Current Report Filing (8-k)

April 14 2015 - 6:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

April 7, 2015

Date

of Report (date of earliest event reported)

PCTEL, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

000-27115 |

|

77-0364943 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

471 Brighton Drive

Bloomingdale, Illinois 60108

(Address of Principal Executive Offices, including Zip Code)

(630) 372-6800

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| ITEM 1.02 |

TERMINATION OF A MATERIAL DEFINITIVE AGREEMENT |

As previously reported by PCTEL, Inc. (the

“Company” or “PCTEL”) in a Current Report on Form 8-K filed with the Securities and Exchange Commission (SEC) on March 5, 2015, PCTEL acquired substantially all of the assets of, and assumed certain specified liabilities of,

Nexgen Wireless, Inc. (“Nexgen”) on February 27, 2015, pursuant to an Asset Purchase Agreement dated as of that date by and among PCTEL, Nexgen and the principals of Nexgen.

On April 7, 2015, Samsung Electronics America, Inc., as successor in interest to Samsung Telecommunications America, LLC (“Samsung”), provided

Nexgen and PCTEL with a notice of Samsung’s election to terminate, effective April 30, 2015, the Contractor Services Agreement, dated May 2, 2012 (the “CSA”), by and between Samsung and Nexgen. Nexgen furnishes services to

Samsung under the CSA including: (a) Meridian™ software-based services and data analytics, and (b) engineering and drive testing contract personnel, as requested by Samsung from time to time. Samsung’s termination notice was

provided under the convenience termination provisions of the CSA, without further explanation. According to the termination notice, such termination applies to the CSA only and will have no effect on other agreements now in place between Samsung or

its affiliates, on the one hand, and Nexgen or PCTEL, on the other.

The Company continues to forecast 15-18 percent revenue growth over 2014 and views

the Nexgen acquisition as accretive to earnings in 2015. Nonetheless, the Company has revised its overall revenue forecast for 2015 in light of reduced business with Samsung, the reduction in capital spending by AT&T, and a decline in new

network infrastructure investment in the oil and gas market. As noted in the Spring Investor Presentation posted on the Company’s website, the Company has revised revenue guidance from the previously-announced range of $133 to $138 million to a

revised range of $124 to $130 million. The contents of the Company’s website are not incorporated into this Current Report on Form 8-K.

Finally, the

Company and the principals of Nexgen have signed a term sheet calling for: (a) a material reduction of the total consideration paid or payable by PCTEL for the Nexgen assets, and (b) a material reduction of the equity compensation for

which John Thakkar, the founder and president of Nexgen and now the Company’s Vice President and Chief Technology Officer, RF Solutions, will be eligible. These reductions seek to align the asset acquisition costs with the revised revenue and

EBITDA estimates.

This Current Report on Form 8-K contains “forward-looking statements” as defined in the Private Securities Litigation Reform

Act of 1995. Specifically, the statements regarding market demand for the Company’s products and services are forward-looking statements. These statements are based on management’s current expectations and actual results may differ

materially from those projected as a result of certain risks and uncertainties, many of which are detailed in the Company’s SEC filings. These forward-looking statements are made only as of the date hereof, and the Company disclaims any

obligation to update or revise the information contained in any forward-looking statement, whether as a result of new information, future events or otherwise.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

Date: April 13, 2015

|

|

|

| |

|

PCTEL, INC. |

| By: |

|

/s/ John W. Schoen |

|

|

John W. Schoen, Chief Financial Officer |

PCTEL (NASDAQ:PCTI)

Historical Stock Chart

From Nov 2024 to Dec 2024

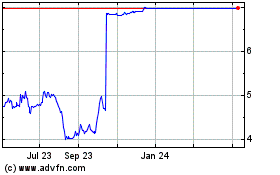

PCTEL (NASDAQ:PCTI)

Historical Stock Chart

From Dec 2023 to Dec 2024