Current Report Filing (8-k)

November 12 2020 - 9:07AM

Edgar (US Regulatory)

RAMBUS INC false 0000917273 0000917273 2020-11-11 2020-11-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

November 11, 2020

Rambus Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

000-22339

|

|

94-3112828

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission

File Number)

|

|

(I. R. S. Employer

Identification No.)

|

4453 North First Street, Suite 100

San Jose, California 95134

(Address of principal executive offices)

(408) 462-8000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading

Symbol

|

|

Name of Each Exchange

on Which Registered

|

|

Common Stock, $.001 Par Value

|

|

RMBS

|

|

The NASDAQ Stock Market LLC

|

|

|

|

|

|

(The NASDAQ Global Select Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On November 11, 2020, Rambus Inc. (NASDAQ: RMBS) (the “Company”) entered into a Supplemental Confirmation under the Master Confirmation entered into on November 11, 2020 (the “Master Agreement,” and together with the Supplemental Confirmation, the “ASR Agreement”) with Deutsche Bank AG, London Branch as counterparty, through its agent Deutsche Bank Securities Inc. (“Deutsche Bank”) pursuant to an accelerated share repurchase program (the “ASR Program”) under which the Company will repurchase shares of the Company’s common stock for an aggregate purchase price of approximately $50 million (the “Shares”). The ASR Program is part of a broader share repurchase program previously authorized by the board of directors of the Company in October 2020.

Under the ASR Agreement, the Company will pre-pay to Deutsche Bank the $50 million purchase price for the Shares and the Company will receive an initial delivery of approximately 2.6 million of the Shares from Deutsche Bank within the first week of the ASR Program. The number of Shares to be ultimately repurchased by the Company under the ASR Program will be determined based on the volume-weighted average price of the Company’s common stock during the terms of the transaction (the “Valuation Period”), minus an agreed upon discount between the parties. The program is expected to be completed within six months. Any additional shares of common stock will be delivered by Deutsche Bank to the Company on the third business day following the Valuation Period described above.

The description of the ASR Agreement contained herein is qualified in its entirety by reference to the ASR Agreement that is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference. The ASR Agreement contains other terms governing the ASR Program, including, but not limited to, the mechanism used to determine the final settlement of the repurchase of the Shares, the method of such settlement, the circumstances under which Deutsche Bank is permitted to make adjustments to the terms of the ASR Agreement, the circumstances under which the ASR Agreement may be terminated early, and various acknowledgements, representations and warranties made by the Company and Deutsche Bank.

|

Item 2.03.

|

Creation of Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information called for by this item is contained in Item 1.01 of this current report on Form 8-K, which is incorporated herein by reference.

On November 12, 2020, the Company issued a press release announcing its entry into the ASR Agreement. A copy of this press release is attached as Exhibit 99.1 to this current report on Form 8-K and incorporated herein by reference.

The information in this press release shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: November 12, 2020

|

|

|

|

|

|

Rambus Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Rahul Mathur

|

|

|

|

|

|

|

|

Rahul Mathur, Senior Vice President, Finance and

Chief Financial Officer

|

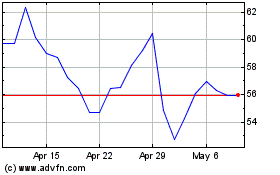

Rambus (NASDAQ:RMBS)

Historical Stock Chart

From Aug 2024 to Sep 2024

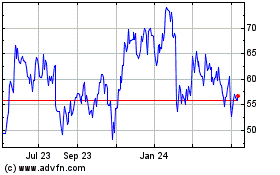

Rambus (NASDAQ:RMBS)

Historical Stock Chart

From Sep 2023 to Sep 2024