PHILADELPHIA, July 20 /PRNewswire-FirstCall/ -- Republic First

Bancorp, Inc. (NASDAQ:FRBK), (the "Company") the holding company

for Republic First Bank (PA), today reported second quarter 2007

earnings of $2.0 million or $.18 per diluted share, compared to

$2.5 million or $.24* per diluted share for the same quarter in

2006. Average loans outstanding increased 17% and core deposits

increased 13% in second quarter 2007 compared to second quarter

2006. Notwithstanding very strong loan growth, earnings decreased

due to industry wide margin compression. The $.06 per share decline

in earnings in second quarter 2007 compared to second quarter 2006

primarily reflected the following reductions: $.06 per share from

higher funding costs, $.02 per share due to the increase in non-

accrual loans, $.02 per share from exiting the tax refund loan

program and $.01 per share due to an increase in operating expenses

tied to branch expansion. These factors were partially offset by a

favorable $.05 per share from loan growth. For second quarter 2007,

interest income increased $2.6 million to $17.2 million from $14.6

million for second quarter 2006. The increase was due primarily to

the increase in average loans outstanding, partially offset by the

reduction of interest income from the increase in non-accrual loans

and the exit from the tax refund loan program. Net interest income

for second quarter 2007 of $7.5 million was $676,000 less than the

second quarter of 2006 as a result of the above factors. Second

quarter net interest margin was 3.23% compared to the 4.30%

recorded in the second quarter of 2006. The reduction was due

primarily to the 101 basis point increase in the rate on total

interest bearing deposits. The Company has historically resolved

problem loans with nominal loss. The $7.5 million increase in

non-accrual loans from March 31, 2007 to June 30, 2007 resulted

from two loans which are well secured with real estate and losses

are not anticipated. The Company anticipates that commercial loan

charge-offs for the year 2007 will be relatively comparable to

2006. Substantially all of the 2007 charge-offs resulted from one

commercial and industrial relationship, due to borrower fraud.

Management believes the loan loss reserve is adequate at current

levels based upon charge-off history and monthly analysis of

problem loans. Harry Madonna, Chairman and Chief Executive Officer,

stated, "While margin compression has reduced current earnings, the

loan growth which has historically propelled earnings continues to

be strong. A renewed focus on expense control combined with the

continued strong loan growth should drive future earnings growth.

The increase in problem loans reflects the changes in the

residential housing market in our area. We are closely monitoring

these loans and believe that these loans are adequately

collateralized." Total shareholders' equity stood at $77.5 million

with a book value per share of $7.44 at June 30, 2007, based on

outstanding common shares of approximately 10.4 million. The

Company continues to be well capitalized. Republic First Bank (PA)

is a full-service, state-chartered commercial bank, whose deposits

are insured by the Federal Deposit Insurance Corporation (FDIC).

The Bank provides diversified financial products through its eleven

offices located in Abington, Ardmore, Bala Cynwyd, Plymouth

Meeting, Media and Philadelphia, Pennsylvania and Voorhees, New

Jersey. The Company may from time to time make written or oral

"forward-looking statements", including statements contained in

this release and in the Company's filings with the Securities and

Exchange Commission. These forward- looking statements include

statements with respect to the Company's beliefs, plans,

objectives, goals, expectations, anticipations, estimates, and

intentions that are subject to significant risks and uncertainties

and are subject to change based on various factors, many of which

are beyond the Company's control. The words "may", "could",

"should", "would", "believe", "anticipate", "estimate", "expect",

"intend", "plan", and similar expressions are intended to identify

forward-looking statements. All such statements are made in good

faith by the Company pursuant to the "safe harbor" provisions of

the Private Securities Litigation Reform Act of 1995. The Company

does not undertake to update any forward-looking statement, whether

written or oral, that may be made from time to time by or on behalf

of the Company. * Prior year earnings per share amounts were

restated to reflect the 10% stock dividend paid April 17, 2007.

Republic First Bancorp, Inc. Condensed Income Statement (Dollar

amounts in thousands except per share data) (unaudited) Three

Months Ended Six Months Ended June 30, June 30, 2007 2006 2007 2006

Net Interest Income $7,510 $8,186 $15,075 $17,495 Provision for

Loan Losses 63 61 143 1,374 Non-interest Income 755 844 1,395 1,959

Non-interest Expenses 5,283 5,122 10,278 10,163 Provision for

income taxes 951 1,320 1,977 2,719 Net Income $1,968 $2,527 $4,072

$5,198 Diluted EPS $0.18 $0.24 (1) $0.38 $0.49 (1) Republic First

Bancorp, Inc. Condensed Balance Sheet (Dollar amounts in thousands)

(unaudited) Assets June 30, June 30, 2007 2006 Federal Funds Sold

and Other Interest Bearing Cash $57,890 $37,776 Investment

Securities 86,882 45,305 Commercial and Other Loans 836,598 740,577

Allowance for Loan Losses (7,661) (7,756) Other Assets 50,871

45,846 Total Assets $1,024,580 $861,748 Liabilities and

Shareholders' Equity: Transaction Accounts $396,937 $380,357 Time

Deposit Accounts 401,233 264,384 FHLB Advances and Trust Preferred

Securities 133,132 138,443 Other Liabilities 15,809 9,195

Shareholders' Equity 77,469 69,369 Total Liabilities and

Shareholders' Equity $1,024,580 $861,748 (1) Prior year earnings

per share has been restated for the 10% stock dividend paid April

17, 2007. Republic First Bancorp, Inc. June 30, 2007 (unaudited) At

or For the At or For the Three Months Ended Six Months Ended June

30, June 30, June 30, June 30, Financial Data: 2007 2006 2007 2006

Return on average assets 0.81% 1.27% 0.85% 1.30% Return on average

equity 10.18% 14.87% 10.71% 15.74% Share information: Book value

per share $7.44 $6.64 (1) $7.44 $6.64 (1) Actual shares outstanding

at period end, net of treasury shares (320,111 and 275,611 shares,

respectively) 10,416,000 10,441,000 (1) 10,416,000 10,441,000 (1)

Average diluted shares outstanding 10,723,000 10,725,000 (1)

10,741,000 10,665,000 (1) (1) Prior year share information has been

restated for the 10% stock dividend payable April 17, 2007.

Republic First Bancorp, Inc. June 30, 2007 (Dollars in thousands)

(unaudited) Credit Quality Ratios: June 30, June 30, 2007 2006

Non-accrual and loans accruing, but past due 90 days or more

$16,612 $2,877 Restructured loans - - Total non-performing loans

16,612 2,877 Other real estate owned 499 594 Total non-performing

assets $17,111 $3,471 Six Months Ended June 30, June 30, 2007 2006

Allowance for Loan Losses Balance at beginning of period $8,058

$7,617 Charge-offs: Commercial and construction 876 434 Tax refund

loans - 1,286 Consumer 2 - Total charge-offs 878 1,720 Recoveries:

Commercial and construction 81 1 Tax refund loans 256 484 Consumer

1 - Total recoveries 338 485 Net charge-offs 540 1,235 Provision

for loan losses 143 1,374 Balance at end of period $7,661 $7,756

Non-performing loans as a percentage of total loans 1.99% 0.39%

Nonperforming assets as a percentage of total assets 1.67% 0.40%

Allowance for loan losses to total loans 0.92% 1.05% Allowance for

loan losses to total non-performing loans 46.12% 269.59% Republic

First Bancorp, Inc. June 30, 2007 (Dollars in thousands )

(unaudited) Quarter-to-Date Average Balance Sheet Three months

ended Three months ended June 30, 2007 June 30, 2006

Interest-Earning Average Average Assets: Average Yield/ Average

Yield/ Balance Interest Cost Balance Interest Cost Commercial and

other loans $821,173 $15,657 7.65% $700,313 $13,751 7.88%

Investment securities 97,328 1,361 5.59 43,131 567 5.26 Federal

funds sold 12,785 169 5.30 20,656 252 4.89 Total interest- earning

assets 931,286 17,187 7.40 764,100 14,570 7.65 Other assets 39,124

36,253 Total assets $970,410 $17,187 $800,353 $14,570

Interest-bearing liabilities: Interest-bearing deposits $701,881

$8,300 4.74% $530,721 $4,939 3.73% Borrowed funds 99,873 1,377 5.53

107,800 1,445 5.37 Interest-bearing liabilities 801,754 9,677 4.84

638,521 6,384 4.01 Non-interest and interest-bearing funding

878,764 9,677 4.42 722,804 6,384 3.54 Other liabilities: 14,086

9,408 Total liabilities 892,850 732,212 Shareholders' equity 77,560

68,141 Total liabilities & shareholders' equity $970,410

$800,353 Net interest income $7,510 $8,186 Net interest margin

3.23% 4.30% Republic First Bancorp, Inc. June 30, 2007 (Dollars in

thousands ) (unaudited) Year-to-Date Average Balance Sheet Six

months ended Six months ended June 30, 2007 June 30, 2006

Interest-Earning Average Average Assets: Average Yield/ Average

Yield/ Balance Interest Cost Balance Interest Cost Commercial and

other loans $810,003 $30,957 7.71% $700,603 $27,905 8.03%

Investment securities 103,414 2,903 5.61 42,488 1,076 5.06 Federal

funds sold 16,257 404 5.01 28,350 652 4.64 Total interest- earning

assets 929,674 34,264 7.43 771,441 29,633 7.75 Other assets 38,595

36,880 Total assets $968,269 $34,264 $808,321 $29,633

Interest-bearing liabilities: Interest-bearing deposits $672,298

$15,693 4.71% $574,380 $10,203 3.58% Borrowed funds 127,458 3,496

5.53 72,562 1,935 5.38 Interest-bearing liabilities 799,756 19,189

4.84 646,942 12,138 3.78 Non-interest and interest-bearing funding

877,485 19,189 4.41 732,117 12,138 3.34 Other liabilities: 14,142

9,602 Total liabilities 891,627 741,719 Shareholders' equity 76,642

66,602 Total liabilities & shareholders' equity $968,269

$808,321 Net interest income $15,075 $17,495 Net interest margin

3.27% 4.57% DATASOURCE: Republic First Bancorp, Inc. CONTACT: Paul

Frenkiel, CFO of Republic First Bancorp, Inc., +1-215-735-4422,

ext. 5255

Copyright

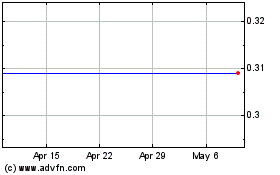

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From May 2024 to Jun 2024

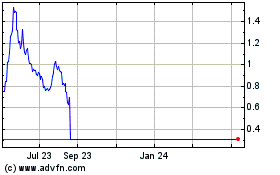

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jun 2023 to Jun 2024