Current Report Filing (8-k)

October 12 2021 - 4:26PM

Edgar (US Regulatory)

0001413447false00014134472021-10-122021-10-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 12, 2021

NXP Semiconductors N.V.

(Exact name of Registrant as specified in charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Netherlands

|

|

001-34841

|

|

98-1144352

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

file number)

|

|

(IRS employer

identification number)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60 High Tech Campus

|

|

|

|

|

|

Eindhoven

|

|

|

|

|

|

Netherlands

|

|

|

|

5656 AG

|

|

(Address of principal executive offices)

|

|

|

|

(Zip code)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

+31

|

40

|

2729999

|

|

(Registrant’s telephone number, including area code)

|

|

|

|

|

|

NA

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading symbol(s)

|

Number of each exchange on which registered

|

|

Common shares, EUR 0.20 par value

|

NXPI

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ¨

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On October 12, 2021, NXP Semiconductors N.V. (the “Company”) announced that Bill Betz, formerly the Company’s Senior Vice President, Business Finance, had been named as Executive Vice President and Chief Financial Officer, effective immediately. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

On October 12, 2021, NXP USA, Inc. (“NXP USA”), a wholly owned subsidiary of the Company, entered into an employment agreement (the “Employment Agreement”) with Bill Betz setting forth the terms and conditions of Mr. Betz’s employment as Executive Vice President and Chief Financial Officer. Under the terms of the Employment Agreement, Mr. Betz’s base salary is set at $450,000 and is subject to annual review whether any increase to the base salary shall be made. His annual incentive target is set at 80% of his base salary, and Mr. Betz will be eligible to participate in all employment benefit plans, policies and programs applicable to other NXP executives and officers. In connection with his appointment as Executive Vice President and Chief Financial Officer, Mr. Betz will be awarded a long-term incentive equity grant with a total grant value of $2,500,000. This equity grant will be awarded 30% in the form of time-based restricted share units and 70% in the form of performance share units. Either Mr. Betz or NXP USA may terminate Mr. Betz’s employment for any reason upon 3 months’ written notice, and NXP USA may terminate his employment immediately under certain conditions involving misconduct. In the event that NXP USA terminates Mr. Betz’s employment absent certain conditions involving misconduct, Mr. Betz is entitled to receive a lump sum cash severance payment of one year’s base salary and pro rata payment of the annual incentive bonus for the period that Mr. Betz performed actual work, to the extent the conditions for a bonus payout have been met. In the event Mr. Betz’s employment is terminated within twelve months following a change of control or if Mr. Betz resigns for “good reason”, in either case not under certain conditions involving misconduct, then Mr. Betz is entitled to the change of control arrangements approved from time to time by the Company’s Compensation Committee, which currently provide a severance payment of 24 months base salary and target bonus and 12 months of benefits continuation. All severance payments are contingent on Mr. Betz signing and not revoking a release of claims. Mr. Betz is subject to non-competition and non-solicitation restrictions for 12 months and customary prohibitions on disclosing confidential information following the termination of his employment for any reason.

The foregoing description of the Employment Agreement is qualified in its entirety by reference to the full text of the Employment Agreement attached as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference herein.

As previously disclosed on Form 8-K on February 2, 2021, Mr. Peter Kelly, the Company’s former Chief Financial Officer, announced his intention to retire from the Company as of February 2022. Effective October 12, 2021, upon Mr. Betz’s appointment, Mr. Kelly has stepped down from his role as Chief Financial Officer. Until his retirement on February 28, 2022, Mr. Kelly will remain an Executive Vice President, reporting to Kurt Sievers, the Company’s President and Chief Executive Officer, under the terms and conditions of Mr. Kelly’s existing employment agreement. In this role, Mr. Kelly will provide advice and assistance to Mr. Sievers and transition assistance and support to Mr. Betz.

|

|

|

|

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

|

|

(d) Exhibits

|

|

|

|

|

|

10.1

|

|

|

|

|

|

99.1

|

|

|

|

|

|

104

|

Cover Page Interactive Data File (formatted as Inline XBRL).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

NXP Semiconductors N.V.

|

|

|

|

|

By: /s/ Dr. Jean A.W. Schreurs

|

|

|

Name: Dr. Jean A.W. Schreurs

|

|

|

Title: SVP and Chief Corporate Counsel

|

Date: October 12, 2021

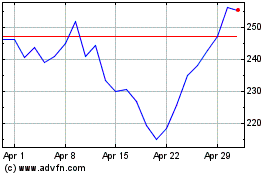

NXP Semiconductors NV (NASDAQ:NXPI)

Historical Stock Chart

From Aug 2024 to Sep 2024

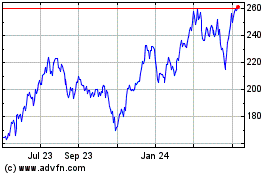

NXP Semiconductors NV (NASDAQ:NXPI)

Historical Stock Chart

From Sep 2023 to Sep 2024