UPDATE: Illinois House Approves CME-CBOE, Sears Tax-Relief Bill

December 12 2011 - 7:38PM

Dow Jones News

CHICAGO (Dow Jones)--A package of tax breaks to keep Chicago's

largest derivatives exchanges and a major retailer in Illinois won

approval Monday in the Illinois House of Representatives, but only

after state government leaders reconfigured the deal.

The House vote was 81-28, with seven members declining to vote.

The measure received only eight "yes" votes late last month when

the same chamber overwhelmingly rejected the proposal.

The defeat was largely due to disagreements about broader tax

relief that would aid low-income workers.

To make the bill politically palatable, legislative leaders

agreed to split it in two, separating relief for CME Group Inc.

(CME), CBOE Holdings Inc. (CBOE) and Sears Holdings Corp. (SHLD),

and help for low-income workers through increases in

earned-income-tax credits.

The House passed the earned-income-tax credits portion of the

legislation earlier in the day.

The bills also must win approval in the State Senate, which is

scheduled to meet Tuesday, and from Democratic Gov. Pat Quinn.

After the House vote, Quinn said the package meets the objective

of "delivering help for both hard-working families and

employers."

Chicago Mayor Rahm Emanuel is believed to be lobbying to ensure

the city remains a hub for derivatives trading and risk

management.

Emanuel said tax changes were necessary to protect thousands of

jobs related to activity at the exchanges.

"By making Illinois more economically competitive, this

legislation, passed with bipartisan support, protects the jobs of

today and invests in the jobs of the future," Emanuel said.

The legislation allows CME and options exchange CBOE to be taxed

on 27.54% of all electronic trades, which make up the vast majority

of the business performed at the exchanges. Currently, the

exchanges pay taxes on 100% of their electronic transactions, even

though many of the buyers and sellers of CME and CBOE trades are

not located in Illinois.

"They're being taxed on all of their trades, and that's not

fair," said Republican House Minority Leader Tom Cross.

The tax breaks would start at the next fiscal year, which begins

July 1.

But Cross warned that other corporations will approach Illinois

for tax breaks almost on a daily basis because of the state's

high-tax environment.

Many Republicans complained Illinois businesses are looking

elsewhere after the legislature in January increased the state's

corporate-tax rate to 7%, from 4.8%.

Testifying at a committee hearing Monday morning, CME Chief

Financial Officer Jamie Parisi said the legislation will

"modernize" tax statutes to account for exchanges' "more global

focus."

CME has market participants in more than 150 countries, Parisi

said.

Sears would pay lower taxes from the renewal of a special taxing

district in the Chicago suburb of Hoffman Estates, which is the

retailer's home.

About 6,000 people work at Sears' Hoffman Estates headquarters.

About 2,000 CME workers are based in Illinois, although Parisi

estimated that 130,000 jobs are tied to the derivatives

industry.

Both companies are mulling offers from other states to leave

Illinois. Indianapolis Mayor Greg Ballard made a personal appeal to

CME executives during a Chicago visit on Dec. 2.

CME has called Chicago its home for all of its 163 years in

business. If CME's board decided to move its headquarters, all that

would stay would be the two trading floors located at the CME-owned

Chicago Board of Trade, CME Chairman Terry Duffy said.

Open-outcry trading at CBOT represents less than 5% of CME's

business, Duffy said during a committee hearing last month.

CME and CBOE representatives declined comment on the House

vote.

Sears spokesman Chris Brathwaite thanked House members for

passing legislation "aimed at keeping Sears an Illinois

company."

"This is a major step in the process," Brathwaite said.

-By Howard Packowitz, Dow Jones Newswires; 312-750-4132;

howard.packowitz@dowjones.com

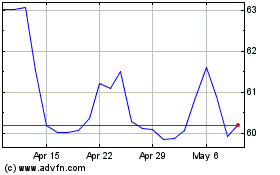

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Oct 2024 to Nov 2024

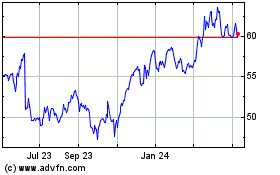

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Nov 2023 to Nov 2024