UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

| NOVAVAX, INC. |

(Name of Registrant as Specified In Its Charter)

|

| |

SHAH CAPITAL MANAGEMENT, INC.

SHAH CAPITAL OPPORTUNITY FUND LP

HIMANSHU H. SHAH

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Shah Capital Management,

Inc. and the other participants named herein (collectively, “Shah Capital”) have filed a preliminary proxy statement and accompanying

GOLD universal proxy card with the Securities and Exchange Commission to be used to solicit votes AGAINST the election of

Richard H. Douglas, Margaret G. McGlynn and David Mott to the Board of Directors of Novavax, Inc., a Delaware corporation (“Novavax”

or the “Company”) at the Company’s 2024 upcoming annual meeting of stockholders (the “Annual Meeting”) and

AGAINST the approval of certain of the Company’s other proposals to be considered by stockholders at the Annual Meeting.

Item 1: On May 7, 2024,

Shah Capital filed with the SEC Amendment No. 2 to the Schedule 13D (“Amendment No. 2 to the Schedule 13D”) with respect to

the filing of Shah Capital’s preliminary proxy statement. A copy of Amendment No. 2 to the Schedule 13D is attached hereto as Exhibit

99.1 and incorporated herein by reference.

Item 2: On May 6, 2024,

Himanshu H. Shah, President and Chief Investment Officer of Shah Capital Management, Inc., was quoted in the following article published

by Reuters:

Shah Capital urges Novavax shareholders to

vote against three directors

By Bhanvi Satija

May 6 (Reuters) – Hedge fund Shah Capital

on Monday urged Novavax (NVAX.O) shareholders to vote against the re-election of three directors and opposed proposals related to executive

compensation, weeks after pushing for a board shakeup at the COVID-19 vaccine maker.

Shah Capital, the biotech's third-largest shareholder with a near

7.5% stake, reiterated the company was "undervalued and continues to suffer from poor profitability".

The hedge fund had previously said it planned to put forward two

of its own candidates for Novavax's board, but was unable to meet the requirements to do so on time.

"I could not get the shares transferred to a transfer agent

on time and on that technicality, the company refused to nominate my two candidates, which is very unfortunate because I think they are

extremely qualified and what this board needs is a fresh perspective," Himanshu Shah, founder and chief investment officer of Shah

Capital Management, told Reuters.

Novavax said in a proxy filing last week it had not received any

valid nominations from stockholders for its 2024 annual shareholder meeting, scheduled to take place on June 13.

The company had raised doubts about its ability to remain in business,

hurt by manufacturing snags and regulatory hurdles that delayed the entry of its protein-based vaccine to the market.

Last month, Shah Capital had expressed concerns over mismanagement

at the Maryland-based biotech and urged it to adopt a marketing strategy that targets consumers who are hesitant to receive mRNA vaccines.

"They really have done a terrible job marketing this vaccine,"

Shah said, adding he believes there is an unmet market for Novavax's protein-based vaccine among people who are hesitant to take one of

the mRNA vaccines for COVID-19.

"Ultimately, I think this company may be better off in the

hands of a larger pharma player," he said.

The hedge fund said on Monday it plans to vote against directors

Richard Douglas, Margaret McGlynn and David Mott at Novavax's shareholder meeting in June.

McGlynn and Mott have served on Novavax's board since 2020 and Douglas

since 2010.

Novavax said it welcomes the perspectives of its shareholders and

values their input.

"We believe we have the right board in place to oversee Novavax's

strategy," the company said in its response.

Shah Capital also plans to vote against three other proposals, including

one related to the compensation of some of Novavax's executives.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Shah Capital Management, Inc., a North Carolina corporation

(“Shah Capital Management”), together with the other participants in its solicitation (collectively, “Shah

Capital”), have filed a preliminary proxy statement and accompanying GOLD proxy card with the Securities and Exchange

Commission (“SEC”) to be used to solicit votes AGAINST the election of Richard H. Douglas, Margaret G. McGlynn

and David Mott to the Board of Directors of Novavax, Inc., a Delaware corporation (the “Company”) at the Company’s

2024 annual meeting of stockholders (the “Annual Meeting”) and AGAINST the approval of certain of the Company’s

other proposals to be considered by stockholders at the Annual Meeting.

SHAH CAPITAL STRONGLY ADVISES ALL STOCKHOLDERS OF

THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC'S WEBSITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS

PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD

BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The participants in the proxy solicitation are anticipated

to be Shah Capital Management, Shah Capital Opportunity Fund LP (“Shah Opportunity”) and Himanshu H. Shah.

As of the date hereof, Shah Capital Management directly beneficially owns

10,300,000 shares of Common Stock, par value $0.01 per share of the Company (the “Common Stock”). As the investment

manager of Shah Opportunity and certain separately managed accounts (the “Shah Managed Accounts”), Shah Capital Management

may be deemed to beneficially own 10,965,794 shares of Common Stock beneficially owned in the aggregate by Shah Opportunity and held in

the Shah Managed Accounts.1

As of the date hereof, Mr. Shah directly beneficially owns 65,382

shares of Common Stock, which are held in an account separately managed by Shah Capital Management for his benefit (the “Mr.

Shah Managed Account”). As the President and Chief Investment Officer of Shah Capital Management, Mr. Shah may be deemed

to beneficially own the 10,965,794 shares of Common Stock beneficially owned in the aggregate by Shah Opportunity and held in the Shah

Managed Accounts, which in addition to the 65,382 shares of Common Stock he beneficially owns directly, constitutes an aggregate of 11,031,176

shares of Common Stock that Mr. Shah may be deemed to beneficially own.

1

The Shah Managed Accounts excludes the Mr. Shah Managed Account (as defined below).

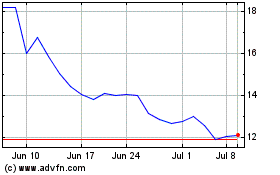

Novavax (NASDAQ:NVAX)

Historical Stock Chart

From Apr 2024 to May 2024

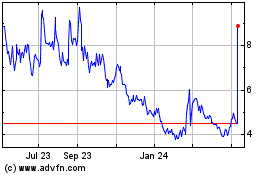

Novavax (NASDAQ:NVAX)

Historical Stock Chart

From May 2023 to May 2024