Current Report Filing (8-k)

April 03 2023 - 4:32PM

Edgar (US Regulatory)

SINCLAIR BROADCAST GROUP INC false 0000912752 0000912752 2023-04-03 2023-04-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

April 3, 2023

Date of Report (Date of earliest event reported)

SINCLAIR BROADCAST GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Maryland |

|

000-26076 |

|

52-1494660 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification Number) |

10706 Beaver Dam Road

Hunt Valley, MD 21030

(Address of principal executive offices and zip code)

(410) 568-1500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Class A Common Stock, par value $ 0.01 per share |

|

SBGI |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On April 3, 2023, Sinclair Broadcast Group, Inc., a Maryland corporation (“Sinclair Broadcast”), entered into an Agreement of Share Exchange and Plan of Reorganization (the “Reorganization Agreement”) with Sinclair, Inc., a Maryland corporation (“New Sinclair”), and Sinclair Holdings, LLC, a Maryland limited liability company. Under the Reorganization Agreement, Sinclair Broadcast would implement a reorganization in which New Sinclair would become the publicly-traded parent company of Sinclair Broadcast and its subsidiaries. Subject to the conditions set forth in the Reorganization Agreement, the reorganization will be effected through a share exchange (the “Reorganization”) under Maryland law. In the Reorganization, each outstanding share of Sinclair Broadcast’s Class A common stock and Class B common stock would be exchanged automatically on a one-for-one basis for a share of Class A common stock and Class B common stock, respectively, of New Sinclair. The rights and benefits of the holders of shares of New Sinclair’s common stock, including voting rights, would be the same as the rights and benefits of the holders of shares of Sinclair Broadcast’s common stock in all material respects. In addition, Sinclair Broadcast will become a wholly-owned subsidiary of New Sinclair.

The Reorganization is not expected to result in a change in the directors, executive officers, management or business of the publicly-traded company, or to impact the timing of the declaration and payment of regular quarterly dividends. The Reorganization is not expected to result in gain or loss to Sinclair Broadcast’s stockholders for U.S. federal income tax purposes. We expect the New Sinclair Class A Common Stock to be listed on the NASDAQ Stock Market’s Global Select Market under the ticker symbol “SBGI,” the same market and ticker symbol currently used by the Sinclair Broadcast Class A Common Stock.

Sinclair Broadcast will complete the Reorganization only if each of the conditions set forth in the Reorganization Agreement is satisfied, including receipt of the required approval of Sinclair Broadcast’s stockholders. Under Maryland law, the Reorganization requires the approval of the stockholders of Sinclair Broadcast by the affirmative vote of two-thirds of all the votes entitled to be cast on the matter.

The Reorganization Agreement or the Reorganization may be deferred or terminated by Sinclair Broadcast’s Board of Directors at any time prior to completion (even after approval by Sinclair Broadcast’s stockholders).

The foregoing description of the Reorganization Agreement is not complete and is qualified in its entirety by reference to the text of the Reorganization Agreement, which is attached hereto as Exhibit 2.1 and is incorporated herein by reference.

| Item 7.01 |

Regulation FD Disclosure. |

On April 3, 2023, Sinclair Broadcast issued a press release pertaining to the Reorganization and posted to its website a Holding Company Reorganization Q&A, copies of which are furnished as Exhibits 99.1 and 99.2, respectively, to this Current Report on Form 8-K.

The information contained in this Item 7.01 and Exhibits 99.1 and 99.2 shall not be incorporated by reference into any filing of the registrant, whether made before, on or after the date hereof, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference hereto. The information contained in this Item 7.01 and Exhibits 99.1 and 99.2 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

For purposes of updating and restating its risk factor disclosure, including as discussed under the heading “Item 1A. Risk Factors” in its Annual Report on Form 10-K for the year ended December 31, 2022 as filed with the Securities and Exchange Commission (the “SEC”) on March 1, 2023, Sinclair Broadcast hereby incorporates by reference into this Current Report on Form 8-K the risk factor disclosure filed as Exhibit 99.3 hereto.

2

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

| * |

Schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The registrant agrees to furnish supplementally a copy of any omitted schedule or exhibit to the SEC upon request. |

Additional Information and Where to Find It

In connection with the Reorganization, New Sinclair has filed a registration statement on Form S-4 that includes a preliminary proxy statement of Sinclair Broadcast and a preliminary prospectus of New Sinclair, and Sinclair Broadcast and New Sinclair may file with the SEC other relevant documents in connection with the proposed Reorganization. SINCLAIR BROADCAST’S STOCKHOLDERS ARE URGED TO CAREFULLY READ THESE DOCUMENTS AND THE DEFINITIVE PROXY STATEMENT/PROSPECTUS, WHEN THEY BECOME AVAILABLE, BECAUSE THEY CONTAIN AND WILL CONTAIN IMPORTANT INFORMATION REGARDING THE REORGANIZATION. Investors may obtain a free copy of the registration statement on Form S-4 and the definitive proxy statement/prospectus, when filed, as well as other filings containing information about Sinclair Broadcast, New Sinclair and the Reorganization, from the SEC at the SEC’s website at http://www.sec.gov. In addition, copies of the registration statement on Form S-4 and the definitive proxy statement/prospectus, when filed, as well as other filings containing information about Sinclair Broadcast, New Sinclair and the Reorganization can be obtained without charge by sending a request to Sinclair Broadcast Group, Inc., 10706 Beaver Dam Road, Hunt Valley, MD 21030; by calling 410-568-1500; or by accessing them on Sinclair Broadcast’s investor relations web page at https://sbgi.net/investor-relations/sec-filings/. Information on Sinclair Broadcast’s web page are not part of, and are not incorporated by reference into, this Current Report on Form 8-K.

Participants in the Solicitation

Sinclair Broadcast and its directors, executive officers and certain other members of management and employees may be deemed to be participants in the solicitation of proxies from Sinclair Broadcast’s stockholders in connection with the Reorganization. Additional information regarding the interests of potential participants in the proxy solicitation is included in the New Sinclair’s registration statement on Form S-4 that includes a preliminary proxy statement of Sinclair Broadcast and a preliminary prospectus of New Sinclair and will be included in the definitive proxy statement/prospectus and other relevant documents that Sinclair Broadcast and New Sinclair have filed, and intend to file, with the SEC in connection with the Reorganization. Copies of these documents can be obtained without charge as described in the preceding paragraph.

3

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No public offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Forward-Looking Statements:

The matters discussed in this Current Report on Form 8-K include forward-looking statements regarding, among other things, future events and actions. When used in this Current Report on Form 8-K, the words “outlook,” “intends to,” “believes,” “anticipates,” “expects,” “achieves,” “estimates,” and similar expressions are intended to identify forward-looking statements. Such statements are subject to a number of risks and uncertainties. Actual results in the future could differ materially and adversely from those described in the forward-looking statements as a result of various important factors, including, but not limited to, and in addition to any assumptions set forth in such statements: Sinclair Broadcast’s ability to obtain the requisite vote to approve the Reorganization or to recognize the intended benefits of the Reorganization, that changes in legislation or regulations may change the tax consequences of the Reorganization, and the impacts of the Reorganization on New Sinclair’s financial condition, business operations, results of operation and outstanding securities, and any risk factors set forth in Sinclair Broadcast’s recent reports on Form 10-Q, Form 10-K and/or Form 8-K, as filed with the SEC. There can be no assurances that the assumptions and other factors referred to in this report will occur. Sinclair Broadcast undertakes no obligation to publicly release the result of any revisions to these forward-looking statements except as required by law.

4

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| SINCLAIR BROADCAST GROUP, INC. |

|

|

| By: |

|

/s/ David R. Bochenek |

| Name: |

|

David R. Bochenek |

| Title: |

|

Senior Vice President / Chief Accounting Officer |

| Date: |

|

April 3, 2023 |

5

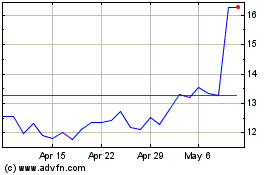

Sinclair (NASDAQ:SBGI)

Historical Stock Chart

From Jun 2024 to Jul 2024

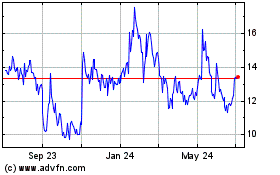

Sinclair (NASDAQ:SBGI)

Historical Stock Chart

From Jul 2023 to Jul 2024