PCTEL, Inc. (Nasdaq: PCTI) announced its results for the fourth

quarter and full year ended December 31, 2020.

Highlights

- Revenue of $21.2 million in the quarter and $77.5 million

for the year, 7.5% lower compared to the fourth quarter 2019

and 14.5% lower in the year compared to 2019. Revenue was higher by

9.5% for the test and measurement product line, and lower by 15.2%

for the antenna product line compared to the fourth quarter 2019.

For the year, revenue was lower by 2.0% for the test and

measurement product line and lower by 19.4% for the antenna product

line.

- Gross profit margin of 50.1% in the fourth quarter and 49.0%

for the year, down 0.2% compared to the gross profit margin in

the fourth quarter 2019 and up 3.2% in the year compared to 2019.

The gross profit percentage in the fourth quarter reflects a higher

mix of higher margin test and measurement products, offsetting

lower gross margin percentages for both test and measurement

products and antenna products.

- GAAP net income per diluted share of $0.10 in the fourth

quarter and $0.18 in the year compared to GAAP net income per

share of $0.10 in the fourth quarter 2019 and $0.21 for the year in

2019.

- Non-GAAP net income and adjusted EBITDA are metrics the

Company uses to measure its core earnings. A reconciliation of

those non-GAAP measures to our GAAP financial statements is

provided later in the press release.

- $41.0 million of cash and investments (including long-term

investments) and no debt at December 31, 2020 compared to $41.3

million and no debt at September 30, 2020.

“We’re pleased with the strong performance for both our antenna

and scanning receiver product lines in the fourth quarter. We saw

improvements in revenue and earnings in the second half of the year

and incoming orders were at the highest level since the second

quarter of 2019,” said David Neumann, PCTEL’s CEO. “We expect

demand to increase for our antennas, IoT devices and 5G solutions

through the year as market conditions improve.”

CONFERENCE CALL / WEBCAST

PCTEL’s management team will discuss the Company’s results today

at 4:30 p.m. ET. The call can be accessed by dialing (888) 506-0062

(United States/Canada) or (973) 528-0011 (International), PIN

number: 528059. The call will also be webcast at

https://investor.pctel.com/news-events/webcasts-events.

REPLAY: A replay will be available for two weeks after the call

on either the website listed above or by calling (877) 481-4010

(United States /Canada), or (919) 882-2331 (International), PIN

number: 40038.

About PCTEL

PCTEL is a leading global provider of wireless technology,

including purpose-built Industrial IoT devices, antenna systems,

and test and measurement solutions. Trusted by our customers for

over 25 years, we solve complex wireless challenges to help

organizations stay connected, transform, and grow.

For more information, please visit our website at

https://www.pctel.com/.

PCTEL Safe Harbor Statement

This press release and our related comments in our earnings

conference call contain “forward-looking statements” as defined in

the Private Securities Litigation Reform Act of 1995. Specifically,

the statements about the Company’s expectations regarding the

impact of the COVID-19 pandemic; our future financial performance;

growth of our antenna solutions and test and measurement

businesses; the impact of our transition plan for manufacturing

inside and outside China; the anticipated demand for certain

products including those related to public safety, Industrial IoT,

5G and intelligent transportation; and the anticipated growth of

public and private wireless systems are forward-looking statements

within the meaning of the safe harbor. These statements are based

on management’s current expectations and actual results may differ

materially from those projected as a result of certain risks and

uncertainties, including the disruptions to the Company’s

workforce, operations, supply chain and customer demand caused by

the COVID-19 pandemic and impact of the pandemic on the Company’s

results of operations, financial condition and stock price; the

impact of data densification and IoT on capacity and coverage

demand; the impact of 5G; customer demand and growth generally in

the Company’s defined market segments, including demand from

customers in China; the impact of the uncertainty regarding renewal

of our lease of our Tianjin, China manufacturing premises; the

impact of tariffs on certain imports from China; and the Company’s

ability to grow its business and create, protect and implement new

technologies and solutions. These and other risks and uncertainties

are detailed in PCTEL's Securities and Exchange Commission filings.

These forward-looking statements are made only as of the date

hereof, and PCTEL disclaims any obligation to update or revise the

information contained in any forward-looking statement, whether as

a result of new information, future events or otherwise.

PCTEL is a registered trademark of PCTEL, Inc. © 2021 PCTEL,

Inc. All rights reserved.

PCTEL, INC. CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited) (in thousands, except share data)

(unaudited) December 31, 2020 December 31,

2019 ASSETS Cash and cash equivalents

$

5,761

$

7,094

Short-term investment securities

30,582

32,556

Accounts receivable, net of allowances of $113 and $104 at December

31, 2020 and December 31, 2019, respectively

16,601

17,380

Inventories, net

9,984

11,935

Prepaid expenses and other assets

1,685

1,842

Total current assets

64,613

70,807

Property and equipment, net

12,505

11,985

Long-term investment securities

4,640

0

Goodwill

3,332

3,332

Intangible assets, net

0

144

Other noncurrent assets

2,441

2,969

TOTAL ASSETS

$

87,531

$

89,237

LIABILITIES AND STOCKHOLDERS’ EQUITY Accounts payable

$

4,430

$

3,190

Accrued liabilities

7,316

9,382

Total current liabilities

11,746

12,572

Long-term liabilities

4,387

3,315

Total liabilities

16,133

15,887

Stockholders’ equity: Common stock, $0.001 par value, 50,000,000

and 100,000,000 shares authorized at December 31, 2020 and December

31, 2019, respectively, and 18,429,350 and 18,611,289 shares issued

and outstanding at December 31, 2020 and December 31, 2019,

respectively

18

19

Additional paid-in capital

128,269

133,954

Accumulated deficit

(56,907

)

(60,305

)

Accumulated other comprehensive income (loss)

18

(318

)

Total stockholders’ equity

71,398

73,350

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

$

87,531

$

89,237

PCTEL, INC. CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (unaudited) (in thousands, except per share

data) Three Months EndedDecember 31,

Years EndedDecember 31,

2020

2019

2020

2019

REVENUES

$

21,185

$

22,898

$

77,456

$

90,617

COST OF REVENUES

10,569

11,385

39,529

49,105

GROSS PROFIT

10,616

11,513

37,927

41,512

OPERATING EXPENSES: Research and development

3,204

3,048

12,519

12,272

Sales and marketing

2,924

3,424

11,103

12,254

General and administrative

2,522

3,072

10,828

13,452

Amortization of intangible assets

0

49

32

219

Restructuring expenses

0

213

124

507

Total operating expenses

8,650

9,806

34,606

38,704

OPERATING INCOME

1,966

1,707

3,321

2,808

Other (expense) income, net

(110

)

107

106

982

INCOME BEFORE INCOME TAXES

1,856

1,814

3,427

3,790

Expense for income taxes

4

16

29

40

NET INCOME

$

1,852

$

1,798

$

3,398

$

3,750

Net Income per Share: Basic

$

0.10

$

0.10

$

0.19

$

0.21

Diluted

$

0.10

$

0.10

$

0.18

$

0.21

Weighted Average Shares: Basic

18,149

18,034

18,207

17,853

Diluted

18,297

18,461

18,399

18,159

Cash dividend per share

$

0.055

$

0.055

$

0.220

$

0.220

PCTEL, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (unaudited) (unaudited, in thousands)

Years Ended December 31,

2020

2019

Operating Activities: Net income

$

3,398

$

3,750

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization

3,019

2,870

Intangible asset amortization

144

885

Stock-based compensation

2,479

4,133

Loss on disposal of property and equipment

21

97

Restructuring costs

(29

)

(33

)

Bad debt recovery

(151

)

(2

)

Changes in operating assets and liabilities, net of acquisitions:

Accounts receivable

960

(1,532

)

Inventories

2,076

873

Prepaid expenses and other assets

638

385

Accounts payable

1,086

(2,841

)

Income taxes payable

(10

)

(22

)

Other accrued liabilities

(231

)

2,263

Deferred revenue

1

92

Net cash provided by operating activities

13,401

10,918

Investing Activities: Capital expenditures

(4,093

)

(2,263

)

Purchase of investments

(49,701

)

(48,245

)

Redemptions/maturities of short-term investments

47,035

46,559

Net cash used in investing activities

(6,759

)

(3,949

)

Financing Activities: Proceeds from issuance of common stock

870

1,183

Proceeds from Paycheck Protection Program Loan

3,500

0

Repayment of Paycheck Protection Program Loan

(3,500

)

0

Payment of withholding tax on stock-based compensation

(1,119

)

(1,152

)

Principle payments on finance leases

(78

)

(99

)

Purchase of common stock from repurchase program

(3,808

)

0

Cash dividends

(4,108

)

(4,068

)

Net cash used in financing activities

(8,243

)

(4,136

)

Net (decrease) increase in cash and cash equivalents

(1,601

)

2,833

Effect of exchange rate changes on cash

268

(68

)

Cash and cash equivalents, beginning of period

7,094

4,329

Cash and Cash Equivalents, End of Period

$

5,761

$

7,094

PCTEL, INC. REVENUE AND GROSS PROFIT BY PRODUCT LINE

(unaudited) (in thousands) Three Months Ended

December 31, 2020 Year Ended December 31, 2020

AntennaProducts Test &MeasurementProducts

Corporate Total AntennaProducts Test

&MeasurementProducts Corporate Total

REVENUES

$12,844

$8,554

($213

)

$21,185

$50,540

$27,565

($649

)

$77,456

GROSS PROFIT

$4,437

$6,135

$44

$10,616

$17,665

$20,244

$18

$37,927

GROSS PROFIT %

34.5

%

71.7

%

50.1

%

35.0

%

73.4

%

49.0

%

Three Months Ended December 31, 2019 Year Ended

December 31, 2019 AntennaProducts Test

&MeasurementProducts Corporate Total

AntennaProducts Test &MeasurementProducts

Corporate Total REVENUES

$15,144

$7,814

($60

)

$22,898

$62,708

$28,115

($206

)

$90,617

GROSS PROFIT

$5,700

$5,806

$7

$11,513

$21,841

$19,640

$31

$41,512

GROSS PROFIT %

37.6

%

74.3

%

50.3

%

34.8

%

69.9

%

45.8

%

Reconciliation of GAAP to non-GAAP

Results (unaudited) (in thousands except per share

information) Reconciliation of

GAAP operating income to non-GAAP operating income

Three Months Ended December 31, Year Ended

December 31,

2020

2019

2020

2019

Operating Income

$

1,966

$

1,707

$

3,321

$

2,808

(a)

Add: Amortization of intangible assets -Cost of

revenues

0

167

111

666

-Operating expenses

0

49

32

219

Restructuring

0

213

124

507

Stock Compensation: -Cost of revenues

65

116

272

408

-Engineering

128

145

530

652

-Sales & marketing

130

151

559

673

-General & administrative

161

475

1,119

2,401

484

1,316

2,747

5,526

Non-GAAP Operating Income

$

2,450

$

3,023

$

6,068

$

8,334

% of revenue

11.6

%

13.2

%

7.8

%

9.2

%

Reconciliation of GAAP net income

to non-GAAP net income Three Months Ended

December 31, Year Ended December 31,

2020

2019

2020

2019

Net Income

$

1,852

$

1,798

$

3,398

$

3,750

Adjustments: (a) Non-GAAP adjustments to operating

income

484

1,316

2,747

5,526

Income Taxes

(183

)

(233

)

(465

)

(705

)

301

1,083

2,282

4,821

Non-GAAP Net Income

$

2,153

$

2,881

$

5,680

$

8,571

Non-GAAP Income per Share: Basic

$

0.12

$

0.16

$

0.31

$

0.48

Diluted

$

0.12

$

0.16

$

0.31

$

0.47

Weighted Average Shares: Basic

18,149

18,034

18,207

17,853

Diluted

18,297

18,461

18,399

18,159

This schedule reconciles the Company's

GAAP operating income to its non-GAAP operating income. The Company

believes that presentation of this schedule provides meaningful

supplemental information to both management and investors that is

indicative of the Company's core operating results and facilitates

comparison of operating results across reporting periods. The

Company uses these non-GAAP measures when evaluating its financial

results as well as for internal planning and forecasting purposes.

These non-GAAP measures should not be viewed as a substitute for

the Company's GAAP results.

The adjustments to GAAP operating income

(a) consist of stock compensation expense and amortization of

intangible assets. The adjustments to GAAP net income include the

non-GAAP adjustments to operating income as well as adjustments for

(b) non-cash income tax expense.

PCTEL, Inc. Reconciliation of GAAP operating income to Adjusted

EBITDA (unaudited, in thousands) Three

Months Ended December 31, Year Ended December 31,

2020

2019

2020

2019

Operating Income

$

1,966

$

1,707

$

3,321

$

2,808

Add: Depreciation and amortization

759

719

3,019

2,870

Intangible amortization

0

216

143

885

Restructuring expenses

0

213

124

507

Stock compensation expenses

484

887

2,480

4,134

Adjusted EBITDA

$

3,209

$

3,742

$

9,087

$

11,204

% of revenue

15.1

%

16.3

%

11.7

%

12.4

%

This schedule reconciles the Company's

GAAP operating income to Adjusted EBITDA. The Company believes that

this schedule provides meaningful supplemental information to both

management and investors that is indicative of the Company's core

operating results and facilitates comparison of operating results

across reporting periods. The Company uses Adjusted EBITDA when

evaluating its financial results as well as for internal planning

and forecasting purposes. Adjusted EBITDA should not be viewed as a

substitute for the Company's GAAP results.

Adjusted EBITDA is defined as net income

before interest, income taxes, depreciation and amortization. The

adjustments on this schedule consist of depreciation, amortization

of intangible assets, and stock compensation expenses.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210225006095/en/

Kevin McGowan CFO PCTEL, Inc. (630) 339-2051

Suzanne Cafferty Vice President, Global Marketing PCTEL, Inc.

(630) 339-2107 public.relations@pctel.com

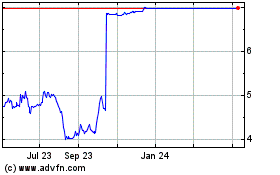

PCTEL (NASDAQ:PCTI)

Historical Stock Chart

From Oct 2024 to Nov 2024

PCTEL (NASDAQ:PCTI)

Historical Stock Chart

From Nov 2023 to Nov 2024