Sierra Bancorp Announces Its Inclusion in the New NASDAQ Global Select Market

July 03 2006 - 3:52PM

PR Newswire (US)

The Market With the Highest Initial Listing Standards in the World

PORTERVILLE, Calif., July 3 /PRNewswire-FirstCall/ -- Sierra

Bancorp (NASDAQ:BSRR) parent of Bank of the Sierra today announced

that it is included in the new NASDAQ Global Select Market. The

NASDAQ Global Select Market has the highest initial listing

standards of any exchange in the world based on financial and

liquidity requirements. Prior to the change, the company had been

listed on the NASDAQ National Market. Beginning July 3,

NASDAQ-listed companies will be classified under three listing

tiers -- NASDAQ Global Select Market, NASDAQ Global Market, and

NASDAQ Capital Market. NASDAQ also plans to launch indexes based on

these new tiers. "Sierra Bancorp is an example of an industry

leader that has achieved superior listing standards, which clearly

defines the essence of the NASDAQ Global Select Market," said Bruce

Aust, Executive Vice President, of NASDAQ. "NASDAQ is focused on

leading a race to the top in terms of listing qualifications. In

recognizing these companies, we are highlighting their achievement

in meeting the requirements to be included in the market with the

highest listing standards in the world," added Mr. Aust. NASDAQ

announced the new three tier listing classification in February

2006. All three market tiers will maintain rigorous listing and

corporate governance standards. For additional information about

the NASDAQ Global Select Market, please go to:

http://www.nasdaq.com/GlobalSelect. About Sierra Bancorp Sierra

Bancorp is the holding company for Bank of the Sierra

(http://www.bankofthesierra.com/), which is in its 29th year of

operations and is the largest independent bank headquartered in the

South San Joaquin Valley. The Company has over $1.1 billion in

total assets and currently maintains twenty branch offices, an

agricultural credit center, and an SBA center. In June 2005, Sierra

Bancorp was added to the Russell 2000 index based on relative

growth in market capitalization. In its July 2005 edition, US

Banker magazine ranked Sierra Bancorp as the nation's 8th best

performing publicly-traded community bank based on three-year

average return on equity. About NASDAQ NASDAQ is the largest U.S.

electronic stock market. With approximately 3,200 companies, it

lists more companies and, on average, trades more shares per day

than any other U.S. market. It is home to companies that are

leaders across all areas of business including technology, retail,

communications, financial services, transportation, media and

biotechnology. NASDAQ is the primary market for trading

NASDAQ-listed stocks. For more information about NASDAQ, visit

http://www.nasdaq.com/ or the NASDAQ Newsroom at

http://www.nasdaq.com/newsroom/. The statements contained in this

release that are not historical facts are forward-looking

statements based on management's current expectations and beliefs

concerning future developments and their potential effects on the

Company. Readers are cautioned not to unduly rely on

forward-looking statements. Actual results may differ from those

projected. These forward-looking statements involve risks and

uncertainties including but not limited to the health of the

national and California economies, the Company's ability to attract

and retain skilled employees, customers' service expectations, the

Company's ability to successfully de ploy new technology and gain

efficiencies there from, the success of branch expansion, changes

in interest rates, loan portfolio performance, the Company's

ability to secure buyers for foreclosed properties, and other

factors detailed in the Company's SEC filings. DATASOURCE: Sierra

Bancorp CONTACT: Ken Taylor, EVP/CFO of Sierra Bancorp,

+1-559-782-4900, or 888-454-BANK Web site: http://www.nasdaq.com/

Copyright

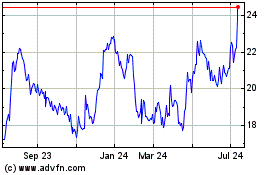

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Jul 2024 to Jul 2024

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Jul 2023 to Jul 2024