UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 2, 2023

OceanTech Acquisitions I Corp.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

| 001-40450 |

|

85-2122558 |

| (Commission File Number) |

|

(IRS Employer

Identification No.) |

515 Madison Avenue, 8th Floor - Suite 8133

New

York, New York 10022

Registrant’s telephone number, including

area code (929) 412-1272

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which

Registered |

| Units, each consisting of

one share of Class A Common Stock and one Redeemable Warrant |

|

OTECU |

|

The Nasdaq Stock Market LLC |

| Class A Common Stock, $0.0001 par value per share |

|

OTEC |

|

The Nasdaq Stock Market LLC |

| Redeemable Warrants, each exercisable

for one share of Class A Common Stock at an exercise price of $11.50 per share |

|

OTECW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01. | Regulation FD Disclosure. |

On May 2, 2023, OceanTech Acquisitions I Corp.,

a Delaware corporation (the “Company” or “OceanTech”), R.B. Merger Sub Ltd., an Israeli company

and a wholly-owned subsidiary of the Company (“Merger Sub”), Aspire Acquisition LLC, the Company’s sponsor (the

“Sponsor”), and Regentis Biomaterials Ltd., an Israeli company (“Regentis”) jointly issued a press

release announcing the execution of a definitive Agreement and Plan of Merger (the “Merger Agreement”) pursuant to

which, among other things, Merger Sub will merge with and into Regentis (the “Merger”), with Regentis surviving the

Merger as a wholly owned subsidiary of the Company (the Merger and the other transactions contemplated by the Merger Agreement, together,

the “Proposed Business Combination”). A copy of the press release is furnished hereto as Exhibit 99.1 and incorporated

herein by reference.

The information in this Item 7.01, including Exhibit

99.1, is being furnished and will not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor will it be deemed to

be incorporated by reference in any filing under the Securities Act or the Exchange Act.

On

May 3, 2023, OceanTech, issued a press release announcing that on May 2, 2023, it caused to be deposited $125,000 into the Company’s

Trust account for its public stockholders, representing $0.067 per public share, allowing the Company to extend the period of time it

has to consummate its initial business combination by one month from May 2, 2023 to June 2, 2023 (the “Extension”).

The Extension is the sixth of six monthly extensions permitted under the Company’s governing documents.

A copy of

the press release is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

Additional Information and Where to Find It

This Current Report on Form 8-K

is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect

to the Proposed Business Combination. However, this Current Report on Form 8-K does not purport to be all-inclusive or to contain all

the information that may be required to make a full analysis of OceanTech, Regentis or the Proposed Business Combination.

In connection with the Proposed Business Combination, OceanTech intends

to file relevant materials with the with the SEC, including a registration statement on Form S-4, which will include a proxy statement/prospectus

(the “Registration Statement”). OceanTech urges its investors, shareholders, and other interested persons to read,

when available, the proxy statement/prospectus filed with the SEC and documents incorporated by reference therein because these documents

will contain important information about OceanTech, Regentis and the Proposed Business Combination. After the Registration Statement is

declared effective by the SEC, the definitive proxy statement/prospectus and other relevant documents will be mailed to the shareholders

of OceanTech as of the record date established for voting on the Proposed Business Combination and will contain important information

about the Proposed Business Combination and related matters. Shareholders of OceanTech and other interested persons are advised to read,

when available, these materials (including any amendments or supplements thereto) and any other relevant documents in connection with

OceanTech’s solicitation of proxies for the meeting of shareholders to be held to approve, among other things, the Proposed Business

Combination because they will contain important information about OceanTech, Regentis and the Proposed Business Combination. Shareholders

will also be able to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus, and other

relevant materials in connection with the transaction without charge, once available, at the SEC’s website at www.sec.gov or by

directing a request to: OceanTech Acquisitions I Corp., 515 Madison Avenue, 8th Floor – Suite 8133, New York, New York, 10022 or

(929) 412-1272. The information contained on, or that may be accessed through, the websites referenced in this Current Report on Form

8-K is not incorporated by reference into, and is not a part of, this Current Report on Form 8-K.

No Offer or Solicitation

This Current Report on Form 8-K is not a proxy

statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Proposed Business Combination

and shall not constitute an offer to sell or a solicitation of an offer to buy any securities nor shall there be any sale of securities

in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under

the securities laws of any such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as amended, or exemptions therefrom.

Participants in Solicitation

OceanTech, Regentis and their respective directors

and executive officers may be deemed participants in the solicitation of proxies from OceanTech’s shareholders in connection with

the Proposed Business Combination. OceanTech’s shareholders and other interested persons may obtain, without charge, more detailed

information regarding the directors and officers of OceanTech in OceanTech’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2022, which was filed with the SEC on March 31, 2023. Information regarding the persons who may, under SEC rules, be deemed

participants in the solicitation of proxies to OceanTech’s shareholders in connection with the Proposed Business Combination will

be set forth in the proxy statement/prospectus for the Proposed Business Combination, when available. Additional information regarding

the interests of participants in the solicitation of proxies in connection with the Proposed Business Combination will be included in

the proxy statement/prospectus that OceanTech intends to file with the SEC. You may obtain free copies of these documents as described

above.

Cautionary Statement Regarding Forward-Looking

Statements

This Current Report on Form 8-K is provided for

informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to the Proposed

Business Combination and for no other purpose. No representations or warranties, express or implied are given in, or in respect of, this

Current Report on Form 8-K. To the fullest extent permitted by law under no circumstances will Regentis, OceanTech or any of their respective

subsidiaries, interest holders, affiliates, representatives, partners, directors, officers, employees, advisors or agents be responsible

or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Current Report on Form 8-K, its

contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise

arising in connection therewith. Industry and market data used in this Current Report on Form 8-K have been obtained from third-party

industry publications and sources as well as from research reports prepared for other purposes. Neither Regentis nor OceanTech has independently

verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject

to change. In addition, this Current Report on Form 8-K does not purport to be all-inclusive or to contain all the information that may

be required to make a full analysis of OceanTech, Regentis or the Proposed Business Combination. Viewers of this Current Report on Form

8-K should each make their own evaluation of OceanTech and Regentis and of the relevance and adequacy of the information and should make

such other investigations as they deem necessary. This Current Report on Form 8-K contains certain “forward-looking statements”

within the meaning of the federal securities laws, including statements regarding the benefits of the Proposed Business Combination,

including Regentis’ ability to accelerate the development of its products and bring them to market, the anticipated timing for

completion of the Proposed Business Combination, and OceanTech’s and Regentis’ expectations, plans or forecasts of future

events and views as of the date of this Current Report on Form 8-K. OceanTech and Regentis anticipate that subsequent events and developments

will cause OceanTech’s and Regentis’ assessments to change. These forward-looking statements, which may include, without

limitation, words such as “expect,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may,” “will”, “could,” “should,”

“believes,” “predicts,” “potential,” “might,” “continues,” “think,”

“strategy,” “future,” and similar expressions, involve significant risks and uncertainties (most of which factors

are outside of the control of OceanTech or Regentis. In addition, this Current Report on Form 8-K includes a summary set of risk factors

that may have a material impact on OceanTech, Regentis or the Proposed Business Combination, which are not intended to capture all the

risks to which OceanTech, Regentis or the Proposed Business Combination is subject or may be subject. Factors that may cause such differences

include but are not limited to: (1) the occurrence of any event, change or other circumstance that could give rise to the termination

of the Merger Agreement; (2) the risk that the Proposed Business Combination may not be completed in a timely manner or at all, which

may adversely affect the price of the securities; (3) the risk that the Proposed Business Combination may not be completed by OceanTech’s

business combination deadline; (4) the inability to complete the Proposed Business Combination, including but not limited to due to the

failure to obtain approval of the stockholders of OceanTech or Regentis for the Merger Agreement, to satisfy the minimum net tangible

assets and minimum cash at closing requirements, to receive certain governmental, regulatory and third party approvals or to satisfy

other conditions to closing in the Merger Agreement; (5) the failure to achieve the minimum amount of cash available following any redemptions

by OceanTech's stockholders; (6) the inability to obtain or maintain the listing of OceanTech’s common stock on Nasdaq following

the Proposed Business Combination, including but not limited to redemptions exceeding anticipated levels or the failure to meet Nasdaq's

initial listing standards in connection with the consummation of the Proposed Business Combination; (7) the effect of the announcement

or pendency of the Proposed Business Combination on Regentis’ business relationships, operating results, and business generally;

(8) risks that the Proposed Business Combination disrupts current plans and operations of Regentis; (9) the inability to realize the

anticipated benefits of the Proposed Business Combination and to realize estimated pro forma results and underlying assumptions, including

but not limited to with respect to estimated stockholder redemptions and costs related to the Proposed Business Combination; (10) the

possibility that OceanTech or Regentis may be adversely affected by other economic or business factors; (11) changes in the markets in

which Regentis competes, including but not limited to with respect to its competitive landscape, technology evolution, or regulatory

changes; (12) changes in domestic and global general economic conditions; (13) risk that Regentis may not be able to execute its growth

strategies; (14) the risk that Regentis experiences difficulties in managing its growth and expanding operations after the Proposed Business

Combination; (15) the risk that the parties will need to raise additional capital to execute the business plan, which may not be available

on acceptable terms or at all; (16) the ability to recognize the anticipated benefits of the Proposed Business Combination to achieve

its commercialization and development plans, and identify and realize additional opportunities, which may be affected by, among other

things, competition, the ability of Regentis to grow and manage growth economically and hire and retain key employees; (17) risk that

Regentis may not be able to develop and maintain effective internal controls; (18) the risk that Regentis may fail to keep pace with

rapid technological developments to provide new and innovative products and services, or may make substantial investments in unsuccessful

new products and services; (19) the ability to develop, license or acquire new products and services; (20) the risk that Regentis is

unable to secure or protect its intellectual property; (21) the risk of product liability or regulatory lawsuits or proceedings relating

to Regentis’ business; (22) the risk of cyber security or foreign exchange losses; (23) changes in applicable laws or regulations;

(24) the outcome of any legal proceedings that may be instituted against the parties related to the Merger Agreement or the Proposed

Business Combination; (25) the impact of the global COVID-19 pandemic and response on any of the foregoing risks, including but not limited

to supply chain disruptions; and (26) other risks and uncertainties to be identified in the Registration Statement, including those under

“Risk Factors” therein, and in other filings with the U.S. Securities and Exchange Commission (“SEC”)

made by OceanTech. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk

Factors” section of OceanTech’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, the Registration Statement to be filed with the SEC with respect to the Proposed Business Combination (as described further below), and other documents

filed by OceanTech from time to time with the SEC. These filings identify and address other important risks and uncertainties that could

cause actual events and results to differ materially from those contained in the forward-looking statements. The foregoing list of factors

is not exhaustive, are provided for illustrative purposes only, and are not intended to serve as, and must not be relied on as, a guarantee,

an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible

to predict and will differ from assumptions. Forward-looking statements speak only as of the date they are made. If any of these risks

materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking

statements. There may be additional risks that neither OceanTech nor Regentis presently know or that OceanTech and Regentis currently

believe are immaterial that could also cause actual results to differ materially from those contained in the forward-looking statements.

OceanTech and Regentis anticipate that subsequent events and developments will cause OceanTech’s and Regentis’ assessments

to change. However, while OceanTech and Regentis may elect to update these forward-looking statements at some point in the future, OceanTech

and Regentis specifically disclaim any obligation to do so. Neither OceanTech nor Regentis gives any assurance that OceanTech or Regentis,

or the combined company, will achieve its expectations. Accordingly, undue reliance should not be placed upon the forward-looking statements,

and they should not be relied upon as representing OceanTech’s and Regentis’ assessments as of any date subsequent to the

date of this Current Report on Form 8-K.

| Item 9.01. | Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

OCEANTECH ACQUISITIONS I CORP.

|

| |

|

|

| Date: May 3, 2023 |

By: |

/s/ Suren Ajjarapu |

| |

|

Name: Suren Ajjarapu

Title: Chief Executive Officer

(Principal Executive Officer) |

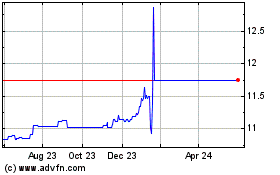

OceanTech Acquisitions I (NASDAQ:OTEC)

Historical Stock Chart

From Apr 2024 to May 2024

OceanTech Acquisitions I (NASDAQ:OTEC)

Historical Stock Chart

From May 2023 to May 2024