false

0001178697

0001178697

2023-12-08

2023-12-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d)

of

The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 8, 2023

Sonim

Technologies, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38907 |

|

94-3336783 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

4445

Eastgate Mall, Suite 200,

San

Diego, CA 92121

(Address

of principal executive offices, including Zip Code)

(650)

378-8100

(Registrant’s

telephone number, including area code)

Not

applicable.

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each Class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

SONM |

|

The

Nasdaq Stock Market LLC

(Nasdaq

Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item

5.02 |

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Employment

Agreement with Chief Executive Officer

On

December 8, 2023, following the approval of the compensation committee of the board of directors of Sonim Technologies, Inc. (the “Company”),

the Company and Peter Liu, the Company’s Chief Executive Officer, entered an amended and restated letter agreement (the “CEO

Employment Agreement”). The terms of Mr. Liu’s employment were amended as follows:

| |

(i) |

a

severance clause in the event of a change in control (the “Change in Control Severance”) was added; and |

| |

|

|

| |

(ii) |

Mr.

Liu’s eligibility for both discretionary and performance-based bonuses (the “Bonus Eligibility”), payable in cash

or in securities of the Company issuable under the Sonim Technologies, Inc. 2019 Equity Incentive Plan (the “Plan”) was

clarified in the text of the CEO Employment Agreement. |

The

Change in Control Severance means that if the Company terminates the CEO Employment Agreement without Cause (as defined in the CEO Employment

Agreement) within the six-month anniversary of a Change in Control (as defined in the Plan), then, Mr. Liu, subject to the execution

of a general release of claims and otherwise compliance with the restrictive covenants set forth in the CEO Employment Agreement and

the ancillary documents thereto, will be entitled to receive a sum equivalent to six (6) months of his base salary in effect as of the

termination date of the CEO Employment Agreement.

Employment

Agreement with Chief Financial Officer

On

December 8, 2023, following the approval of the compensation committee of the board of directors of the Company, the Company and Clay

Crolius, the Company’s Chief Financial Officer, entered an amended and restated letter agreement (the “CFO Employment Agreement”).

The terms of Mr. Crolius’s employment were amended as follows:

| |

(i) |

retroactively,

as of November 1, 2023, Mr. Crolius’s base salary was increased from $275,000 to $320,000; |

| |

|

|

| |

(ii) |

the

Change in Control Severance was added, with the terms identical to those in the CEO Employment Agreement; and |

| |

|

|

| |

(iii) |

Mr.

Crolius’s Bonus Eligibility was clarified in a manner identical to the CEO Employment Agreement. |

The

foregoing descriptions of the CEO Employment Agreement and the CFO Employment Agreement are qualified in their entirety by reference

to the full text of the CEO Employment Agreement and the CFO Employment Agreement, copies of which are filed herewith as Exhibits 10.1

and 10.2, respectively, and are incorporated herein by reference.

| Item

9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits.

| † |

|

Certain

schedules, exhibits, and similar attachments have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company hereby undertakes

to furnish copies of such omitted materials supplementally upon request by the SEC. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

SONIM

TECHNOLOGIES, INC. |

| |

|

|

| Date:

December 11, 2023 |

By: |

/s/

Clay Crolius |

| |

Name: |

Clay

Crolius |

| |

Title: |

Chief

Financial Officer |

Exhibit

10.1

December

8, 2023

Mr.

Peter Liu

Via

E-mail Delivery

Re:

Employment Agreement

Dear

Mr. Liu:

This

amended and restated letter agreement (the “Agreement”) confirms the terms of your employment with Sonim Technologies,

Inc. (the “Company”).

1.

Position and Duties. Effective December 8, 2023, you will continue to serve as the Chief Executive Officer (the “CEO”)

of the Company, reporting to the Company’s Board of Directors (the “Board”). You will also continue to

serve as a member of the Board. Of course, the Company may change your position, duties, and work location from time to time, as it deems

necessary within its sole discretion. You will devote your full and exclusive business time and attention to the business affairs of

the Company. You must obtain approval from the Board prior to joining membership of the board of directors of any other entity. As a

Company employee, you will be expected to abide by the Company’s rules and policies and to acknowledge in writing that you have

read the Company’s employee handbook.

2.

Compensation and Benefits.

(a)

Base Salary. You will receive a base salary of $450,000 per year, less required and designated payroll deductions and withholdings,

and payable according to the Company’s regular payroll schedule. Your annual base salary will be reviewed from time to time and

is subject to change at the discretion of the Company.

(b)

Benefits. You will be eligible to participate in the Company’s standard employee benefits pursuant to the terms, conditions

and limitations of the applicable benefit plans, which are subject to change from time to time.

(d)

Discretionary Bonus. You will be eligible to receive an annual bonus within the sole discretion of the Board of Directors. There

is no guarantee that you may receive a bonus at any time. Any determination as to whether the Company’s performance warrants a

bonus and the amount of any bonus earned as a result of such performance is determined by the Board in its sole discretion; provided,

however, that if the Board shall determine that a bonus is warranted, the target amount of such bonus will be 40% of your base salary

set forth in Section 2(a) of this Agreement, less required and designated payroll deductions and withholdings. Any bonus shall be paid

within thirty (30) days after the Board’s determination that a bonus shall be awarded, which typically shall occur in January of

each year. You must be employed on the day that your bonus (if any) is paid to earn the bonus. Therefore, if your employment is terminated

either by you or the Company for any reason prior to the bonus being paid, you will not have earned the bonus and no partial or prorated

bonus will be owed or paid. In addition, you shall be eligible to participate in any equity compensation plan or similar long-term incentive

program adopted by the Company, and the Board or any committee administering such plan may grant such additional bonuses and/or equity

compensation as it deems appropriate within its sole discretion.

3.

Proprietary Information Agreement and Company Policies. As a condition of your employment, you must sign and abide by the Company’s

standard form of Confidential Information and Invention Assignment Agreement (the “Proprietary Information Agreement”),

a copy of which is attached hereto as Exhibit A. In your work for the Company, you will be expected not to use or disclose any

confidential information, including trade secrets, of any former employer or other Person to whom you have an obligation of confidentiality.

Rather, you will be expected to use only that information which is generally known and used by Persons with training and experience comparable

to your own, which is common knowledge in the industry or otherwise legally in the public domain, or which is otherwise provided or developed

by the Company. You agree that you will not bring onto Company premises any unpublished documents or property belonging to any former

employer or other Person to whom you have an obligation of confidentiality. You hereby represent that your employment does not create

a conflict with any agreement between you and a third party.

4.

At-Will Employment Relationship; Board Resignation. Your employment relationship is at will, meaning either you or the Company may

terminate your employment relationship at any time, with or without Cause, and with or without advance notice. In addition, the Company

may modify the other terms and conditions of your employment, including, but not limited to, compensation, benefits, position, title,

reporting relationship and office location, from time to time in its sole discretion. Your at-will employment relationship can only be

changed in a written agreement signed by you and a duly authorized member of the Board. If you cease serving as the Company’s CEO

for any reason, you agree that this Agreement constitutes your resignation from the Board as of the date of such cessation of service.

5.

Definitions.

(a)

Cause. For purposes of this Agreement, “Cause” is defined as any of the following: (i) your commission

of any felony or any crime involving fraud, dishonesty or moral turpitude under the laws of the United States, any state thereof, or

any applicable foreign jurisdiction; (ii) your attempted commission of, or participation in, a fraud or act of dishonesty against the

Company or any affiliate of the Company; (iii) your intentional, material violation of any contract or agreement between you and the

Company or any affiliate of the Company or of any statutory duty owed to the Company or any affiliate of the Company; (iv) your unauthorized

use or disclosure of the Company’s or any affiliate of the Company’s confidential information or trade secrets; or (v) your

gross misconduct. The determination that a termination of your employment is either for Cause or without Cause shall be made by the Company

in its sole discretion.

(b)

Change in Control. For purposes of this Agreement, the definition of a “Change in Control” is as defined

in section 13(i) of the Company’s 2019 Equity Incentive Plan (as in effect on the date hereof).

(c)

Person. For the purpose of this Agreement, “Person” means an individual or an entity, including a corporation,

limited liability company, partnership, trust, unincorporated organization, association or other business or investment entity, or any

governmental authority.

6.

Code Section 409A. It is intended that all of the benefits and payments under this Agreement satisfy, to the greatest extent possible,

the exemptions from the application of Code Section 409A provided under Treasury Regulations 1.409A-1(b)(4), 1.409A-1(b)(5) and 1.409A-

1(b)(9), and this Agreement will be construed to the greatest extent possible as consistent with those provisions. If not so exempt,

this Agreement (and any definitions hereunder) will be construed in a manner that complies with Code Section 409A and incorporates by

reference all required definitions and payment terms. For purposes of Code Section 409A (including, without limitation, for purposes

of Treasury Regulation Section 1.409A-2(b)(2)(iii)), your right to receive any installment payments under this Agreement (whether severance

payments, reimbursements or otherwise) will be treated as a right to receive a series of separate payments and, accordingly, each installment

payment hereunder will at all times be considered a separate and distinct payment. Notwithstanding any provision to the contrary in this

Agreement, if you are deemed by the Company at the time of your Separation from Service to be a “specified employee” for

purposes of Code Section 409A(a)(2)(B)(i), and if any of the payments upon Separation from Service set forth herein and/or under any

other agreement with the Company are deemed to be “deferred compensation”, then if delayed commencement of any portion of

such payments is required to avoid a prohibited distribution under Code Section 409A(a)(2)(B)(i) and the related adverse taxation under

Section 409A, the timing of the payments upon a Separation from Service will be delayed as follows: on the earlier to occur of (i) the

date that is six months and one day after the effective date of your Separation from Service, and (ii) the date of the your death (such

earlier date, the “Delayed Initial Payment Date”), the Company will (A) pay to you a lump sum amount equal

to the sum of the payments upon Separation from Service that you would otherwise have received through the Delayed Initial Payment Date

if the commencement of the payments had not been delayed pursuant to this paragraph, and (B) commence paying the balance of the payments

in accordance with the applicable payment schedules set forth above. No interest will be due on any amounts so deferred. Notwithstanding

anything to the contrary in this Agreement, you shall be responsible for any taxes imposed on the recipient of the compensation and benefits

set forth in this Agreement including without limitation any taxes under Section 409A of the Code.

7.

Non-Disparagement. During your employment and at all times thereafter, you shall not, directly or through any other Person make any

public statements to the press (whether orally, in writing, via electronic transmission, or otherwise) that disparage, denigrate or malign

the Company; or (ii) any of the businesses, activities, operations, affairs, reputations or prospects of the Company; or (iii) any of

the officers, employees, directors, managers, partners (general and limited), agents, members or shareholders of the Company. For purposes

of clarification, and not limitation, a statement shall be deemed to disparage, denigrate or malign a Person if such statement could

be reasonably construed to adversely affect the opinion any other Person may have or form of such first Person. The foregoing limitations

shall not be violated by truthful statements made by you (a) to any governmental authority or (b) which are in response to legal process,

or in connection with required governmental testimony or filings, or administrative or arbitral proceedings (including, without limitation,

depositions in connection with such proceedings). Nothing herein shall be construed to limit your rights (if any) under Section 7 of

the National Labor Relations Act.

8.

Cooperation. During your employment and at all times thereafter, you agree to cooperate with the Company in any internal investigation,

any administrative, regulatory, or judicial proceeding or any dispute with a third party, concerning issues about which you have knowledge

or that may relate to you or your employment or service with the Company (or the termination thereof). Your obligation to cooperate hereunder

includes, without limitation, being available to the Company upon reasonable notice for interviews and factual investigations, appearing

in any forum at the Company’s request to give testimony (without requiring service of a subpoena or other legal process), volunteering

to the Company pertinent information, and turning over to the Company all relevant documents which are or may come into your possession.

The Company shall promptly reimburse you for the reasonable pre-approved out-of-pocket expenses incurred by you at the Company’s

request in connection with such cooperation. For the avoidance of doubt, the foregoing shall not require the Company to reimburse you

for any attorneys’ fees or related costs you may incur absent written approval by the Company.

9.

Severance. If the Company terminates your employment without Cause at any time up to the six-month anniversary of the closing of

a Change in Control, the Company will pay you a sum equivalent to six (6) months of your base salary in effect as of your termination

date, less required and designated payroll deductions and withholdings. The severance benefit described in this Section 9 is conditional

upon (a) your continuing to comply with your obligations under your Proprietary Information Agreement, including the non-solicitation

provisions thereof; (b) your delivering to the Company a duly executed and effective general release of claims against the Company in

a form acceptable to the Company within 30 days following your termination date; and (d) if requested by the Company to confirm your

Board resignation, if you are a member of the Board, your resignation from the Board, to be effective no later than the date of your

termination date (or such other date as requested by the Board).

10.

Entire Agreement. This Agreement, including Exhibit A, constitutes the complete, final and exclusive embodiment of the entire

agreement between you and the Company with respect to the terms and conditions of your employment. If you enter into this Agreement,

you are doing so voluntarily, and without reliance on any promise, warranty, representation or agreement, written or oral, other than

those expressly contained herein. This Agreement supersedes any and all promises, warranties, representations or agreements, whether

oral or written, including any prior offer letters or employment agreement between you and the Company. This Agreement may not be amended

or modified except by a written instrument signed by you and a duly authorized member of the Board.

11.

Enforceability. If any provision of this Agreement is determined to be invalid or unenforceable, in whole or in part, this determination

will not affect any other provision of this Agreement, and the Agreement, including the invalid or unenforceable provisions, shall be

enforced insofar as possible to achieve the intent of the parties.

12.

Binding Nature. This Agreement will be binding upon and inure to the benefit of the personal representatives and successors of the

respective parties hereto.

13.

Governing Law. This Agreement will be governed by and construed in accordance with the laws of the State of California without regard

to conflicts of law principles.

14.

Miscellaneous. With respect to the enforcement of this Agreement, no waiver of any right hereunder shall be effective unless it is

in writing. For purposes of construction of this Agreement, any ambiguity shall not be construed against either party as the drafter.

This Agreement may be executed in more than one counterpart, and signatures transmitted via facsimile shall be deemed equivalent to originals.

If

these revised terms of your employment with the Company are acceptable to you, please sign this Agreement and return it to me.

| |

Sincerely, |

| |

|

|

| |

|

/s/

Clay Crolius |

| |

Name: |

Clay

Crolius |

| |

Title: |

Chief

Financial Officer |

| /s/

Hao Liu |

|

| Hao

(Peter) Liu |

|

| Date:

December 8, 2023 |

|

Exhibit

A

Confidential

Information and Invention Assignment Agreement

(attached hereto)

Exhibit

10.2

December

8, 2023

Mr.

Clay Crolius

Via

E-mail Delivery

Re:

Employment Agreement

Dear

Mr. Crolius:

This

amended and restated letter agreement (the “Agreement”) confirms the terms of your employment with Sonim Technologies,

Inc. (the “Company”).

1.

Position and Duties. Effective November 1, 2023, you will continue to serve as the Company’s Chief Financial Officer (the “CFO”),

reporting to the Company’s Chief Executive Officer. Of course, the Company may change your position, duties, and work location

from time to time, as it deems necessary within its sole discretion. You will devote your full and exclusive business time and attention

to the business affairs of the Company. You must obtain approval from the Company’s Board of Directors (the “Board”)

prior to joining membership of the board of directors of any other entity. As a Company employee, you will be expected to abide by the

Company’s rules and policies and to acknowledge in writing that you have read the Company’s employee handbook.

2.

Compensation and Benefits.

(a)

Base Salary. You will receive a base salary of $320,000 per year, less required and designated payroll deductions and withholdings,

and payable according to the Company’s regular payroll schedule. On the first regular payroll date following execution of this

Agreement, you will receive a lump sum payment for your salary increase in this Agreement retroactive to November 1, 2023, less applicable

withholdings. Your annual base salary will be reviewed from time to time and is subject to change at the discretion of the Company.

(b)

Benefits. You will be eligible to participate in the Company’s standard employee benefits pursuant to the terms, conditions

and limitations of the applicable benefit plans, which are subject to change from time to time.

(c)

Discretionary Bonus. You will be eligible to receive an annual bonus within the sole discretion of the Board or a pertinent committee

thereof, as applicable. There is no guarantee that you may receive a bonus at any time. Any determination as to whether the Company’s

performance warrants a bonus and the amount of any bonus earned as a result of such performance is determined by the Board (or a pertinent

committee thereof, as applicable) in its sole discretion. Any bonus shall be paid within thirty (30) days after the determination that

a bonus shall be awarded, which typically shall occur in January of each year. You must be employed on the day that your bonus (if any)

is paid to earn the bonus. Therefore, if your employment is terminated either by you or the Company for any reason prior to the bonus

being paid, you will not have earned the bonus and no partial or prorated bonus will be owed or paid. In addition, you shall be eligible

to participate in any equity compensation plan or similar long-term incentive program adopted by the Company, and the Board or any committee

administering such plan may grant such additional bonuses and/or equity compensation as it deems appropriate within its sole discretion.

3.

Proprietary Information Agreement and Company Policies. As a condition of your employment, you must sign and abide by the Company’s

standard form of Confidential Information and Invention Assignment Agreement (the “Proprietary Information Agreement”),

a copy of which is attached hereto as Exhibit A. In your work for the Company, you will be expected not to use or disclose any

confidential information, including trade secrets, of any former employer or other person to whom you have an obligation of confidentiality.

Rather, you will be expected to use only that information which is generally known and used by persons with training and experience comparable

to your own, which is common knowledge in the industry or otherwise legally in the public domain, or which is otherwise provided or developed

by the Company. You agree that you will not bring onto Company premises any unpublished documents or property belonging to any former

employer or other person to whom you have an obligation of confidentiality. You hereby represent that your employment does not create

a conflict with any agreement between you and a third party.

4.

At-Will Employment Relationship; Board Resignation. Your employment relationship is at will, meaning either you or the Company may

terminate your employment relationship at any time, with or without Cause, and with or without advance notice. In addition, the Company

may modify the other terms and conditions of your employment, including, but not limited to, compensation, benefits, position, title,

reporting relationship and office location, from time to time in its sole discretion. Your at-will employment relationship can only be

changed in a written agreement signed by you and a duly authorized member of the Board. If you cease serving as the Company’s CFO

for any reason, you agree that this Agreement constitutes your resignation from the Board as of the date of such cessation of service.

5.

Definitions.

(a)

Cause. For purposes of this Agreement, “Cause” is defined as any of the following: (i) your commission

of any felony or any crime involving fraud, dishonesty or moral turpitude under the laws of the United States, any state thereof, or

any applicable foreign jurisdiction; (ii) your attempted commission of, or participation in, a fraud or act of dishonesty against the

Company or any affiliate of the Company; (iii) your intentional, material violation of any contract or agreement between you and the

Company or any affiliate of the Company or of any statutory duty owed to the Company or any affiliate of the Company; (iv) your unauthorized

use or disclosure of the Company’s or any affiliate of the Company’s confidential information or trade secrets; or (v) your

gross misconduct. The determination that a termination of your employment is either for Cause or without Cause shall be made by the Company

in its sole discretion.

(b)

Change in Control. For purposes of this Agreement, the definition of a “Change in Control” is as defined

in section 13(i) of the Company’s 2019 Equity Incentive Plan (as in effect on the date hereof).

(c)

Person. For the purpose of this Agreement, “Person” means an individual or an entity, including a corporation,

limited liability company, partnership, trust, unincorporated organization, association or other business or investment entity, or any

governmental authority.

6.

Code Section 409A. It is intended that all of the benefits and payments under this Agreement satisfy, to the greatest extent possible,

the exemptions from the application of Code Section 409A provided under Treasury Regulations 1.409A-1(b)(4), 1.409A-1(b)(5) and 1.409A-

1(b)(9), and this Agreement will be construed to the greatest extent possible as consistent with those provisions. If not so exempt,

this Agreement (and any definitions hereunder) will be construed in a manner that complies with Code Section 409A and incorporates by

reference all required definitions and payment terms. For purposes of Code Section 409A (including, without limitation, for purposes

of Treasury Regulation Section 1.409A-2(b)(2)(iii)), your right to receive any installment payments under this Agreement (whether severance

payments, reimbursements or otherwise) will be treated as a right to receive a series of separate payments and, accordingly, each installment

payment hereunder will at all times be considered a separate and distinct payment. Notwithstanding any provision to the contrary in this

Agreement, if you are deemed by the Company at the time of your Separation from Service to be a “specified employee” for

purposes of Code Section 409A(a)(2)(B)(i), and if any of the payments upon Separation from Service set forth herein and/or under any

other agreement with the Company are deemed to be “deferred compensation”, then if delayed commencement of any portion of

such payments is required to avoid a prohibited distribution under Code Section 409A(a)(2)(B)(i) and the related adverse taxation under

Section 409A, the timing of the payments upon a Separation from Service will be delayed as follows: on the earlier to occur of (i) the

date that is six months and one day after the effective date of your Separation from Service, and (ii) the date of the your death (such

earlier date, the “Delayed Initial Payment Date”), the Company will (A) pay to you a lump sum amount equal

to the sum of the payments upon Separation from Service that you would otherwise have received through the Delayed Initial Payment Date

if the commencement of the payments had not been delayed pursuant to this paragraph, and (B) commence paying the balance of the payments

in accordance with the applicable payment schedules set forth above. No interest will be due on any amounts so deferred. Notwithstanding

anything to the contrary in this Agreement, you shall be responsible for any taxes imposed on the recipient of the compensation and benefits

set forth in this Agreement including without limitation any taxes under Section 409A of the Code.

7.

Non-Disparagement. During your employment and at all times thereafter, you shall not, directly or through any other Person make any

public statements to the press (whether orally, in writing, via electronic transmission, or otherwise) that disparage, denigrate or malign

the Company; or (ii) any of the businesses, activities, operations, affairs, reputations or prospects of the Company; or (iii) any of

the officers, employees, directors, managers, partners (general and limited), agents, members or shareholders of the Company. For purposes

of clarification, and not limitation, a statement shall be deemed to disparage, denigrate or malign a Person if such statement could

be reasonably construed to adversely affect the opinion any other Person may have or form of such first Person. The foregoing limitations

shall not be violated by truthful statements made by you (a) to any governmental authority or (b) which are in response to legal process,

or in connection with required governmental testimony or filings, or administrative or arbitral proceedings (including, without limitation,

depositions in connection with such proceedings). Nothing herein shall be construed to limit your rights

(if any) under Section 7 of the National Labor Relations Act.

8.

Cooperation. During your employment and at all times thereafter, you agree to cooperate with the Company in any internal investigation,

any administrative, regulatory, or judicial proceeding or any dispute with a third party, concerning issues about which you have knowledge

or that may relate to you or your employment or service with the Company (or the termination thereof). Your obligation to cooperate hereunder

includes, without limitation, being available to the Company upon reasonable notice for interviews and factual investigations, appearing

in any forum at the Company’s request to give testimony (without requiring service of a subpoena or other legal process), volunteering

to the Company pertinent information, and turning over to the Company all relevant documents which are or may come into your possession.

The Company shall promptly reimburse you for the reasonable pre-approved out-of-pocket expenses incurred by you at the Company’s

request in connection with such cooperation. For the avoidance of doubt, the foregoing shall not require the Company to reimburse you

for any attorneys’ fees or related costs you may incur absent written approval by the Company.

9.

Severance. If the Company terminates your employment without Cause at any time up to the six-month anniversary of the closing of

a Change in Control, the Company will pay you a sum equivalent to six (6) months of your base salary in effect as of your termination

date, less required and designated payroll deductions and withholdings. The severance benefit described in this Section 9 is conditional

upon (a) your continuing to comply with your obligations under your Proprietary Information Agreement, including the non-solicitation

provisions thereof; (b) your delivering to the Company a duly executed and effective general release of claims against the Company in

a form acceptable to the Company within 30 days following your termination date; and (d) if requested by the Company to confirm your

Board resignation, if you are a member of the Board at such date, your resignation from the Board, to be effective no later than the

date of your termination date (or such other date as requested by the Board).

10.

Entire Agreement. This Agreement, including Exhibit A thereto, constitutes the complete, final and exclusive embodiment of

the entire agreement between you and the Company with respect to the terms and conditions of your employment. If you enter into this

Agreement, you are doing so voluntarily, and without reliance on any promise, warranty, representation or agreement, written or oral,

other than those expressly contained herein. This Agreement supersedes any and all promises, warranties, representations or agreements,

whether oral or written, including any prior offer letters or employment agreement between you and the Company. This Agreement may not

be amended or modified except by a written instrument signed by you and a duly authorized member of the Board.

11.

Enforceability. If any provision of this Agreement is determined to be invalid or unenforceable, in whole or in part, this determination

will not affect any other provision of this Agreement, and the Agreement, including the invalid or unenforceable provisions, shall be

enforced insofar as possible to achieve the intent of the parties.

12.

Binding Nature. This Agreement will be binding upon and inure to the benefit of the personal representatives and successors of the

respective parties hereto.

13.

Governing Law. This Agreement will be governed by and construed in accordance with the laws of the State of California without regard

to conflicts of law principles.

14.

Miscellaneous. With respect to the enforcement of this Agreement, no waiver of any right hereunder shall be effective unless it is

in writing. For purposes of construction of this Agreement, any ambiguity shall not be construed against either party as the drafter.

This Agreement may be executed in more than one counterpart, and signatures transmitted via facsimile shall be deemed equivalent to originals.

If

these revised terms of your employment with the Company are acceptable to you, please sign this Agreement and return it to me.

| |

|

Sincerely, |

| |

|

|

| |

|

/s/

Hao Liu |

| |

Name: |

Hao

(Peter) Liu |

| |

Title: |

Chief

Executive Officer |

| /s/

Clay Crolius |

|

| Clay

Crolius |

|

| Date:

December 8, 2023 |

|

Exhibit

A

Confidential

Information and Invention Assignment Agreement

(attached hereto)

v3.23.3

Cover

|

Dec. 08, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 08, 2023

|

| Entity File Number |

001-38907

|

| Entity Registrant Name |

Sonim

Technologies, Inc.

|

| Entity Central Index Key |

0001178697

|

| Entity Tax Identification Number |

94-3336783

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

4445

Eastgate Mall

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

San

Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92121

|

| City Area Code |

(650)

|

| Local Phone Number |

378-8100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per share

|

| Trading Symbol |

SONM

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Entity Information, Former Legal or Registered Name |

Not

applicable.

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

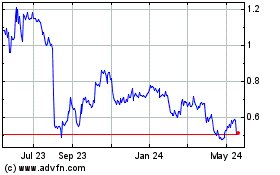

Sonim Technologies (NASDAQ:SONM)

Historical Stock Chart

From Oct 2024 to Nov 2024

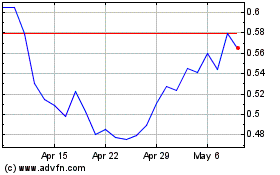

Sonim Technologies (NASDAQ:SONM)

Historical Stock Chart

From Nov 2023 to Nov 2024