Current Report Filing (8-k)

December 28 2022 - 6:03AM

Edgar (US Regulatory)

ODP Corp false 0000800240 0000800240 2022-12-27 2022-12-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): December 27, 2022

THE ODP CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Delaware |

|

1-10948 |

|

85-1457062 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

| 6600 North Military Trail, Boca Raton, FL |

|

|

|

33496 |

| (Address of Principal Executive Offices) |

|

|

|

(Zip Code) |

(561) 438-4800

(Registrant’s Telephone Number, Including Area Code)

Former Name or Former Address, If Changed Since Last Report: N/A

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of Each Class |

|

Trading

Symbol(s) |

|

Name of Each Exchange on which Registered |

| Common Stock, par value $0.01 per share |

|

ODP |

|

The NASDAQ Stock Market (NASDAQ Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. |

Entry into a Material Definitive Agreement. |

As previously disclosed, on January 25, 2021, The ODP Corporation (“ODP” or the “Company”) entered into a Cooperation Agreement (the “Agreement”) with HG Vora Capital Management, LLC (“HG Vora”), and on December 30, 2021, the Company and HG Vora entered into a First Amendment to the Agreement (the “First Amendment”). On December 27, 2022, the Company and HG Vora entered into a Second Amendment to the Agreement (the “Second Amendment”). Among other things, the Second Amendment:

| |

• |

|

extends the term of the Agreement to the earlier of (i) the date that is 14 days prior to the first date on which shareholders are permitted under the Company’s bylaws to submit director nominations for the 2024 annual meeting of the shareholders of the Company (the “2024 Annual Meeting”) and (ii) December 31, 2023, subject to an immediate termination of the Agreement if HG Vora (together with any affiliates of HG Vora) ceases to own at least 5% of the Company’s then outstanding shares of common stock (the “Company Ownership Level Minimum”); |

| |

• |

|

requires during the term of the Agreement that, except in the event HG Vora (together with any affiliates of HG Vora) ceases to satisfy the Company Ownership Level Minimum or HG Vora has materially breached the Agreement and failed to cure such breach within five business days of notice thereof, the Board of Directors of the Company (the “Board”) nominate Marcus B. Dunlop (the “HG Vora Designee”) for election as one of the directors of the Company at the 2023 annual meeting of the shareholders of the Company (the “2023 Annual Meeting”) (as one of a total of not more than nine candidates or, if greater (to the extent the Board size is increased as permitted by the Agreement), the number of candidates equal to the size of the Board as of immediately prior to the 2023 Annual Meeting for election to the Board at the 2023 Annual Meeting); |

| |

• |

|

requires during the term of the Agreement that, except in the event HG Vora (together with any affiliates of HG Vora) ceases to own at least 9.9% of the Company’s then outstanding shares of common stock (the “Specified Company Ownership Level”) or HG Vora has materially breached the Agreement and failed to cure such breach within five business days of notice thereof, in the event that any current member of the Board (other than the HG Vora Designee or the Chief Executive Officer of the Company) does not stand for election at the 2023 Annual Meeting or ceases to be a director, whether as a result of death or incapacity or for any other reason, and at such time there is not more than one nominee of HG Vora on the Board for any reason, HG Vora shall have right to designate to the Board a substitute person to fill the resulting vacancy who shall either be a “Partner” or more senior member of HG Vora, or qualify as “independent” pursuant to applicable rules and regulations of the Nasdaq stock market and the SEC (the “Second HG Vora Designee”) on the same terms applicable to the HG Vora Designee except that any references to the Company Ownership Level Minimum with respect to the Second HG Vora Designee shall refer to the Specified Company Ownership Level; provided that HG Vora shall only be entitled to designate one Second HG Vora Designee; |

| |

• |

|

prohibits any increase in the size of the Board to more than nine directors during the term of the Agreement (or ten directors, following the time that HG Vora shall be entitled to designate a Second HG Vora Designee), except (A) in the event HG Vora (together with any affiliates of HG Vora) ceases to satisfy the Company Ownership Level Minimum or HG Vora has materially breached the Agreement and failed to cure such breach within five business days of notice thereof or (B) to the extent reasonably advisable (as determined in good faith by the Board) in connection with any bona fide settlement or cooperation agreement relating to any actual or threatened contested solicitation of proxies or consents to vote for the election of directors; and |

| |

• |

|

requires that the HG Vora Designee must offer to resign from the Board on December 31, 2023 or, if earlier, if (a) HG Vora (together with any affiliates of HG Vora) ceases to satisfy the Company Ownership Level Minimum, (b) HG Vora otherwise ceases to comply with or breaches any material provision of the Agreement or (c) HG Vora submits a notice of director nominations in connection with the 2024 Annual Meeting. |

The foregoing description of the Second Amendment is qualified in its entirety by reference to the full text of the Second Amendment, which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

As previously disclosed, on December 30, 2021, in connection with the execution of the First Amendment, Mr. Dunlop executed and delivered to the Board an irrevocable resignation effective upon the earliest of (i) such time as HG Vora (together with any affiliates of HG Vora) ceases to satisfy the Company Ownership Level Minimum, (ii) such time as HG Vora otherwise ceases to comply with or breaches any material provision of the Agreement, (iii) such time as HG Vora submits a notice of director nominations in connection with the 2023 Annual Meeting and (iv) December 31, 2022 (the “Prior Irrevocable Resignation”). In connection with the execution of the Second Amendment, on December 27, 2022, Mr. Dunlop executed and submitted to the Board an irrevocable resignation effective upon the earliest of (i) such time as HG Vora (together with any affiliates of HG Vora) ceases to satisfy the Company Ownership Level Minimum, (ii) such time as HG Vora otherwise ceases to comply with or breaches any material provision of the Agreement, (iii) such time as HG Vora submits a notice of director nominations in connection with the 2024 Annual Meeting and (iv) December 31, 2023 (the “Irrevocable Resignation”). The Board agreed that, effective December 27, 2022, the Irrevocable Resignation superseded the Prior Irrevocable Resignation and the Prior Irrevocable Resignation became void and of no further force or effect.

2

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated into this Item 5.02 by reference.

In connection with the execution of the Second Amendment, on December 27, 2022, Mr. Dunlop executed and submitted to the Board the Irrevocable Resignation. The Board agreed that, effective December 27, 2022, the Irrevocable Resignation superseded the Prior Irrevocable Resignation and the Prior Irrevocable Resignation became void and of no further force or effect.

Other than the Agreement (as amended by the First Amendment and the Second Amendment) and the Irrevocable Resignation, there are no arrangements or understandings between Mr. Dunlop and any other persons pursuant to which Mr. Dunlop was selected as a director. Further, other than the Agreement (as amended by the First Amendment and the Second Amendment) and the Irrevocable Resignation, there are no transactions, arrangements or relationships between the Company or its subsidiaries, on the one hand, and Mr. Dunlop, on the other hand, which would require disclosure pursuant to Item 404(a) of Regulation S-K.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits:

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

THE ODP CORPORATION |

|

|

|

| Date: December 28, 2022 |

|

|

|

/s/ Sarah E. Hlavinka |

|

|

|

|

Name: |

|

Sarah E. Hlavinka |

|

|

|

|

Title: |

|

Executive Vice President, Chief Legal Officer and Corporate Secretary |

4

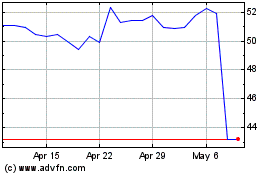

ODP (NASDAQ:ODP)

Historical Stock Chart

From Oct 2024 to Nov 2024

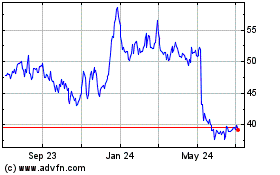

ODP (NASDAQ:ODP)

Historical Stock Chart

From Nov 2023 to Nov 2024