believe SpartanNash’s latest apparent attempt to mislead

shareholders and rewrite history about the incumbent Board’s

destruction of value and blatant lack of succession planning

validates our case for urgent change. We believe there are serious

risks associated with maintaining the status quo at SpartanNash,

including allowing the Company’s long-tenured directors – who have

already failed to create meaningful value for shareholders – to

continue to oversee management as it executes a reactionary and

suspect operating plan.

The Board’s reactive self-refresh, failed to add relevant

grocery and food distribution expertise or a shareholder’s

perspective. It also left the three directors we are targeting in

key leadership positions as Chair of the Board, Chair of the

Nominating and Governance Committee and Chair of the Audit

Committee, suggesting to us that once shareholder pressure is

eased, the Company will continue to underperform. With an

average tenure of over 19 years, we find no reason to have

Chairman Douglas Hacker, William Voss or Margaret Shan Atkins

continue at the helm of this Board.

Our nominees bring a shareholder perspective, operational

knowhow, relevant grocery and food distribution expertise and

successful track records. We strongly believe that all three

nominees, who collectively possess the right skills, experience and

perspectives to help drive long-term value at SpartanNash.”

***

Vote on the BLUE Proxy Card to Elect the Investor Group’s

Aligned and Qualified Nominees

Contact Info@SaratogaProxy.com With

Questions About How to Vote

***

About Macellum

Macellum Capital Management is an activist investment firm, with

deep expertise in the retail and consumer sectors, founded in 2009

by Jonathan Duskin. Macellum invests in undervalued companies that

it believes can appreciate significantly in value as a result of a

change in corporate strategy or improvements in operations, capital

allocation or corporate governance. Macellum’s investment team,

advisors and network of industry experts draw upon their extensive

strategic, operating and boardroom experience to assist companies

in designing and implementing initiatives to improve long-term

shareholder value. Macellum prefers to constructively engage with

management to improve its governance and performance for the

benefit of all shareholders. However, when management is

entrenched, Macellum has run successful proxy contests to

effectuate meaningful change. Macellum has run successful election

contests to effectuate meaningful change at many companies,

including at The Children’s Place Inc., Citi Trends, Inc., Bed Bath

and Beyond and Big Lots, Inc. Learn more at

www.macellumcapitalmanagement.com.

About Ancora

Founded in 2003, Ancora Holdings Group, LLC offers integrated

investment advisory, wealth management and retirement plan services

to individuals and institutions across the United States. The

firm's comprehensive service offering is complemented by a

dedicated team that has the breadth of expertise and operational

structure of a global institution, with the responsiveness and

flexibility of a boutique firm. For more information about Ancora,

please visit https://ancora.net.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220517006251/en/

For Investors: Saratoga Proxy Consulting John Ferguson / Joe

Mills, 212-257-1311 info@saratogaproxy.com

For Media: Longacre Square Partners Greg Marose / Casie

Connolly, 646-386-0091 macellum@longacresquare.com

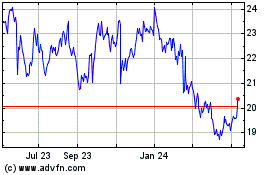

SpartanNash (NASDAQ:SPTN)

Historical Stock Chart

From Oct 2024 to Nov 2024

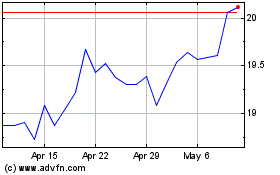

SpartanNash (NASDAQ:SPTN)

Historical Stock Chart

From Nov 2023 to Nov 2024