PCTEL, Inc. (Nasdaq: PCTI) announced its results for the fourth

quarter ended December 31, 2018.

Highlights from Continuing

Operations

- Revenue of $21.2 million in the

quarter and $83.0 million for the year, 9% lower in the quarter

and 9% lower for the year compared to the prior year. Revenue was

lower in both the antenna and test & measurement product lines

in the quarter and for the year compared to the prior year.

- Gross profit margin of 40.9% in the

quarter and 37.5% for the year, down 3.1% in the quarter and

4.9% for the year compared to the prior year. The decrease in the

quarter is due to lower test & measurement product revenue

which has higher gross margin compared to antenna products. The

decrease for the year is due to both the lower test &

measurement product revenue and price erosion in the small cell

antenna market.

- GAAP net loss per share of $0.53 in

the quarter and a GAAP net loss of $0.75 for the year, compared

to net income of $0.19 per share in the quarter and $0.24 for the

year in the prior year. Approximately $0.51 per share of the GAAP

net loss in the quarter and $0.54 of the GAAP net loss in the year

are attributed to non-cash income tax expense related to the

Company’s valuation allowance for deferred tax assets. The income

tax adjustment reflects a full valuation allowance on the Company’s

deferred tax assets.

- Non-GAAP net income and adjusted

EBITDA are measures the Company uses to reflect the results of its

core earnings. A reconciliation of those non-GAAP measures to

our financial statements is provided later in the press release.

- Non-GAAP net income per share of

$0.03 in the quarter and a net loss of $0.04 for the year

compared to net income of $0.08 in the quarter and $0.28 for the

year in the prior year.

- Adjusted EBITDA margin as a percent

of revenue of 6% in the quarter and 2% for the year compared to

10% in the quarter and 9% for the year in the prior year.

- $35.2 million of cash and short-term

investments at December 31, 2018 and no debt.

“Our combined sales force with a dedicated business development

team is having a real impact in public safety, industrial IoT and

5G targeted markets,” said David Neumann, PCTEL’s CEO. “It is

encouraging to see all the major U.S. operators, along with leading

operators in Europe and Asia, deploying 5G networks. This drives

test and measurement sales for deployments today and will drive

growth in our small cell, transit and industrial IoT solutions over

the long term. After a challenging year, we are pleased to see

sequential growth in revenue and earnings in the fourth

quarter.”

CONFERENCE CALL / WEBCAST

PCTEL’s management team will discuss the Company’s results today

at 4:30 p.m. ET. The call can be accessed by dialing (888) 782-2072

(U.S. / Canada) or (706) 679-6397 (International), conference ID:

2979119. The call will also be webcast at

http://investor.pctel.com/news-events/webcasts-presentations.

REPLAY: A replay will be available for two weeks after the call

on either the website listed above or by calling (855) 859-2056

(U.S./Canada), or International (404) 537-3406, conference ID:

2979119.

About PCTEL

PCTEL, Inc. is a leading global supplier of antennas and

wireless network testing solutions. Founded in 1994, we are

currently celebrating our 25th anniversary. PCTEL’s precision

antennas are deployed in small cells, enterprise Wi-Fi access

points, fleet management and transit systems, and in equipment and

devices for the Industrial Internet of Things (IIoT). We offer

in-house design, testing, radio integration, and manufacturing

capabilities for our customers. PCTEL’s test and measurement tools

improve the performance of wireless networks globally, with a focus

on LTE, public safety, and emerging 5G technologies. Network

operators, neutral hosts, and equipment manufacturers rely on our

scanning receivers and testing solutions to analyze, design, and

optimize their networks.

For more information, please visit our website at

https://www.pctel.com/.

PCTEL Safe Harbor Statement

This press release and our related comments in our earnings

conference call contain “forward-looking statements” as defined in

the Private Securities Litigation Reform Act of 1995. Specifically,

the statements regarding our future financial performance, growth

of our antenna solutions and test and measurement businesses,

anticipated demand for certain products including those related to

antennas, the industrial IoT and the rollout of 5G, our

expectations regarding increasing capital expenditures in 2019 by

wireless operators, the impact of tariffs on certain imports from

China, and the anticipated growth of public and private wireless

systems are forward-looking statements within the meaning of the

safe harbor. These statements are based on management’s current

expectations and actual results may differ materially from those

projected as a result of certain risks and uncertainties, including

the impact of data densification and IoT on capacity and coverage

demand, impact of 5G, customer demand for these types of products

and services generally including demand from customers in China,

growth and continuity in PCTEL’s vertical markets, and PCTEL’s

ability to grow its wireless products business and create, protect

and implement new technologies and solutions. These and other risks

and uncertainties are detailed in PCTEL's Securities and Exchange

Commission filings. These forward-looking statements are made only

as of the date hereof, and PCTEL disclaims any obligation to update

or revise the information contained in any forward-looking

statement, whether as a result of new information, future events or

otherwise.

PCTEL, INC. CONDENSED CONSOLIDATED BALANCE

SHEETS (in thousands, except share data)

December 31, December 31, 2018

2017 ASSETS Cash and cash equivalents $ 4,329 $ 5,559

Short-term investment securities 30,870 32,499 Accounts receivable,

net of allowances of $63 and $319 at December 31, 2018 and

December 31, 2017, respectively

15,864 18,624 Inventories, net 12,848 12,756 Prepaid expenses and

other assets 1,416 1,605 Total current

assets 65,327 71,043 Property and equipment, net 12,138

12,369 Goodwill 3,332 3,332 Intangible assets, net 1,029 2,113

Deferred tax assets, net 0 7,734 Other noncurrent assets 45

72

TOTAL ASSETS $ 81,871

$ 96,663 LIABILITIES AND

STOCKHOLDERS’ EQUITY Accounts payable $ 6,083 $ 5,471 Accrued

liabilities 5,801 7,481 Total current

liabilities 11,884 12,952 Long-term liabilities 381

392 Total liabilities 12,265

13,344 Stockholders’ equity: Common stock, $0.001 par value,

100,000,000 shares authorized, 18,271,249 and 17,806,792

shares issued and outstanding at December

31, 2018 and December 31, 2017, respectively

18 18 Additional paid-in capital 133,859 134,505 Accumulated

deficit (64,055 ) (51,258 ) Accumulated other comprehensive (loss)

income (216 ) 54 Total stockholders’ equity

69,606 83,319

TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY $ 81,871 $

96,663 PCTEL,

INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited) (in thousands, except per share data)

Three Months Ended Year Ended December

31, December 31, 2018 2017 2018

2017 REVENUES $ 21,241 $ 23,301 $ 82,979 $

91,437

COST OF REVENUES 12,543 13,056

51,898 52,626

GROSS

PROFIT 8,698 10,245 31,081

38,811

OPERATING EXPENSES: Research and

development 2,830 3,002 11,851 11,142 Sales and marketing 3,024

3,236 12,083 12,630 General and administrative 3,184 3,028 12,355

13,110 Amortization of intangible assets 85

124 418 496 Total operating

expenses 9,123 9,390 36,707

37,378

OPERATING (LOSS) INCOME (425 )

855 (5,626 ) 1,433 Other income, net 78 32

564 105

(LOSS) INCOME BEFORE

INCOME TAXES (347 ) 887 (5,062 ) 1,538 Expense (benefit) for

income taxes 8,788 (2,402 ) 7,827

(2,471 )

(LOSS) INCOME FROM CONTINUING

OPERATIONS (9,135 ) 3,289 (12,889 ) 4,009

NET LOSS FROM

DISCONTINUED OPERATIONS, NET OF TAX BENEFIT 0

(39 ) 0 (187 )

NET (LOSS) INCOME

$ (9,135 ) $ 3,250 $ (12,889 ) $ 3,822

Net

(Loss) Income per Share from Continuing Operations: Basic $

(0.53 ) $ 0.19 $ (0.75 ) $ 0.24 Diluted $ (0.53 ) $ 0.19 $ (0.75 )

$ 0.24

Net (Loss) Income per Share from Discontinued

Operations: Basic $ 0.00 $ (0.00 ) $ 0.00 $ (0.01 ) Diluted $

0.00 $ (0.00 ) $ 0.00 $ (0.01 )

Net (Loss) Income per

Share: Basic $ (0.53 ) $ 0.19 $ (0.75 ) $ 0.23 Diluted $ (0.53

) $ 0.19 $ (0.75 ) $ 0.23

Weighted Average Shares:

Basic 17,361 16,926 17,186 16,626 Diluted 17,361 17,299 17,186

16,913 Cash dividend per share $ 0.055 $ 0.055 $ 0.220 $

0.210

PCTEL, INC. CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited, in

thousands) Twelve Months Ended December

31,

2018 2017 Operating Activities: Net

(loss) income from continuing operations $ (12,889 ) $ 4,009

Adjustments to reconcile net (loss) income to net cash provided by

operating activities: Depreciation 2,806 2,567 Intangible asset

amortization 1,084 1,162 Stock-based compensation 3,261 3,005 Loss

on disposal of property and equipment 19 18 Restructuring costs (39

) (78 ) Bad debt provision 265 55 Deferred tax provision 7,817

(2,647 ) Changes in operating assets and liabilities: Accounts

receivable 2,362 798 Inventories (336 ) 1,970 Prepaid expenses and

other assets 198 (121 ) Accounts payable 1,095 (1,037 ) Income

taxes payable (3 ) (199 ) Other accrued liabilities (1,657 ) 182

Deferred revenue (40 ) 85 Net cash provided by

operating activities 3,943 9,769

Investing Activities: Capital expenditures (2,754 ) (2,666 )

Proceeds from disposal of property and equipment 15 1 Purchases of

investments (44,591 ) (49,009 ) Redemptions/maturities of

short-term investments 46,220 34,966

Net cash used in investing activities (1,110 )

(16,708 )

Financing Activities: Proceeds from issuance of

common stock 686 1,975 Payment of withholding tax on stock-based

compensation (578 ) (1,298 ) Principle payments on capital leases

(125 ) (98 ) Cash dividends (4,015 ) (3,705 ) Net

cash used in financing activities (4,032 ) (3,126 )

Cash flows from discontinued operations: Net cash used in

operating activities 0 (795 ) Net cash provided by investing

activities 0 1,434 Net cash flows

provided by discontinued operations 0 639

Net decrease in cash and cash equivalents (1,199 )

(9,426 ) Effect of exchange rate changes on cash (31 ) 130 Cash and

cash equivalents, beginning of period 5,559

14,855

Cash and Cash Equivalents, End of Period $

4,329 $ 5,559

PCTEL, INC.

P&L INFORMATION BY PRODUCT LINE - Continuing Operations

(unaudited) (in thousands) Three

Months Ended December 31, 2018 Year Ended December 31,

2018 Test & Test & Antenna

Measurement Antenna Measurement

Products Products Corporate Total

Products Products Corporate Total

REVENUES $16,209 $5,042 ($10) $21,241 $66,328 $16,733 ($82)

$82,979

GROSS PROFIT $5,423 $3,257 $18 $8,698 $20,157 $10,883

$41

$31,081

GROSS PROFIT % 33.5% 64.6% 40.9% 30.4% 65.0%

37.5%

Three Months Ended December 31, 2017 Year Ended

December 31, 2017 Test & Test &

Antenna Measurement Antenna Measurement

Products Products Corporate Total

Products Products Corporate Total

REVENUES $16,487 $6,861 ($47) $23,301 $68,612 $23,019 ($194)

$91,437

GROSS PROFIT $5,157 $5,077 $11 $10,245 $22,439

$16,354 $18

$38,811

GROSS PROFIT % 31.3% 74.0% 44.0% 32.7% 71.0% 42.4%

Reconciliation of

GAAP to non-GAAP Results - Continuing Operations

(unaudited)

(in thousands except per share information)

Reconciliation of

GAAP operating loss to non-GAAP operating (loss) income -

Continuing Operations

Three Months Ended December 31, Year Ended

December 31,

2018

2017

2018

2017

Operating (Loss) Income ($425) $855 ($5,626) $1,433

(a)

Add: Amortization of intangible assets -Cost of

revenues 167 167 666 666 -Operating expenses 85 124 418 496 Stock

Compensation: -Cost of revenues 93 68 224 268 -Engineering 158 123

620 517 -Sales & marketing 114 112 576 474 -General &

administrative 324 244 1,841 1,745 941 838 4,345 4,166

Non-GAAP

Operating (Loss) Income $516 $1,693 ($1,281) $5,599 % of

revenue 2.4% 7.3% -1.5% 6.1%

Reconciliation of

GAAP net loss to non-GAAP net (loss) income - Continuing

Operations

Three Months Ended December 31, Year Ended

December 31,

2018

2017

2018

2017

Net (Loss) Income ($9,135) $3,289 ($12,889) $4,009

Adjustments: (a) Non-GAAP adjustment to operating

loss 941 838 4,345 4,166 Income Taxes 8,740 (2,713) 7,884 (3,498)

9,681 (1,875) 12,229 668

Non-GAAP Net (Loss) Income $546

$1,414 ($660) $4,677

Non-GAAP (Loss) Income per

Share: Basic $0.03 $0.08 ($0.04) $0.28 Diluted $0.03 $0.08

($0.04) $0.28

Weighed Average Shares: Basic 17,361

16,926 17,186 16,626 Diluted 17,481 17,299 17,186 16,913

This schedule reconciles the Company's GAAP operating loss to its

non-GAAP operating (loss) income. The Company believes that

presentation of this schedule provides meaningful supplemental

information to both management and investors that is indicative of

the Company's core operating results and facilitates comparison of

operating results across reporting periods. The Company uses these

non-GAAP measures when evaluating its financial results as well as

for internal planning and forecasting purposes. These non-GAAP

measures should not be viewed as a substitute for the Company's

GAAP results. The adjustments to GAAP operating loss (a)

consist of stock compensation expense and amortization of

intangible assets. The adjustments to GAAP net loss include the

non-GAAP adjustments to operating loss as well as adjustments for

(b) non-cash income tax expense.

PCTEL,

Inc.

Reconciliation of

GAAP operating loss to Adjusted EBITDA - Continuing

Operations

(unaudited, in thousands)

Three Months Ended December

31, Year Ended December 31,

2018

2017

2018

2017

Operating (Loss) Income ($425) $855 ($5,626) $1,433

Add: Depreciation and amortization 718 653 2,806

2,566 Intangible amortization 252 291 1,084 1,162 Stock

compensation expenses 689 547 3,261 3,004

Adjusted EBITDA

$1,234 $2,346 $1,525 $8,165

% of revenue 5.8% 10.1% 1.8%

8.9% This schedule reconciles the Company's GAAP

operating loss to Adjusted EBITDA. The Company believes that this

schedule provides meaningful supplemental information to both

management and investors that is indicative of the Company's core

operating results and facilitates comparison of operating results

across reporting periods. The Company uses Adjusted EBITDA when

evaluating its financial results as well as for internal planning

and forecasting purposes. Adjusted EBITDA should not be viewed as a

substitute for the Company's GAAP results. Adjusted EBITDA

is defined as net income before interest, income taxes,

depreciation and amortization. The adjustments on this schedule

consist of depreciation, amortization of intangible assets, and

stock compensation expenses

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190314005774/en/

Kevin McGowanCFOPCTEL, Inc.(630) 372-6800Michael

RosenbergDirector of MarketingPCTEL, Inc.(301)

444-2046public.relations@pctel.com

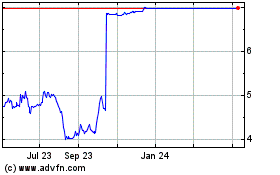

PCTEL (NASDAQ:PCTI)

Historical Stock Chart

From Oct 2024 to Nov 2024

PCTEL (NASDAQ:PCTI)

Historical Stock Chart

From Nov 2023 to Nov 2024