UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the

Registrant

¨

Filed by a Party other than the Registrant

x

Check the appropriate box:

|

¨

|

Preliminary Proxy Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

¨

|

Definitive Proxy Statement

|

|

x

|

Definitive Additional Materials

|

|

¨

|

Soliciting Material Pursuant to §240.14a-12

|

TICC CAPITAL

CORP.

(Name of Registrant as Specified In Its Charter)

TPG Specialty Lending, Inc.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

TPG Specialty Lending, Inc., together with the other participants named herein (collectively,

“TSLX”), has filed a definitive proxy statement and an accompanying GOLD proxy card with the Securities and Exchange Commission to be used to solicit votes from the stockholders of TICC Capital Corp. (“TICC”) to: (a) elect

TSLX’s director nominee at TICC’s 2016 annual meeting of stockholders and (b) approve a proposal to terminate the Investment Advisory Agreement, dated as of July 1, 2011, by and between TICC and TICC Management, LLC, as

contemplated by Section 15(a) of the Investment Company Act of 1940, as amended.

On August 24, 2016, Bloomberg issued the

following article, which includes certain statements made by Joshua Easterly, Chairman and Co-Chief Executive Officer of TSLX:

TPG Turns Activist in

Bid to Fire Manager of Lender TICC Capital

Bloomberg

Devin Banerjee

24 August 2016

In a quiet corner of finance, a fight is heating up.

TPG,

which manages more than $70 billion in alternative assets, is agitating for change at publicly traded lender TICC Capital Corp. The managers of TICC should be fired for subpar performance and the board should include a new

director chosen by TPG, which owns 3.2 percent of TICC via a lending vehicle, the firm said in a string of letters ahead of a Sept. 2 shareholder vote.

In the past week, independent proxy advisory firms Glass Lewis & Co., Egan-Jones Ratings Co. and Institutional Shareholder Services

Inc. recommended that shareholders vote in favor of both of TPG’s proposals. TICC on Tuesday called those proposals self-serving and said TPG is evaluating its performance using misleading time periods.

The scuffle throws the crop of lenders into a light that many players hope will force the 36-year-old industry to mature.

Known as business development companies, the lending vehicles mostly attract money from individuals seeking current income, which the BDCs pay out in the form

of dividends in exchange for avoiding corporate taxation.

“The challenge is TICC and many BDCs don’t have institutional

shareholders,” Josh Easterly, a TPG partner who oversees its BDC called TPG Specialty Lending Inc., said in an interview. “We’re trying to clean up the neighborhood. It would be a watershed moment.”

Total Returns

At issue is TICC’s performance.

From its 2003 initial public offering to Aug. 4 the company had a 62 percent total return — including stock price movement and dividends paid. A composite of comparable BDCs had a 254 percent return, while the S&P 500

Index returned 172 percent and U.S. Treasuries 70 percent, according to a TPG presentation.

TICC has said the time period is misleading

due to a change of strategy. In 2009, it switched from lending solely to technology companies to a wider swath of debt issuers and started investing in collateralized loan obligations. From that point forward the company’s total return has

topped 300 percent, outperforming peers and the S&P 500, according to a TICC presentation.

“Following a period of recent market

volatility in the fixed income markets, we have updated and enhanced TICC’s investment strategy to adapt to a changing market and deliver returns for our stockholders,” Steve Novak, the chairman of Greenwich,

Connecticut-based TICC, said in an e-mail.

“The strategy is beginning to take hold, as evidenced by our recent record operating results and the

significant increase in the book value of our common stock,” he added. TICC has climbed 41 percent to $6.24 since its low this year on Jan. 15. It hit an all-time high of $17.22 in May 2007.

Better Off

The three proxy advisory firms have

disagreed with TICC, saying shareholders would be better off with a new group managing the fund’s assets.

One “major risk” of firing

management would be a decline in asset values until a new contract is negotiated, Chris Testa, an analyst at National Securities Corp. who’s advocated retaining the existing management contract, said in a report Tuesday.

TPG hasn’t said whether it would attempt to oversee TICC’s assets if shareholders vote to

terminate the management agreement.

For the alternative-asset manager, the yearlong fight has been worth the effort, TPG’s Easterly said. If

institutions become comfortable investing in the industry — which has grown as a financing source for mid-sized U.S. companies as traditional bank lenders retrench under new regulations — all BDCs could benefit.

“The industry has a very good chance of being a solution for the broader economy by providing credit, but only if it can garner institutional

support,” Easterly said. “If you can’t fire a management team that’s under-performing, the wheels of capitalism stop turning. It would make the BDC space, to many people, un-investable in the long term.”

About TPG Specialty Lending

TPG Specialty Lending, Inc.

(“TSLX” or the “Company”) is a specialty finance company focused on lending to middle-market companies. The Company seeks to generate current income primarily in U.S.-domiciled middle-market companies through direct originations

of senior secured loans and, to a lesser extent, originations of mezzanine loans and investments in corporate bonds and equity securities. The Company has elected to be regulated as a business development company, or BDC, under the Investment

Company Act of 1940 and the rules and regulations promulgated thereunder. TSLX is externally managed by TSL Advisers, LLC, a Securities and Exchange Commission registered investment adviser. TSLX leverages the deep investment, sector, and operating

resources of TPG Special Situations Partners, the dedicated special situations and credit platform of TPG, with over $16 billion of assets under management as of March 31, 2016, and the broader TPG platform, a global private investment firm

with over $74 billion of assets under management as of March 31, 2016. For more information, visit the Company’s website at

www.tpgspecialtylending.com

.

Forward-Looking Statements

Information set forth herein

may contain forward-looking statements, including, but not limited to, statements with regard to the expected future financial position, results of operations, cash flows, dividends, portfolio, financing plans, business strategy, budgets, capital

expenditures, competitive positions, growth opportunities, plans and objectives of management of TICC Capital Corp. (“TICC”), statements with regard to the expected future financial position, results of operations, cash flows, dividends,

portfolio, financing plans, business strategy, budgets, capital expenditures, competitive positions, growth opportunities, plans and objectives of management of TPG Specialty Lending, Inc. (“TSLX”), and statements with regard to

TSLX’s proposed business combination transaction with TICC (including any financing required in connection with a possible transaction and the benefits, results, effects and timing of a possible transaction). Statements set forth herein

concerning the business outlook or future economic performance, anticipated profitability, revenues, expenses, dividends or other financial items, and product or services line growth of TSLX, TICC and/or the combined businesses of TSLX and TICC,

including, but not limited to, statements containing words such as “anticipate,” “approximate,” “believe,” “plan,” “estimate,” “expect,” “project,” “could,”

“would,” “should,” “will,” “intend,” “may,” “potential,” “upside” and other similar expressions, together with other statements that are not historical facts, are forward-looking

statements that are estimates reflecting the best judgment of TSLX based upon currently available information.

Such forward-looking statements are

inherently uncertain, and stockholders and other potential investors must recognize that actual results may differ materially from TSLX’s expectations as a result of a variety of factors including, without limitation, those discussed below.

Such forward-looking statements are based upon TSLX’s current expectations and include known and unknown risks, uncertainties and other factors, many of which TSLX is unable to predict or control, that may cause TSLX’s plans with respect

to TICC or the actual results or performance of TICC, TSLX or TICC and TSLX on a combined basis to differ materially from any plans, future results or performance expressed or implied by such forward-looking statements. These statements involve

risks, uncertainties and other factors discussed below and detailed from time to time in TSLX’s filings with the Securities and Exchange Commission (“SEC”).

Risks and uncertainties related to a possible transaction include, among others, uncertainty as to whether TSLX

will further pursue, enter into or consummate a transaction on the terms set forth in its proposal or on other terms, uncertainty as to whether TICC’s board of directors will engage in good faith, substantive discussions or negotiations with

TSLX concerning its proposal or any other possible transaction, potential adverse reactions or changes to business relationships resulting from the announcement or completion of a transaction, uncertainties as to the timing of a transaction, adverse

effects on TSLX’s stock price resulting from the announcement or consummation of a transaction or any failure to complete a transaction, competitive responses to the announcement or consummation of a transaction, the risk that regulatory or

other approvals and any financing required in connection with the consummation of a transaction are not obtained or are obtained subject to terms and conditions that are not anticipated, costs and difficulties related to a potential integration of

TICC’s businesses and operations with TSLX’s businesses and operations, the inability to obtain, or delays in obtaining, cost savings and synergies from a transaction, unexpected costs, liabilities, charges or expenses resulting from a

transaction, litigation relating to a transaction, the inability to retain key personnel, and any changes in general economic and/or industry specific conditions.

In addition to these factors, other factors that may affect TSLX’s plans, results or stock price are set forth in TSLX’s Annual Report on Form 10-K

and in its reports on Forms 10-Q and 8-K.

Many of these factors are beyond TSLX’s control. TSLX cautions investors that any forward-looking

statements made by TSLX are not guarantees of future performance. TSLX disclaims any obligation to update any such factors or to announce publicly the results of any revisions to any of the forward-looking statements to reflect future events or

developments.

Third Party-Sourced Statements and Information

Certain statements and information included herein have been sourced from third parties. TSLX does not make any representations regarding the accuracy,

completeness or timeliness of such third party statements or information. Except as expressly set forth herein, permission to cite such statements or information has neither been sought nor obtained from such third parties. Any such statements or

information should not be viewed as an indication of support from such third parties for the views expressed herein. All information in this communication regarding TICC, including its businesses, operations and financial results, was obtained from

public sources. While TSLX has no knowledge that any such information is inaccurate or incomplete, TSLX has not verified any of that information. TSLX reserves the right to change any of its opinions expressed herein at any time as it deems

appropriate. TSLX disclaims any obligation to update the data, information or opinions contained herein.

Proxy Solicitation Information

In connection with TSLX’s solicitation of proxies for the 2016 annual meeting of TICC stockholders in favor of (a) the election of TSLX’s

nominee to serve as a director of TICC and (b) TSLX’s proposal to terminate the Investment Advisory Agreement, dated as of July 1, 2011, by and between TICC and TICC Management, LLC, as contemplated by Section 15(a) of the

Investment Company Act of 1940, as amended, TSLX filed an amended definitive proxy statement in connection therewith on Schedule 14A with the SEC on July 14, 2016 (the “TSLX Proxy Statement”). TSLX has mailed the TSLX Proxy Statement

and accompanying GOLD proxy card to stockholders of TICC. This communication is not a substitute for the TSLX Proxy Statement.

TSLX STRONGLY ADVISES ALL

STOCKHOLDERS OF TICC TO READ THE TSLX PROXY STATEMENT AND THE OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN IMPORTANT INFORMATION. SUCH TSLX PROXY MATERIALS ARE AND WILL BECOME AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE

AT HTTP://WWW.SEC.GOV AND ON TSLX’S WEBSITE AT HTTP://WWW.TPGSPECIALTYLENDING.COM. IN ADDITION, TSLX WILL PROVIDE COPIES OF THE TSLX PROXY STATEMENT WITHOUT CHARGE UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO TSLX’S PROXY

SOLICITOR AT TPG@MACKENZIEPARTNERS.COM.

The participants in the solicitation are TSLX and T. Kelley Millet, and certain of TSLX’s directors and

executive officers may also be deemed to be participants in the solicitation. As of the date hereof, TSLX beneficially owned 1,633,719 shares of common stock of TICC. As of the date hereof, Mr. Millet did not directly or indirectly beneficially

own any shares of common stock of TICC.

Security holders may obtain information regarding the names, affiliations and interests of TSLX’s directors

and executive officers in TSLX’s Annual Report on Form 10-K for the year ended December 31, 2015, which was filed with the SEC on February 24, 2016, its proxy statement for the 2016 annual meeting of TSLX stockholders, which was filed

with the SEC on April 8, 2016, and certain of its Current Reports on Form 8-K. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the interests of these participants in the proxy

solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is available in the TSLX Proxy Statement and other relevant materials to be filed with the SEC (if and when available).

This document shall not constitute an offer to sell, buy or exchange or the solicitation of an offer to sell, buy

or exchange any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No

offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

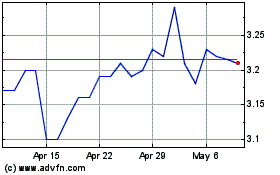

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Jun 2024 to Jul 2024

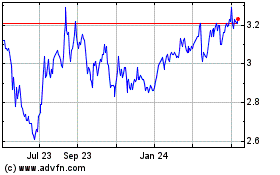

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Jul 2023 to Jul 2024