2nd UPDATE: State Senate Approves Tax Relief For Chicago Exchanges, Sears

December 13 2011 - 7:15PM

Dow Jones News

The Illinois government's attempt to keep Chicago's largest

derivatives exchanges and a major retailer in the state cleared its

final legislative hurdle on Tuesday.

The Illinois Senate sent to the Governor a proposal providing

tax relief to CME Group Inc. (CME), CBOE Holdings Inc. (CBOE) and

Sears Holdings Corp. (SHLD). All three were considering relocating

their headquarters to other states, putting at risk thousands of

Illinois jobs.

The Senate vote was 44-9. The bill passed the Illinois House on

Monday, and Democratic Gov. Pat Quinn has indicated he will sign

the legislation.

"The package that is on the way to my desk is a win for workers

and a win for employers in Illinois," Quinn said in a prepared

statement.

Quinn pushed for the deal to also include tax relief for

low-income workers in the form of earned income tax credits. It

also provides aid for small businesses and family farms.

CME and options exchange CBOE loudly protested the

Democratic-controlled legislature's vote in January to boost the

cash-strapped state's corporate tax rate to 7%, from 4.8%.

For CME, the tax hike costs an extra $50 million per year,

according to Chairman Terry Duffy.

However, Democratic Senate President John Cullerton said he and

Duffy agreed that the tax increase was not the problem, but rather

the "unfairness of how it's applied to his company."

The tax rate for CME and CBOE would stay at 7%, however the

state would tax the exchanges on only 27.54% of all electronic

trades, which is the dominant method of buying and selling

derivatives contracts.

Currently, the exchanges pay taxes on all electronic

transactions, even though most of the trades are not based in

Illinois.

Tax breaks would start for the next fiscal year, which begins

July 1. Initially, CME lobbied for the deal to take effect this

fiscal year.

Reduced taxes are likely to boost earnings for both exchanges,

according to a research note published late Tuesday by analysts at

Keefe, Bruyette & Woods. CME's earnings per share could

increase by 5% in 2013, while CBOE's earnings per share could rise

3% during the same year, KBW analysts said.

The state Senate's action "enables our exchanges to continue to

drive economic growth in Illinois and to retain Chicago's rightful

status as a world financial center," said William Brodsky, CBOE's

chief executive officer in a prepared statement.

"This more equitable tax structure places Chicago's financial

exchanges on equal footing with other major Illinois corporations

that transact the bulk of their business outside of Illinois and

enables us to better compete in an intensely competitive global

industry," Brodsky also said.

A CME spokesman declined comment on the state Senate vote.

Sears would pay lower taxes through renewal of a special taxing

district in the Chicago suburb of Hoffman Estates.

Although the legislation has yet to be signed by the Governor,

Sears CEO Lou D'Ambrosio said in a statement that "state leaders

recognize our impact on the state of Illinois and have taken the

step necessary to keep Sears Holdings an Illinois company."

Sears, also the parent company for Kmart and Lands' End, employs

20,000 people in Illinois and is a "significant" taxpayer in the

state, with more than $213 million in taxes paid last year and

"billions" more during the past 20 years, according to

D'Ambrosio.

About 2,000 CME employees are based in Illinois, but 130,000

jobs are connected to the exchange industry, noted CME chief

financial officer Jamie Parisi, during testimony Monday before a

state House committee.

Some lawmakers during Tuesday's Senate debate questioned the

fairness of picking winners and losers in the deal.

Republican Sen. Chris Lauzen deemed the bill "corporate welfare"

and a "give-away to a favored few."

However, Sen. Kirk Dillard, also a Republican, said he's

comforted that CME and Sears are "long-standing Illinois

entities."

"These two companies that we're picking as winners have been

here for a long-time," said Dillard.

CME has called Chicago its home for all of its 163 years in

business. Chicago Mayor Rahm Emanuel said in a statement Tuesday

that the tax deal will "protect jobs" and "keep the CME Group where

it belongs, here in the city."

-By Howard Packowitz, Dow Jones Newswires; 312-750-4132;

howard.packowitz@dowjones.com

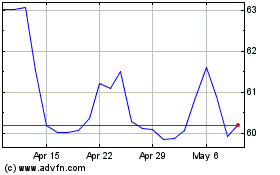

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Oct 2024 to Nov 2024

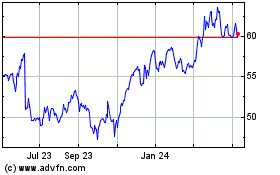

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Nov 2023 to Nov 2024