PHILADELPHIA, July 30 /PRNewswire-FirstCall/ -- Republic First

Bancorp, Inc. (NASDAQ:FRBK), (the "Company") the holding company

for Republic First Bank (PA), today reported second quarter 2008

earnings of $1.2 million or $.11 per diluted share. Income

Statement (dollars in thousands, except per share data) Three

months ended % % 6/30/08 3/31/08 Change 6/30/07 Change Total

revenues* $7,840 $7,887 -1% $8,265 -5% Net income $1,189 $(2,778)

143% $1,968 -40% Diluted net income per share $0.11 $(0.27) 141%

$0.18 -39% * Net interest income plus noninterest income Balance

Sheet (dollars in millions) % % 6/30/08 3/31/08 Change 6/30/07

Change Total assets $948 $999 -5% $1,025 -8% Total deposits $729

$750 -3% $798 -9% Total loans (net) $784 $787 - $829 -5% Chief

Executive Officer's Statement In commenting on the Company's

financial results, Harry D. Madonna, Chief Executive Officer noted

the following highlights: -- Core deposits grew 8% on a linked

quarter basis. -- Credit quality stabilized as nonperforming assets

were reduced to $17.4 million at June 30, 2008, down from $26.0

million at December 31, 2008. -- The net interest margin stabilized

in the quarter to 3.19%, which was flat compared to the first

quarter. As a result of significant maturities of higher cost

certificates of deposit, margins should begin to show meaningful

improvement in the remaining quarters of 2008. -- Noninterest

expenses were reduced to $6.1 million in the quarter from $6.5

million in the prior quarter, primarily as a result of reduced

expenses related to other real estate owned. Salary expense was

also modestly reduced. -- A successful $10.8 million trust

preferred offering generated significant capital for growth,

resulting in a 10%+ tier one leverage ratio. As a result of higher

long-term investment rates, the Company was able to offset the

future interest cost with investments in full faith and credit

government securities. -- Tier one leverage capital amounted to

10.7% at June 30, 2008. Harry D. Madonna, Chief Executive Officer,

stated, "We believe that the second quarter marked a significant

milestone in the Company's primary goal of increasing shareholder

value. The Company's issuance of $10.8 million of trust preferred

securities included a significant investment by Mr. Vernon Hill.

That additional capital is available to fund future growth, and

results in a tier one leverage ratio which now exceeds 10%. More

notably, Mr. Hill became a consultant to the Company with the goal

of significantly expanding the Bank's lower cost deposits and

thereby increasing earnings. Mr. Hill's consultancy encompasses

various strategies by which he built his previously affiliated

institution's distribution systems into one of the largest and most

noteworthy in the country. His branch banking and related

strategies are arguably the most successful in the history of

modern banking. Previously the Company had emphasized banking for

small businesses and professionals, with minor emphasis on

individuals. Now, we are committed to driving forward on a fast

track to implement these retail strategies. "Additionally,

nonperforming assets declined to $17.4 million from $26.0 million

at December 31, 2007 and $19.5 million at March 31, 2008." Income

Statement (dollars in thousands, except per share data) Three

months ended Six months ended % % % 6/30/08 3/31/08 Change 6/30/07

Change 6/30/08 6/30/07 Change Total revenues* $7,840 $7,887 -1%

$8,265 -5% $15,727 $16,470 -5% Total operating expenses $6,061

$6,448 -6% $5,283 15% $12,509 $10,278 22% Net income $1,189

$(2,778) 143% $1,968 -40% $(1,589) $4,072 -139% Diluted earnings

per share $0.11 $(0.27) 141% $0.18 -39% $(0.16) $0.38 -142% * Net

interest income plus noninterest income Total revenues of $7.8

million for the second quarter approximated the first quarter

amount. The lower revenues in 2008 compared to the prior year,

reflected lower loan balances which also contributed to a lower net

interest margin. Operating expenses were reduced 6% to $6.1 million

from $6.5 million in the prior quarter primarily as a result of

reduced other real estate owned expenses. Expenses were higher in

2008 compared to the prior year, primarily as a result of such

expenses. Net Interest Income and Net Interest Margin Net interest

income (on a tax equivalent basis) of $7.1 million in the second

quarter, compared to $7.3 million in the first quarter and $7.6

million for the prior year period. The lower current year amounts

reflected lower balances of loans and securities, and a lower net

interest margin. As a result of higher rate certificate of deposit

maturities, management believes that margins should improve going

forward. The net interest margin was 3.19% in both linked quarters,

compared to 3.26% for the prior year quarter. We expect net

interest margin to improve. Noninterest Income: Three months ended

Six months ended % % % 6/30/08 3/31/08 Change 6/30/07 Change

6/30/08 6/30/07 Change Deposit charges, service fees $297 $287 3%

$280 6% $584 $582 - Other income 539 378 43% 475 13% 917 813 13%

Non- interest Income $836 $665 26% $755 11% $1,501 $1,395 8%

Noninterest Expenses: Three months ended Six months ended % % %

6/30/08 3/31/08 Change 6/30/07 Change 6/30/08 6/30/07 Change

Salaries and employee benefits $2,703 $2,730 -1% $2,545 6% $5,433

$5,161 5% Occupancy 595 603 -1% 604 -1% 1,198 1,141 5% Depreciation

and amortization 339 326 4% 355 -5% 665 689 -3% Legal 274 197 39%

195 40% 471 272 73% Other real estate 382 1,016 -62% 17 2147% 1,398

20 nm Advertising 149 129 16% 159 -6% 278 244 14% Data processing

203 203 0% 155 30% 406 314 29% Insurance 148 104 42% 94 57% 252 187

35% Professional fees 144 99 46% 124 17% 243 250 -3% Regulatory

assessments and costs 178 52 242% 44 305% 230 87 164% Taxes, other

251 261 -4% 211 19% 512 414 24% Other operating expenses 695 728

-4% 780 -11% 1,423 1,499 -5% Total non- interest expense $6,061

$6,448 -6% $5,283 15% $12,509 $10,278 22% Noninterest expenses were

reduced to $6.1 million from $6.5 million in the prior quarter, or

6%, primarily as a result of reduced other real estate owned

expenses. Expenses were higher in 2008 compared to the prior year,

primarily as a result of such expenses. Salaries and employee

benefits expenses amounted to $2.7 million in each quarter of 2008.

Such expenses increased $158,000, or 6%, in the current quarter

compared to the prior year period. Additionally, regulatory

assessments increased to $178,000 in the current quarter, primarily

as a result of increases in statutory FDIC insurance rates. Balance

Sheet Highlights (dollars in thousands) % % 6/30/08 3/31/08 Change

6/30/07 Change Total assets $947,589 $999,163 -5% $1,024,580 -8%

Total loans (net) 784,115 787,345 0% 828,937 -5% Total deposits

728,559 749,532 -3% 798,170 -9% Total core deposits* 346,885

322,433 8% 396,937 -13% * Core deposits exclude all certificates of

deposit. The Company adopted a defensive balance sheet strategy as

a result of the economic downturn, with a resulting 5% decrease in

loans between June 30, 2008 and the prior year. Net loans were

relatively constant on a linked quarter basis, amounting to $784

million at period end. Management believes that there will be

meaningful loan growth by year end 2008, subject to stringent

underwriting requirements. Core deposits, which exclude all

certificates of deposit, increased to $347 million at June 30,

2008, an increase of $24.5 million, or 8% from March 31, 2008. A

decrease compared to the prior year reflected intentional

reductions of higher cost deposits. Lending Gross loans amounted to

$791 million, a decrease of $7 million or 1% compared to March 31,

2008. The composition of the Company's loan portfolio is as

follows: % of % of $ % of 6/30/08 Total 3/31/08 Total Incr/(Decr)

6/30/07 Total Commercial: Real estate secured $466,328 59% $462,058

58% $4,270 $485,048 58% Construction & land development 220,104

28% 226,317 28% (6,213) 242,602 29% Non real estate secured 75,053

9% 75,949 9% (896) 76,533 9% Non real estate unsecured 2,676 0%

5,878 1% (3,202) 6,856 1% Total commercial 764,161 96% 770,202 96%

(6,041) 811,039 97% Residential real estate 5,870 1% 5,915 1% (45)

6,050 1% Consumer & other 20,844 3% 21,384 3% (540) 19,509 2%

Gross loans $790,875 100% $797,501 100% $(6,626) $836,598 100%

Asset Quality The Company's asset quality ratios are highlighted

below: Quarter Ended 6/30/08 3/31/08 6/30/07 Nonperforming

assets/total assets 1.84% 1.95% 1.67% Net loan charge-offs/average

total loans 1.73% 2.05% 0.37% Loan loss reserve/gross loans 0.85%

1.27% 0.92% Nonperforming loan coverage 215% 331% 46% Nonperforming

assets/capital and reserves 20% 22% 20% Nonperforming assets at

June 30, 2008 totaled $17.4 million, or 1.84% of total assets

compared to $19.5 million or 1.95% of total assets at March 31,

2008 and $17.1 million or 1.67% of total assets a year ago. The

reduction at June 30, 2008 compared to the prior quarter, reflected

the sale of several OREO properties. Core Deposits Core deposits by

type of account are as follows: 2nd Qtr 2008 % % Cost of 6/30/08

3/31/08 Change 6/30/07 Change Funds Demand noninterest- bearing

$77,404 $80,440 -4% $83,049 -7% 0.00% Demand interest-bearing

30,167 32,845 -8% 38,942 -23% 0.89% Money market and savings

239,314 209,148 14% 274,946 -13% 2.61% Total core deposits $346,885

$322,433 8% $396,937 -13% 1.83% Core deposits, which exclude all

certificates of deposit, increased to $347 million at June 30,

2008, an increase of $24.5 million or 8% from March 31, 2008. A

decrease compared to the prior year reflected intentional

reductions of higher cost deposits. Capital The Company's capital

ratios at June 30, 2008 were: Republic Regulatory Guidelines First

"Well Capitalized" Leverage Ratio 10.69% 5.00% Tier I 11.63% 6.00%

Total Capital 12.41% 10.00% Three months ended Six months ended

6/30/08 3/31/08 6/30/07 6/30/08 6/30/07 Return on equity 6.12%

-13.90% 10.18% -4.02% 10.71% Total shareholders' equity stood at

$78.4 million with a book value per share of $7.43 at June 30,

2008, based on common shares of approximately 10.6 million.

Republic First Bank (PA) is a full-service, state-chartered

commercial bank, whose deposits are insured by the Federal Deposit

Insurance Corporation (FDIC). The Bank provides diversified

financial products through its twelve offices located in Abington,

Ardmore, Bala Cynwyd, Plymouth Meeting, Media and Philadelphia,

Pennsylvania and Voorhees, New Jersey. The Company may from time to

time make written or oral "forward-looking statements", including

statements contained in this release and in the Company's filings

with the Securities and Exchange Commission. These forward-looking

statements include statements with respect to the Company's

beliefs, plans, objectives, goals, expectations, anticipations,

estimates, and intentions that are subject to significant risks and

uncertainties and are subject to change based on various factors,

many of which are beyond the Company's control. The words "may",

"could", "should", "would", "believe", "anticipate", "estimate",

"expect", "intend", "plan", and similar expressions are intended to

identify forward-looking statements. All such statements are made

in good faith by the Company pursuant to the "safe harbor"

provisions of the Private Securities Litigation Reform Act of 1995.

The Company does not undertake to update any forward-looking

statement, whether written or oral, that may be made from time to

time by or on behalf of the Company. Republic First Bancorp, Inc.

Selected Consolidated Financial Data (unaudited) At or for the

Three months ended (in thousands, except % % per share amounts)

6/30/08 3/31/08 Change 6/30/07 Change Income Statement Data: Net

interest income $7,004 $7,222 -3% $7,510 -7% Provision for loan

losses 43 5,812 -99% 63 -32% Noninterest income 836 665 26% 755 11%

Total revenues 7,840 7,887 -1% 8,265 -5% Noninterest operating

expenses 6,061 6,448 -6% 5,283 15% Net income 1,189 (2,778) -143%

1,968 -40% Per Common Share Data: Net income: Basic $0.11 $(0.27)

-141% $0.19 -42% Net income: Diluted 0.11 (0.27) -141% 0.18 -39%

Book Value Weighted average shares outstanding: Basic 10,445 10,364

10,448 Diluted 10,862 10,504 10,738 Balance Sheet Data: Total

assets $947,589 $999,163 -5% Loans (net) 784,115 787,345 0%

Allowance for loan losses 6,760 10,156 -33% Investment securities

84,572 86,360 -2% Total deposits 728,559 749,532 -3% Core deposits*

346,885 322,433 8% Trust preferred 22,476 11,341 98% Stockholders'

equity 78,399 77,677 1% Capital: Stockholders' equity to total

assets 8.27% 7.77% Leverage ratio 10.69% 9.23% Risk based capital

ratios: Tier 1 11.63% 9.96% Total Capital 12.41% 11.10% Performance

Ratios: Cost of funds 2.96% 3.51% 4.42% Deposit cost of funds 2.98%

3.51% 4.27% Net interest margin 3.19% 3.19% 3.26% Return on average

assets 0.51% -1.16% 0.81% Return on average total stockholders'

equity 6.12% -13.90% 10.18% Asset Quality Net charge-offs to

average loans outstanding 1.73% 2.05% Nonperforming assets to total

period-end assets 1.84% 1.95% Allowance for loan losses to total

period-end loans 0.85% 1.27% Allowance for loan losses to

nonperforming loans 215% 331% Nonperforming assets to capital and

reserves 20% 22% At or for the Six months ended % (in thousands,

except per share amounts) 6/30/08 6/30/07 Change Income Statement

Data: Net interest income $14,226 $15,075 -6% Provision for loan

losses 5,855 143 3994% Noninterest income 1,501 1,395 8% Total

revenues 15,727 16,470 -5% Noninterest operating expenses 12,509

10,278 22% Net income (1,589) 4,072 -139% Per Common Share Data:

Net income: Basic $(0.16) $ 0.39 -141% Net income: Diluted (0.16)

0.38 -142% Book Value Weighted average shares outstanding: Basic

10,404 10,447 Diluted 10,693 10,749 Balance Sheet Data: Total

assets $947,589 $1,024,580 -8% Loans (net) 784,115 828,937 -5%

Allowance for loan losses 6,760 7,661 -12% Investment securities

84,572 86,882 -3% Total deposits 728,559 798,170 -9% Core deposits*

346,885 396,937 -13% Trust preferred 22,746 11,341 98%

Stockholders' equity 78,399 77,469 1% Capital: Stockholders' equity

to total assets 8.27% 7.56% Leverage ratio 10.69% 9.18% Risk based

capital ratios: Tier 1 11.63% 9.91% Total Capital 12.41% 10.76%

Performance Ratios: Cost of funds 3.23% 4.41% Deposit cost of funds

3.23% 4.22% Net interest margin 3.19% 3.30% Return on average

assets -0.33% 0.85% Return on average total stockholders' equity

-4.02% 10.71% Asset Quality Net charge-offs to average loans

outstanding 1.89% 0.13% Nonperforming assets to total period-end

assets 1.84% 1.67% Allowance for loan losses to total period-end

loans 0.85% 0.92% Allowance for loan losses to nonperforming loans

215% 46% Nonperforming assets to capital and reserves 20% 20% *

Core deposits exclude certificates of deposit Republic First

Bancorp, Inc. Average Balances and Net Interest Income (unaudited)

For the three months ended For the three months ended June 30, 2008

March 31, 2008 Interest-earning assets: (Dollars in Interest

Interest thousands) Average Income/ Yield/ Average Income/ Yield/

Balance Expense Rate Balance Expense Rate Federal funds sold and

other interest- earning assets $10,618 $58 2.20% $12,271 $96 3.15%

Securities 82,392 1,167 5.67% 87,545 1,313 6.00% Loans receivable

797,233 12,160 6.13% 817,702 13,453 6.62% Total interest- earning

assets 890,243 13,385 6.05% 917,518 14,862 6.51% Other assets

55,336 42,977 Total assets $945,579 $960,495 Interest-bearing

liabilities: Demand-non interest bearing $74,126 $83,393 Demand

interest- bearing 31,236 $69 0.89% 41,993 $146 1.40% Money market

& savings 211,281 1,371 2.61% 207,571 1,667 3.23% Time deposits

441,069 4,169 3.80% 384,040 4,440 4.65% Total deposits 757,712

5,609 2.98% 716,997 6,253 3.51% Total interest- bearing deposits

683,586 5,609 3.30% 633,604 6,253 3.97% Other borrowings 101,186

715 2.84% 151,552 1,326 3.52% Total interest- bearing liabilities

$784,772 $6,324 3.24% $785,156 $7,579 3.88% Total deposits and

other borrowings 858,898 6,324 2.96% 868,549 7,579 3.51%

Noninterest- bearing liabilities 8,532 11,558 Shareholders' equity

78,149 80,388 Total liabilities and shareholders' equity $945,579

$960,495 Net interest income $7,061 $7,283 Net interest spread

2.81% 2.63% Net interest margin 3.19% 3.19% For the three months

ended June 30, 2007 Interest-earning assets: Interest (Dollars in

thousands) Average Income/ Yield/ Balance Expense Rate Federal

funds sold and other interest-earning assets $12,785 $169 5.30%

Securities 97,328 1,428 5.87% Loans receivable 821,173 15,657 7.65%

Total interest-earning assets 931,286 17,254 7.43% Other assets

39,124 Total assets $970,410 Interest-bearing liabilities:

Demand-noninterest bearing $77,010 Demand interest-bearing 40,577

$118 1.17% Money market & savings 307,512 3,532 4.61% Time

deposits 353,792 4,650 5.27% Total deposits 778,891 8,300 4.27%

Total interest-bearing deposits 701,881 8,300 4.74% Other

borrowings 99,873 1,377 5.53% Total interest-bearing liabilities

$801,754 $9,677 4.84% Total deposits and other borrowings 878,764

9,677 4.42% Noninterest-bearing liabilities 14,086 Shareholders'

equity 77,560 Total liabilities and shareholders' equity $970,410

Net interest income $7,577 Net interest spread 2.59% Net interest

margin 3.26% For the six months ended For the six months ended June

30, 2008 June 30, 2007 Interest-earning assets: (Dollars in

Interest Interest thousands) Average Income/ Yield/ Average Income/

Yield/ Balance Expense Rate Balance Expense Rate Federal funds sold

and other interest- earning assets $11,444 $154 2.71% $16,257 $404

5.01% Securities 84,969 2,480 5.84% 103,414 3,037 5.87% Loans

receivable 807,468 25,613 6.38% 810,003 30,957 7.71% Total

interest- earning assets 903,881 28,247 6.28% 929,674 34,398 7.46%

Other assets 51,107 38,595 Total assets $954,988 $968,269

Interest-bearing liabilities: Demand-noninterest bearing $80,710

$77,729 Demand interest- bearing 36,615 $215 1.18% 42,184 $218

1.04% Money market & savings 209,426 3,038 2.92% 288,362 6,554

4.58% Time deposits 412,554 8,609 4.20% 341,752 8,921 5.26% Total

deposits 739,305 11,862 3.23% 750,027 15,693 4.22% Total interest-

bearing deposits 658,595 11,862 3.62% 672,298 15,693 4.71% Other

borrowings 126,369 2,041 3.25% 127,458 3,496 5.53% Total interest-

bearing liabilities $784,964 $13,903 3.56% $799,756 $19,189 4.84%

Total deposits and other borrowings 865,674 13,903 3.23% 877,485

19,189 4.41% Noninterest-bearing liabilities 9,818 14,142

Shareholders' equity 79,496 76,642 Total liabilities and

shareholders' equity $954,988 $968,269 Net interest income $14,344

$15,209 Net interest spread 2.72% 2.62% Net interest margin 3.19%

3.30% The above tables are presented on a tax equivalent basis.

Republic First Bancorp, Inc. Summary of Allowance for Loan Losses

and Other Related Data (unaudited) Year Three months ended ended

Six months ended (dollar amounts in thousands) 6/30/08 3/31/08

6/30/07 12/31/07 6/30/08 6/30/07 Balance at beginning of period $

10,156 $8,508 $8,355 $8,058 $8,508 $8,058 Provisions charged to

operating expense 43 5,812 63 1,590 5,855 143 10,199 14,320 8,418

9,648 14,363 8,201 Recoveries on loans charged-off: Commercial -

117 72 81 117 81 Tax refund loans - 69 49 283 69 256 Consumer - 2 -

2 2 1 Total recoveries - 188 121 366 188 338 Loans charged-off:

Commercial (3,434) (4,344) (876) (1,503) (7,778) (876) Tax refund

loans - - - - - - Consumer (5) (8) (2) (3) (13) (2) Total

charged-off (3,439) (4,352) (878) (1,506) (7,791) (878) Net

charge-offs (3,439) (4,164) (757) (1,140) (7,603) (540) Balance at

end of period $6,760 $ 10,156 $7,661 $8,508 $6,760 $7,661 Net

charge-offs as a percentage of average loans outstanding 1.73%

2.05% 0.37% 0.14% 1.89% 0.13% Allowance for loan losses as a

percentage of period-end loans 0.85% 1.27% 0.92% 1.04% 0.85% 0.92%

Republic First Bancorp, Inc. Summary of Nonperforming Loans and

Assets (unaudited) June 30, March 31, Dec. 31, Sept. 30, June 30,

2008 2008 2007 2007 2007 Nonaccrual loans: Commercial real estate

$2,366 $2,427 $14,757 $ 13,986 $688 Construction - - 6,747 10,902

15,369 Consumer and other 780 640 776 547 555 Total nonaccrual

loans 3,146 3,067 22,280 25,435 16,612 Loans past due 90 days or

more and still accruing - - - - - Renegotiated loans - - - - -

Total nonperforming loans 3,146 3,067 22,280 25,435 16,612 Other

real estate owned 14,245 16,378 3,681 42 499 Total nonperforming

assets $ 17,391 $ 19,445 $25,961 $ 25,477 $ 17,111 Nonperforming

loans to total loans 0.40% 0.38% 2.71% 3.02% 1.99% Nonperforming

assets to total assets 1.84% 1.95% 2.55% 2.45% 1.67% Nonperforming

loan coverage 215% 331% 38% 35% 46% Allowance for loan losses as a

percentage of total period-end loans 0.85% 1.27% 1.04% 1.04% 0.92%

Nonperforming assets/capital plus allowance for loan losses 20% 22%

29% 29% 20% DATASOURCE: Republic First Bancorp, Inc. CONTACT: Paul

Frenkiel, CFO of Republic First Bancorp, Inc., +1-215-735-4422 ext.

5255

Copyright

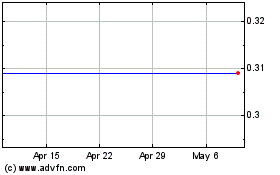

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From May 2024 to Jun 2024

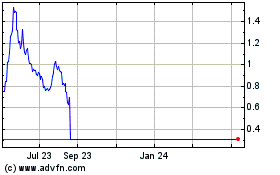

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jun 2023 to Jun 2024