UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under the Securities

Exchange Act of 1934

(Amendment No. 16)*

Renovaro Inc.

(Name of Issuer)

Common Stock, par value $0.0001

(Title of Class of Securities)

29350E 104

(CUSIP Number)

William Anderson Wittekind

8581 Santa Monica Blvd. #317

West Hollywood, CA 90069

(424) 235-1810

with a copy to:

Patrick T. McCloskey

McCloskey Law PLLC

425 Madison Avenue, Suite 1700

New York, NY 10017

(646) 970.0611

(Name, Address and Telephone

Number of Person Authorized to Receive Notices and Communications)

May 16, 2024

(Date of Event which Requires

Filing of this Statement)

If the filing person has previously

filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. o

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies

are to be sent.

* The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any

subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

CUSIP No. 29350E104

| 1. | Names of Reporting Persons. |

| | | I.R.S. Identification Nos. of above persons (entities only). |

| | | |

| | | William

Anderson Wittekind |

| 2. | Check the Appropriate Box if a Member of a Group (See Instructions) |

| 4. | Source

of Funds (See Instructions) OO |

| 5. | Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

| 6. | Citizenship

or Place of Organization United States |

| |

|

|

| Number of |

7. |

Sole Voting Power 6,429,8241 |

| Shares Bene- |

|

|

| ficially by |

8. |

Shared Voting Power 12,526,5522 |

| Owned by Each |

|

|

| Reporting |

9. |

Sole Dispositive Power 6,429,8241 |

| Person With |

|

|

| 10. | Shared

Dispositive Power 12,526,5522 |

| 11. | Aggregate

Amount Beneficially Owned by Each Reporting Person 18,956,376 |

| 12. | Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

| 13. | Percent

of Class Represented by Amount in Row (11) 12.9%3 |

| 14. | Type of Reporting Person (See Instructions)

I |

_____________________________

1 Consists

of (a) 3,615,757 shares owned by William Anderson Wittekind (“Wittekind”); (b) 1,313,499 shares owned by Weird Science LLC

(“Weird Science”); (c) 633,921 shares owned by the William Anderson Wittekind 2020 Annuity Trust, a grantor retained annuity

trust of which Wittekind is the sole trustee (the “Wittekind 2020 Annuity Trust”); (d) 450,568 shares owned by the Dybul 2020

Angel Annuity Trust, a grantor retained trust of which Wittekind is the sole trustee (the “Dybul 2020 Annuity Trust”); (e)

50,000 shares owned by the Ty Mabry 2021 Annuity Trust, a grantor retained annuity trust of which Wittekind is sole trustee (the “Mabry

2021 Annuity Trust”); and (f) 366,079 shares owned by the William Anderson Wittekind 2021 Annuity Trust, a grantor retained annuity

trust of which Wittekind is the sole trustee (the “Wittekind 2021 Annuity Trust” and, together with the Wittekind 2020 Annuity

Trust, the Dybul 2020 Annuity Trust and the Mabry 2021 Annuity Trust, the “Trusts”). In his capacity as the sole manager of

Weird Science, Wittekind has sole voting and sole dispositive power over the shares owned by Weird Science. In his capacity as the sole

trustee of the Trusts, Wittekind has sole voting power and sole dispositive power over the shares owned by the Trusts.

2 Consists

of 88,121 shares owned by Wittekind and Serhat Gumrukcu, Wittekind’s spouse (“Gumrukcu”), as joint tenants with a right

of survivorship (“JTWROS”) and 12,438,431 shares owned by Gumrukcu, of which Wittekind shares voting power and dispositive

power through a power of attorney dated June 24, 2022. Pursuant to an order of the United States District Court for the District of Vermont

(the “Vermont District Court”) dated October 27 2023, the 12,438,431 shares owned by Gumrukcu are subject to a writ

of attachment to secure the plaintiffs’ claim in The Estate of Gregory Davis et al. v. Serhat Daniel Gumrukcu (Civil Case

No. 5:22-cv-123).

3

Based upon 147,504,944 shares of common stock outstanding as of May 10, 2024, as disclosed in the issuer’s Form 10-Q filed with

the Commission on May 15, 2024.

EXPLANATORY NOTE

This Amendment No. 16 amends the Schedule 13D filed by Weird Science

LLC, a California limited liability company (“Weird Science”) and William Anderson Wittekind, a member and

manager of Weird Science (“Wittekind”) with respect to the shares of common stock, par value $0.0001 per share

(“Common Stock”) of Renovaro Inc. (the “Issuer”) received by Weird Science pursuant

to that certain Agreement and Plan of Merger dated January 12, 2018 (the “Merger Agreement”) by and among the

Issuer (then known as DanDrit BioTech USA, Inc.), DanDrit Acquisition Sub, Inc., a Delaware corporation and a wholly-owned subsidiary

of the Issuer (“Merger Sub”), Renovaro Biopharma, Inc., a Delaware corporation then known as Enochian Biopharma

Inc. (“Target”), and Weird Science, in its capacity as the majority stockholder of the Target, as amended by

Amendment No. 1, Amendment No. 2, Amendment 3, Amendment No. 4, Amendment No. 5, Amendment No. 6, Amendment No. 7, Amendment No. 8, Amendment

No. 9, Amendment No. 10, Amendment No. 11, Amendment No. 13, Amendment No. 14 and Amendment No. 15 thereto. Wittekind is the sole reporting

person under this Amendment No. 16 to Schedule 13D (the “Reporting Person”).

Capitalized terms used but not defined in this Amendment No. 16

have the meanings given to such terms in the initial Schedule 13D, as amended by Amendment No. 1, Amendment No. 2, Amendment No. 3, Amendment

No. 4, Amendment No. 5, Amendment No. 6, Amendment No. 7, Amendment No. 8, Amendment No. 9, Amendment No. 10, Amendment No. 11, Amendment

No. 12, Amendment No. 13, Amendment No. 14 and Amendment No. 15 thereto.

| Item 4. | Purpose of Transaction |

The

information in Item 6 of this Amendment No. 16 is hereby incorporated by reference into this Item 4.

| Item 5. | Interests in Securities

of the Issuer |

(a)-(b) The

information in Items 7-11 and Item 13 of the cover page of this Amendment No. 16, including

the accompanying footnotes, is hereby incorporated by reference into this Item 5.

(c) None.

(d) Not applicable.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings

or Relationships with Respect to Securities of the Issuer.

Denial of Rule 11 Motion

On April 11, 2024 legal counsel for the Board Defendants filed

a Reply to Wittekind’s and Weird Science’s Rule 11 Opposition and a Declaration in Support of such Reply with the California

District Court for the Central District. The Reply to the Rule 11 Opposition is attached to this Amendment No. 16 as Exhibit 22 and the

Declaration in Support of such Reply is attached to this Amendment No. 16 as Exhibit 23.

On May 16, 2024 the California District Court for the Central District

issued an order denying the Rule 11 Motion. A copy of such order is attached to this Amendment No. 16 as Exhibit 24.

Stockholder Derivative Complaint

In accordance with the May 16, 2024 order denying the Rule 11 Motion,

Wittekind and Weird Science intend to amend the Stockholder Derivative Complaint no later than May 31, 2024, or by a date otherwise permitted

by the Court.

Resales of Common Stock

To the extent any shares of Common Stock owned by Weird Science, Wittekind

or the Trusts are included in a registration statement that is filed by the Issuer and declared effective by the SEC (including, without

limitation, the Form S-1 that the Issuer agreed to file to register resales by Lincoln Park Capital Fund LLC pursuant to the Registration

Rights Agreement between the Issuer and Lincoln Park dated June 20, 2023), Weird Science, Wittekind and the Trusts (as applicable) intend

to resell shares under such registration statement(s) in accordance with the Investor Rights Agreement.

In

addition, Wittekind intends to (individually and on behalf of Weird Science), and may cause

the Trusts to, resell shares of Common Stock from time to time in accordance with Rule 144

under the 1933 Act.

| Item 7. | Material

to be Filed as Exhibits

|

* Exhibit A to this Exhibit has been omitted

pursuant to Item 601(a)(5) of Regulation S-K (17 CFR §229.601(a)(5)) but will be furnished supplementally to the SEC upon request.

SIGNATURE

After reasonable inquiry and to the best of

my knowledge and belief, I certify that the information set forth in this Amendment No. 16 is true, complete and correct.

Date: May 17, 2024

| |

/s/ William Anderson Wittekind |

|

| |

WILLIAM ANDERSON WITTEKIND |

5

Exhibit 22

BOARD DEFENDANTS REPLY IN FURTHER SUPPORT OF MOTION FOR SANCTIONS 1 2 3 4 5 6 7 8 9 10 11

12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 VEDDER PRICE (CA), LLP ATTORNEYS AT LAW LOS ANGELES VEDDER PRICE (CA), LLP Michael

J. Quinn, Bar No. 198349 mquinn@vedderprice.com Marie E. Christiansen, Bar No. 325352 mchristiansen@vedderprice.com 1925 Century Park

East, Suite 1900 Los Angeles, California 90067 T: +1 424 204 7700 F: +1 424 204 7702 Attorneys for the Board Defendants UNITED STATES

DISTRICT COURT CENTRAL DISTRICT OF CALIFORNIA WESTERN DIVISION WEIRD SCIENCE LLC and WILLIAM ANDERSON WITTEKIND, derivatively on behalf

of RENOVARO BIOSCIENCES, INC., Plaintiffs, vs. SINDLEV, et al., Defendants. Case No. 2:24-cv-00645-HDV-MRW Hon. Hernan D. Vera BOARD

DEFENDANTS REPLY IN FURTHER SUPPORT OF MOTION FOR SANCTIONS AGAINST PLAINTIFFS AND PLAINTIFFS COUNSEL [Filed concurrently with Declaration

of Michael J. Quinn and Objections to Declaration of Megan A. Maitia] Date: April 25, 2024 Time: 10:00 a.m. Courtroom: 5B

TABLE OF CONTENTS Page - i - 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

24 25 26 27 28 VEDDER PRICE (CA), LLP ATTORNEYS AT LAW LOS ANGELES I. INTRODUCTION ...........................................................................................

1 II. ARGUMENT .................................................................................................. 2 A. Plaintiffs Opposition

Misconstrues The Fundamental Precept of Delaware Law That Filing This Derivative Action Immediately After Making A Pre-Suit Demand Is

Improper .................................... 2 B. Board Defendants Cited Applicable Ninth Circuit Precedent Holding That Plaintiffs

Are Not Suitable Derivative Plaintiffs Given Their Ongoing Litigations Against Renovaro ............................ 6 C. Plaintiffs

Filed This Action in an Improper Forum .............................. 8 D. Any Purported Amendments By Plaintiffs Could Not Cure The

Fundamental Defects In This Lawsuit .................................................. 9 III. CONCLUSION .............................................................................................

10

BOARD DEFENDANTS MOTION FOR SANCTIONS ii 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19

20 21 22 23 24 25 26 27 28 VEDDER PRICE (CA), LLP ATTORNEYS AT LAW LOS ANGELES TABLE OF AUTHORITIES Page(s) Cases Dahle v. Pope, No.

2019-0136, 2020 WL 504982 (Del. Ch. Jan. 31, 2020) ........................ 2, 4, 5 Hornreich v. Plant Indus., Inc., 535 F.2d 550 (9th

Cir. 1976) ................................................................................ 7 Larson v. Dumke, 900 F.2d 1363 (9th Cir.

1990) .............................................................................. 7 Lee v. Fisher, 70 F.4th 1129 (9th Cir. 2023) ...........................................................................

8, 9 Solak ex rel Ultragenyx Pharm. Inc. v. Welch, 2019 WL 5588877 (Del. Ch. Oct. 30, 2019) ........................................................

3 Statutes Delaware General Corporation Law § 115 ................................................................ 8 Securities

Exchange Act of 1934 ............................................................................... 8 Other Authorities FED. R. CIV.

P. 11 .................................................................................................. 1, 6 FED. R. CIV. 23.1 .......................................................................................................

7

BOARD DEFENDANTS MOTION FOR SANCTIONS 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

21 22 23 24 25 26 27 28 VEDDER PRICE (CA), LLP ATTORNEYS AT LAW LOS ANGELES I. INTRODUCTION Defendants Rene Sindlev, Mark Dybul, Gregg

Alton, Carol Brosgart, Henrik Grønfeldt-Sørensen, James Sapirstein, and Jayne McNicols (collectively, the Board Defendants)

motion for sanctions pursuant to Fed. R. Civ. P. 11 against Plaintiffs Weird Science LLC (Weird Science) and William Anderson Wittekind

(Wittekind, together with Weird Science, Plaintiffs) (the Motion) set out multiple bright-line legal defects that preclude Plaintiffs

purported shareholders derivative suit. These defects include Plaintiffs violation of the fundamental precept of Delaware law that a

derivative shareholder plaintiff who makes a demand on the board of directors has no right to file suit unless and until the board refuses

their demand, Plaintiffs inability to serve as derivative plaintiffs suing for the benefit of Renovaro while there are multiple other

actions pending in which Plaintiffs are adverse to Renovaro, and a contractual forum selection clause that requires Plaintiffs claims

be filed in courts located in Delaware. Each of these well-established legal principles set forth by the Board Defendants motion is supported

by copious analogous legal authorities from Delaware and the Ninth Circuit Court of Appeals. Plaintiffs Opposition, on the other hand,

devotes very little space to addressing these fundamental legal questions regarding the validity of their lawsuit at this juncture. Rather,

most of the Opposition simply lays out irrelevant and misleading background facts and allegations, many of which took place after the

filing of this lawsuit and therefore have no bearing on the propriety of this lawsuit at the time it was filed, and which, in any event,

fail to rebut the legal defects in Plaintiffs filings.1 Where Plaintiffs do bother to address the legal defects in their 1 Plaintiffs

devote much of their Opposition to the recitation of these mostly irrelevant background facts that they claim justify their lawsuit,

or at least weigh against the imposition of sanctions. Most of these irrelevant facts are not worth addressing in this Reply, but there

are some critical misrepresentations in the Opposition that will be addressed within the applicable Argument sections.

BOARD DEFENDANTS REPLY IN FURTHER SUPPORT OF MOTION FOR SANCTIONS 2 1 2 3 4 5 6 7 8 9 10

11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 VEDDER PRICE (CA), LLP ATTORNEYS AT LAW LOS ANGELES lawsuit, they mischaracterize

the issues entirely, and the scant legal support provided does not justify this Court disregarding the well-established legal principles

raised in the Board Defendants Motion. In short, after Plaintiffs failed TRO, during which the legal defects raised in the Motion were

first brought to Plaintiffs attention, the Board Defendants gave Plaintiffs and their counsel the opportunity to do the right thing and

withdraw their defective Complaint while the Renovaro Board conducted an investigation of Plaintiffs accusations in accordance with their

demand, but Plaintiffs and their counsel refused. Their insistence on maintaining this action clearly warrants the imposition of sanctions

on Plaintiffs and their counsel, and the Court should grant this motion accordingly. II. ARGUMENT A. Plaintiffs Opposition Misconstrues

The Fundamental Precept of Delaware Law That Filing This Derivative Action Immediately After Making A Pre-Suit Demand Is Improper A fatal,

threshold defect in Plaintiffs case is their demand upon Renovaros board of directors for corrective action, followed almost immediately

by the filing of this lawsuit alleging demand futility. (See Compl., ¶¶ 111-113.) This is a fundamental precept of Delaware

law: Under Delaware law, a stockholder plaintiff bringing a derivative suit has two options: make a pre-suit demand on the board, or

plead demand futility. The pre-suit demandif properly rejectedleads to a higher pleading burden. These options are mutually exclusive:

a stockholder is not permitted to have his cake and litigate it, too. Dahle v. Pope, No. 2019-0136, 2020 WL 504982, at *1-4 (Del. Ch.

Jan. 31, 2020) (emphasis added) (citing Spiegel v. Buntrock, 571 A.2d 767, 777 (Del. 1990)). In the face of this bright-line legal rule,

Plaintiffs attempt to argue that the law on this issue is not so straightforward, and that, in fact, Plaintiffs January 19, 2024 letter

is arguably not a pre-suit demand under the governing standard, which

BOARD DEFENDANTS REPLY IN FURTHER SUPPORT OF MOTION FOR SANCTIONS 3 1 2 3 4 5 6 7 8 9 10

11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 VEDDER PRICE (CA), LLP ATTORNEYS AT LAW LOS ANGELES considers whether the communication

identifies the alleged wrongdoers, the alleged wrongdoing and harm to the corporation, and the legal action the stockholder wants the

board to take. (Dkt. 22-1 at 14:12-19.) Plaintiffs do not even attempt to explain how their January 19, 2024 letter does not meet the

governing standard for what constitutes a pre-suit demand, and instead simply claim that that they did not intend to make a demand on

the Board, as if that should be the end of the inquiry. It should not. Solak ex rel Ultragenyx Pharm. Inc. v. Welch, 2019 WL 5588877,

at *4-5 (Del. Ch. Oct. 30, 2019) (Delaware law prohibits a stockholder from both making a demand and pleading demand futility . . . That

prohibition would become a virtual nullity if a stockholder could avoid a judicial determination that pre-suit demand was made by simply

stating this is not a demand . . . .). Even a cursory review of the letter demonstrates that their claim they did not intend to make

a demand is blatantly disingenuous. For starters, the letter itself is titled Demand for Corrective Action, and the first substantive

paragraph of the letter states that Plaintiffs counsel is writ[ing] to demand that the Companys Board of Directors (Board) take the following

immediate and corrective action to address the misconduct and corporate wrongdoing described in the attached draft Verified Derivative

Stockholder Complaint. (Declaration of Michael J. Quinn (Quinn Decl.), Ex. A.) The email sent to the Renovaro Board attaching the letter

also refers to it as a demand on the Renovaro Board of Directors. (Id.) Moreover, the Complaint itself describes the letter as a demand

that the Board take action, in a section titled Demand and Demand Futility. (Compl. Sec. X, ¶¶ 114-16.) This is nothing less

than a binding judicial admission that the January 19, 2024 letter was a demand on the board, and Plaintiffs creative description of

it in the Opposition as merely a good-faith inquiry into whether litigation could be avoided before the Special Meeting deserves no credence.

Indeed, no matter how artfully Plaintiffs try to describe it, Plaintiffs January 19, 2024 letter plainly meets the

BOARD DEFENDANTS REPLY IN FURTHER SUPPORT OF MOTION FOR SANCTIONS 4 1 2 3 4 5 6 7 8 9 10

11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 VEDDER PRICE (CA), LLP ATTORNEYS AT LAW LOS ANGELES governing standard they identified

in the Opposition for what constitutes a demand under Delaware law. The letter (i) identifies the alleged wrongdoers as the individual

board members, consultants, and attorneys who were ultimately named as defendants in this lawsuit, (ii) describes the alleged wrongdoing

and harm to the corporation as, among other things, the alleged exploitation of material non-public information that resulted in the

ill-gotten conversion of Renovaro shares and/or ill-gotten profits to defendants, and (iii) the legal action the stockholder wants the

board to take, which here was not only to supplement the Proxy Statement and delay the Special Meeting, but also to disgorge any ill-gotten

shares or profits and commence a legal action against K&L Gates LLP and Clayton E. Parker for legal malpractice . . . . (Quinn Decl.

Ex. A; Dkt. 22-1 at 14:16-24 (citing the governing standard).) Plaintiffs additional argument that the bright-line prohibition against

making a demand and then immediately filing a lawsuit alleging demand futility should not apply to them is equally unavailing. In this

effort, Plaintiffs make a convoluted argument conflating the separate concepts of demand refused and demand excused in an attempt to

patch together a legal framework under which their conduct would be permissible. These efforts necessarily fail. As set forth in the

Motion, it is black letter Delaware law that a shareholder cannot make a pre-suit demand on the company then immediately file a lawsuit

attempting to plead demand futility, which is precisely what Plaintiffs have done here. See Dkt. 18 at 6-9; Dahle, 2020 WL 504982, at

*1-4. By making a pre-suit demand, Plaintiffs are deemed to have waived, as a matter of law, any argument that demand would have been

futile and did not need to be made prior to filing the lawsuit (i.e., demand excused). Id. But once they made the demand that the Board

take action to correct the alleged wrongdoing identified in the January 19, 2024 letter, Plaintiffs could not file their lawsuit unless

and until the Board refused to take action on their demand (i.e., demand refused). Id.

BOARD DEFENDANTS REPLY IN FURTHER SUPPORT OF MOTION FOR SANCTIONS 5 1 2 3 4 5 6 7 8 9 10

11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 VEDDER PRICE (CA), LLP ATTORNEYS AT LAW LOS ANGELES Here, Plaintiffs essentially

argue that there would have been a basis for the Court to excuse the demand requirement because Plaintiffs plausibly alleged that there

was reasonable doubt a majority of the Renovaro Board would respond to the demand in good faith, and therefore, the prohibition against

pleading demand futility immediately after making a demand should not apply to Plaintiffs. The demand futility arguments raised by Plaintiffs

are irrelevant, however, because Plaintiffs did make a demand on the Renovaro Board, so authorities in which a court excused the making

of a pre-suit demand altogether have absolutely no application to the matter at hand. Having made the demand, Plaintiffs are required

under Delaware law to give the Renovaro Board an opportunity to investigate their allegations and make a decision as to the corrective

action demanded before they may file suit based on the same alleged misconduct.2 Dahle, 2020 WL 504982, at *1-4. Plaintiffs also attempt

a meager argument that the Renovaro Board has already acted unreasonably and refused or rejected their demand, but Plaintiffs recitation

of the facts in this regard is beyond misleading and fails to justify their blatant disregard of applicable Delaware law. Plaintiffs

claim that [o]n January 19, 2024, Plaintiffs counsel notified Renovaros Board in writing of serious violations of the federal securities

laws that were harmful to all Renovaro stockholders . . . [and] requested that the Board act to cure the [] violations before the Special

Meeting, but that Plaintiffs counsel received no response from Renovaros Board until the morning of January 23, 2024, when defense counsel

for the Board Defendants . . . first made themselves available. (Dkt. 22-1 at 6:6-23.) But in suggesting that the Board Defendants or

their counsel unreasonably delayed responding to the demand letter, Plaintiffs fail to note for the Court that January 19, 2024 was a

Friday, and that their 2 Notably, the Board has done just that and has spent the time and money to appoint a Special Committee of independent

directors, which has retained counsel who has begun an investigation into Plaintiffs demands. (Quinn Decl. ¶ 3.) Yet the Board is

nonetheless forced to litigate this improper action. That is precisely the harm Delaware law seeks to prevent.

BOARD DEFENDANTS REPLY IN FURTHER SUPPORT OF MOTION FOR SANCTIONS 6 1 2 3 4 5 6 7 8 9 10

11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 VEDDER PRICE (CA), LLP ATTORNEYS AT LAW LOS ANGELES demand letter was not sent

until after close of business on the East Coast and in Europe (where defendants are located). The Board Defendants then took less than

one business day to retain new counsel to represent them in this matter, which they were forced to do because Plaintiffs demand identified

Renovaros corporate counsel, K&L Gates, as an intended defendant, and new counsel promptly reached out to Plaintiffs counsel to discuss

the issues raised in the demand letter and draft complaint. That discussion between counsel took place first thing in the morning on

January 23, 2024. Far from unreasonably delaying, the Board Defendants acted with all deliberate speed to address Plaintiffs demands

and threatened litigation. Furthermore, Plaintiffs suggestion that the Renovaro Boards non-response to the letter before the January

25, 2024 Special Meeting amounts to a demand refusal is beyond ludicrous. (Dkt. 22-1 at 1:23-25.) Did Plaintiffs seriously expect the

Renovaro Board to orchestrate, conduct, and conclude an independent investigation of the accusations of wrongdoing in Plaintiffs demand

letter in the six days between when the letter was sent and the Special Meeting took place? Indeed, even if the Board had managed such

a feat, such a truncated investigation would almost certainly be held inadequate as a matter of law. There simply is no basis for concluding

that the Renovaro Boards decision to take more than six days to conduct the investigation amounts to a demand refusal. Indeed, as recognized

by the Court at the TRO hearing, it was Plaintiffs who chose to file this action at such a late date after spending months preparing

it. For these reasons, and those set forth in the Motion, Plaintiffs disregard of principles of Delaware law in filing this derivative

suit warrants Rule 11 sanctions, and the Court should grant the Motion. B. Board Defendants Cited Applicable Ninth Circuit Precedent

Holding That Plaintiffs Are Not Suitable Derivative Plaintiffs Given Their Ongoing Litigations Against Renovaro Plaintiffs argue that

the Board Defendants failed to cite the correct leading

BOARD DEFENDANTS REPLY IN FURTHER SUPPORT OF MOTION FOR SANCTIONS 7 1 2 3 4 5 6 7 8 9 10

11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 VEDDER PRICE (CA), LLP ATTORNEYS AT LAW LOS ANGELES Ninth Circuit precedent, Larson

v. Dumke, 900 F.2d 1363 (9th Cir. 1990), when making their argument that Plaintiffs are not suitable derivative plaintiffs in this case

in light of the multiple ongoing litigations in which they are adverse to Renovaro. (Dkt. 22-1 at 16:26-17:5.) According to Plaintiffs,

Larson laid out an eight factor test that the Court should apply here when assessing whether Plaintiffs are suitable derivative plaintiffs,

rather than the bright-line rule set forth in Hornreich v. Plant Indus., Inc., 535 F.2d 550 (9th Cir. 1976) and the other authorities

cited by the Board Defendants. (Id.) Plaintiffs reliance on Larson is misplaced, however, and the case in no way undermines the well-established

precedent in Horneich that a derivative plaintiff cannot fairly and adequately protect other shareholders if it is involved in other

litigation against the company. Id; see also 5 Moores Fed. Prac. Civ. § 23.1.09[5][b] (collecting cases). Hornreich, which remains

good law and was actually cited as precedent in Larson, involved a derivative action in which the derivative shareholder plaintiff was

adverse to the corporation in multiple other litigations, just like the Plaintiffs here. Hornreich, 535 F.2d at 551-52. The Ninth Circuit

thus affirmed the district courts dismissal of plaintiffs case on the grounds that it was an unsuitable derivative plaintiff under Federal

Rule of Civil Procedure 23.1 due to, among other things, these other pending litigations. Id. at 552. In contrast, Larson did not involve

a plaintiff who was adverse to the corporation in other litigations at the same time it was attempting to sue derivatively on behalf

of the company. For this reason, it was not immediately clear to the court that the plaintiff was not an adequate representative, as

it was in Hornreich, so the court had to establish other criteria for making that assessment when a plaintiffs sufficiency was challenged

under Rule 23.1. Larson, 900 F.2d at 1367. But Larson did not in any way overrule Hornreich, which remains the standard when a derivative

plaintiff is adverse to the corporation in other lawsuits. It is also worth noting that Plaintiffs are not just any other principled

BOARD DEFENDANTS REPLY IN FURTHER SUPPORT OF MOTION FOR SANCTIONS 8 1 2 3 4 5 6 7 8 9 10

11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 VEDDER PRICE (CA), LLP ATTORNEYS AT LAW LOS ANGELES shareholders taking a stand

on behalf of the corporation. The other litigations between Plaintiffs and Renovaro involve well-founded allegations that purported derivative

plaintiff Wittekind, his husband Serhat Gumrukcu, and various companies currently under their control have defrauded Renovaro of millions

of dollars. (Dkt. 18 at 10:26-11:8.) It is thus clear that Plaintiffs are not normal shareholders looking out for the best interests

of the company and its other shareholders. This baseless lawsuit is just another attempt to further damage Renovaro and its shareholders,

either to extract even more money from the company, or to use as leverage in their other litigations. No matter which test or rule is

applied, Plaintiffs cannot adequately represent the interests of the other shareholders, and as such, the Motion should be granted. C.

Plaintiffs Filed This Action in an Improper Forum In opposition to the Board Defendants argument that the forum selection clause in the

Merger Agreement through which Plaintiffs received their shares in Renovaro required them to file this lawsuit in a court in Delaware,

Plaintiffs cite Delaware General Corporation Law § 115 and Lee v. Fisher, 70 F.4th 1129 (9th Cir. 2023) to misguidedly argue that

a forum selection clause specific to shareholder litigation must have been included in Renovaros Certificate of Incorporation or Bylaws

in order to be valid and enforceable. (Dkt. 22-1 at 18:4-17.) But neither of these authorities state any such thing. Lee involved a shareholders

challenge to the validity of a Delaware forum-selection clause in a corporations bylaws. The court found the provision to be enforceable

by way of contract-interpretation principles. Lee, 70 F.4th at 1138. In so holding, the court rejected the plaintiffs arguments that

the forum selection clause in the bylaws violated the anti-waiver provision of the Securities Exchange Act of 1934 and was unenforceable

under the doctrine of forum non conveniens. Id. at 1141, 1150. Lee did not in any way address the situation in this case, where Plaintiffs

have

BOARD DEFENDANTS REPLY IN FURTHER SUPPORT OF MOTION FOR SANCTIONS 9 1 2 3 4 5 6 7 8 9 10

11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 VEDDER PRICE (CA), LLP ATTORNEYS AT LAW LOS ANGELES a separate contract with Renovaro

(the Merger Agreement) containing a forum selection clause that required Plaintiffs to file any suit arising out of or relating to their

ownership of Renovaro stock in a court in Delawareand Lee certainly did not hold that such contractual forum selection clauses are invalid.

Thus, as set forth in the Motion, the forum selection clause in the Merger Agreement applies to this dispute, and Plaintiffs were required

to file suit in Delaware. Plaintiffs clearly realize this because they are currently plaintiffs in litigation filed in Delaware against

Renovaro and are represented by the same counsel. Their deliberate filing of this action in the Central District of California instead,

where venue and jurisdiction are lacking, justifies the imposition of sanctions and the Court should grant the Motion. D. Any Purported

Amendments By Plaintiffs Could Not Cure The Fundamental Defects In This Lawsuit Plaintiffs assert in their Opposition that the Court

should deny the Motion on the additional grounds that Plaintiffs have been telling defense counsel for weeks that they intend to amend

their Derivative Complaint and are on solid ground to argue demand futility and alternatively a bad-faith rejection of Plaintiffs pre-Special

Meeting efforts based on the current version of the complaint, and an amended complaint would expand on these allegations. (Dkt. 22-1

at 13:19-24.) Notwithstanding that Plaintiffs have yet to file this purportedly expansive amended complaint that they claim would cure

the fundamental defects in their lawsuit, despite first telling counsel for the Board Defendants of their intention to do so over two

months ago, as explained above, having made a demand upon the Board for corrective action, Plaintiffs cannot allege or argue demand futility

in any amended complaint. See, supra, at II.A. There simply is no way at this juncture for Plaintiffs to amend their way around their

waiver, as a matter of law, of the demand futility argument by virtue of their January 19, 2024 demand letter to the Board. Delaware

law is clear that at this point Plaintiffs must dismiss their lawsuit, and allow the Board

BOARD DEFENDANTS REPLY IN FURTHER SUPPORT OF MOTION FOR SANCTIONS 10 1 2 3 4 5 6 7 8 9 10

11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 VEDDER PRICE (CA), LLP ATTORNEYS AT LAW LOS ANGELES to investigate their allegations

of wrongdoing and respond to the demand.3 Moreover, the facts which Plaintiffs intend to include in an amended complaint as demonstrating

the Boards purported bad faith rejection of Plaintiffs demand are patently false. As explained above, Plaintiffs narrative about the

Board Defendants and their counsels alleged unreasonable delay in responding to the demand is in no way based on the actual events that

occurred. And any delay prior to the Special Meeting was entirely the fault of Plaintiffs, whose counsel acknowledged that she investigated

the accusations and planned the lawsuit and TRO for over a month before finally sending the demand letter and complaint to the Renovaro

Board less than one week before the Special Meeting. She then immediately filed the complaint and request for TRO after the Board told

her it would need time to investigate the accusations and was not willing to capitulate to her 11th hour demand that the Special Meeting

be delayed while it did so. Relatedly, counsel for the Board Defendants did not refuse[] to answer questions about the independent committee

conducting the investigation (Dkt. 22-1 at 13:28-14:2.) Rather, as demonstrated in Plaintiffs counsels own declaration, Board Defendants

counsel provided the information he had available at the time. Plaintiffs have not followed up with the Board seeking additional information

since that discussion. III. CONCLUSION For these reasons, and those set forth in the Motion, the Court should grant the Motion and impose

sanctions on Plaintiffs and their counsel. 3 Plaintiffs also criticize the Board Defendants for not agreeing to stay Plaintiffs legally

defective litigation while the Board investigates. (Dkt. No. 22-1 at 13:24-25.) Notwithstanding that demand futility is not the only

fundamental flaw in Plaintiffs lawsuit, and therefore, a stay would make no material difference to the outcome here, the Board Defendants

are not required to give Plaintiffs time and opportunity to try to cure some of the foundational legal defects of pleadings which could

not properly be filed here in the first place.

BOARD DEFENDANTS REPLY IN FURTHER SUPPORT OF MOTION FOR SANCTIONS 11 1 2 3 4 5 6 7 8 9 10

11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 VEDDER PRICE (CA), LLP ATTORNEYS AT LAW LOS ANGELES Dated: April 11, 2024 VEDDER

PRICE (CA), LLP By:/s/ Michael J. Quinn Michael J. Quinn Marie E. Christiansen Attorneys for Board Defendants

BOARD DEFENDANTS REPLY IN FURTHER SUPPORT OF MOTION FOR SANCTIONS 12 1 2 3 4 5 6 7 8 9 10

11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 VEDDER PRICE (CA), LLP ATTORNEYS AT LAW LOS ANGELES CERTIFICATE OF COMPLIANCE The

undersigned, counsel of record for Rene Sindlev, Mark Dybul, Gregg Alton, Carol Brosgart, Henrik Grønfeldt-Sørensen, James

Sapirstein, and Jayne McNicol, certifies that this brief contains 3,598 words, which complies with the word limit of L.R. 11-6.1. Dated:

April 11, 2024 VEDDER PRICE (CA), LLP By:/s/ Michael J. Quinn Michael J. Quinn Marie E. Christiansen Attorneys for Board Defendants

BOARD DEFENDANTS REPLY IN FURTHER SUPPORT OF MOTION FOR SANCTIONS 13 1 2 3 4 5 6 7 8 9 10

11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 VEDDER PRICE (CA), LLP ATTORNEYS AT LAW LOS ANGELES CERTIFICATE OF SERVICE I hereby

certify that on April 11, 2024, I caused to be electronically filed a true and correct copy of the foregoing with the Clerk of Court

using the CM/ECF system and that all counsel of record will be served via the Notice of Electronic Filing generated by CM/ECF. /s/ Michael

J. Quinn . Michael J. Quinn

Exhibit 23

DECLARATION OF MICHAEL J. QUINN 1 2 3 4 5 6 7 8 9 10 11 12

13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 VEDDER PRICE (CA), LLP ATTORNEYS AT LAW LOS ANGELES VEDDER PRICE (CA), LLP Michael J.

Quinn, Bar No. 198349 mquinn@vedderprice.com Marie E. Christiansen, Bar No. 325352 mchristiansen@vedderprice.com 1925 Century Park East,

Suite 1900 Los Angeles, California 90067 T: +1 424 204 7700 F: +1 424 204 7702 Attorneys for the Board Defendants UNITED STATES DISTRICT

COURT CENTRAL DISTRICT OF CALIFORNIA WESTERN DIVISION WEIRD SCIENCE LLC and WILLIAM ANDERSON WITTEKIND, derivatively on behalf of RENOVARO

BIOSCIENCES, INC.,, Plaintiffs, v. SINDLEV, et al., Defendants. Case No. 2:24-cv-00645-HDV-MRW Hon. Hernan D. Vera DECLARATION OF MICHAEL

J. QUINN IN SUPPORT OF REPLY [Filed concurrently with Memorandum of Points and Authorities and Objections to Declaration of Megan A.

Maitia] Date: April 25, 2024 Time: 10:00 a.m. Courtroom: 5B

DECLARATION OF MICHAEL J. QUINN 1 2 3 4 5 6 7 8 9 10 11 12

13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 VEDDER PRICE (CA), LLP ATTORNEYS AT LAW LOS ANGELES VEDDER PRICE (CA), LLP Michael J.

Quinn, Bar No. 198349 mquinn@vedderprice.com Marie E. Christiansen, Bar No. 325352 mchristiansen@vedderprice.com 1925 Century Park East,

Suite 1900 Los Angeles, California 90067 T: +1 424 204 7700 F: +1 424 204 7702 Attorneys for the Board Defendants UNITED STATES DISTRICT

COURT CENTRAL DISTRICT OF CALIFORNIA WESTERN DIVISION WEIRD SCIENCE LLC and WILLIAM ANDERSON WITTEKIND, derivatively on behalf of RENOVARO

BIOSCIENCES, INC.,, Plaintiffs, v. SINDLEV, et al., Defendants. Case No. 2:24-cv-00645-HDV-MRW Hon. Hernan D. Vera DECLARATION OF MICHAEL

J. QUINN IN SUPPORT OF REPLY [Filed concurrently with Memorandum of Points and Authorities and Objections to Declaration of Megan A.

Maitia] Date: April 25, 2024 Time: 10:00 a.m. Courtroom: 5B

DECLARATION OF MICHAEL J. QUINN 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

23 24 25 26 27 28 VEDDER PRICE (CA), LLP ATTORNEYS AT LAW LOS ANGELES DECLARATION OF MICHAEL J. QUINN I, Michael J. Quinn, hereby declare

as follows: 1. I am a shareholder at the law firm of Vedder Price (CA) LLP, counsel for defendants René Sindlev, Mark Dybul, Gregg

Alton, James Sapirstein, Jayne McNicol, Henrik Grønfeldt-Sørensen, and Carol L. Brosgart (collectively, the Board Defendants).

I am duly licensed to practice law in the State of California and have been admitted to practice before this Court. I make this declaration

in support of the Board Defendants Reply in Further Support of Motion for Sanctions Against Plaintiffs and Plaintiffs Counsel. The matters

stated in this declaration are true and correct of my own knowledge, and if called as a witness I could and would testify truthfully

to the facts stated herein. 2. On January 19, 2024, Megan Maitia, counsel for Plaintiffs, sent an email with the subject line RENB Demand

for Corrective Action; Verified Derivative Stockholder Complaint to Rene Sindlev, Mark Dybul, and Renovaros counsel at K&L Gates

LLP. The email attached Plaintiffs demand letter and draft derivative complaint. Attached hereto as Exhibit A is a true and correct copy

of Ms. Maitias e-mail and attached demand letter. 3. In direct response to Plaintiffs demand letter, the Renovaro Board appointed a Special

Committee of independent directors, Leni Boeren and Ruud Hendriks. The Special Committee retained Stradling Yocca Carlson & Rauth

LLP as counsel, who has begun an investigation into Plaintiffs demands. I declare under penalty of perjury that the foregoing is true

and correct. Executed on April 11, 2024. /s/ Michael J. Quinn Michael J. Quinn

DECLARATION OF MICHAEL J. QUINN 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

23 24 25 26 27 28 VEDDER PRICE (CA), LLP ATTORNEYS AT LAW LOS ANGELES CERTIFICATE OF SERVICE I hereby certify that on April 11, 2024,

I caused to be electronically filed a true and correct copy of the foregoing with the Clerk of Court using the CM/ECF system and that

all counsel of record will be served via the Notice of Electronic Filing generated by CM/ECF. /s/ Michael J. Quinn . Michael J. Quinn

Exhibit 24

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

23 24 25 26 27 28 UNITED STATES DISTRICT COURT CENTRAL DISTRICT OF CALIFORNIA WEIRD SCIENCE LLC, et al., Plaintiffs, v. SINDLEV, et al.,

Defendants. Case No. 2:24-cv-00645-HDV-MRWx ORDER DENYING DEFENDANTS MOTION FOR SANCTIONS [DKT. NO. 18]

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

23 24 25 26 27 28 UNITED STATES DISTRICT COURT CENTRAL DISTRICT OF CALIFORNIA WEIRD SCIENCE LLC, et al., Plaintiffs, v. SINDLEV, et al.,

Defendants. Case No. 2:24-cv-00645-HDV-MRWx ORDER DENYING DEFENDANTS MOTION FOR SANCTIONS [DKT. NO. 18]

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

23 24 25 26 27 28 2 I. INTRODUCTION This action arises out of a derivative suit that Plaintiffs Weird Science LLC and William Anderson

Wittekind filed on behalf of the shareholders of Renovaro Biosciences, Inc. (Renovaro) against the companys Board and Officers, various

Renovaro investors, and Renovaros outside counsel.1 Complaint [Dkt. No. 1]. Plaintiffs allege several securities law violations, breach

of fiduciary duty, corporate waste, and other claims relating to Renovaros acquisition of the company GEDi (the Acquisition). After the

Court denied Plaintiffs ex parte application for a temporary restraining order that sought to enjoin the Renovaro Board from holding

a shareholder vote relating to the acquisition on January 25, 2024, see (Ex Parte Order) [Dkt. No. 12], Defendants filed a motion for

sanctions (Motion) [Dkt. No. 18], which includes a request for attorneys fees. Defendants Motion is denied.2 The Court finds that Plaintiffs

Complaint is nonfrivolous and concludes that Plaintiffs counsel have satisfied their Rule 11 duties in bringing this action. Moreover,

Rule 11 motions should not be used to test the sufficiency of the pleadings. If Defendants believe that the allegations in the Complaint

fail to state a claim as a matter of law, they must file an appropriate motion under Rule 12 after the required meet and confer process.3

The Court declines Defendants unorthodox invitation to engage in a fulsome analysis of a series of dispositive (and highly contested)

legal and factual questions on a motion for sanctions.4 1 Defendants include Rene Sindlev, Mark Dybul, Gregg Alton, James Sapirstein,

Jayne McNicol, Henrik Gronfeldt-Sorensen, Carol L. Brosgart, RS Group APS, RS Bio APS, Paseco APS, Ole Abildgaard, Karsten Ree Holding

I APS, Karsten Ree Holding B APS, Karsten Ree, Poma Invest APS, TBC Invest A/S, Torben Bjorn Christensen, K&L Gates LLP, Clayton

E. Parker, Lincoln Park Capital Fund LLC, and Renovaro Biosciences Inc. 2 The Court grants Defendants unopposed Request for Judicial

Notice [Dkt. No. 18-3] under Federal Rule of Evidence 201, as all exhibits consist of official court records. See United States v. Black,

482 F.3d 1035, 1041 (9th Cir. 2007) ([Courts] may take notice of proceedings in other courts, both within and without the federal judicial

system, if those proceedings have a direct relation to matters at issue.). 3 Plaintiffs have indicated a desire to amend their Complaint

to add further detail. They should do so immediately (by no later than May 31, 2024), and any Rule 12 motion by Defendant should follow

in due course. 4 The Court denies both parties requests for attorneys fees related to the filing of this Motion.

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

23 24 25 26 27 28 2 I. INTRODUCTION This action arises out of a derivative suit that Plaintiffs Weird Science LLC and William Anderson

Wittekind filed on behalf of the shareholders of Renovaro Biosciences, Inc. (Renovaro) against the companys Board and Officers, various

Renovaro investors, and Renovaros outside counsel.1 Complaint [Dkt. No. 1]. Plaintiffs allege several securities law violations, breach

of fiduciary duty, corporate waste, and other claims relating to Renovaros acquisition of the company GEDi (the Acquisition). After the

Court denied Plaintiffs ex parte application for a temporary restraining order that sought to enjoin the Renovaro Board from holding

a shareholder vote relating to the acquisition on January 25, 2024, see (Ex Parte Order) [Dkt. No. 12], Defendants filed a motion for

sanctions (Motion) [Dkt. No. 18], which includes a request for attorneys fees. Defendants Motion is denied.2 The Court finds that Plaintiffs

Complaint is nonfrivolous and concludes that Plaintiffs counsel have satisfied their Rule 11 duties in bringing this action. Moreover,

Rule 11 motions should not be used to test the sufficiency of the pleadings. If Defendants believe that the allegations in the Complaint

fail to state a claim as a matter of law, they must file an appropriate motion under Rule 12 after the required meet and confer process.3

The Court declines Defendants unorthodox invitation to engage in a fulsome analysis of a series of dispositive (and highly contested)

legal and factual questions on a motion for sanctions.4 1 Defendants include Rene Sindlev, Mark Dybul, Gregg Alton, James Sapirstein,

Jayne McNicol, Henrik Gronfeldt-Sorensen, Carol L. Brosgart, RS Group APS, RS Bio APS, Paseco APS, Ole Abildgaard, Karsten Ree Holding

I APS, Karsten Ree Holding B APS, Karsten Ree, Poma Invest APS, TBC Invest A/S, Torben Bjorn Christensen, K&L Gates LLP, Clayton

E. Parker, Lincoln Park Capital Fund LLC, and Renovaro Biosciences Inc. 2 The Court grants Defendants unopposed Request for Judicial

Notice [Dkt. No. 18-3] under Federal Rule of Evidence 201, as all exhibits consist of official court records. See United States v. Black,

482 F.3d 1035, 1041 (9th Cir. 2007) ([Courts] may take notice of proceedings in other courts, both within and without the federal judicial

system, if those proceedings have a direct relation to matters at issue.). 3 Plaintiffs have indicated a desire to amend their Complaint

to add further detail. They should do so immediately (by no later than May 31, 2024), and any Rule 12 motion by Defendant should follow

in due course. 4 The Court denies both parties requests for attorneys fees related to the filing of this Motion.

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

23 24 25 26 27 28 3 II. BACKGROUND The dispute focuses on allegations that Renovaros board members, officers, investors, and outside

counsel violated securities laws and fiduciary duties by failing to disclose information related to the companys acquisition of GEDi.

On January 23, 2024, Plaintiffs simultaneously filed its Complaint and ex parte application for a temporary restraining order that sought

to enjoin a shareholder meeting scheduled for January 25, 2024. [Dkt Nos. 1, 2]. The Court immediately set the application for hearing

and heard oral argument January 24, 2024. [Dkt. No. 11]. That same day, the Court denied Plaintiffs application. See Ex Parte Order.

While the Court ruled that Plaintiffs failed to show a likelihood of success of this record, no specific findings adverse to Plaintiffs

on these issues were made. Id. at 2. After the Courts ruling, on January 26, 2024, Defendants counsel reached out to Plaintiffs counsel

to inquire about their litigation intentions given the Courts ruling. Declaration of Michael J. Quinn (Quinn Decl.) ¶ 2, Ex. A.

Defendants indicated that they believe[d] Rule 11 is implicated and wanted to afford [Plaintiffs] the opportunity to avoid it, asking

if Plaintiffs intend[ed] to dismiss this particular litigation. Id. The Defendants then prepared and served Plaintiffs counsel with the

sanctions motion papers on February 6, 2024. Id. ¶ 4, Ex. B. Plaintiffs refused to withdraw their Complaint, and Defendants filed

the Motion now before the Court.5 III. LEGAL STANDARD Under Rule 11(b) of the Federal Rules of Civil Procedure, an attorneys filing of

any complaint, motion, or other documents constitutes a representation to the Court that: (1) it is not being presented for any improper

purpose, such as to harass, cause unnecessary delay, or needlessly increase the cost of litigation; (2) the claims, defenses, and other

legal contentions are warranted by existing law or by a nonfrivolous argument for extending, modifying, or reversing existing law or

for establishing new law; (3) the factual contentions have evidentiary support or, if specifically so identified, will likely have evidentiary

support after a reasonable opportunity for further investigation or discovery; and (4) the denials of factual contentions are warranted

on the evidence or, if specifically so identified, are reasonably based on belief or a lack of information. 5 On April 4, 2024, Plaintiffs

filed their Opposition (Opp.) [Dkt. No. 21]. On April 11, 2024, Defendants filed their Reply [Dkt. No. 24].

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

23 24 25 26 27 28 3 II. BACKGROUND The dispute focuses on allegations that Renovaros board members, officers, investors, and outside

counsel violated securities laws and fiduciary duties by failing to disclose information related to the companys acquisition of GEDi.

On January 23, 2024, Plaintiffs simultaneously filed its Complaint and ex parte application for a temporary restraining order that sought

to enjoin a shareholder meeting scheduled for January 25, 2024. [Dkt Nos. 1, 2]. The Court immediately set the application for hearing

and heard oral argument January 24, 2024. [Dkt. No. 11]. That same day, the Court denied Plaintiffs application. See Ex Parte Order.

While the Court ruled that Plaintiffs failed to show a likelihood of success of this record, no specific findings adverse to Plaintiffs

on these issues were made. Id. at 2. After the Courts ruling, on January 26, 2024, Defendants counsel reached out to Plaintiffs counsel

to inquire about their litigation intentions given the Courts ruling. Declaration of Michael J. Quinn (Quinn Decl.) ¶ 2, Ex. A.

Defendants indicated that they believe[d] Rule 11 is implicated and wanted to afford [Plaintiffs] the opportunity to avoid it, asking

if Plaintiffs intend[ed] to dismiss this particular litigation. Id. The Defendants then prepared and served Plaintiffs counsel with the

sanctions motion papers on February 6, 2024. Id. ¶ 4, Ex. B. Plaintiffs refused to withdraw their Complaint, and Defendants filed

the Motion now before the Court.5 III. LEGAL STANDARD Under Rule 11(b) of the Federal Rules of Civil Procedure, an attorneys filing of

any complaint, motion, or other documents constitutes a representation to the Court that: (1) it is not being presented for any improper

purpose, such as to harass, cause unnecessary delay, or needlessly increase the cost of litigation; (2) the claims, defenses, and other

legal contentions are warranted by existing law or by a nonfrivolous argument for extending, modifying, or reversing existing law or

for establishing new law; (3) the factual contentions have evidentiary support or, if specifically so identified, will likely have evidentiary

support after a reasonable opportunity for further investigation or discovery; and (4) the denials of factual contentions are warranted

on the evidence or, if specifically so identified, are reasonably based on belief or a lack of information. 5 On April 4, 2024, Plaintiffs

filed their Opposition (Opp.) [Dkt. No. 21]. On April 11, 2024, Defendants filed their Reply [Dkt. No. 24].

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

23 24 25 26 27 28 4 Fed. R. Civ. P. 11(b). In short, Rule 11 imposes a duty upon those who sign pleadings to certify by their signature

that (1) they have read the pleadings or motions they file and (2) the pleading or motion is well-grounded in fact, has a colorable basis

in law, and is not filed for an improper purpose. Smith v. Ricks, 31 F.3d 1478, 1488 (9th Cir. 1994) (citations omitted). But the Committee

Notes on Amendments to the Federal Rules of Civil Procedure explain that Rule 11 motions for sanctions should not be employed to test

the legal sufficiency or efficacy of allegations in the pleadings; other motions are available for those purposes. Nor should such motions

be prepared to emphasize the merits of a partys position, to intimidate an adversary into withdrawing contentions that are fairly debatable,

[or] to increase the costs of litigation. Id. Rule 11 requires an evaluation of what constitutes a reasonable inquiry under all the circumstances

of a case. [Ninth Circuit] precedent outlines several relevant (but not mandatory) factors, including access to relevant information,

the experience of an attorney versus the level of specialized expertise necessary, whether the allegations are related to knowledge,

purpose, or intent, the relation of an allegedly frivolous claim to the pleading as a whole, the length of time the attorney had to investigate,

and the complexity of the case. Persian Gulf, Inc. v. Alon USA Energy, Inc., No. 22-56016, 2023 WL 8889557, at *1 (9th Cir. Dec. 26,

2023) (citations omitted). [T]he imposition of a Rule 11 sanction is not a judgment on the merits of an action. Rather, it requires the

determination of a collateral issue: whether the attorney has abused the judicial process, and, if so, what sanction would be appropriate.

Cooter & Gell v. Hartmarx Corp., 496 U.S. 384, 396 (1990). IV. DISCUSSION Defendants argue that Plaintiffs Complaint is frivolous

and merits sanctions for three primary reasons. Motion at 618. First, Defendants assert that Plaintiffs demand futility theory is foreclosed

based on their actions and Delaware law. Second, Defendants contend that Plaintiffs are unsuited to serve as derivative plaintiffs given

their ongoing litigation against Renovaro in other courts. And third, Defendants aver that this Court lacks jurisdiction based on the

forum selection clause in the merger agreement between Weird Science and Renovaro. The Court rejects and addresses each issue in turn.

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

23 24 25 26 27 28 4 Fed. R. Civ. P. 11(b). In short, Rule 11 imposes a duty upon those who sign pleadings to certify by their signature

that (1) they have read the pleadings or motions they file and (2) the pleading or motion is well-grounded in fact, has a colorable basis

in law, and is not filed for an improper purpose. Smith v. Ricks, 31 F.3d 1478, 1488 (9th Cir. 1994) (citations omitted). But the Committee

Notes on Amendments to the Federal Rules of Civil Procedure explain that Rule 11 motions for sanctions should not be employed to test

the legal sufficiency or efficacy of allegations in the pleadings; other motions are available for those purposes. Nor should such motions

be prepared to emphasize the merits of a partys position, to intimidate an adversary into withdrawing contentions that are fairly debatable,

[or] to increase the costs of litigation. Id. Rule 11 requires an evaluation of what constitutes a reasonable inquiry under all the circumstances

of a case. [Ninth Circuit] precedent outlines several relevant (but not mandatory) factors, including access to relevant information,

the experience of an attorney versus the level of specialized expertise necessary, whether the allegations are related to knowledge,

purpose, or intent, the relation of an allegedly frivolous claim to the pleading as a whole, the length of time the attorney had to investigate,

and the complexity of the case. Persian Gulf, Inc. v. Alon USA Energy, Inc., No. 22-56016, 2023 WL 8889557, at *1 (9th Cir. Dec. 26,

2023) (citations omitted). [T]he imposition of a Rule 11 sanction is not a judgment on the merits of an action. Rather, it requires the

determination of a collateral issue: whether the attorney has abused the judicial process, and, if so, what sanction would be appropriate.

Cooter & Gell v. Hartmarx Corp., 496 U.S. 384, 396 (1990). IV. DISCUSSION Defendants argue that Plaintiffs Complaint is frivolous

and merits sanctions for three primary reasons. Motion at 618. First, Defendants assert that Plaintiffs demand futility theory is foreclosed

based on their actions and Delaware law. Second, Defendants contend that Plaintiffs are unsuited to serve as derivative plaintiffs given

their ongoing litigation against Renovaro in other courts. And third, Defendants aver that this Court lacks jurisdiction based on the

forum selection clause in the merger agreement between Weird Science and Renovaro. The Court rejects and addresses each issue in turn.

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

23 24 25 26 27 28 5 A. Demand Futility Defendants contend that Plaintiffs demand futility claims are completely unjustified and constitute

a brazen violation of the fundamental precepts of Delaware law given their letter for corrective action sent to Defendants on January

19, 2024. Motion at 69, Complaint ¶¶ 111113. They assert that Plaintiffs had two options: (1) to sue Defendants without sending

a demand letter under demand futility or (2) to wait for Defendants to respond to the demand letter. Motion at 67 (citing Dahle v. Pope,

No. 2019-0136, 2020 WL 504982 at *14 (Del. Ch. Jan. 31, 2020)). Because Plaintiffs sent the January 19, 2024 letter, Defendants argue

that they are foreclosed from filing suit. But Plaintiffs put forth many good faith factual and legal reasons as to why this might not

be true. See Opp. 1416. Defendants provided very little information in their papers and at oral argument about the status of the investigation

by the board of directors (including whether anything has happened in the investigation to date), nor have Defendants moved to stay the

case pending the investigation. And Plaintiffs argue that since their allegations implicate the board, they may be able to skirt the

demand issues. In short, the Court finds that this issue has not been fully developed and is not ripe for adjudication on a sanctions

motion. The Court does not express an opinion on the validity or invalidity of these arguments except to find that Plaintiffs position

is not frivolous. B. Suitability of Plaintiffs Next, Defendants argue that Plaintiffs are patently unsuitable derivative plaintiffs given

their ongoing litigation against Renovaro, and thus are not legally permitted to bring this actionregardless of its merits. Motion at

9. Defendants note that derivative plaintiff Wittekind has been sued for fraud by Renovaro in Los Angeles County Superior Court6 and

is suing Renovaro in the Delaware Court of Chancery for breach of an Investor Rights Agreement.7 Motion at 11. They allege the Delaware

Action in particular overlaps with the allegations in this action. Id. at 12. This challenge is a serious one. But determining whether

Plaintiffs are suitable derivative plaintiffs in this action involves a complex factual analysis requiring a multi-factor inquiry. See

6 Enochian Biosciences, Inc. v. Gumrukcu, et al., Case No. 22STCV34071. 7 Weird Science LLC, et al. v. Renovaro Biosciences, Inc., et

al., Case No. 2023-0599-MTZ.

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

23 24 25 26 27 28 5 A. Demand Futility Defendants contend that Plaintiffs demand futility claims are completely unjustified and constitute

a brazen violation of the fundamental precepts of Delaware law given their letter for corrective action sent to Defendants on January

19, 2024. Motion at 69, Complaint ¶¶ 111113. They assert that Plaintiffs had two options: (1) to sue Defendants without sending

a demand letter under demand futility or (2) to wait for Defendants to respond to the demand letter. Motion at 67 (citing Dahle v. Pope,

No. 2019-0136, 2020 WL 504982 at *14 (Del. Ch. Jan. 31, 2020)). Because Plaintiffs sent the January 19, 2024 letter, Defendants argue

that they are foreclosed from filing suit. But Plaintiffs put forth many good faith factual and legal reasons as to why this might not

be true. See Opp. 1416. Defendants provided very little information in their papers and at oral argument about the status of the investigation

by the board of directors (including whether anything has happened in the investigation to date), nor have Defendants moved to stay the

case pending the investigation. And Plaintiffs argue that since their allegations implicate the board, they may be able to skirt the

demand issues. In short, the Court finds that this issue has not been fully developed and is not ripe for adjudication on a sanctions

motion. The Court does not express an opinion on the validity or invalidity of these arguments except to find that Plaintiffs position

is not frivolous. B. Suitability of Plaintiffs Next, Defendants argue that Plaintiffs are patently unsuitable derivative plaintiffs given

their ongoing litigation against Renovaro, and thus are not legally permitted to bring this actionregardless of its merits. Motion at

9. Defendants note that derivative plaintiff Wittekind has been sued for fraud by Renovaro in Los Angeles County Superior Court6 and

is suing Renovaro in the Delaware Court of Chancery for breach of an Investor Rights Agreement.7 Motion at 11. They allege the Delaware

Action in particular overlaps with the allegations in this action. Id. at 12. This challenge is a serious one. But determining whether

Plaintiffs are suitable derivative plaintiffs in this action involves a complex factual analysis requiring a multi-factor inquiry. See

6 Enochian Biosciences, Inc. v. Gumrukcu, et al., Case No. 22STCV34071. 7 Weird Science LLC, et al. v. Renovaro Biosciences, Inc., et

al., Case No. 2023-0599-MTZ.

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

23 24 25 26 27 28 6 Larson v. Dumke, 900 F.2d 1363, 1367 (9th Cir. 1990) (establishing eight factors that are intertwined or interrelated,

and it is frequently a combination of factors which leads a court to conclude that the plaintiff does not fulfill the requirements of

[Rule] 23.1.). Only a few factors consider the relative magnitude of the plaintiffs personal interests and the plaintiffs vindictiveness

towards the defendants. Id. Evaluating these factors is appropriate in the event of a motion to dismiss, not a motion for sanctions.

Reviewing the complaints, this action does not appear identical to the Los Angeles County and Delaware litigation that Defendants cite.

A motion for sanctions is not an appropriate mechanism to decide this issue. C. Forum-Selection Clause Finally, Defendants argue that

Plaintiffs deliberately selected this forum in direct contravention of a contractual forum-selection clause conferring exclusive jurisdiction

and venue over this matter in the courts of Delaware. Motion at 14. On January 12, 2018, Weird Science, Renovaro, and other parties entered

signed a Merger Agreement (2018 Merger Agreement), which stated that for the purpose of any action arising out of or relating to this

Agreement brought by any Party against another Party arising out of or relating to this Agreement irrevocably and unconditionally consents

and submits to the exclusive jurisdiction and venue of the Court of Chancery of the State of Delaware. Declaration of Dr. Mark Dybul

(Dybul Decl.) ¶ 2, Ex. A 2018 Merger Agreement, § 11.10 [Dkt. No. 18-1]. But Plaintiffs take the plausible legal position that

the misconduct alleged in this derivative complaint are unrelated to the 2018 Merger Agreement because the complaint focuses on a derivative

claim for violating the federal securities laws. Instead of a dispute related to the merger of entities, this suit deals with shareholders

suing the company itself. And Plaintiffs indicate that neither Renovaros Certificate of Incorporation nor Renovaros Bylaws have a forum

selection clause for shareholder litigation, arguments which Plaintiffs counsel conveyed to Defendants. Declaration of Megan A. Maitia

(Maitia Decl.) ¶¶ 4344 [Dkt. No. 21-1]. Such a position is not frivolous, and the Court finds that this is not an appropriate

basis for sanctions. D. Other Reasons Defendants then point to a grab bag of other arguments to justify sanctions, which the Court

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22

23 24 25 26 27 28 6 Larson v. Dumke, 900 F.2d 1363, 1367 (9th Cir. 1990) (establishing eight factors that are intertwined or interrelated,

and it is frequently a combination of factors which leads a court to conclude that the plaintiff does not fulfill the requirements of

[Rule] 23.1.). Only a few factors consider the relative magnitude of the plaintiffs personal interests and the plaintiffs vindictiveness

towards the defendants. Id. Evaluating these factors is appropriate in the event of a motion to dismiss, not a motion for sanctions.

Reviewing the complaints, this action does not appear identical to the Los Angeles County and Delaware litigation that Defendants cite.

A motion for sanctions is not an appropriate mechanism to decide this issue. C. Forum-Selection Clause Finally, Defendants argue that

Plaintiffs deliberately selected this forum in direct contravention of a contractual forum-selection clause conferring exclusive jurisdiction

and venue over this matter in the courts of Delaware. Motion at 14. On January 12, 2018, Weird Science, Renovaro, and other parties entered

signed a Merger Agreement (2018 Merger Agreement), which stated that for the purpose of any action arising out of or relating to this

Agreement brought by any Party against another Party arising out of or relating to this Agreement irrevocably and unconditionally consents

and submits to the exclusive jurisdiction and venue of the Court of Chancery of the State of Delaware. Declaration of Dr. Mark Dybul

(Dybul Decl.) ¶ 2, Ex. A 2018 Merger Agreement, § 11.10 [Dkt. No. 18-1]. But Plaintiffs take the plausible legal position that

the misconduct alleged in this derivative complaint are unrelated to the 2018 Merger Agreement because the complaint focuses on a derivative

claim for violating the federal securities laws. Instead of a dispute related to the merger of entities, this suit deals with shareholders

suing the company itself. And Plaintiffs indicate that neither Renovaros Certificate of Incorporation nor Renovaros Bylaws have a forum

selection clause for shareholder litigation, arguments which Plaintiffs counsel conveyed to Defendants. Declaration of Megan A. Maitia

(Maitia Decl.) ¶¶ 4344 [Dkt. No. 21-1]. Such a position is not frivolous, and the Court finds that this is not an appropriate

basis for sanctions. D. Other Reasons Defendants then point to a grab bag of other arguments to justify sanctions, which the Court

123456789101112131415161718192021222324252627287rejects for

similar reasons discussed supra. Motion at 1820. In particular, the Court rejects Defendants argument that sanctions are warranted because

the Colorado River doctrine prevents the Court from exercising jurisdiction over this action. See Colorado River Water Conservation Dist.

v. United States, 424 U.S. 800(1976). In Seneca Ins. v. Strange Land, Inc., the Ninth Circuit discusses the eight-factor test under Colorado

River, explaining that these factors are not a mechanical checklist but must be examined in a pragmatic, flexible manner with a few to

the realities of the case at hand, and with the balance heavily weighed in favor of the exercise ofjurisdiction. 862 F.3d 835, 84142

(9th Cir. 2017)(citations omitted). Defendants fail to adequately grapple with these factors, which are more appropriate for a motion

to dismiss or transfer. The mere fact that the Delaware Actionis not a shareholder derivative suit, while this one is, necessitates the

need for analysis and demonstrates a reasonable basis for Plaintiffs pleading. Plaintiffs have demonstrated that their legal positions

are fairly debatable, warranted by existing law or by a nonfrivolous argument for extending,modifying, or reversing existing law or for

establishing new law. Fed. R. Civ. P. 11(b)(2) and Notes of Advisory Committee on Rules (1993).In summary, aRule 11 motion for sanctions

is not an appropriate substitute for a motion to dismiss. The Court declines to view this as a motion on the pleadings. Plaintiffs havedemonstrated

that their legal positions are nonfrivolous and have not been litigated in bad faith.V.CONCLUSIONDefendants Motion is denied. Dated:

May16,2024 _______________________________________ Hernán D. VeraUnited States District Judge ____________________________

123456789101112131415161718192021222324252627287rejects for

similar reasons discussed supra. Motion at 1820. In particular, the Court rejects Defendants argument that sanctions are warranted because

the Colorado River doctrine prevents the Court from exercising jurisdiction over this action. See Colorado River Water Conservation Dist.

v. United States, 424 U.S. 800(1976). In Seneca Ins. v. Strange Land, Inc., the Ninth Circuit discusses the eight-factor test under Colorado

River, explaining that these factors are not a mechanical checklist but must be examined in a pragmatic, flexible manner with a few to

the realities of the case at hand, and with the balance heavily weighed in favor of the exercise ofjurisdiction. 862 F.3d 835, 84142

(9th Cir. 2017)(citations omitted). Defendants fail to adequately grapple with these factors, which are more appropriate for a motion

to dismiss or transfer. The mere fact that the Delaware Actionis not a shareholder derivative suit, while this one is, necessitates the

need for analysis and demonstrates a reasonable basis for Plaintiffs pleading. Plaintiffs have demonstrated that their legal positions

are fairly debatable, warranted by existing law or by a nonfrivolous argument for extending,modifying, or reversing existing law or for

establishing new law. Fed. R. Civ. P. 11(b)(2) and Notes of Advisory Committee on Rules (1993).In summary, aRule 11 motion for sanctions

is not an appropriate substitute for a motion to dismiss. The Court declines to view this as a motion on the pleadings. Plaintiffs havedemonstrated

that their legal positions are nonfrivolous and have not been litigated in bad faith.V.CONCLUSIONDefendants Motion is denied. Dated:

May16,2024 _______________________________________ Hernán D. VeraUnited States District Judge ____________________________

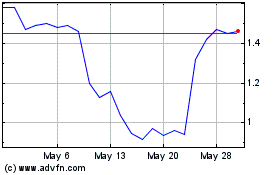

Renovaro (NASDAQ:RENB)

Historical Stock Chart

From May 2024 to Jun 2024

Renovaro (NASDAQ:RENB)

Historical Stock Chart

From Jun 2023 to Jun 2024