Marlin & Associates Adds Industry Veteran and Goldman Sachs Alumnus, Thomas Conigliaro

January 05 2012 - 6:00AM

Marketwired

Marlin & Associates ("M&A"), the boutique investment

banking and strategic advisory firm, today announced that industry

veteran and Goldman Sachs alumnus Thomas V. Conigliaro has joined

the firm as a partner. Tom will be based in New York.

For the past eight years, while at Goldman Sachs, Tom led

"Hudson Street" and Goldman's investments into (and, in some cases,

exits from) firms such as: iSuppli, Lusight, Medley, Trim Tabs,

QSG, Pacific Epoch, Wall Street on Demand, and Epocrates (NASDAQ:

EPOC). During this period, Tom traveled the world vetting hundreds

of companies, meeting key industry players, leading investments,

serving on more than a dozen boards, and leveraging his operating

experience to advise portfolio companies on ways to improve

productivity and performance.

Prior to joining Goldman Sachs in 2003, Tom spent 16 years at

Merrill Lynch where, among other things, he ran an independent

research and clearing business. This experience provided Tom unique

insights into the dynamic needs of investment managers, investment

bankers, traders, and operations professionals and the knowledge of

what it takes to match those needs with solutions from a myriad of

service providers.

"We are fortunate to have attracted Tom to our team," commented

Ken Marlin, Founder and Managing Partner of Marlin &

Associates. "His combination of real-world operating experience and

transactional expertise is a hallmark of our firm. His appointment

combined with our strong team and a growing list of global offices,

will add to our ability to advise clients seeking to capitalize on

worldwide opportunities and help M&A to remain one of the

world's leading financial and strategic advisors to U.S. and

international firms that provide technology, digital information

and healthcare-related products, technology and services."

Marlin & Associates is one of the most active investment

banking and strategic advisory firms providing strategic and

financial advice to worldwide buyers and sellers of middle-market

technology firms. The firm is headquartered in New York, NY and has

additional offices in Washington, DC; Toronto, Canada; and Hong

Kong.

M&A's team of professionals has advised on more than 200

transactions involving companies that provide information and

technology to a wide range of communities including those that

serve the banking, capital markets, insurance, marketing and

healthcare arenas. The firm is the recipient of numerous awards,

including "Middle Market Investment Banking Firm of the Year,"

"Middle Market Financing Agent of the Year - Equity" and numerous

"Deal-of-the-Year" awards, including Corporate and Strategic

Acquisition-of-the-Year, Financial Services Deal-of-the-Year,

Information Technology Deal-of-the-Year, and Middle Market

Deal-of-the-Year.

In December, two transactions on which Marlin & Associates

advised were named as part of The M&A Advisor's Special "Deals

of the Decade" Celebration.

About Marlin & Associates

Marlin & Associates Holding LLC is a boutique investment

banking and strategic advisory firm specializing in acquisitions

and divestitures of U.S. and international middle-market firms that

provide technology, digital information and healthcare-related

products, technology and services. The firm is headquartered in New

York, NY and has additional offices in Washington, DC; Toronto,

Canada; and Hong Kong. Further information can be read at

www.MarlinLLC.com.

Marlin & Associates Securities LLC, a wholly-owned

subsidiary of Marlin & Associates Holding LLC, is a

broker-dealer registered with the Securities and Exchange

Commission and is a FINRA/SIPC member firm (www.finra.org).

Investment banking and/or securities are offered through Marlin

& Associates Securities LLC. Marlin & Associates'

professionals have advised on more than 200 successfully completed

transactions. Some other recent clients that Marlin &

Associates has advised include:

- Welsh, Carson, Anderson & Stowe of New York, NY, which

Marlin & Associates advised on its acquisition of a majority

interest in Triple Point Technology;

- Atrium Network of London, United Kingdom, which Marlin &

Associates advised on its sale to TMX Group (TSX: X);

- NYSE Euronext (NYSE: NYX) of New York, NY, which Marlin &

Associates advised on its acquisition of Metabit;

- Subserveo, Inc. of Vancouver, Canada, which Marlin &

Associates advised on its sale to DST Systems, Inc. (NYSE:

DST);

- Photolibrary Group of Sydney, Australia, which Marlin &

Associates advised on its sale to Getty Images, Inc.;

- NaviNet, Inc. of Cambridge, Massachusetts, which Marlin &

Associates advised on its acquisition of Prematics;

- Qatarlyst of Doha, Qatar, which Marlin & Associates advised

on its acquisition of London-based RI3K;

- SMARTS Group of Sydney, Australia, which Marlin &

Associates advised on its sale to NASDAQ OMX (NASDAQ: NDAQ);

- SWIFT (Society for Worldwide Interbank Financial

Telecommunication) of Brussels, Belgium, which Marlin &

Associates advised on its acquisition of Ambit Messaging Hub from

SunGard;

- Avox of Wexford Wales, UK, a majority-owned company of Deutsche

Börse (ETR: DB1), which Marlin & Associates advised on its sale

to The Depository Trust & Clearing Corporation (DTCC);

- Strategic Analytics of Santa Fe, New Mexico, which Marlin &

Associates advised on its sale to Verisk Analytics (NASDAQ: VRSK);

and

- Logical Information Machines, Inc. (LIM) of Chicago, Illinois,

which Marlin & Associates advised on its sale to Morningstar,

Inc. (NASDAQ: MORN).

Contact: Krystle Bates contact@MarlinLLC.com +1 212 257-6300

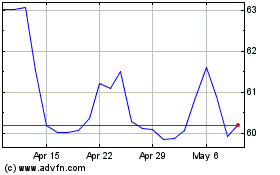

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Oct 2024 to Nov 2024

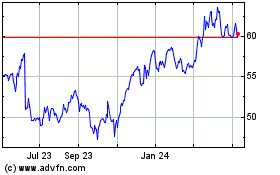

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Nov 2023 to Nov 2024