false0000895447DEF 14A00008954472020-02-022021-01-3000008954472022-01-302023-01-2800008954472021-01-312022-01-290000895447ecd:NonPeoNeoMemberscvl:FairValueOfUnvestedPriorYearAwardsMemberscvl:OtherMember2023-01-292024-02-030000895447scvl:WordenMember2021-01-312022-01-290000895447ecd:NonPeoNeoMemberscvl:MrEdwardsMemberscvl:PriorYearFairValueOfAwardsVestingInCurrentYearMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:MrScibettaMemberscvl:FairValueOfUnvestedCurrentYearAwardsMember2023-01-292024-02-030000895447scvl:MrEdwardsMember2023-01-292024-02-03000089544722023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:MrScibettaMemberscvl:PriorYearFairValueOfUnvestedPriorYearAwardsMember2023-01-292024-02-030000895447scvl:SiffordMember2021-01-312022-01-29000089544732023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:OtherMemberscvl:ValueAtVestOfCurrentYearAwardsVestingInCurrentYearMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:GrantDateFairValueOfCurrentYearAwardsMemberscvl:MrEdwardsMember2023-01-292024-02-030000895447scvl:MrChiltonMember2023-01-292024-02-0300008954472023-01-292024-02-030000895447scvl:OtherMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:ValueAtVestOfPriorYearAwardsVestingInCurrentYearMemberscvl:MrEdwardsMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:ValueAtVestOfCurrentYearAwardsVestingInCurrentYearMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:OtherMemberscvl:PriorYearFairValueOfForfeitedPriorYearAwardsMember2023-01-292024-02-030000895447scvl:WordenMemberscvl:PriorYearFairValueOfUnvestedPriorYearAwardsMember2023-01-292024-02-030000895447scvl:WordenMemberscvl:FairValueOfUnvestedPriorYearAwardsMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:FairValueOfUnvestedPriorYearAwardsMemberscvl:MrEdwardsMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:GrantDateFairValueOfCurrentYearAwardsMemberscvl:MrChiltonMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:PriorYearFairValueOfAwardsVestingInCurrentYearMember2023-01-292024-02-030000895447scvl:WordenMemberscvl:FairValueOfUnvestedCurrentYearAwardsMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:OtherMemberscvl:PriorYearFairValueOfUnvestedPriorYearAwardsMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:MrEdwardsMemberscvl:PriorYearFairValueOfUnvestedPriorYearAwardsMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:FairValueOfUnvestedCurrentYearAwardsMember2023-01-292024-02-030000895447scvl:MrScibettaMember2023-01-292024-02-030000895447scvl:WordenMember2023-01-292024-02-030000895447scvl:SiffordMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:ValueAtVestOfPriorYearAwardsVestingInCurrentYearMemberscvl:OtherMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:FairValueOfUnvestedCurrentYearAwardsMemberscvl:MrEdwardsMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:PriorYearFairValueOfAwardsVestingInCurrentYearMemberscvl:MrChiltonMember2023-01-292024-02-030000895447scvl:SiffordMember2020-02-022021-01-300000895447ecd:NonPeoNeoMemberscvl:FairValueOfUnvestedCurrentYearAwardsMemberscvl:MrChiltonMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:GrantDateFairValueOfCurrentYearAwardsMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:PriorYearFairValueOfAwardsVestingInCurrentYearMemberscvl:OtherMember2023-01-292024-02-03000089544712023-01-292024-02-030000895447scvl:WordenMember2022-01-302023-01-280000895447scvl:ValueAtVestOfPriorYearAwardsVestingInCurrentYearMemberscvl:WordenMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:MrScibettaMemberscvl:ValueAtVestOfPriorYearAwardsVestingInCurrentYearMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:PriorYearFairValueOfUnvestedPriorYearAwardsMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:FairValueOfUnvestedPriorYearAwardsMemberscvl:MrChiltonMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:MrScibettaMemberscvl:PriorYearFairValueOfAwardsVestingInCurrentYearMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:ValueAtVestOfPriorYearAwardsVestingInCurrentYearMemberscvl:MrChiltonMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:PriorYearFairValueOfForfeitedPriorYearAwardsMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:MrScibettaMemberscvl:GrantDateFairValueOfCurrentYearAwardsMember2023-01-292024-02-030000895447scvl:GrantDateFairValueOfCurrentYearAwardsMemberscvl:WordenMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:MrScibettaMemberscvl:FairValueOfUnvestedPriorYearAwardsMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:GrantDateFairValueOfCurrentYearAwardsMemberscvl:OtherMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:FairValueOfUnvestedPriorYearAwardsMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:ValueAtVestOfPriorYearAwardsVestingInCurrentYearMember2023-01-292024-02-030000895447ecd:NonPeoNeoMemberscvl:MrChiltonMemberscvl:PriorYearFairValueOfUnvestedPriorYearAwardsMember2023-01-292024-02-030000895447scvl:WordenMemberscvl:PriorYearFairValueOfAwardsVestingInCurrentYearMember2023-01-292024-02-03000089544742023-01-292024-02-0300008954472023-02-042024-02-03xbrli:pureiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

|

|

|

|

Filed by the Registrant |

[ |

X |

] |

Filed by a Party other than the Registrant |

[ |

|

] |

Check the appropriate box:

|

|

|

|

[ |

|

] |

Preliminary Proxy Statement |

[ |

|

] |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

[ |

X |

] |

Definitive Proxy Statement |

[ |

|

] |

Definitive Additional Materials |

[ |

|

] |

Soliciting Material Pursuant to §240.14a-12 |

|

SHOE CARNIVAL, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

|

|

|

|

[ |

X |

] |

No fee required. |

[ |

|

] |

Fee paid previously with preliminary materials. |

[ |

|

] |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

May 14, 2024

Dear Shareholder:

On behalf of the Board of Directors and management, we wish to extend an invitation to you to attend our 2024 annual meeting of shareholders (the “Annual Meeting”) to be held on Tuesday, June 25, 2024 at the Shoe Carnival, Inc. Southern Office located at 234 Kingsley Drive, Suite 200, Fort Mill, South Carolina. The Annual Meeting will begin at 9:00 a.m., Eastern Daylight Time (EDT).

You will find information regarding the business to be conducted at the Annual Meeting in the Notice of Annual Meeting of Shareholders and Proxy Statement, including information you should consider when you vote your shares. As allowed by the rules of the Securities and Exchange Commission, we are furnishing this Proxy Statement, our 2023 Annual Report to Shareholders and our other proxy materials to our shareholders primarily via the Internet. This electronic process gives you fast, convenient access to the materials, diminishes the impact on the environment and reduces our printing and mailing costs. A paper copy of these materials can be requested using one of the methods described in the materials.

At the Annual Meeting, in addition to the matters described in the Notice of Annual Meeting of Shareholders and the Proxy Statement, I will be providing a report on the financial position of the Company and opening the floor for questions from shareholders.

The members of the Board of Directors and management look forward to your attendance. However, whether or not you plan to attend personally, and regardless of the number of shares you own, representation of our shares is important. We encourage you to vote your shares via the Internet, by telephone, or, if you received a paper copy of the proxy materials, by signing, dating and returning your proxy card or voting instruction form as soon as possible to ensure your shares are voted regardless of whether you attend the Annual Meeting.

Thank you for your ongoing support of and continued interest in Shoe Carnival.

Sincerely,

Mark J. Worden

President and Chief Executive Officer

SHOE CARNIVAL, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 25, 2024

The annual meeting of shareholders of Shoe Carnival, Inc. (the “Company,” “we,” “us” and “our”) will be held at our Southern Office located at 234 Kingsley Drive, Suite 200, Fort Mill, South Carolina, on Tuesday, June 25, 2024, at 9:00 a.m., EDT, for the following purposes:

(1) To elect two directors to serve until the 2027 annual meeting of shareholders and until their successors are elected and have qualified, as set forth in the accompanying proxy statement;

(2) To approve, in an advisory (non-binding) vote, the compensation paid to the Company’s named executive officers;

(3) To ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm for the Company for Fiscal 2024; and

(4) To transact such other business as may properly come before the meeting, or any adjournment or postponement thereof.

All shareholders of record at the close of business on April 24, 2024 will be eligible to vote.

As allowed by the rules of the Securities and Exchange Commission, we are furnishing proxy materials to our shareholders primarily via the Internet. Accordingly, on or about May 14, 2024, we mailed a majority of our shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy materials and vote via the Internet, and mailed a printed copy of this proxy statement, a proxy card and our 2023 annual report to shareholders to our other shareholders.

Whether or not you plan to attend the meeting, your vote is important, and we urge you to vote promptly as described below and in the accompanying materials.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You may vote your shares online via the Internet, or |

|

|

|

You may vote your shares by telephone, or |

|

|

|

|

|

|

|

|

|

You may vote your shares in person at the annual meeting, or |

|

|

|

If you received a copy of the proxy materials by mail, you may vote by returning your proxy card in the self-addressed envelope provided. |

|

|

|

|

|

|

|

If a bank, broker or nominee holds your shares, please review the voting options provided by them on your voting instruction form and act accordingly. For your vote to be counted, you will need to communicate your voting decisions to your bank, broker or nominee.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held on June 25, 2024

The notice of annual meeting of shareholders, proxy statement, form of proxy card and 2023 annual report to shareholders are available at www.envisionreports.com/SCVL.

|

|

|

By Order of the Board of Directors, |

|

|

|

Patrick C. Edwards, Secretary May 14, 2024 |

TABLE OF CONTENTS

SHOE CARNIVAL, INC.

7500 East Columbia Street

Evansville, Indiana 47715

PROXY STATEMENT

Annual Meeting of Shareholders

June 25, 2024

Why am I receiving these proxy materials?

We are providing these proxy materials to you in connection with the solicitation by the Board of Directors (the “Board”) of Shoe Carnival, Inc. (the “Company,” “we,” “us” or “our”) for proxies to be voted at our annual meeting of shareholders (the “annual meeting”) and at any adjournment or postponement thereof. We are holding this annual meeting at 9:00 a.m., EDT, on Tuesday, June 25, 2024, at our Southern Office located at 234 Kingsley Drive, Suite 200, Fort Mill, South Carolina. Directions to the annual meeting can be obtained by calling 812-867-4034.

As allowed by the rules of the Securities and Exchange Commission (the “SEC”), we are furnishing our proxy materials to our shareholders primarily via the Internet. This electronic process diminishes the impact on the environment and reduces our printing and mailing costs. Accordingly, on or about May 14, 2024, we mailed a majority of our shareholders a Notice of Internet Availability of Proxy Materials (the “E-Proxy Notice”) containing instructions on how to access our proxy materials and vote via the Internet, and mailed a printed copy of this proxy statement, a proxy card and our 2023 annual report to shareholders to our other shareholders. If you received an E-Proxy Notice and would like to receive a paper copy of our proxy materials, please follow the instructions included in the E-Proxy Notice.

What proposals will be voted on at the annual meeting?

There are three proposals scheduled to be voted on at the annual meeting:

•To elect two directors to serve until the 2027 annual meeting of shareholders and until their successors are elected and have qualified;

•To approve, in an advisory (non-binding) vote, the compensation paid to our Executives (as defined below and under “Executive Compensation – Compensation Discussion and Analysis”), as disclosed in the Compensation Discussion and Analysis, the compensation tables and the related narratives in this proxy statement; and

•To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for Fiscal 2024.

In addition, any other business that may properly come before the annual meeting will be considered and a vote will be taken. The Board currently knows of no additional business that is to be brought before the annual meeting. However, if other matters properly come before the meeting, the persons indicated on the enclosed proxy will vote that proxy based on their judgment on such matters.

How does the Board recommend that I vote on the proposals?

The Board recommends that you vote your shares:

•FOR the election of Charles B. Tomm and Mark J. Worden as directors (Proposal 1);

•FOR the approval, on an advisory basis, of the compensation paid to our Executives, as disclosed in the Compensation Discussion and Analysis, the compensation tables and the related narratives in this proxy statement (Proposal 2); and

•FOR the ratification of Deloitte & Touche LLP as our independent registered public accounting firm for Fiscal 2024 (Proposal 3).

Who may vote?

You may vote at the annual meeting or by proxy if you were a shareholder of record at the close of business on April 24, 2024, the record date for the meeting. As of April 24, 2024, there were 27,158,322 shares of our common stock outstanding and entitled to vote at the annual meeting. On all matters, including the election of directors, each shareholder will have one vote for each share held.

What constitutes a quorum for the annual meeting?

In order to constitute a quorum, a majority of the votes entitled to be cast at the annual meeting must be present either in person or by proxy. Abstentions and broker non-votes will be considered as present for determining a quorum.

A proxy might indicate that not all shares represented by it are being voted for specific proposals. For example, a broker cannot vote shares held in street name on certain proposals when the owner of those shares has not provided instructions on how he or she would like them to be voted, which are called “broker non-votes.” The election of directors and the proposal relating to executive compensation fall into this category. Accordingly, if you hold your shares in street name and wish your shares to be voted on Proposals 1 and 2, you must give your broker voting instructions.

What vote is required for each of the proposals to be approved?

For Proposal 1, to be elected, each director nominee must receive the affirmative vote of a majority of the votes cast with respect to the director, which for this proposal means that the number of shares voted “FOR” the director’s election must exceed the number of shares voted “AGAINST” the director’s election. Shareholders will not be allowed to cumulate their votes in the election of the directors. Abstentions and broker non-votes will not be considered as votes cast on this proposal and therefore will not affect the outcome of this proposal.

Proposal 2 will be approved if more shares are voted “FOR” the proposal than “AGAINST.” Neither abstentions nor broker non-votes will affect the outcome of this proposal.

Proposal 3 will be approved if more shares are voted “FOR” the proposal than “AGAINST.” Abstentions will not affect the outcome of this proposal.

How do I vote my shares?

Voting of Shares Registered Directly in the Name of the Shareholder. If you hold shares of our common stock in your own name as the holder of record, you may vote your shares by using any of the following methods:

•Via the Internet. You may vote by proxy via the Internet by following the instructions on the E-Proxy Notice or the instructions on the proxy card if you receive printed copies of the proxy materials by mail.

•By Telephone. If you receive printed copies of the proxy materials by mail, you may vote by proxy by calling the toll-free number found on the proxy card and following the recorded instructions.

•By Mail. If you receive printed copies of the proxy materials by mail, you may vote by proxy by completing, signing and dating the proxy card and mailing it back in the postage-paid envelope

provided. Properly executed proxies that are received in time and not subsequently revoked will be voted as instructed on the proxy card.

•In Person at the Annual Meeting. If you attend the annual meeting, you may vote your shares in person. If you choose to vote in person at the annual meeting, please bring proof of identification. Even if you plan to attend the annual meeting, we encourage you to vote your shares in advance by proxy via the Internet, by telephone or by mail so that your vote will be counted if you later decide not to attend the annual meeting.

Voting of Shares Registered in the Name of a Brokerage Firm or Bank. If your shares of our common stock are held in “street name” through a brokerage account or by a bank or other nominee, you may vote your shares by using any of the following methods:

•Via the Internet. You may vote by proxy via the Internet by following the instructions on the E-Proxy Notice or the instructions on the voting instruction form if you receive printed copies of the proxy materials by mail.

•By Telephone. If you receive printed copies of the proxy materials by mail, you may vote by proxy by calling the toll-free number found on the voting instruction form and following the recorded instructions.

•By Mail. If you receive printed copies of the proxy materials by mail, you may vote by proxy by completing, signing and dating the voting instruction form and mailing it back in the envelope provided.

•In Person at the Annual Meeting. If you are a “street name” shareholder and you wish to vote in person at the annual meeting, you must obtain a legal proxy from your broker, bank or other nominee giving you the right to vote the shares. Please contact that organization for instructions regarding obtaining a legal proxy. Even if you plan to attend the annual meeting, we encourage you to vote your shares in advance so that your vote will be counted if you later decide not to attend the annual meeting.

What if I return my proxy but do not provide voting instructions?

Your shares will be voted in accordance with your instructions as specified. If you are a shareholder of record and you submit your proxy via the Internet, by telephone or by signing and returning your proxy card but do not give voting instructions, your shares will be voted “FOR” the election of each of the nominees listed under Proposal 1 and “FOR” Proposals 2 and 3. If any other matters properly come before the meeting, the persons indicated as proxies will vote that proxy based on their judgment on such matters. If your shares are held in “street name” and you do not provide your broker, bank or other nominee with specific voting instructions, your broker, bank or other nominee may vote on Proposal 3, the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for Fiscal 2024. However, your broker, bank or other nominee cannot vote your shares without specific instructions on Proposals 1 and 2. If your broker, bank or other nominee does not receive instructions from you on how to vote your shares on Proposals 1 and 2, your broker, bank or other nominee will inform the inspector of election that it does not have the authority to vote on those proposals with respect to your shares.

May I revoke my proxy?

If you have submitted your proxy via the Internet, by telephone or by mail, you may still revoke it at any time as long as it has not been exercised. Your proxy may be revoked by giving written notice of revocation to us, delivering a subsequently dated proxy via the Internet, by phone or by mail or attending the annual meeting and voting in person.

How are votes counted?

Votes cast by proxy or in person at the annual meeting will be counted and certified by representatives of our transfer agent, Computershare Trust Company, N.A.

Where can I find the voting results of the annual meeting?

We will announce preliminary voting results at the annual meeting and publish the voting results in a Current Report on Form 8-K to be filed with the SEC within four business days of the annual meeting.

Who pays for the cost of proxy preparation and solicitation?

The cost of this solicitation of proxies will be borne by us. Proxies may also be solicited personally or by telephone, facsimile transmission or other electronic means of communication by our employees acting without additional compensation.

Are there any defined terms used in this proxy statement?

The below sets forth the definitions for certain defined terms used in this proxy statement:

•Our fiscal year is a 52/53 week year ending on the Saturday closest to January 31. Referred to herein, “Fiscal 2023” is the fiscal year ended February 3, 2024; “Fiscal 2022” is the fiscal year ended January 28, 2023; “Fiscal 2021” is the fiscal year ended January 29, 2022; “Fiscal 2020” is the fiscal year ended January 30, 2021; and “Fiscal 2019” is the fiscal year ended February 1, 2020. Fiscal 2022, Fiscal 2021, Fiscal 2020 and Fiscal 2019 all consisted of 52 weeks. Fiscal 2023 consisted of 53 weeks. “Fiscal 2024” is our current fiscal year ending February 1, 2025 and will consist of 52 weeks.

•Our Executive Incentive Compensation Plan is referred to as the “EICP.”

•The Shoe Carnival, Inc. Amended and Restated 2017 Equity Incentive Plan is referred to as the “2017 Equity Plan.”

•Our Code of Business Conduct and Ethics is referred to as our “Code of Ethics.”

•Our Board of Directors is referred to as the “Board.” The committees of our Board are referred to as follows: the Nominating and Corporate Governance Committee is referred to as the “Nominating Committee”; the Compensation Committee is referred to as the “Compensation Committee, except in the Compensation Discussion and Analysis where it is referred to as the “Committee”; and the Audit Committee is referred to as the “Audit Committee.”

•Our “Executives” are our President and Chief Executive Officer, our Senior Vice President – Chief Financial Officer, Treasurer and Secretary, and our other named executive officers included in the Summary Compensation Table on page 33 of this proxy statement. At the end of Fiscal 2023, our Executives included Mark J. Worden, Patrick C. Edwards, Carl N. Scibetta, Marc A. Chilton, and Clifton E. Sifford.

•Our performance-based stock units and service-based restricted stock units granted to the Executives and others are referred to as “PSUs” and “RSUs”, respectively.

•In our Pay Versus Performance disclosure beginning on page 43, the Summary Compensation Table is referred to as the “SCT,” the compensation actually paid, calculated in accordance with the SEC’s guidelines, is referred to as “CAP,” total shareholder return is referred to as “TSR” and our principal executive officer is referred to as our “PEO.”

•The Securities Exchange Act of 1934, as amended, is referred to as the “Exchange Act.”

•The Nasdaq Stock Market LLC is referred to as “Nasdaq.”

•The Public Company Accounting Oversight Board is referred to as the “PCAOB.”

•The United States Securities and Exchange Commission is referred to as the “SEC.”

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Nominee and Director Information

Our Board is divided into three classes, and generally, each director holds office for a three-year term expiring at the annual meeting of shareholders held in the year that is three years after the director’s election and thereafter until his or her successor is elected and qualified.

At the annual meeting, our shareholders will be asked to elect two directors. Charles B. Tomm and Mark J. Worden have been nominated by the Board, upon the recommendation of the Nominating Committee, for election as directors for a term to expire at the 2027 annual meeting of shareholders and until their successors are elected and have qualified. Mr. Tomm has served as a director since 2017 and is our Lead Independent Director, Chairman of our Audit Committee and a member of our Compensation Committee. Mr. Tomm is also our audit committee financial expert. Mr. Worden has served as a director since 2021 and is our President and CEO.

To be elected, a director nominee must receive the affirmative vote of a majority of the votes cast, which means that the number of shares voted “for” the director’s election must exceed the number of shares voted “against” the director’s election. This majority vote standard is in effect because this is an uncontested election (i.e., the number of nominees for director does not exceed the number of directors to be elected as of the record date of the annual meeting). For any contested election, the director would be elected by a plurality of the votes cast by the shares entitled to vote on the election of directors.

If a director nominee who is serving as a director is not elected at the annual meeting, under Indiana law the director would continue to serve on the Board as a “holdover director.” However, under our by-laws, any incumbent director who fails to be elected must immediately tender his or her resignation to the Board, subject to acceptance by the Board. The Nominating Committee would then make a recommendation to the Board on whether to accept or reject the resignation, or whether other action should be taken. The Board, taking into account the recommendation of the Nominating Committee, would determine the appropriate responsive action with respect to the tendered resignation. The director who tenders his or her resignation may not participate in the Board’s decision. If a nominee who was not already serving as a director is not elected at the annual meeting, under Indiana law that nominee would not become a director and would not serve on the Board as a “holdover director.” The nominees for election as directors at the annual meeting are currently serving on the Board.

The Nominating Committee is responsible for recommending to the Board the director nominees that collectively have the complementary experience, qualifications, skills and attributes to guide us and function effectively as a Board. Each nominee for election as a director is selected based on his or her experience, judgment, integrity, ability to make independent inquiries, an understanding of our business environment and a willingness to devote adequate time to Board duties. The Nominating Committee's general view is to re-nominate an incumbent director who continues to satisfy the criteria for membership on the Board, continues to make important contributions to the Board and consents to continue his or her service on the Board. However, as the Board and Nominating Committee continue to assess the long-term succession planning of the Board and the diversity of its collective skill set, incumbent directors may not be re-nominated in future years and the size of the Board is subject to change.

Over the last four years, three total board members have transitioned from our Board, creating space for new directors who have enhanced our diversity and collective skill set. Our Board succession planning continues. Consistent with our objective to enhance the diversity of our Board, the Board has prioritized the identification of diverse director candidates and is actively evaluating diverse candidates. Our Board will appoint an ethnically diverse director to the Board as soon as reasonably practicable but no later than by our 2025 annual meeting of shareholders.

Set forth below are the current nominees for director as well as our other continuing directors and information regarding each person's service as a director, business experience, director positions held currently or at any time in the last five years, and the experiences, qualifications, attributes or skills that caused the Nominating Committee and the Board to recommend the director nominees and to determine that the continuing directors should serve as members of our Board. Unless otherwise indicated, the principal occupation of

each director has been the same for the last five years. There is no family relationship between any of our directors or executive officers.

|

|

Charles B. Tomm |

|

Mr. Tomm has served as the Managing Partner and Chief Executive Officer of Pablo River Partners, an investor in the retail automotive industry, since January 2017. He is also a director of Margo Caribe Inc., a company involved in garden products. Previously, he was President and Chief Executive Officer of Brumos Automotive (Mercedes-Benz, Porsche and Lexus dealerships) from January 2009 until its sale in April 2016. He started in the retail automotive business with Coggin Automotive Group in April 1994 as Vice President, Chief Financial Officer and General Counsel and was named company President in 1997. After a 1998 merger with Asbury Automotive Group Inc. (“Asbury”) and a subsequent merger with Courtesy Automotive in 2003, Mr. Tomm became President and Chief Executive Officer of the Asbury subsidiary Coggin/Courtesy Auto Group, with 27 dealerships and $1.7 billion in revenue. He served as a director of Asbury from 2000 to 2002 and 2005 to 2007. Prior to entering the retail automotive industry, he was Executive Vice President & COO of PIE Nationwide Inc. (trucking), an investment banker, Deputy General Counsel of Schlumberger Ltd. (oilfield services), Vice President & General Counsel of Arkansas Best Corporation, now ArcBest Corporation (trucking), an adjunct professor of law at the University of Arkansas and in the private practice of law with Winthrop, Stimson, Putnam & Roberts (now Pillsbury Winthrop Shaw Pittman LLP) in New York City. He served from 1968 to 1972 as a diver and officer on the U.S. Navy's only troop carrying submarine and earned the Navy Achievement, Vietnam Service, Vietnam Campaign and National Defense Medals. He is an emeritus trustee of Washington & Lee University and of Mayo Clinic. Formerly, he was a trustee of The Bolles School (“Bolles”), a trustee and board chair of Jacksonville University, a trustee of HabiJax (Habitat for Humanity in Jacksonville), a commissioner and board chair of the Jacksonville Housing Authority, a chair of the Jacksonville Sports Council, and a lacrosse coach at Bolles. He also served as a director of Florida Bank Group, Inc. from September 2007 until its merger with IBERIABANK Corporation in 2015. |

|

|

|

Mr. Tomm’s areas of relevant experience include strategic planning, corporate governance and leadership, corporate finance, capital markets, financial reporting, risk management and mergers and acquisitions. |

|

|

|

Term: Director nominee for a three-year term to expire at the annual meeting of shareholders in 2027 |

|

Director since: 2017 |

|

Age: 78 |

|

|

Mark J. Worden |

|

Mr. Worden has served as our President and Chief Executive Officer since October 2021 and prior to that appointment served as our President and Chief Customer Officer since September 2019. From September 2018 to September 2019, Mr. Worden served as our Executive Vice President – Chief Strategy and Marketing Officer. Prior to joining us, Mr. Worden led the Northern European region for S. C. Johnson & Son, Inc. (“SC Johnson”), a manufacturer of household cleaning supplies and products, and was responsible for revenue and share growth objectives across six countries from May 2014 to July 2018. Prior to that, Mr. Worden served as Assistant to the Chairman and Chief Executive Officer of SC Johnson from May 2012 to May 2014 and as a Senior Marketing Director from 2009 to 2012. Mr. Worden also served as a Senior Brand Manager at Kimberly-Clark Corporation and held multiple marketing roles across its flagship brands during his tenure there from 2003 through 2009. |

|

|

|

Mr. Worden’s areas of relevant experience include strategic planning, corporate governance and leadership, marketing and customer engagement, and mergers and acquisitions. |

|

|

|

Term: Director nominee for a three-year term to expire at the annual meeting of shareholders in 2027 |

|

Director since: 2021 |

|

Age: 50 |

The Board recommends a vote FOR each of the director nominees listed above.

|

DIRECTORS CONTINUING IN OFFICE |

|

|

James A. Aschleman |

|

Mr. Aschleman retired from the law firm Baker & Daniels LLP (now Faegre Drinker Biddle & Reath LLP) in December 2011. As a partner in the firm since 1976, Mr. Aschleman advised public and private companies on a wide range of issues, including corporate governance, executive compensation, mergers and acquisitions and compliance with SEC rules and regulations. Additionally, Mr. Aschleman previously served on our Board from 2001 until 2006 and has extensive knowledge of our operations. |

|

|

|

Mr. Aschleman’s areas of relevant experience include strategic planning, capital markets and corporate finance, corporate governance and legal and regulatory analysis. |

|

|

|

Term: Director with term expiring at the annual meeting of shareholders in 2025 |

|

Director since: 2012 |

|

Age: 79 |

|

|

Andrea R. Guthrie |

|

Ms. Guthrie has served as the Chief Strategy Officer at Kiln Holdings, Inc., a provider of flexible office and lifestyle spaces in the western United States, since October 2021. From 2015 to July 2023, she also led Gyde Travel, LLC, an online travel technology business, which she co-founded in 2015. From August 2009 to January 2014, Ms. Guthrie served as Senior Vice President, Strategic New Businesses at Claire’s Stores, Inc., one of the world’s leading specialty retailers of fashionable jewelry and accessories for young women, teens, tweens, and kids. Prior to that, Ms. Guthrie was a Principal at The Boston Consulting Group, where she led client projects and addressed strategic and operational issues, with a particular emphasis on the retail and consumer industries, from January 2002 to August 2009. She held merchandising roles with A|X Armani Exchange and Saks Fifth Avenue from 1993 to 1999. |

|

|

|

Ms. Guthrie’s areas of relevant experience include strategic planning, e-commerce, consumer insights and market research, loyalty/CRM, competitive analysis, financial modeling and analytics, market analysis and mergers and acquisitions. |

|

|

|

Term: Director with term expiring at the annual meeting of shareholders in 2025 |

|

Director since: 2015 |

|

Age: 52 |

|

|

Clifton E. Sifford |

|

Mr. Sifford has served as our Vice Chairman of the Board since October 2021. He served as our Vice Chairman of the Board and Chief Executive Officer from September 2019 to September 2021. Mr. Sifford also served as our President and Chief Executive Officer from October 2012 to September 2019. Mr. Sifford served as our Chief Merchandising Officer from October 2012 to March 2016. From June 2001 to October 2012, Mr. Sifford served as our Executive Vice President – General Merchandise Manager and from April 1997 to June 2001, Mr. Sifford served as our Senior Vice President – General Merchandise Manager. |

|

|

|

Mr. Sifford, as our Vice Chairman and a former long-standing member of our senior management team, brings to the Board an in-depth knowledge of our Company and the retail industry. Mr. Sifford’s areas of relevant experience include detailed knowledge and experience in executive leadership and retail merchandising, encompassing merchandise procurement, building brand awareness, proprietary brand development and consumer behavior. |

|

|

|

Term: Director with term expiring at the annual meeting of shareholders in 2025 |

|

Director since: 2012 |

|

Age: 70 |

|

|

Diane E. Randolph |

|

Ms. Randolph was appointed to our Board effective September 16, 2021. From 2014 to 2020, Ms. Randolph served as the Chief Information Officer of U.S. beauty retailer, Ulta Beauty, Inc. (“Ulta”). Prior to Ulta, Ms. Randolph served as the Chief Information Officer of Reitmans (Canada) Limited, a Canadian specialty apparel retailer, from 2008 to 2014. In August 2023, Ms. Randolph was appointed to the Board of Directors of Dollar Tree, Inc., a Fortune 200 retailer, and serves on its Audit Committee and Finance Committee. In February 2022, Ms. Randolph was appointed to the Board of Directors of Flexe, Inc., a venture-backed company that delivers technology-powered, omnichannel logistics programs. Ms. Randolph served on the Board of Directors of Core-Mark Holding Company, Inc., a leader in fresh food distribution to convenience stores, from January 2020 until Core-Mark was acquired and also served on its Nominating and Corporate Governance Committee. Ms. Randolph has also served on the Executive Committee of the National Retail Foundation CIO Council and on the Advisory Council of Chicago CIOs. |

|

|

|

Mr. Randolph’s areas of relevant experience include retail sector information technology, cybersecurity, risk management, supply chain, and human resources. |

|

|

|

Term: Director with term expiring at the annual meeting of shareholders in 2026 |

|

Director since: 2021 |

|

Age: 69 |

|

|

J. Wayne Weaver |

|

Mr. Weaver has served as Chairman of our Board since March 1988. From 1993 until January 2012 when the franchise was sold, Mr. Weaver served as Chairman and Chief Executive Officer of the Jacksonville Jaguars, LTD, a professional football franchise. From 1978 until February 1993, Mr. Weaver's principal occupation was as President and Chief Executive Officer of Nine West Group, Inc., a designer, developer and marketer of women's footwear. Mr. Weaver previously served two terms as a director of Stein Mart, Inc., a publicly traded chain of off-price retail stores, from June 2014 until March 2016 and from November 2000 until April 2008. |

|

|

|

Mr. Weaver's areas of relevant experience include strategic planning, marketing/branding, economic indicators and issues, and industry trends. |

|

|

|

Term: Director with term expiring at the annual meeting of shareholders in 2026 |

|

Director since: 1988 |

|

Age: 89 |

|

INFORMATION REGARDING THE BOARD OF

DIRECTORS AND COMMITTEES

The primary functions of our Board are:

•To oversee management performance on behalf of our shareholders;

•To ensure that the long-term interests of our shareholders are being served; and

•To monitor adherence to and the effectiveness of our internal standards and policies.

Annual Meeting of Shareholders and Board Meetings

Our directors are expected to attend the annual meeting of shareholders each year, and each of our directors attended our 2023 annual meeting of shareholders. During Fiscal 2023, the Board held seven meetings. Each of our directors standing for re-election and each of our directors continuing in office attended at least 75% of the aggregate of the Board meetings and the meetings of the respective committees on which he or she served.

Board Leadership Structure

Our Corporate Governance Guidelines provide that the Board should be free to choose its Chairman based upon the Board’s view of what is in the best interests of the Company at a particular point in time, based on the recommendation of the Nominating Committee. Our Board does not have a policy on whether the role of Chairman and Chief Executive Officer should be separate or combined and, if separate, whether the Chairman should be selected from the non-employee directors or be an employee.

The Board has determined at this time that the separation of the offices of Chairman of the Board and Chief Executive Officer enhances Board independence and oversight. Moreover, the separation of these positions allows the Chief Executive Officer to better focus on running the Company, enhancing shareholder value and expanding and strengthening our brand while allowing the Chairman of the Board to lead the Board in its fundamental role of providing advice to and independent oversight of management.

A majority of our directors are “independent directors” as defined by the listing rules of Nasdaq, and the Board has determined that such independent directors have no relationship with us that would interfere with the exercise of their independent judgment in carrying out the responsibilities of a director. The independent directors are Mr. Aschleman, Ms. Guthrie, Ms. Randolph, and Mr. Tomm. In addition, none of our directors are a party to any agreement or arrangement that would require disclosure pursuant to Nasdaq Rule 5250(b)(3).

To facilitate communication between our management and our non-employee directors, Mr. Tomm has been designated as the Lead Independent Director and presides at executive sessions of the non-employee directors. Following an executive session, the Lead Independent Director discusses any issues or requested actions to be taken with the Chief Executive Officer. The Lead Independent Director is also responsible for disseminating information to the rest of the Board in a timely manner, for scheduling and preparing agendas for meetings of our non-employee directors and, together with our Chairman of the Board, our Vice Chairman of the Board, and our President and Chief Executive Officer, for scheduling and preparing agendas for meetings of our Board.

The Board evaluates its leadership structure on an ongoing basis and may change it as circumstances warrant.

Board Committees

The Board has an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each of the committees operates pursuant to a written charter, which can be viewed on our website at investors.shoecarnival.com/governance/governance-documents.

Audit Committee

The Audit Committee is solely responsible for the selection and hiring of the independent registered public accounting firm to audit our financial statements and records and pre-approves audit and permitted non-audit services undertaken by the independent registered public accounting firm. It is also responsible for the review of our (i) financial reports, (ii) systems of internal controls regarding finance, accounting, legal compliance and ethics, (iii) auditing, accounting and financial reporting processes, and (iv) financial and enterprise risk exposures. See “Board and Committee Role in Risk Oversight and ESG Initiatives” for additional information. The Audit Committee approves all related person transactions and meets with management and our independent registered public accounting firm as necessary.

The Audit Committee consists of three non-employee directors: Mr. Tomm (Chair), Mr. Aschleman, and Ms. Guthrie. The Board and the Audit Committee believe the current member composition satisfies the Nasdaq Listing Rules governing audit committee composition, including the requirement that the audit committee members all be “independent” directors, as that term for audit committee members is defined in the Nasdaq Listing Rules and Rule 10A-3 of the Exchange Act. The Board has also determined that Mr. Tomm qualifies as an “audit committee financial expert” as defined by the SEC rules adopted pursuant to the Sarbanes-Oxley Act of 2002. The Audit Committee met seven times during Fiscal 2023.

Compensation Committee

The Compensation Committee is responsible for evaluating and approving our director and officer compensation plans, policies and programs. The Compensation Committee also administers our equity compensation and retirement plans and reviews the risks related to our compensation policies and programs. For a detailed description of the roles of the Compensation Committee and management in setting compensation, see “Executive Compensation – Compensation Discussion and Analysis” starting on page 19 of this proxy statement.

In January 2023 and January 2022, the Compensation Committee engaged Pearl Meyer & Partners, LLC (“Pearl Meyer”) as its independent compensation consultant. Pearl Meyer assisted the Compensation Committee in establishing the peer group utilized by the Compensation Committee in setting Fiscal 2023 and Fiscal 2022 Executive compensation and designing and structuring our annual cash incentive program, our long-term equity-based incentive compensation program and our non-employee director compensation program, including a comparison of our programs and practices to companies in our peer group.

Pearl Meyer reported directly to the Compensation Committee and has not provided any other services to the Company. Prior to engaging Pearl Meyer, the Compensation Committee assessed the independence of Pearl Meyer pursuant to SEC rules and the Nasdaq Listing Rules and concluded that no conflict of interest exists.

The Compensation Committee consists of four non-employee directors: Mr. Aschleman (Chair), Ms. Guthrie, Ms. Randolph and Mr. Tomm. Each of the members meets the independence requirements of the Nasdaq Listing Rules and Rule 10C-1(b)(1) promulgated under the Exchange Act and is a “Non-Employee Director” as defined in Rule 16b-3 under the Exchange Act. During Fiscal 2023, none of the members were involved in a relationship requiring disclosure as an interlocking executive officer/director or as a former officer or employee. In addition, none of the members were involved in a relationship requiring disclosure under Item 404(a) of Regulation S-K. The Compensation Committee held seven meetings during Fiscal 2023.

Nominating and Corporate Governance Committee

The Nominating Committee exercises a leadership role in shaping our corporate governance and recommends to the Board corporate governance principles on a number of topics, including (i) Board organization, membership and function, (ii) committee structure and membership, (iii) oversight of the annual performance evaluation of the Board, the committees of the Board and individual directors, and (iv) oversight of matters that involve our image, reputation and standing as a responsible corporate citizen, including our environmental, social and governance (“ESG”) related initiatives and activities. As the nominating body of the Board, it also interviews, evaluates, nominates and recommends individuals for membership on the Board and on the various committees of the Board. Nominees will be evaluated based on their experience, judgment, integrity, ability to make independent inquiries, understanding of our business environment and willingness to devote adequate time to Board duties.

Our Corporate Governance Guidelines provide that in identifying potential director nominees, our Nominating Committee is to take into account geographic, occupational, gender, race/ethnicity and age diversity and the board diversity objectives set forth in Nasdaq’s corporate governance requirements. Broadly defined, diversity means diversity of viewpoints, background, experience and other demographics. The Nominating Committee implements that policy, and assesses its effectiveness, by examining the diversity of all of the directors on the Board when it selects nominees for directors. The diversity of directors is one of the factors that the Nominating Committee considers, along with the other selection criteria described above.

Director candidates may come to the attention of the Nominating Committee through current Board members, management, professional search firms or other persons. The Nominating Committee also will consider director candidates recommended by shareholders. A shareholder who wishes to recommend a director candidate for consideration should send such recommendation to our Secretary at 7500 East Columbia Street, Evansville, Indiana 47715, who will forward it to the Nominating Committee. Any such recommendation should include a description of the candidate's qualifications for Board service, the candidate's written consent to be considered for nomination and to serve if nominated and elected, and addresses and telephone numbers for contacting the shareholder and the candidate for more information. A shareholder who wishes to nominate an individual as a director candidate at an annual meeting of shareholders, rather than recommend the individual to the Nominating Committee as a nominee, must comply with the advance notice requirements set forth in our by-laws, a copy of which may be obtained from our Secretary. A summary of such requirements is provided in this proxy statement under “Shareholder Proposals for 2025 Annual Meeting.” The Nominating Committee’s process for identifying and evaluating nominees for director will be the same whether the nominee is from the Nominating Committee’s search for a candidate or whether the nominee was recommended by a shareholder.

The Nominating Committee consists of three non-employee directors: Ms. Guthrie (Chair), Mr. Aschleman, and Ms. Randolph. Each member is “independent,” as such term for nominating committee members is defined in the Nasdaq Listing Rules. The Nominating Committee met four times during Fiscal 2023.

Board and Committee Role in Risk Oversight and ESG Initiatives

Our Board has ultimate oversight responsibility for our risk management process, and its various committees assist the full Board in fulfilling these oversight responsibilities in certain areas of risk. In particular, the Audit Committee focuses on financial and enterprise risk exposures, including internal controls. The Audit Committee discusses with management, internal audit, and the independent registered public accounting firm our major financial risk exposures, including risks related to fraud, liquidity and regulatory compliance, our policies with respect to risk assessment and risk management, and the steps management has taken to monitor and control such exposures. The Board also periodically receives information about our risk management activities and the most significant risks we face, principally through Audit Committee reports to the Board and summary briefings provided by management. Risks associated with technology are a particular focus, and at least annually, our Senior Vice President and Chief Information Officer provides reports to the Audit Committee regarding our protocols, material threats or incidents and other developments related to our information technology, including cybersecurity risks. The Audit Committee members, as well as each other Board member, also have access to our Chief Financial Officer and any other members of our management for discussions between meetings as warranted.

The charter of the Nominating Committee includes specific authority to assist the Board in its oversight of matters relating to our image, reputation, and standing as a responsible corporate citizen, including ESG initiatives and activities. Our management provides reports on the development of our ESG initiatives to our Nominating Committee. These updates address our human capital resources and initiatives that reduce our impact on the environment as well as the impact these areas might have on our public image.

The Compensation Committee regularly reviews the risks associated with how we compensate our executive officers and Board members. For a description of the Compensation Committee’s role in overseeing compensation-related risks, see “Executive Compensation – Compensation-Related Risk Assessment” on page 32 of this proxy statement.

On June 19, 2023, the Board, based on the recommendation of the Compensation Committee, adopted an amended and restated compensation recovery (or clawback) policy providing for the recoupment of certain incentive compensation awarded to our current and former “officers,” as defined in Section 16a-1(f) of the Exchange Act, which includes our Executives. The policy was amended and restated to align with Nasdaq’s final listing standards with respect to compensation recovery policies that were finalized during 2023. As further noted on page 29 of this proxy statement, the policy applies to accounting restatements as required by the Nasdaq listing standards and to fraud or intentional misconduct resulting in a violation of law that causes significant financial or reputational harm to us, which is not required by the Nasdaq listing standards.

Social and Environmental Responsibility

We recognize and embrace the importance of being a good corporate citizen who values our associates, meaningfully gives back to our communities and actively addresses the impact our operations have on the environment. We understand that accomplishing these goals, along with delivering strong financial performance, drives long-term shareholder value.

Culture and Human Capital Management

We have intentionally built an employee-centric, customer-focused organization designed to compete at the highest levels in the retail industry. Our commitment to, and investment in, a strong performance culture is paramount to our long-term sustainability and success.

Workforce Diversity

We serve a diverse customer base and seek diversity in and among our workforce in all areas, from our stores to our Evansville distribution center and our corporate offices. We are firmly committed to providing equal opportunities in all aspects of employment and believe that all individuals should be treated with respect and dignity. Diversity is an important element in our ongoing annual mandatory training for all employees and managers. We do not tolerate harassment or unlawful discrimination of any kind.

We have clear policies encouraging strong relationships and protecting open lines of communication with management at every level. This, coupled with our non-retaliation policy, encourages employees to communicate issues and seek immediate redress of those issues if they should arise.

We understand the value of diversity at all levels, whether of gender, race, ethnicity, background or experience. As of our Fiscal 2023 year end, our workforce identified as 64% female and 36% male. Our broad-based leadership team, including those who manage and lead our stores and those who lead our Company, identified as 62% female and 38% male. With respect to ethnicity, our leadership team identified as 60% Caucasian and 40% non-Caucasian. The diversity of our leadership team trends with the diversity of our customer base, which based on recent data from our Shoe Perks customer loyalty program, approximates 70% Caucasian and 30% non-Caucasian and is more female than male.

In our corporate leadership roles (senior director-level employees through our named executive officers), the percentage identifying as female has significantly increased over the last five years from 5% to 24% with several departments, such as human resources, buying and merchandising, technology and accounting, being led by those that identify as female.

Board Diversity

We are also focused on the diversity of our Board. Currently, two of four of our non-employee Board members and two of seven of our total Board members identify as female. We are continuing to refresh our Board and assess long-term succession as well as the diversity of the Board’s collective skill set. Over the last four years, three board members have transitioned, creating opportunity for new directors who have enhanced our diversity. Consistent with our objective to enhance the diversity of our Board, the Board has prioritized the identification of diverse director candidates and is actively evaluating diverse candidates. Our Board will appoint an ethnically diverse director to the Board as soon as reasonably practicable but no later than by our 2025 annual meeting of shareholders.

The following matrix summarizes the diversity of our Board as of April 24, 2024 and April 19, 2023:

|

|

|

|

|

|

|

|

Total Number of Directors |

7 |

|

Female |

|

Male |

|

Non-Binary |

|

Did Not Disclose |

Gender Identity |

2 |

|

5 |

|

– |

|

– |

|

|

|

|

|

|

|

|

Demographic Background: White |

2 |

|

5 |

|

– |

|

– |

Retention

We believe our employee-centric culture not only supports higher levels of execution and performance, but also has led to increased retention of key talent.

Our store-level training programs provide the foundation for long-term careers and our ability to promote from within. We support the first-time jobs for many of our associates where they gain workforce experiences that may grow into long-term careers.

Currently, all of the general managers who operate our Shoe Carnival bannered stores and 94% of our district managers who oversee those general managers were trained, developed and promoted from within. As of our Fiscal 2023 year end, of our 32 district managers across both banners, 66% have been employed by us for more than 20 years. The average tenure of the general managers who operate our Shoe Carnival and Shoe Station bannered stores was 14 years as of Fiscal 2023 year end.

Individuals who comprise our leadership team, which includes our named executive officers, vice presidents and senior director-level employees, have been employed by Shoe Carnival or Shoe Station for an average of 18 years.

Annually we survey a cross-section of employees on matters involving policy and procedure, organizational structure, operating style, commitment to hiring a competent workforce and commitment to integrity and ethical values. Since 2004, responses to this survey have had an average score of 4.2 to 4.3, with 5 being “strongly agree.”

Employee Benefits

Among the many ways we seek to serve our employees, we offer a complete range of benefits. These include competitive wages and incentives; an employee stock purchase plan with a discount off the fair value of our common stock; employer-subsidized medical plans with dental and vision benefits; qualified and unqualified defined contribution plans with employer matching contributions; and merchandise discounts, among other benefits.

Training and Code of Business Conduct and Ethics

We are dedicated to strengthening our culture and execution through ongoing training for all associates. We are uniquely focused on training within our store-level, customer-facing operations. Employees must obtain necessary certifications in order to be responsible for the keys to a store and eventually to become a general manager. Our broad-based training program also engages and educates our employees on the following key topics:

•Code of Business Conduct and Ethics (“Code of Ethics”);

•Non-discrimination and anti-harassment;

•Cybersecurity awareness and responsibility; and

More information regarding our approach to conducting business responsibly, including our guidelines on discrimination and harassment, can be found in our Code of Ethics. Our Code of Ethics applies to all of our Board members, officers and employees, including our principal executive officer and our principal financial and accounting officer.

Our Code of Ethics is posted on our website at investors.shoecarnival.com/governance/governance-documents. We intend to disclose any amendments to the Code of Ethics by posting such amendments on our website. In addition, any waivers of the Code of Ethics for our Board members or executive officers will be disclosed in a Current Report on Form 8-K.

Expectations of our Vendor Partners

In Fiscal 2023 we adopted a vendor code of conduct, which is posted on our website at shoecarnival.com/content/about-us#vendor-code-of-conduct. As set forth in the vendor code of conduct, we expect our vendors to have similar, ethical business practices to those set forth in our Code of Ethics and our other policies and procedures and follow both in spirit and letter. We expect our vendors to promote fair dealing and disclose conflicts. The vendor code of conduct (1) includes prohibitions against forced or involuntary labor, discrimination, harassment and abuse and (2) promotes fair labor standards, workforce health and safety, compliance with environmental law, supply chain security, data security, and arm’s length transactions.

Safety of our Employees and Security of our Data

We strive to provide our associates with a safe and healthy work environment. We measure OSHA recordable incidents to gauge the success of our safety protocol. During calendar year 2023, we recorded 62 non-COVID-related OSHA recordable incidents, an approximate 2% reduction in incidents compared to five years ago. Excluding the Shoe Station operations, which continue to be integrated into our safety culture, the decrease compared to five years ago was 5%.

Our strategies to address the ever-expanding complexities of protecting customer and employee data and executing our business strategies in an increasingly digital world continue to advance. Our technology department monitors and regularly tests compliance with our protocols, provides regular updates to employees and management and conducts annual training.

We are committed to helping build stronger communities by giving back to the areas where we do business. Throughout our history, we have demonstrated that commitment through sponsored events, educational programs, charitable donations, and volunteerism all focused on assisting the communities where we operate. We support both national and local chapters of nonprofit organizations such as the Two Ten Foundation, United Way, Junior Achievement, National CASA/GAL Association, Youth First, the American Red Cross, Ronald McDonald House Charities, and Habitat for Humanity.

In addition, every year each store is provided funds to support local nonprofits in its local community. Further, corporate associates can request and receive an annual financial stipend to support family-related nonprofit initiatives important to their families.

Our stores serve as a platform for our customers to contribute to causes by providing the option for customers to “round up” transactions to the nearest dollar, among other initiatives. Organizations that have recently benefited from our ability to perform this critical function include St. Jude’s Research Hospital, the Boys and Girls Club, the American Cancer Society, and the Toys for Tots Foundation.

We are fully committed to accessibility for our disabled customers, whether at our physical stores or through our e-commerce platforms. Our partnership with eSSENTIAL Accessibility allows all customers, regardless of ability, to shop via our website. Through an assistive technology app, customers who have trouble typing, moving a mouse, gesturing or reading a screen are able to navigate our website using hands-free face tracking, voice activated controls, visual click assist, an on-screen keyboard, and speech-to-text.

Environmental Initiatives

We seek to minimize our impact on the environment and reduce our carbon footprint by actively implementing environmentally-friendly processes throughout our business, including energy efficiency initiatives, waste minimization, and the use of recycled materials within our supply chain. Our most significant areas of focus are fuel and packaging material used to deliver merchandise to our Evansville distribution center and stores; the HVAC and lighting systems in our stores, Evansville distribution center, and corporate offices; and recycling methods.

Fuel Consumption

Working closely with our dedicated transportation provider, we optimize the routing efficiency of trucks transporting product from our centralized distribution center to our retail stores. Further fuel efficiency is achieved as we maximize the amount of product placed in each truck in a “load floor to ceiling” approach, resulting in fewer outbound shipments required to support our stores.

Recycle and Reuse of Corrugated Boxes, Paper and Wooden Pallets

In our Evansville distribution center, we have established a reuse and recycle program with the corrugated boxes we receive in shipments from vendors, reusing those boxes to ship product to our stores. Where further reuse is not practicable, corrugate across our operations is recycled. In addition, we recycle wooden pallets when they are no longer useable. This emphasis on responsible recycling of wood-based material extends across our operations, where a single stream recycling practice and policy has been established.

Energy Management

We have several important initiatives underway that reflect our commitment to responsibly minimize our use of energy.

At our corporate headquarters, we have implemented a wide range of energy reduction initiatives that have lowered our energy usage. These include reconfiguration of the HVAC, installation of UV window coverings, and use of LED lighting and occupancy sensors.

At our Evansville distribution center, energy-efficient lighting systems are also installed with occupancy sensors and HVAC upgrades have been made. “Opportunity chargers” are in place, providing a more efficient battery-charging process for material handling equipment throughout the facility.

This focus on minimizing environmental impact extends to our retail stores. Whenever a store is newly constructed, it is equipped with LED lighting and an Energy Management System (“EMS”). The EMS monitors and regulates HVAC, lighting, and storefront sign lighting, reducing energy consumption by 25%. This program currently extends to 60% of our Shoe Carnival bannered stores. As part of our store modernization program, we are installing LED lighting and an EMS at each location and expect to continue to modernize stores and add EMS and LED lighting in Fiscal 2024. For those stores awaiting future implementation of the EMS, specialized thermostats reduce overall energy use.

We are proud of our ongoing sustainability accomplishments and progress to date regarding ongoing energy management initiatives.

Proposal No. 2

Advisory Vote on the Compensation Paid to our Executives

We are providing shareholders the opportunity to cast advisory votes on named executive officer compensation as required by Section 14A of the Exchange Act. This proposal, commonly known as a “say-on-pay” proposal, gives our shareholders the opportunity to express their views on the compensation of our Executives. The “Executives” are our President and Chief Executive Officer, our Senior Vice President – Chief Financial Officer, Treasurer and Secretary, and our other executive officers named in the Summary Compensation Table on page 33 of this proxy statement.

This vote is not intended to address any specific item of compensation but rather the overall compensation of our Executives and the philosophy, policies and practices described in this proxy statement. Accordingly, we are asking our shareholders to approve the following resolution at the annual meeting:

“RESOLVED, that the Company's shareholders approve, on an advisory basis, the compensation of the Executives, as disclosed in the Company's Proxy Statement for the 2024 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the compensation tables and the other related disclosure.”

We encourage our shareholders to read the Compensation Discussion and Analysis section, along with the compensation tables and narrative discussion contained in this proxy statement. We believe that our Fiscal 2023 Executive compensation aligned with the objectives of our pay-for-performance compensation philosophy and with our financial performance and was effective in fulfilling the Compensation Committee’s compensation objectives.

Although the outcome of this annual vote is not binding on the Company, our Board or our Compensation Committee, our Board and our Compensation Committee value the opinion of our shareholders and will consider the results of the vote on this proposal when setting future compensation for our Executives.

The Board recommends that our shareholders vote FOR the approval, on an advisory basis, of the compensation paid to our Executives, as disclosed in this proxy statement.

Executive Compensation

Compensation Discussion and Analysis

Overview

This “Compensation Discussion and Analysis” section of the proxy statement is intended to help our shareholders understand our overall executive compensation programs, objectives, framework and elements and to discuss and analyze the compensation paid to our named executive officers shown in the Summary Compensation Table and in the other tables and narrative discussion that follow (the “Executives”), as determined and approved by the Compensation Committee (the “Committee”). The Committee maintains the following executive compensation governance practices, each of which reinforces our compensation philosophy and objectives:

|

|

What We Do |

What We Do Not Do |

•Long-term equity-based awards granted to our Executives are weighted toward performance-based stock units (“PSUs”). |

•Our Executives’ employment contracts do not provide for excise tax gross-ups upon a change in control and do not guarantee salary increases, bonuses or awards of equity-based compensation. |

•Both our annual cash incentive plan and our PSUs include performance thresholds and payout caps. |

•Our directors and Executives are prohibited from hedging and pledging our stock. |

•Our PSUs and service-based restricted stock units (“RSUs”) only vest following a change in control if employment is terminated without cause or for good reason (“double trigger”). |

· Our Executives receive limited perquisites. |

•Our directors and executive officers are subject to stock ownership requirements. |

•There is no guaranteed return or above-market return on compensation that has been deferred. |

•Our clawback policy for each Executives’ incentive compensation applies to both accounting restatements due to material noncompliance with financial reporting requirements, as well as fraud and intentional misconduct. |

•We do not provide any pension benefits. |

•The Committee has the discretion to lower performance-based awards when it determines that such adjustments would be in the best interests of the Company and our shareholders. |

· We have not granted stock options since 2008. |

•Compensation decisions for the CEO and other Executives are subject to the review and approval of the Compensation Committee, comprised of independent directors and advised by its selected independent advisors. |

|

Amendment and Restatement of the 2017 Equity Incentive Plan

At our 2023 annual meeting on June 20, 2023, our shareholders approved an amendment and restatement of the Shoe Carnival, Inc. 2017 Equity Incentive Plan (as amended and restated, the “2017 Equity Plan”). Pursuant to the amendment and restatement, the number of shares of our common stock reserved for issuance under the 2017 Equity Plan was increased by an additional 1,800,000 shares, the term of the 2017 Equity Plan was extended to June 20, 2033, and certain other design changes were made to the plan.

The 2017 Equity Plan includes a number of provisions that we believe promote and reflect compensation practices that closely align our equity compensation arrangements with the interests of our shareholders, including the following key features:

•Dividends, distributions and dividend equivalents payable only on vested awards. The 2017 Equity Plan provides that any dividends, distributions or dividend equivalents payable with respect to the shares of our common stock that are subject to an award will be subject to the same restrictions and risk of forfeiture as the award and will only be paid if the vesting provisions of an award are met.

•No evergreen provision. There is no “evergreen” or automatic replenishment provision pursuant to which the shares authorized for issuance under the 2017 Equity Plan are automatically replenished.

•No automatic grants. The 2017 Equity Plan does not provide for automatic grants to any participant.

•Limited definition of “change in control.” No change in control would be triggered by shareholder approval of a business combination transaction, the announcement or commencement of a tender offer or any Board assessment that a change in control is imminent.

•No liberal share recycling provisions. We may not add back to the 2017 Equity Plan’s share reserve shares that are delivered or withheld to satisfy a tax withholding obligation in connection with any form of award currently granted to our Executives.

Our Executives for Fiscal 2023

Our Executives and their positions at the end of Fiscal 2023 were:

|

Mark J. Worden, President and Chief Executive Officer |

Patrick C. Edwards, Senior Vice President – Chief Financial Officer, Treasurer and Secretary |

Carl N. Scibetta, Senior Executive Vice President – Chief Merchandising Officer |

Marc A. Chilton, Executive Vice President – Chief Operating Officer |

Clifton E. Sifford, Vice Chairman of the Board |

This Compensation Discussion and Analysis focuses principally on the compensation paid to Mr. Worden, Mr. Edwards, Mr. Scibetta and Mr. Chilton. The compensation paid to Mr. Sifford is discussed on page 27. During Fiscal 2023, W. Kerry Jackson and Erik D. Gast each served as our principal financial officer for part of the year. The compensation for these former executive officers is discussed on page 27.

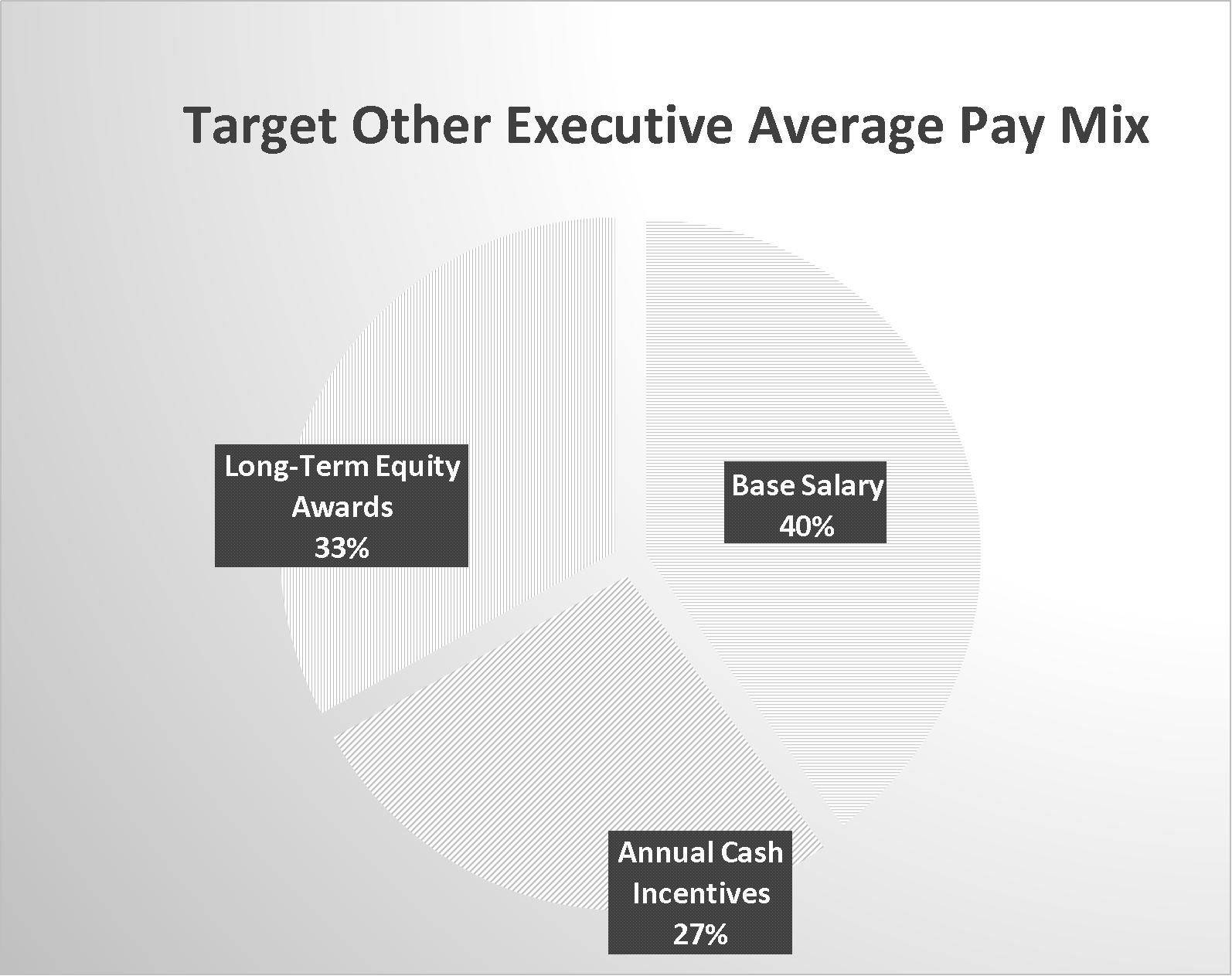

Target Pay Mix

Total compensation for our Executives is primarily comprised of a mix of base salary, annual cash incentives and long-term equity-based compensation. The following charts show, with respect to our Chief Executive Officer and our other Executives, (i) base salary, (ii) target annual cash incentives under our Executive Incentive Compensation Plan (the “EICP”), and (iii) the grant date fair value of the PSUs and service-based RSUs granted to our Executives under the 2017 Equity Plan, each as a percentage of total target direct compensation, for Fiscal 2023. The other Executives include Messrs. Edwards, Scibetta and Chilton.

Fiscal 2023 Financial Results

The following table highlights comparisons of some of the key financial metrics that we use to evaluate our performance for the purposes of making compensation decisions. ($ amounts in thousands except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Key Financial Metrics |

|

Fiscal 2023 |

|

Fiscal 2022 |

|

Fiscal 2021 |

|

Fiscal 2020 |

|

Fiscal 2019 |

Net Sales |

|

$ |

1,175,882 |

|

$ |

1,262,235 |

|

$ |

1,330,394 |

|

$ |

976,765 |

|

$ |

1,036,551 |

Comparable Store Sales Change |

|

|

(8.8)% |

|

|

(11.1)% |

|

|

35.3% |

|

|

(5.3)% |

|

|

1.9% |

Gross Profit Percentage |

|

|

35.8% |

|

|

37.1% |

|

|

39.6% |

|

|

28.7% |

|

|

30.1% |

Operating Income |

|

$ |

93,505 |

|

$ |

146,444 |

|

$ |

207,654 |

|

$ |

21,865 |

|

$ |

54,209 |

Net Income |

|

$ |

73,348 |

|

$ |

110,068 |

|

$ |

154,881 |

|

$ |

15,991 |

|

$ |

42,914 |

Diluted Net Income Per Share |

|

$ |

2.68 |

|

$ |

3.96 |

|

$ |

5.42 |

|

$ |

0.56 |

|

$ |

1.46 |

In Fiscal 2023, our results were impacted by continuing inflation, higher interest rates, and reduced tax refunds. These economic factors particularly impacted our Shoe Carnival banner and its lower income customers and more urban markets. Our Diluted Net Income per Share ("EPS") earned in Fiscal 2023 was $2.68 compared to $3.96 earned in Fiscal 2022. The primary driver of the lower EPS in Fiscal 2023 compared to Fiscal 2022 was an $86.4 million, or 6.8%, decline in Net Sales, with our Shoe Carnival banner down 7.8%, offset by a 4.5% increase from our Shoe Station banner.