Republic First Bancorp, Inc. Reports 156% Increase in Third Quarter

Earnings PHILADELPHIA, Oct. 25 /PRNewswire-FirstCall/ -- Republic

First Bancorp, Inc. (NASDAQ:FRBK) (the "Company"), the holding

company for Republic First Bank (PA) and First Bank of Delaware

(DE), today reported third quarter 2004 earnings of $3.1 million.

Total third quarter 2004 diluted earnings per share amounted to

$0.41* compared to $0.16* for the prior year third quarter, a 156%

increase from the prior year third quarter. Total year to date

earnings increased to $6.3 million in 2004, compared to $3.7

million for the prior year. Total year to date diluted earnings per

share increased to $0.83* compared to $.50* in the prior year.

Average commercial and construction loans and core deposits grew in

excess of 20% in third quarter 2004 compared to the comparable

prior year period. Chairman Harry Madonna stated, "While the large

one-time loan loss recovery during the period was a positive

development, it should not overshadow the continued improvement in

core earnings. The growth in commercial loans and core deposits,

which exceeded 20%, also augurs well for the future. During the

quarter, $125 million of the Bank's Federal Home Loan Bank

borrowings, with a blended rate of over 6%, began to be paid off,

and will continue to be paid off through February of 2005. These

pay offs will significantly decrease our cost of funds in the

current rate environment. We will continue to focus on our

carefully selected lines of business, each of which continues to

meet or exceed our expectations. We look forward to making

continued progress, and further increasing shareholder value."

Total shareholders' equity stood at $62.6 million with a book value

per share of $8.65* at September 30, 2004, based on outstanding

common shares of approximately 7.3 million*. As of that date, the

Company continued to be well capitalized. Republic First Bank (PA)

and First Bank of Delaware (DE) are full-service, state-chartered

commercial banks, whose deposits are insured by the Federal Deposit

Insurance Corporation (FDIC). The Banks provide diversified

financial products through their twelve offices located in

Abington, Ardmore, Bala Cynwyd, East Norriton, and Philadelphia,

Pennsylvania and Wilmington, Delaware. The Company may from time to

time make written or oral "forward-looking statements," including

statements contained in this release and in the Company's filings

with the Securities and Exchange Commission. These forward-looking

statements include statements with respect to the Company's

beliefs, plans, objectives, goals, expectations, anticipations,

estimates, and intentions that are subject to significant risks and

uncertainties and are subject to change based on various factors,

many of which are beyond the Company's control. The words "may,"

"could," "should," "would," "believe," "anticipate," "estimate,"

"expect," "intend," "plan," and similar expressions are intended to

identify forward-looking statements. All such statements are made

in good faith by the Company pursuant to the "safe harbor"

provisions of the Private Securities Litigation Reform Act of 1995.

The Company does not undertake to update any forward-looking

statement, whether written or oral, that may be made from time to

time by or on behalf of the Company. * All current and prior year

per share amounts and total shares outstanding reflect the 10%

stock dividend paid August 24, 2004. Republic First Bancorp, Inc.

Condensed Income Statement (Dollar amounts in thousands except per

share data) Three Months Ended Nine Months Ended September 30,

September 30, 2004 2003 2004 2003 Net Interest Income $5,514 $4,081

$15,443 $21,474 Provision for Loan Losses (611) 647 263 6,345 Other

Income 3,817 2,826 9,393 4,218 Other Expenses 5,346 4,421 15,153

13,797 Income Taxes 1,513 606 3,168 1,873 Net Income $3,083 $1,233

$6,252 $3,677 Basic EPS $0.43 $0.17 $0.88 $0.52 Diluted EPS $0.41

$0.16 $0.83 $0.50 Republic First Bancorp, Inc. Condensed Balance

Sheet (Dollar amounts in thousands) Assets September 30 September

30 2004 2003 Federal Funds Sold and Other Interest Bearing Cash

$59,319 $71,122 Investment Securities 54,080 50,702 Commercial and

Other Loans 553,263 471,775 Allowance for Loan Losses (8,338)

(8,731) Other Assets 54,564 59,899 Total Assets $712,888 $644,767

Liabilities and Shareholders' Equity: Transaction Accounts $345,145

$266,845 Time Deposit Accounts 185,848 180,768 FHLB Advances and

Trust Preferred Securities 106,186 131,000 Other Liabilities 13,063

11,188 Shareholders' Equity 62,646 54,966 Total Liabilities and

Shareholders' Equity $712,888 $644,767 Republic First Bancorp, Inc.

September 30, 2004 At or For the Three Months Ended September 30

September 30 Financial Data: 2004 2003 Return on average assets

1.79% 0.75% Return on average equity 20.52% 8.94% Share

information: Book value per share $8.65 $7.62 Shares o/s at period

end 7,242,991 7,141,000 Average diluted shares o/s 7,607,000

7,481,000 At or For the Nine Months Ended September 30 September 30

Financial Data: 2004 2003 Return on average assets 1.20% 0.75%

Return on average equity 13.83% 9.26% Republic First Bancorp, Inc.

Press release 9/30/04 (Dollars in thousands except per share data)

Credit Quality Ratios: Sept. 30 Dec. 31, Sept. 30 2004 2003 2003

Non-accrual and loans accruing, but past due 90 days or more $7,640

$8,611 $6,983 Restructured loans - - - Total non-performing loans

7,640 8,611 6,983 OREO 207 207 1,015 Total non-performing assets

$7,847 $8,818 $7,998 Non-performing loans as a percentage of total

loans 1.38% 1.76% 1.48% Non-performing assets as a percentage of

total assets 1.10% 1.35% 1.24% Allowance for loan losses to total

loans 1.51% 1.78% 1.85% Allowance for loan losses to total

non-performing loans 109.14% 101.00% 119% Republic First Bancorp,

Inc. Press release 9/30/04 (Dollars in thousands) Quarter-to-Date

Average Balance Sheet Three months ended Three months ended

September 30, 2004 September 30, 2003 Interest-Earning Average

Average Assets: Average Yield/ Average Yield/ Balance Interest Cost

Balance Interest Cost Commercial and other loans $535,942 $8,714

6.45 % $458,719 $7,339 6.35 % Investment securities 58,723 502 3.42

54,552 586 4.29 Federal funds sold 43,913 161 1.45 76,927 243 1.25

Total interest-earning assets 638,578 9,377 5.82 590,198 8,168 5.50

Other assets 60,688 57,736 Total assets $699,266 $9,377 $647,934

$8,168 Interest-bearing liabilities: Interest-bearing deposits

$408,421 $1,957 1.90 % $374,876 $2,007 2.12 % Borrowed funds

120,648 1,906 6.27 134,074 2,079 6.15 Other liabilities 529,069

3,863 3.06 508,950 4,086 3.19 Non-interest and interest-bearing

funding 623,687 3,863 2.46 579,980 4,086 2.80 Other liabilities:

14,590 13,227 Total liabilities 638,277 593,207 Shareholders'

equity 60,989 54,727 Total liabilities & shareholders' equity

$699,266 $647,934 Net interest income $5,514 $4,082 Interest rate

spread 3.36 % 2.70 % Net interest margin 3.42 % 2.75 % Republic

First Bancorp, Inc. Press release 9/30/04 (Dollars in thousands)

Year to Date Average Balance Sheet Nine months ended Nine months

ended September 30, 2004 September 30, 2003 Interest-Earning

Average Average Assets: Average Yield/ Average Yield/ Balance

Interest Cost Balance Interest Cost Commercial and Other Loans

$516,373 $25,057 6.47 % $468,853 $31,215 8.90 % Investment

securities 64,664 1,629 3.36 68,877 2,331 4.51 Federal funds sold

60,352 524 1.16 76,684 735 1.28 Total interest- earning assets

641,389 27,210 5.65 614,414 34,281 7.46 Non-interest-earning assets

52,143 44,210 Total Assets $693,532 $27,210 $658,624 $34,281

Interest-bearing liabilities: Interest-bearing deposits $395,180

$5,785 1.96 % $390,114 $6,639 2.28 % Borrowed funds 128,091 5,982

6.24 133,316 6,168 6.19 Total interest- bearing liabilities 523,271

11,767 3.01 523,430 12,807 3.27 Cost of funds 618,930 11,767 2.54

596,546 12,807 2.87 Non-interest- bearing liabilities: 14,335 8,978

Total liabilities 633,265 605,524 Shareholders' Equity 60,267

53,100 Total liabilities & shareholders' equity $693,532

$658,624 Net interest income $15,443 $21,474 Interest rate spread

3.11 % 4.59 % Net interest margin 3.21 % 4.67 % DATASOURCE:

Republic First Bancorp, Inc. CONTACT: Paul Frenkiel, CFO of

Republic First Bancorp, +1-215-735-4422 ext. 255

Copyright

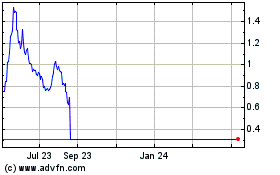

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From May 2024 to Jun 2024

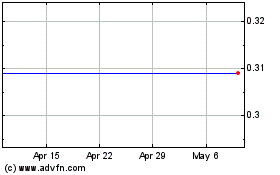

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jun 2023 to Jun 2024