SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 4

TO

SCHEDULE 14D-9

(Rule 14d-101)

Solicitation/Recommendation Statement Under Section 14(d)(4)

of the Securities Exchange Act of 1934

MONOGRAM BIOSCIENCES, INC.

(Name of Subject Company)

MONOGRAM BIOSCIENCES, INC.

(Name of

Person Filing Statement)

Common Stock, $0.001 par value per share

(Title of Class of Securities)

60975U207

(CUSIP Number of Class of Securities)

William D. Young

Chief Executive Officer

Monogram Biosciences, Inc.

345 Oyster Point Blvd.

South San Francisco, California 94080

(650) 635-1100

(Name, Address and Telephone Number of Person Authorized to Receive Notices and

Communications on Behalf of the Person Filing Statement)

With copies to:

Barbara L. Borden, Esq.

Steven M. Przesmicki, Esq.

Cooley Godward Kronish LLP

4401 Eastgate Mall

San Diego, CA 92121

(858) 550-6000

|

¨

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

This Amendment No. 4 to the Schedule 14D-9 (this

“Amendment No. 4”

)

amends and supplements the Solicitation/Recommendation Statement on Schedule 14D-9 filed with the Securities and Exchange Commission (the

“SEC”

) on July 1, 2009 (as amended on July 13, 2009, July 16, 2009

and July 17, 2009, and as amended or supplemented from time to time hereafter, and together with the exhibits thereto, the

“Schedule 14D-9”

) by Monogram Biosciences, Inc., a Delaware corporation

(

“Monogram”

or the

“Company”

). The Schedule 14D-9 relates to the tender offer by Mastiff Acquisition Corp. (

“Purchaser”

), a Delaware corporation and a wholly-owned subsidiary of

Laboratory Corporation of America Holdings, a Delaware corporation (

“LabCorp”

), disclosed in a Tender Offer Statement on Schedule TO, dated July 1, 2009 (as amended on July 13, 2009 and July 17, 2009, and as

amended or supplemented from time to time hereafter, and together with the exhibits thereto, the

“Schedule TO”

), to purchase all of the outstanding shares of Common Stock not owned by LabCorp, Purchaser or the Company at a

purchase price of $4.55 per share, net to the seller in cash, without interest and subject to any tax withholding (the

“Offer Price”

), upon the terms and subject to the conditions set forth in the Offer to Purchase, dated

July 1, 2009 (as amended on July 13, 2009 and July 17, 2009, and as amended or supplemented from time to time, the

“Offer to Purchase”

), and in the related Letter of Transmittal (as amended or supplemented from

time to time, the

“Letter of Transmittal”

, which together with the Offer to Purchase constitute the

“Offer”

). The Schedule TO was filed with the SEC on July 1, 2009. Copies of the Offer to

Purchase and Letter of Transmittal are filed as Exhibits (a)(1)(A) and (a)(1)(B) to the Schedule 14D-9, respectively.

All capitalized

terms used in this Amendment No. 4 without definition have the meanings ascribed to them in the Schedule 14D-9.

The information

in the Schedule 14D-9 is incorporated into this Amendment No. 4 by reference to all of the applicable items in the Schedule 14D-9, except that such information is hereby amended and supplemented to the extent specifically provided in this

Amendment No. 4.

|

Item 4.

|

The Solicitation or Recommendation.

|

Item 4

(“

The Solicitation or Recommendation

”) of the Schedule 14D-9 is hereby amended and supplemented by amending and restating the first and second full paragraphs and the two tables contained therein on page 29 of the Schedule 14D-9

under the heading “Financial Projections.” as follows:

“The “base case” projections included the following

estimates of the Company’s future financial performance:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Projected*

|

|

|

|

2009

|

|

|

2010

|

|

|

2011

|

|

|

2012

|

|

|

2013

|

|

|

|

(Unaudited, amounts in millions)

|

|

Total Revenue

|

|

$

|

72

|

|

|

$

|

96

|

|

|

$

|

116

|

|

|

$

|

141

|

|

|

$

|

171

|

|

Virology (HIV)

|

|

$

|

70

|

|

|

$

|

75

|

|

|

$

|

80

|

|

|

$

|

84

|

|

|

$

|

87

|

|

Oncology

|

|

$

|

3

|

|

|

$

|

21

|

|

|

$

|

36

|

|

|

$

|

57

|

|

|

$

|

83

|

|

Cost of Product Revenue

|

|

$

|

31

|

|

|

$

|

36

|

|

|

$

|

41

|

|

|

$

|

47

|

|

|

$

|

55

|

|

Gross Profit (Loss)

|

|

$

|

41

|

|

|

$

|

60

|

|

|

$

|

75

|

|

|

$

|

94

|

|

|

$

|

116

|

|

Operating Expenses

|

|

$

|

50

|

|

|

$

|

57

|

|

|

$

|

65

|

|

|

$

|

72

|

|

|

$

|

79

|

|

Operating Income (Loss)

|

|

$

|

(9

|

)

|

|

$

|

3

|

|

|

$

|

10

|

|

|

$

|

22

|

|

|

$

|

37

|

|

Free Cash Flow

|

|

$

|

(10

|

)

|

|

$

|

(8

|

)

|

|

$

|

(3

|

)

|

|

$

|

7

|

|

|

$

|

16

|

|

Virology (HIV)

|

|

$

|

12

|

|

|

$

|

10

|

|

|

$

|

11

|

|

|

$

|

13

|

|

|

$

|

14

|

|

Oncology

|

|

$

|

(22

|

)

|

|

$

|

(18

|

)

|

|

$

|

(14

|

)

|

|

$

|

(6

|

)

|

|

$

|

2

|

|

*

|

Presented on a non-GAAP basis as described below. Due to rounding, amounts presented as totals may vary from the sum of the component parts.

|

The “upside case” projections included the following estimates of the Company’s future

financial performance:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Projected*

|

|

|

|

2009

|

|

|

2010

|

|

2011

|

|

2012

|

|

2013

|

|

|

|

(Unaudited, amounts in millions)

|

|

Total Revenue

|

|

$

|

72

|

|

|

$

|

123

|

|

$

|

186

|

|

$

|

273

|

|

$

|

380

|

|

Virology (HIV)

|

|

$

|

70

|

|

|

$

|

93

|

|

$

|

113

|

|

$

|

132

|

|

$

|

148

|

|

Oncology

|

|

$

|

3

|

|

|

$

|

30

|

|

$

|

73

|

|

$

|

141

|

|

$

|

232

|

|

Cost of Product Revenue

|

|

$

|

31

|

|

|

$

|

49

|

|

$

|

66

|

|

$

|

90

|

|

$

|

120

|

|

Gross Profit (Loss)

|

|

$

|

41

|

|

|

$

|

74

|

|

$

|

120

|

|

$

|

183

|

|

$

|

260

|

|

Operating Expenses

|

|

$

|

50

|

|

|

$

|

63

|

|

$

|

82

|

|

$

|

105

|

|

$

|

131

|

|

Operating Income (Loss)

|

|

$

|

(9

|

)

|

|

$

|

11

|

|

$

|

38

|

|

$

|

78

|

|

$

|

129

|

|

*

|

Presented on a non-GAAP basis as described below. Due to rounding, amounts presented as totals may vary from the sum of the component parts.

|

Item 4 (“

The Solicitation or Recommendation

”) of the Schedule 14D-9 is hereby amended and supplemented by amending and restating

the paragraph under the heading “

Financial Analyses

,

” on page 32 as follows:

“

Sum-of-the-Parts

Discounted Cash Flow Analysis

. Lazard performed an analysis of the net present value of the Company’s cash flows. In performing this analysis, Lazard separately discounted the cash flow associated with the two parts of the

Company’s business: (1) HIV and (2) Oncology. For each part, Lazard separately calculated (a) the net present value of the projected “base case” operating free cash flows for 2009 to 2013, where operating free cash flow

is defined as net income plus net change in working capital, plus depreciation, and less capital expenditures; and (b) the net present value of the terminal value of the HIV or Oncology business, as applicable. Because the HIV business consists

of mature products, Lazard calculated the HIV terminal value by applying various perpetuity growth rates (-2.5%, 0%, and +2.5%) to the projected 2013 “base case” operating free cash flow. And, because the Oncology business consists of new

and speculative products with no historical revenues, Lazard calculated the Oncology terminal value by applying various revenue multiples (2.0x, 3.0x, and 4.0x), which were based on an enterprise value to revenue ratio for similar high-tech growth

companies, to 2013 forecasted revenues. Lazard then discounted the cash flows and terminal values for each part (HIV and Oncology) using the same set of discount rates for each part (16%, 18%, and 20%). These assumed discount rates were derived from

a weighted average cost of capital analysis that Lazard performed using debt and equity data for Monogram and selected comparable companies. To reach an implied total equity value, Lazard then summed the discounted cash flows and terminal values for

HIV and Oncology, added the discounted tax benefit of the Company’s federal net operating losses, which were estimated at $265 million as of December 31, 2008, and subtracted the net debt of Monogram under the “base case”

projections of Monogram’s management. The tax benefits were also discounted using discount rates ranging from 16% to 20%. Based on this analysis, Lazard arrived at an implied total equity value range for Monogram of $93 million to $191 million,

or an implied per share value range for Monogram of $4.03 to $8.31 per share (based on 23 million fully diluted outstanding shares). Lazard noted that this range is inclusive of the Offer Price of $4.55.”

|

Item 8.

|

Additional Information

|

All of the paragraphs under

the heading “

Legal Proceeding

” included in

Item 8

(“

Additional Information

”) of the Schedule 14D-9 are hereby replaced in their entirety with the following paragraphs:

“On June 30, 2009, a single plaintiff, Tim Bleymeyer, initiated a putative shareholder class action lawsuit in the Court of Chancery of the State of

Delaware against Monogram, LabCorp, the Purchaser, and individual members of the Company’s Board of Directors (the “Defendants”). The action, styled

Tim Bleymeyer v. Monogram Biosciences, Inc., et al.

, Civil Action No. 4703-CC

(“Bleymeyer Action”), alleges that (i) individual members of the Company’s board of directors violated their fiduciary duties to the Company’s stockholders, including their duties to (a) fully inform themselves of the

Company’s market value before taking action, (b) act in the interests of the equity owners, (c) maximize shareholder value, (d) obtain the best financial and other terms when Monogram’s existence will be materially altered by the

transaction, (e) act in accordance with fundamental duties of loyalty, care and good faith and (f) act independently in the best interest of the corporation and its shareholders, and (ii) LabCorp and Monogram aided and abetted the other defendants

in the breaches of their fiduciary duties. Bleymeyer seeks to enjoin the acquisition of Monogram by Purchaser and LabCorp and requests monetary damages in an unspecified amount. On July 6, 2009, Bleymeyer amended his complaint to include allegations

stemming from alleged misstatements and omissions in Monogram’s Schedule 14D-9. On July 7, 2009, a second complaint was filed in the Court of Chancery of the State of Delaware, styled

Kurt Kvist v. Monogram Biosciences, Inc., et al.

,

Civil Action No. 4717-CC (“Kvist Action”), asserting allegations and claims identical to those set forth in the Bleymeyer Action. On July 9, 2009, the Delaware Chancery Court issued an order consolidating the Bleymeyer and Kvist Actions

into an action styled

In re Monogram Biosciences, Inc. Shareholder Litigation

, Civil Action No. 4703-CC (the “Delaware Action”). On July 9, 2009, the Delaware Chancery Court heard a motion for expedited proceedings submitted by the

plaintiffs in the Bleymeyer and Kvist Actions (the “Delaware Plaintiffs”). On July 13, 2009, the Delaware Plaintiffs submitted a renewed motion for expedited proceedings raising only certain disclosure issues. On July 23, 2009, the

Delaware Chancery Court scheduled a preliminary injunction hearing for July 28, 2009 limited to the disclosure issues identified in the renewed motion for expedited proceedings and related letter submissions. On July 23 and 24, 2009, Monogram

produced a limited set of documents to Delaware Plaintiffs.

Defendants believe that the Delaware Action is entirely without merit and that they have valid defenses

to all claims. Nevertheless, and despite their belief that they ultimately would have prevailed in the defense of Delaware Plaintiffs’ claims, to minimize the costs associated with this litigation, on July 27, 2009, Defendants and Delaware

Plaintiffs entered into a memorandum of understanding (“MOU”) contemplating the settlement of all claims in the Delaware Action. Under the MOU, subject to court approval and further definitive documentation, Delaware Plaintiffs and the

putative class agreed to settle and release, against Defendants and their affiliates and agents, any and all claims in the Delaware Action and any potential claim related to the Offer and the merger, the fiduciary obligations of the Defendants, the

negotiations in connection with the Offer, the merger and the disclosure obligations of the Defendants in connection with the Offer and the merger, the alleged aiding and abetting of any breach of fiduciary duty, any alleged conflict of interest of

any remuneration or employment benefits to any individual made in connection with the Offer and the merger and all other allegations in the Delaware Action. Pursuant to the terms of the MOU, the Company agreed to provide additional supplemental

disclosures to its Schedule 14D-9 (which disclosures are included above). Defendants have also agreed not to oppose any fee application by Plaintiffs’ counsel that does not exceed $215,000. The settlement is contingent upon, among other things,

approval of the fee award by the Chancery Court and the merger becoming effective under Delaware law.

On June 26, 2009, a single

plaintiff, Andrei Pevgonen, initiated a putative shareholder class action in Superior Court of the State of California, San Francisco County, against the Defendants. The action, styled

Andrei Pevgonen v. William Young, et al.

, Case No.

CGC-09-489866 (“1st SF Action”), alleged that (i) individual members of the Company’s board of directors violated their fiduciary duties to the Company’s stockholders, including their duties of loyalty, good faith, independence

and candor, and allegedly failed to maximize value for the Company’s stockholders by conducting an unfair sales process and entering into the merger agreement, and (ii) LabCorp and Monogram aided and abetted the other defendants in the breach

of their fiduciary duties. Pevgonen sought to enjoin the acquisition of Monogram by Purchaser and LabCorp and requested monetary damages in an unspecified amount. On July 2, 2009, Pevgonen filed an amended complaint, which added allegations and a

breach of fiduciary duty claim stemming from alleged misstatements and omissions in Monogram’s Schedule 14D-9, which was filed with the SEC on July 1, 2009. On July 2, 2009, a second putative class action was initiated in Superior Court of the

State of California, San Francisco County, styled

Charulata Patel v. Monogram Biosciences, Inc., et al.

, Case No. CGC-09-490059 (“2nd SF Action”). The complaint in the 2nd SF Action alleged similar claims to those made in the 1st SF

Action. Both actions were voluntarily dismissed by plaintiffs on July 10 and July 7, 2009, respectively. On July 7, 2009, Andrei Pevgonen filed a complaint in Superior Court of California, San Mateo County (the “Court”), styled

Andrei

Pevgonen v. William Young, et al.

, Case No. Civ. 485636 (the “California Action”), asserting the same allegations and claims that he made in the 1st SF Action. On July 8, 2009, Pevgonen filed an amended complaint, adding named

plaintiffs Charulata Patel and Rebecca Jordan (collectively “California Plaintiffs”). On July 14, 2009, the San Mateo Superior Court stayed the California Action for ninety (90) days because a similar, parallel action was proceeding in

Delaware (the “Stay”). On July 23, 2009, California Plaintiffs filed a Notice of Case Update, requesting a status conference to discuss whether the Stay should be lifted (the “Request”). Defendants opposed and, on July 24, 2009,

the Court denied California Plaintiffs’ Request. On July 28, 2009, Defendants and California Plaintiffs entered into a memorandum of understanding, pursuant to which California Plaintiffs agreed to request the Court to enter an Order to dismiss

the California Action with prejudice and to release, against Defendants, and their affiliates and agents, any and all claims in the California Action and any potential claim related to the Offer and the merger, the fiduciary obligations of the

Defendants, the negotiations in connection with the Offer and the merger, the disclosure obligations of the Defendants in connection with the Offer and the merger, the alleged aiding and abetting of any breach of fiduciary duty, any alleged conflict

of interest of any remuneration or employment benefits to any individual made in connection with the Offer and the merger, and all other allegations in the California Action. Defendants agreed not to oppose any fee application to be submitted by

California Plaintiffs’ counsel that does not exceed $65,000.

Investors and stockholders of Monogram are cautioned that statements in

this Item 8 that are not strictly historical statements, including, without limitation, statements relating to the proposed settlement, constitute forward-looking statements. These statements are based on current expectations, forecasts and

assumptions of Monogram that are subject to risks and uncertainties that could cause actual outcomes and results to differ materially from those statements. Risks and uncertainties include, among others, the risk that the proposed settlement is not

consummated, conditions to the tender offer or the merger set forth in the agreement and plan of merger will not be satisfied and the transactions will not be consummated, uncertainties as to the timing of the tender offer and merger, uncertainties

as to how many Monogram stockholders will tender their stock in the offer, changes in Monogram’s business during the period between now and the closing that could cause a condition to closing not to be satisfied, as well as other factors

detailed in LabCorp’s and Monogram’s filings with the SEC, including LabCorp’s Annual Report on Form 10-K for the year ended December 31, 2008 and subsequent SEC filings, and Monogram’s Annual Report on Form 10-K for the

year ended December 31, 2008 and subsequent SEC filings.”

Item 8 (“

Additional Information

”) of the Schedule 14D-9 is

further amended and supplemented by adding the following paragraph immediately following the last paragraph of Item 8 of the Schedule 14D-9:

“

Extension of Offer

On July 28, LabCorp announced that Purchaser is extending the Offer upon the

terms and conditions set forth in the Offer to Purchase, until 12:00 midnight, New York City time, at the end of the day on Monday, August 3, 2009. The Offer had been previously scheduled to expire at 12:00 midnight, New York City time, at the

end of the day on Wednesday, July 29, 2009. On July 27, 2009, LabCorp and Monogram issued a joint press release announcing, among other things, the extension of the offer. The full text of the press release is set forth as Exhibit

(a)(5)(F) hereto and is incorporated by reference herein.”

Item 9. Exhibits

Item 9 (

“Exhibits”

) of the Schedule 14D-9 is hereby amended and supplemented by adding the following exhibit:

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

(a)(5)(F)

|

|

Press Release, dated July 28, 2009, issued by LabCorp and Monogram. (incorporated herein by reference to Exhibit (a)(5)(G) to the Schedule TO filed with the SEC on July 28,

2009).

|

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

|

|

MONOGRAM BIOSCIENCES, INC.

|

|

|

|

|

By:

|

|

/s/ William D. Young

|

|

Name:

|

|

William D. Young

|

|

Title:

|

|

Chairman of the Board of Directors

and Chief

Executive Officer

|

Dated: July 28, 2009

EXHIBIT INDEX

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

(a)(5)(F)

|

|

Press Release, dated July 28, 2009, issued by LabCorp and Monogram. (incorporated herein by reference to Exhibit (a)(5)(G) to the Schedule TO filed with the SEC on July 28,

2009).

|

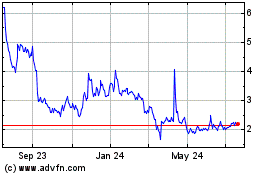

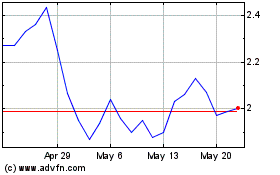

Monogram Technologies (NASDAQ:MGRM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Monogram Technologies (NASDAQ:MGRM)

Historical Stock Chart

From Nov 2023 to Nov 2024