PHILADELPHIA, Oct. 20 /PRNewswire-FirstCall/ -- Republic First

Bancorp, Inc. (NASDAQ:FRBK), the holding company for Republic First

Bank (PA), today reported third quarter 2005 earnings from

continuing operations of $2,143,000 or $0.24 per diluted share.

That compares with $2,555,000 or $0.30* for the same period last

year which included $1.3 million of one-time income. Earnings from

continuing operations for the nine-month period ended September 30,

2005 were $6,299,000 or $0.72 per diluted share, compared to

$3,984,000 or $.47 per diluted share for the comparable prior year

period. The improvement in 2005 earnings reflects significant

growth in commercial loans and core deposits and the payoff of the

high priced Federal Home Loan Bank borrowings. Average loans grew

in excess of 20% for the third quarter 2005 compared to the

comparable prior year period. Total assets at September 30, 2005

were $820,517,000 compared to $662,710,000 as of September 30,

2004. Total shareholders' equity stood at $60,834,000 with a book

value per share of $7.17 at September 30, 2005. The Company remains

well capitalized. Chairman Madonna stated: "Management and the

Board are very pleased with the improvement in earnings and we

believe the Bank is well situated to continue to increase

profitability." Republic First Bank (PA) is a full-service,

state-chartered commercial bank, whose deposits are insured by the

Federal Deposit Insurance Corporation (FDIC). The Bank provides

diversified financial products through its eleven offices located

in Abington, Ardmore, Bala Cynwyd, East Norriton, Media, and

Philadelphia, Pennsylvania. The Company may from time to time make

written or oral "forward-looking statements," including statements

contained in the Company's filings with the Securities and Exchange

Commission. These forward-looking statements include statements

with respect to the Company's beliefs, plans, objectives, goals,

expectations, anticipations, estimates, and intentions that are

subject to significant risks and uncertainties and are subject to

change based on various factors, many of which are beyond the

Company's control. The words "may," "could," "should," "would,"

"believe," "anticipate," "estimate," "expect," "intend," "plan,"

and similar expressions are intended to identify forward- looking

statements. All such statements are made in good faith by the

Company pursuant to the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995. The Company does not

undertake to update any forward- looking statement, whether written

or oral, that may be made from time to time by or on behalf of the

Company. * Per share value amounts were restated to reflect the 12%

stock dividend paid June 7, 2005. Republic First Bancorp, Inc.

Condensed Income Statement (Dollar amounts in thousands except per

share data) (unaudited) Three Months Ended Nine Months Ended

September 30 September 30 2005 2004 2005 2004 Net Interest Income

$7,256 $4,516 $21,385 $12,866 Provision for Loan Losses 314

(1,363)(1) 1,136 (863)(1) Other Income 903 1,984 (1) 2,805 3,418

(1) Other Expenses 4,602 4,047 13,613 11,243 Income Taxes 1,100

1,261 3,142 1,920 Net Income From Continuing Operations 2,143 2,555

6,299 3,984 Net Income From Discontinued Operations, Net of Tax -

503 - 2,266 Net Income $2,143 $3,058 $6,299 $6,250 Diluted EPS From

Continuing Operations $0.24 $0.30 (3)(1) $0.72 $0.47 (3)(1) Diluted

EPS From Discontinued Operations, Net of Tax - 0.06 - 0.27 Diluted

EPS $0.24 $0.36 (3)(1) $0.72 $0.74 (3)(1) Republic First Bancorp,

Inc. Condensed Balance Sheet (Dollar amounts in thousands)

(unaudited) Assets September 30, September 30, 2005 2004 (2)

Federal Funds Sold and Other Interest Bearing Cash $66,413 $50,508

Investment Securities 66,097 52,752 Commercial and Other Loans

645,613 517,532 Allowance for Loan Losses (7,401) (7,048) Other

Assets 49,795 48,966 Total Assets $820,517 $662,710 Liabilities and

Shareholders' Equity: Transaction Accounts $357,081 $313,750 Time

Deposit Accounts 228,162 181,765 FHLB Advances and Trust Preferred

Securities 166,999 106,186 Other Liabilities 7,441 8,688

Shareholders' Equity 60,834 52,321 Total Liabilities and

Shareholders' Equity 820,517 $662,710 (1) Prior year reflects

impact of a $1.3 million one time award arising from a legal

settlement in connection with a loan recovery. (2) Prior year has

been adjusted to exclude the First Bank of Delaware balance sheet,

reflecting the spin-off of that bank effective January 1, 2005. (3)

Prior year earnings per share has been restated for the 12% stock

dividend paid June 7, 2005. Republic First Bancorp, Inc. September

30, 2005 (unaudited) At or For the At or For the Three Months Ended

Nine Months Ended September 30, September 30, September 30,

September 30, Financial Data: 2005 2004 (1) 2005 2004 (1) Return on

average assets on continuing operations 1.19% 1.57%(2) 1.18%

0.82%(2) Return on average equity on continuing operations 14.24%

19.88%(2) 14.71% 10.59%(2) Share information: Book value per share

$7.17 $6.45 $7.17 $6.45 Shares o/s at period end, net of Treasury

shares 8,479,000 8,112,150 8,479,000 8,112,150 Average diluted

shares o/s 8,770,000 8,519,000 8,706,000 8,455,000 (1) Prior year

amounts have been adjusted for the spin-off of First Bank of

Delaware effective January 1, 2005. (2) Prior year reflects impact

of a $1.3 million one time award arising from a legal settlement in

connection with a loan recovery. Republic First Bancorp, Inc. Press

release 09/30/2005 (Dollars in thousands) (unaudited) Credit

Quality Ratios: September 30 September 30 2005 2004 (1) Non-accrual

and loans accruing, but past due 90 days or more $2,872 $7,167

Restructured loans - - Total non-performing loans 2,872 7,167 OREO

137 207 Total non-performing assets $3,009 $7,374 Non-performing

loans as a percentage of total loans 0.44% 1.38% Nonperforming

assets as a percentage of total assets 0.37% 1.11% Allowance for

loan losses to total loans 1.15% 1.36% Allowance for loan losses to

total non-performing loans 257.69% 98.34% (1) Prior year has been

adjusted to exclude the First Bank of Delaware loans, reflecting

the spin-off of that bank effective January 1, 2005. Republic First

Bancorp, Inc. Press release 09/30/2005 (Dollars in thousands )

(unaudited) Quarter-to-Date Average Balance Sheet Three months

ended Three months ended September 30, 2005 September 30, 2004 (1)

Interest-Earning Average Average Assets: Average Yield/ Average

Yield/ Balance Interest Cost Balance Interest Cost Commercial and

other loans $604,531 $10,576 6.94 % $501,189 $7,621 6.03 %

Investment securities 48,752 464 3.81 57,479 482 3.35 Federal funds

sold 20,952 192 3.64 37,604 139 1.47 Total interest- earning assets

674,235 11,232 6.61 596,272 8,242 5.48 Other assets 39,460 50,569

Total assets $713,695 $11,232 $646,841 $8,242 Interest-bearing

liabilities: Interest-bearing deposits $485,512 $3,219 2.63 %

$380,038 $1,824 1.90 % Borrowed funds 74,441 757 4.03 120,648 1,902

6.25 Interest-bearing liabilities 559,953 3,976 2.82 500,686 3,726

2.95 Non-interest and interest-bearing funding 645,967 3,976 2.44

588,997 3,726 2.51 Other liabilities: 8,022 6,854 Total liabilities

653,989 595,851 Shareholders' equity 59,706 50,990 Total

liabilities & shareholders' equity $713,695 $646,841 Net

interest income $7,256 $4,516 Net interest margin 4.32 % 3.04 % (1)

Prior year has been adjusted to exclude the First Bank of Delaware,

reflecting the spin-off of that bank effective January 1, 2005.

Republic First Bancorp, Inc. Press release 09/30/2005 (Dollars in

thousands ) (unaudited) Year-to-Date Average Balance Sheet Nine

months ended Nine months ended September 30, 2005 September 30,

2004 (1) Interest-Earning Average Average Assets: Average Yield/

Average Yield/ Balance Interest Cost Balance Interest Cost

Commercial and other loans $583,033 $30,347 6.96 % $484,338 $22,332

6.16 % Investment securities 47,526 1,350 3.79 63,254 1,558 3.28

Federal funds sold 41,885 863 2.75 57,524 501 1.16 Total interest-

earning assets 672,444 32,560 6.47 605,116 24,391 5.39 Other assets

41,205 41,427 Total assets $713,649 $32,560 $646,543 $24,391

Interest-bearing liabilities: Interest-bearing deposits $492,758

$9,236 2.51 % $367,299 $5,486 2.00 % Borrowed funds 67,167 1,939

3.86 136,545 6,039 5.91 Interest-bearing liabilities 559,925 11,175

2.67 503,844 11,525 3.06 Non-interest and interest-bearing funding

648,151 11,175 2.31 587,505 11,525 2.62 Other liabilities: 8,229

8,729 Total liabilities 656,380 596,234 Shareholders' equity 57,269

50,309 Total liabilities & shareholders' equity $713,649

$646,543 Net interest income $21,385 $12,866 Net interest margin

4.25 % 2.84 % (1) Prior year has been adjusted to exclude the First

Bank of Delaware, reflecting the spin-off of that bank effective

January 1, 2005. DATASOURCE: Republic First Bancorp, Inc. CONTACT:

Paul Frenkiel, CFO, Republic First Bancorp, +1-215-735-4422 ext.

5255

Copyright

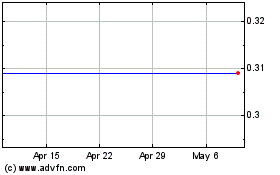

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From May 2024 to Jun 2024

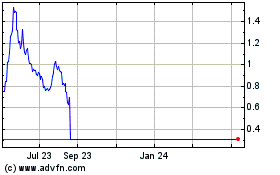

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jun 2023 to Jun 2024