NYSE, Deutsche Boerse Set To Vie For Technology Business

February 14 2012 - 4:01PM

Dow Jones News

NYSE Euronext (NYX) and Deutsche Boerse AG (DB1.XE, DBOEF) are

squaring up to compete again after burying their merger plan, and

both see selling technology and market services to other exchanges

and traders as key to their independent futures.

The Big Board operator has already laid out an ambitious plan to

more than double annual revenue from its technology arm to $1

billion by 2015, and its erstwhile partner this week detailed its

own strategy, creating a new IT and data unit to extol the virtues

of German engineering.

The world's largest exchange operators have in recent years

viewed the sale of technology services and data as a key growth

driver, mitigating the ups and down of trading fees. Selling the

hardware that powers trading and back-office services is also a

useful path for tapping growth in emerging markets.

"Exchanges today at their core are technology companies," said

Russ Chrusciel, head of derivatives risk management services for

trading technology company SunGard. "What used to be a crowd of

several hundred people on a trading floor has turned into a

conglomeration of buildings, servers and technology

architecture."

Deutsche Boerse systems already powers exchanges in Ireland,

Slovakia and Austria, while NYSE clients include markets in Japan,

Qatar and Poland. The technology arena has also drawn in rivals

like Nasdaq OMX Group Inc. (NDAQ), CME Group Inc. (CME) and London

Stock Exchange Group plc (LSE.LN).

The prospect of intensifying competition between NYSE and

Deutsche Boerse carries an added twist. The companies spent a year

talking about how they could stitch together a unified trading

system using the best pieces from each of their operations.

"There was bound to be some sort of learning process, but I'd be

surprised if either one completely opened the door" during those

discussions, said William Rhode, senior analyst for the market

research firm Tabb Group.

Representatives for NYSE Euronext and Deutsche Boerse declined

comment.

Deutsche Boerse's plan involves consolidating its existing

services in supplying price data and other market information into

a new unit that will also export the systems that run the German

company's stock and derivatives markets. Together the businesses

last year contributed about EUR92 million ($120.4 million) of

Deutsche Boerse's EUR2.3 billion ($3 billion) in sales revenue.

"In the process, we can bolster our technology leadership,

strengthen customer relations and pack a more powerful punch

overall," said Deutsche Boerse Chief Executive Reto Francioni on a

conference call with analysts Tuesday.

The German effort mirrors the Big Board's two-year-old push to

consolidate and expand its NYSE Technologies division, which now

includes two purpose-built data center facilities near New York and

London as well as a growing range of services designed pump more

market data to traders at faster speeds. NYSE Euronext on Tuesday

rolled out a new mechanism that automates some compliance

functions.

Institutional investors like mutual funds and pension plans have

begun to embrace the same tools that algorithm-driven firms, such

as high-frequency traders, have developed to scan and trade the

increasingly fragmented electronic markets. Exchanges have

responded with a broader and custom-built array of systems ranging

from cloud computing services to brick-and-mortar trading hubs

built to withstand hurricanes and bomb blasts.

"There's a tremendous amount of new regulation coming into play,

especially for the derivatives market, and that creates a need for

more automated systems," said Tyler Moeller, chief executive of

Broadway Technology LLC.

NYSE Euronext CEO Duncan Niederauer last week projected that

revenues from his company's technology services would rise at least

10% this year, up from $490 million in 2011. The company aims to

build on existing partnerships with banks like Goldman Sachs Group

(GS) and Citigroup Inc. (C), as well as foreign-based markets that

have installed NYSE Euronext-designed trading engines.

Deutsche Boerse already maintains its own portfolio of

partnerships with smaller exchanges and elsewhere has acquired

economic indicators, like the Chicago Purchasing Managers Index, to

help expand a service that feeds such numbers directly to

electronic trading firms' automated strategies.

-By Jacob Bunge, Dow Jones Newswires; 312 750 4117; jacob.bunge@dowjones.com

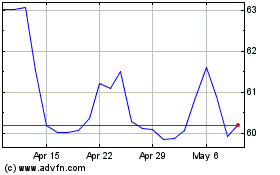

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Apr 2024 to May 2024

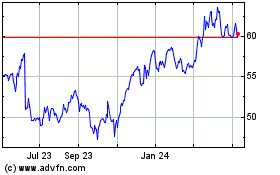

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From May 2023 to May 2024