UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

x

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended June 30, 2008

or

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

.

Commission File Number 001-33092

LEMAITRE VASCULAR, INC.

(Exact name of registrant as specified in its

charter)

|

|

|

|

|

Delaware

|

|

04-2825458

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

63 Second Avenue, Burlington, Massachusetts

|

|

01803

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(781) 221-2266

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and

(2) has been subject to such filing requirements for the past 90 days. Yes

x

No

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the

definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

¨

|

|

Accelerated filer

|

|

¨

|

|

|

|

|

|

|

Non-accelerated filer

|

|

¨

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Exchange

Act). Yes

¨

No

x

The registrant had 15,616,800 shares of common stock, $.01 par value per share, outstanding as of August 11, 2008.

LEMAITRE VASCULAR

FORM 10-Q

TABLE OF CONTENTS

2

Part I. Financial Information

|

Item 1.

|

Financial Statements

|

LeMaitre Vascular, Inc.

Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

|

|

(unaudited)

June 30

2008

|

|

|

December 31

2007

|

|

|

|

|

(in thousands, except share data)

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

10,648

|

|

|

$

|

6,397

|

|

|

Marketable securities

|

|

|

7,623

|

|

|

|

16,198

|

|

|

Accounts receivable, net of allowances of $188 at June 30, 2008, and $219 at December 31, 2007

|

|

|

7,148

|

|

|

|

7,020

|

|

|

Inventory

|

|

|

9,658

|

|

|

|

9,589

|

|

|

Prepaid expenses and other current assets

|

|

|

2,447

|

|

|

|

2,562

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

37,524

|

|

|

|

41,766

|

|

|

Property and equipment, net

|

|

|

2,820

|

|

|

|

2,891

|

|

|

Goodwill

|

|

|

10,959

|

|

|

|

10,942

|

|

|

Other intangibles, net

|

|

|

3,349

|

|

|

|

3,886

|

|

|

Other assets

|

|

|

1,376

|

|

|

|

1,372

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

56,028

|

|

|

$

|

60,857

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Revolving line of credit

|

|

$

|

—

|

|

|

$

|

262

|

|

|

Accounts payable

|

|

|

2,108

|

|

|

|

2,271

|

|

|

Accrued expenses

|

|

|

4,991

|

|

|

|

6,661

|

|

|

Acquisition-related obligations

|

|

|

1,386

|

|

|

|

851

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

8,485

|

|

|

|

10,045

|

|

|

Long-term debt

|

|

|

45

|

|

|

|

42

|

|

|

Deferred tax liabilities

|

|

|

1,351

|

|

|

|

996

|

|

|

Other long-term liabilities

|

|

|

456

|

|

|

|

1,188

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

10,337

|

|

|

|

12,271

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value; authorized 5,000,000 shares; none outstanding

|

|

|

—

|

|

|

|

—

|

|

|

Common stock, $0.01 par value; authorized 100,000,000 shares; issued 15,574,254 shares at June 30, 2008, and 15,516,412 shares at

December 31, 2007

|

|

|

156

|

|

|

|

155

|

|

|

Additional paid-in capital

|

|

|

61,717

|

|

|

|

61,187

|

|

|

Accumulated deficit

|

|

|

(16,369

|

)

|

|

|

(12,880

|

)

|

|

Accumulated other comprehensive income

|

|

|

371

|

|

|

|

291

|

|

|

Treasury stock, at cost; 30,799 shares at June 30, 2008, and 26,852 shares at December 31, 2007

|

|

|

(184

|

)

|

|

|

(167

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders’ equity

|

|

|

45,691

|

|

|

|

48,586

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity

|

|

$

|

56,028

|

|

|

$

|

60,857

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to consolidated financial statements.

3

LeMaitre Vascular, Inc.

Consolidated Statements of Operations

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended

|

|

|

For the six months ended

|

|

|

|

|

June 30,

2008

|

|

|

June 30,

2007

|

|

|

June 30,

2008

|

|

|

June 30,

2007

|

|

|

|

|

(in thousands, except per share data)

|

|

|

(in thousands, except per share data)

|

|

|

Net sales

|

|

$

|

12,739

|

|

|

$

|

10,315

|

|

|

$

|

24,586

|

|

|

$

|

20,198

|

|

|

Cost of sales

|

|

|

3,853

|

|

|

|

2,702

|

|

|

|

7,211

|

|

|

|

5,215

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

8,886

|

|

|

|

7,613

|

|

|

|

17,375

|

|

|

|

14,983

|

|

|

|

|

|

|

|

|

Sales and marketing

|

|

|

5,153

|

|

|

|

4,737

|

|

|

|

10,981

|

|

|

|

9,548

|

|

|

General and administrative

|

|

|

2,733

|

|

|

|

2,206

|

|

|

|

5,561

|

|

|

|

4,576

|

|

|

Research and development

|

|

|

1,474

|

|

|

|

1,118

|

|

|

|

2,824

|

|

|

|

2,272

|

|

|

Restructuring charges

|

|

|

347

|

|

|

|

(1

|

)

|

|

|

980

|

|

|

|

5

|

|

|

Impairment charge

|

|

|

48

|

|

|

|

—

|

|

|

|

483

|

|

|

|

7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

9,755

|

|

|

|

8,060

|

|

|

|

20,829

|

|

|

|

16,408

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

|

(869

|

)

|

|

|

(447

|

)

|

|

|

(3,454

|

)

|

|

|

(1,425

|

)

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

120

|

|

|

|

344

|

|

|

|

298

|

|

|

|

697

|

|

|

Interest expense

|

|

|

(16

|

)

|

|

|

—

|

|

|

|

(32

|

)

|

|

|

(1

|

)

|

|

Foreign currency gains

|

|

|

19

|

|

|

|

34

|

|

|

|

166

|

|

|

|

61

|

|

|

Other expense, net

|

|

|

(5

|

)

|

|

|

(6

|

)

|

|

|

(2

|

)

|

|

|

(8

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes

|

|

|

(751

|

)

|

|

|

(75

|

)

|

|

|

(3,024

|

)

|

|

|

(676

|

)

|

|

Provision (benefit) for income taxes

|

|

|

175

|

|

|

|

(302

|

)

|

|

|

465

|

|

|

|

(274

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income

|

|

$

|

(926

|

)

|

|

$

|

227

|

|

|

$

|

(3,489

|

)

|

|

$

|

(402

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income per share of common stock:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

(0.06

|

)

|

|

$

|

0.01

|

|

|

$

|

(0.22

|

)

|

|

$

|

(0.03

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted

|

|

$

|

(0.06

|

)

|

|

$

|

0.01

|

|

|

$

|

(0.22

|

)

|

|

$

|

(0.03

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

15,542

|

|

|

|

15,378

|

|

|

|

15,524

|

|

|

|

15,358

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted

|

|

|

15,542

|

|

|

|

15,760

|

|

|

|

15,524

|

|

|

|

15,358

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to consolidated financial statements.

4

LeMaitre Vascular, Inc.

Consolidated Statements of Cash Flows

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

For the six months ended

June 30

|

|

|

|

|

2008

|

|

|

2007

|

|

|

|

|

(in thousands)

|

|

|

Operating activities

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(3,489

|

)

|

|

$

|

(402

|

)

|

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

924

|

|

|

|

684

|

|

|

Stock-based compensation

|

|

|

344

|

|

|

|

239

|

|

|

Accretion of discount on marketable securities

|

|

|

(71

|

)

|

|

|

(97

|

)

|

|

Impairment charges

|

|

|

483

|

|

|

|

7

|

|

|

Provision for losses in accounts receivable

|

|

|

27

|

|

|

|

48

|

|

|

Provision for inventory write-downs

|

|

|

515

|

|

|

|

273

|

|

|

Loss on sales of marketable securities

|

|

|

42

|

|

|

|

2

|

|

|

Loss on disposal of property and equipment

|

|

|

5

|

|

|

|

5

|

|

|

Changes in operating assets and liabilities, net of effect of business acquisitions:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

78

|

|

|

|

(995

|

)

|

|

Inventory

|

|

|

(296

|

)

|

|

|

(1,416

|

)

|

|

Prepaid expenses and other assets

|

|

|

154

|

|

|

|

343

|

|

|

Accounts payable and other liabilities

|

|

|

(1,913

|

)

|

|

|

(532

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in operating activities

|

|

|

(3,197

|

)

|

|

|

(1,841

|

)

|

|

Investing activities

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment

|

|

|

(554

|

)

|

|

|

(529

|

)

|

|

Payments related to acquisitions

|

|

|

(272

|

)

|

|

|

(432

|

)

|

|

Purchase of technology and licenses

|

|

|

(103

|

)

|

|

|

—

|

|

|

Sales and maturities of marketable securities

|

|

|

8,406

|

|

|

|

5,867

|

|

|

Purchases of marketable securities

|

|

|

—

|

|

|

|

(8,071

|

)

|

|

Other assets

|

|

|

—

|

|

|

|

1

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) investing activities

|

|

|

7,477

|

|

|

|

(3,164

|

)

|

|

Financing activities

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock

|

|

|

186

|

|

|

|

85

|

|

|

Repayment of revolving line of credit

|

|

|

(262

|

)

|

|

|

—

|

|

|

Principal payments on capital lease obligations

|

|

|

—

|

|

|

|

(32

|

)

|

|

Expenses associated with equity transactions

|

|

|

—

|

|

|

|

(121

|

)

|

|

Purchase of treasury stock

|

|

|

(17

|

)

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in financing activities

|

|

|

(93

|

)

|

|

|

(68

|

)

|

|

Effect of exchange rate changes on cash and cash equivalents

|

|

|

64

|

|

|

|

(79

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents

|

|

|

4,251

|

|

|

|

(5,152

|

)

|

|

Cash and cash equivalents at beginning of period

|

|

|

6,397

|

|

|

|

17,626

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of period

|

|

$

|

10,648

|

|

|

$

|

12,474

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosures of cash flow information (see Note 15).

|

|

|

|

|

|

|

|

|

See accompanying notes to consolidated financial statements.

5

LeMaitre Vascular, Inc.

Notes to Consolidated Financial Statements

June 30, 2008

(unaudited)

1. Organization and Basis for Presentation

Description of Business

Unless the context requires otherwise, references to LeMaitre Vascular, we, our, and us refer to LeMaitre Vascular, Inc. and our subsidiaries. LeMaitre

Vascular develops, manufactures, and markets medical devices and implants used primarily in the field of vascular surgery. We operate in a single segment in which our principal product lines are thoracic stent grafts, abdominal stent grafts,

anastomotic clips, radiopaque tape, valvulotomes, carotid shunts, remote endarterectomy devices, covered stents, contrast injectors, balloon catheters, vascular grafts, vein strippers, cholangiogram catheters, and vascular access ports. We also

distribute in 11 European countries an abdominal stent graft manufactured by a third party. Our offices are located in Burlington, Massachusetts, Sulzbach, Germany, Rome, Italy, Brindisi, Italy, and Tokyo, Japan.

Basis of Presentation

The

accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States for interim financial information and with the instructions to Form 10-Q and Article 10 of

Regulation S-X. Accordingly, they do not include all of the information and footnotes required by accounting principles generally accepted in the United States for complete financial statements. In the opinion of management, all adjustments,

consisting only of normal, recurring adjustments considered necessary for a fair presentation of the results of these interim periods have been included. Preparing financial statements requires management to make estimates and assumptions that

affect the reported amounts of assets, liabilities, revenues and expenses. Actual results may differ from these estimates. Our estimates and assumptions, including those related to bad debts, inventories, intangible assets, sales returns and

discounts, share-based compensation, and income taxes are updated as appropriate. The results for the three and six months ended June 30, 2008 are not necessarily indicative of results to be expected for the entire year. The information

contained in these interim financial statements should be read in conjunction with our audited consolidated financial statements as of and for the year ended December 31, 2007, including the notes thereto, included in our Form 10-K filed with

the Securities and Exchange Commission (SEC).

Certain prior year amounts have been reclassified in the consolidated financial statements

and accompanying notes to conform to the current period’s presentation.

Consolidation

Our consolidated financial statements include the accounts of LeMaitre Vascular and the accounts of our wholly-owned subsidiaries, LeMaitre Vascular GmbH,

LeMaitre Vascular GK (successor to LeMaitre Vascular KK, reorganized in June 2007), LeMaitre UK Acquisition LLC, Vascutech Acquisition LLC, LeMaitre Acquisition LLC, LeMaitre Vascular SAS (organized in 2007), Biomateriali S.r.l. (acquired in 2007),

and LeMaitre Vascular S.r.l. (organized in 2007). All significant intercompany accounts and transactions have been eliminated in consolidation.

2.

Recent Accounting Pronouncements

In March 2008 the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting

Standards (SFAS) No. 161,

Disclosures about Derivative Instruments and Hedging Activities, an amendment of FASB statement No. 133

(SFAS No. 161). SFAS No. 161 requires enhanced disclosures regarding an entity’s

derivative instruments and related hedging activities. These enhanced disclosures include information regarding how and why an entity uses derivative instruments; how derivative instruments and related hedge items are accounted for under SFAS

No. 133,

Accounting for Derivative Instruments and Hedging Activities

, and its related interpretations; and how derivative instruments and related hedged items affect an entity’s financial position, financial performance, and cash

flows. SFAS No. 161 is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008. The adoption of SFAS No. 161 will not have a material impact on our financial position, results

of operations, or liquidity.

6

In December 2007 the FASB issued SFAS No. 141 (revised 2007),

Business Combinations

, (SFAS

No. 141(R)). SFAS No. 141(R) replaces SFAS No. 141,

Business Combinations

, and requires the acquiring entity in a business combination to recognize the full fair value of assets acquired and liabilities assumed in the

transaction; requires certain contingent assets and liabilities acquired to be recognized at their fair values on the acquisition date; requires contingent consideration to be recognized at its fair value on the acquisition date and changes in the

fair value to be recognized in earnings until settled; requires the expensing of most transaction and restructuring costs; and generally requires the reversals of valuation allowances related to acquired deferred tax assets and changes to acquired

income tax uncertainties to also be recognized in earnings. SFAS No. 141(R) is effective for financial statements issued for fiscal years beginning after December 15, 2008, and will be adopted by us in the first quarter of 2009. The

adoption of SFAS No. 141(R) will change our accounting treatment for business combinations on a prospective basis for business combinations entered into subsequent to December 31, 2008.

In December 2007 the FASB issued SFAS No. 160,

Noncontrolling Interests in Consolidated Financial Statements—an amendment of Accounting

Research Bulletin No. 51

(SFAS No. 160). SFAS No. 160 establishes accounting and reporting standards for ownership interests in subsidiaries held by parties other than the parent, the amount of consolidated net income attributable

to the parent and to the noncontrolling interest, changes in a parent’s ownership interest, and the valuation of retained noncontrolling equity investments when a subsidiary is deconsolidated. SFAS No. 160 also establishes disclosure

requirements that clearly identify and distinguish between the interests of the parent and the interests of the noncontrolling owners. SFAS No. 160 is effective for fiscal years beginning after December 15, 2008, and will be adopted by us

in the first quarter of 2009. We do not expect that the adoption of SFAS No. 160 will have a material effect on our consolidated results of operations and financial condition.

In December 2007 the FASB ratified Emerging Issues Task Force (EITF) Issue No. 07-1,

Accounting for Collaborative Arrangements

(EITF

07-1

)

. EITF 07-1 provides guidance on collaborative arrangements within the scope of this issue, including the classification of the payments between participants in the arrangement, the appropriate income statement presentation as well as

disclosures related to these arrangements. EITF 07-1 is effective for fiscal years beginning after December 15, 2008, and will be adopted by us in the first quarter of 2009. We are currently evaluating the potential impact of EITF 07-1 on our

financial position and results of operations.

3. Income Tax Expense

We operate in multiple taxing jurisdictions, both within the United States and outside of the United States, and are or may be subject to audits from various tax authorities regarding transfer pricing, the

deductibility of certain expenses, intercompany transactions, and other matters. Our income tax expense for the period varies from the amount that would normally be derived based upon statutory rates in the respective jurisdictions in which we

operate. The significant reasons for this variation are our inability to record a tax benefit on its losses generated in the United States, coupled with a tax provision on foreign earnings, and the effect of tax-deductible goodwill, for which a

deferred tax liability has been recorded. In addition, we recorded a one-time tax benefit of $0.5 million related to the reorganization of our Japanese subsidiary in June 2007 for which a loss carry back was realized.

Our policy is to classify interest and penalties related to unrecognized tax benefits as income tax expense. This policy has been consistently applied in

prior periods.

We have not identified any uncertain tax positions for which it is reasonably possible that the total amount of

unrecognized tax benefits will significantly increase or decrease within the 12 months ending June 30, 2009, except with respect to matters that may be identified under audit that we cannot reasonably estimate as discussed in our audited

consolidated financial statements as of and for the year ended December 31, 2007, including the notes thereto, included in our Form 10-K filed with the Securities and Exchange Commission. As of June 30, 2008, the liability for unrecognized

tax benefits was approximately $28,000. There was no change in the liability during the six months ended June 30, 2008.

7

As of January 1, 2008, a summary of the tax years that remain subject to examination in our most

significant tax jurisdictions is:

|

|

|

|

|

United States—federal

|

|

2006 and forward

|

|

Germany

|

|

2007

|

|

Japan

|

|

2004 and forward

|

|

Italy

|

|

2007

|

|

France

|

|

2007

|

4. Inventories

Inventories consist of the following:

|

|

|

|

|

|

|

|

|

|

|

June 30, 2008

|

|

December 31, 2007

|

|

|

|

(in thousands)

|

|

Raw materials

|

|

$

|

2,271

|

|

$

|

2,374

|

|

Work-in-process

|

|

|

1,384

|

|

|

1,540

|

|

Finished products

|

|

|

6,003

|

|

|

5,675

|

|

|

|

|

|

|

|

|

|

Total inventory

|

|

$

|

9,658

|

|

$

|

9,589

|

|

|

|

|

|

|

|

|

5. Goodwill and other Intangibles

The changes in the carrying amount of goodwill for the six months ended June 30, 2008, are as follows:

|

|

|

|

|

|

|

|

June 30, 2008

|

|

|

|

(in thousands)

|

|

Beginning balance

|

|

$

|

10,942

|

|

Adjustments to purchase price on prior year acquisitions:

|

|

|

|

|

Cardiovascular Innovations acquisition

|

|

|

5

|

|

Vascular Architects acquisition

|

|

|

12

|

|

|

|

|

|

|

Ending balance

|

|

$

|

10,959

|

|

|

|

|

|

The components of our identifiable intangible assets are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2008

|

|

December 31, 2007

|

|

|

|

Gross

Carrying

Value

|

|

Accumulated

Amortization

|

|

Net Carrying

Value of

Intangible

Assets

|

|

Gross

Carrying

Value

|

|

Accumulated

Amortization

|

|

Net

Carrying

Value of

Intangible

Assets

|

|

|

|

|

|

|

|

(in thousands)

|

|

|

|

|

|

|

|

Patents

|

|

$

|

2,276

|

|

$

|

656

|

|

$

|

1,620

|

|

$

|

2,184

|

|

$

|

532

|

|

$

|

1,652

|

|

Trademarks and technology licenses

|

|

|

1,275

|

|

|

429

|

|

|

846

|

|

|

1,265

|

|

|

356

|

|

|

909

|

|

Customer relationships

|

|

|

881

|

|

|

157

|

|

|

724

|

|

|

1,233

|

|

|

92

|

|

|

1,141

|

|

Other intangible assets

|

|

|

184

|

|

|

25

|

|

|

159

|

|

|

190

|

|

|

6

|

|

|

184

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total identifiable intangible assets

|

|

$

|

4,616

|

|

$

|

1,267

|

|

$

|

3,349

|

|

$

|

4,872

|

|

$

|

986

|

|

$

|

3,886

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8

Intangible assets are amortized over their estimated useful lives, ranging from 5 to 17 years.

Amortization expense amounted to $104,000 and $63,000 for the three months ended June 30, 2008 and June 30, 2007, respectively. Amortization expense amounted to $233,000 and $118,000 for the six months ended June 30, 2008 and

June 30, 2007, respectively. Amortization expense is included in general and administrative expense. Estimated amortization expense for the reminder of 2008 and each of the five succeeding fiscal years is as follows:

|

|

|

|

|

|

|

|

(in thousands)

|

|

2008 (remaining 6 months)

|

|

$

|

250

|

|

2009

|

|

|

453

|

|

2010

|

|

|

443

|

|

2011

|

|

|

422

|

|

2012

|

|

|

378

|

|

2013

|

|

|

294

|

In June 2008, we recognized an impairment charge of $48,000 related to patents which were deemed

to have no value based upon a lack of future expected economic benefits. In January 2008, we were notified by one of the customers of our Biomateriali subsidiary that they would no longer purchase a certain product line from us, and, as a result, we

incurred an impairment charge of $435,000 due to the write-down of related intangible assets.

6. Financing Arrangements

We maintain a $10.0 million revolving line of credit that provides for up to $3.0 million in letters of credit. Loans made under this revolving line of

credit bear interest at the bank’s base rate or LIBOR plus 200 basis points, at our discretion, and are collateralized by substantially all of our assets. The loan agreement requires that we meet certain financial and operating covenants. As of

June 30, 2008 and December 31, 2007, we did not have an outstanding balance under this facility and we were in compliance with these covenants.

In addition, at the acquisition date, Biomateriali had two existing revolving lines of credit with their bank for a total of approximately $0.7 million to be used in connection with the financing of sales to certain

customers. Loans made under these lines bear interest at 20% per annum. On December 31, 2007, we had $0.3 million of borrowings outstanding under one of these lines of credit, which were paid in full in January 2008. As of June 30,

2008, we did not have an outstanding balance under either of these two Biomateriali lines of credit.

7. Accrued Expenses

Accrued expenses consist of the following:

|

|

|

|

|

|

|

|

|

|

|

June 30, 2008

|

|

December 31, 2007

|

|

|

|

(in thousands)

|

|

Compensation and related taxes

|

|

$

|

2,930

|

|

$

|

3,146

|

|

Restructuring

|

|

|

96

|

|

|

1,129

|

|

Income and other taxes

|

|

|

524

|

|

|

673

|

|

Professional fees

|

|

|

351

|

|

|

811

|

|

Other

|

|

|

1,090

|

|

|

902

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

4,991

|

|

$

|

6,661

|

|

|

|

|

|

|

|

|

8. Restructuring Charges

During the three months ended June 30, 2008, we incurred $0.3 million of restructuring charges, primarily related to a termination agreement with a former Italian distributor. During the six months ended

June 30, 2008, we incurred $1.0 million of restructuring charges. Included in the restructuring charges for the six months ended June 30, 2008

9

were $0.6 million for contractual obligations associated with non-compete and consulting agreements related to termination agreements with two former

European distributors and $0.4 million for severance costs related to a reduction in force of 32 employees that we initiated in the first quarter.

The components of the restructuring charges are follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

June 30

|

|

|

Six months ended

June 30

|

|

|

|

2008

|

|

2007

|

|

|

2008

|

|

2007

|

|

|

|

(in thousands)

|

|

|

(in thousands)

|

|

Severance

|

|

$

|

20

|

|

$

|

(1

|

)

|

|

$

|

379

|

|

$

|

5

|

|

Distributor termination costs

|

|

|

327

|

|

|

—

|

|

|

|

601

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

347

|

|

$

|

(1

|

)

|

|

$

|

980

|

|

$

|

5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Activity related to accrued restructuring costs is as follows:

|

|

|

|

|

|

|

|

|

|

|

Six months ended

June 30

|

|

|

|

2008

|

|

2007

|

|

|

|

(in thousands)

|

|

Balance at beginning of period

|

|

$

|

1,129

|

|

$

|

46

|

|

Plus:

|

|

|

|

|

|

|

|

Current period restructuring costs

|

|

|

980

|

|

|

5

|

|

Other

|

|

|

21

|

|

|

|

|

Less:

|

|

|

|

|

|

|

|

Payments for termination of contractual obligations

|

|

|

1,751

|

|

|

—

|

|

Payment of employee severance costs

|

|

|

283

|

|

|

34

|

|

|

|

|

|

|

|

|

|

Balance at end of period

|

|

$

|

96

|

|

$

|

17

|

|

|

|

|

|

|

|

|

We expect that the remaining restructuring costs will be paid over the next 12 months.

10

9. Comprehensive Loss

The components of other comprehensive income (loss) generally include foreign exchange translation and unrealized gains and losses on marketable securities. The computation of comprehensive loss was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

June 30

|

|

|

Six months ended

June 30

|

|

|

|

|

2008

|

|

|

2007

|

|

|

2008

|

|

|

2007

|

|

|

|

|

(in thousands)

|

|

|

(in thousands)

|

|

|

Net income (loss)

|

|

$

|

(926

|

)

|

|

$

|

227

|

|

|

$

|

(3,489

|

)

|

|

$

|

(402

|

)

|

|

Other comprehensive income (loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized loss on available-for-sale securities

|

|

|

(230

|

)

|

|

|

(44

|

)

|

|

|

(174

|

)

|

|

|

(23

|

)

|

|

Foreign currency translation adjustment

|

|

|

(96

|

)

|

|

|

(27

|

)

|

|

|

254

|

|

|

|

18

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total other comprehensive income (loss)

|

|

|

(326

|

)

|

|

|

(71

|

)

|

|

|

80

|

|

|

|

(5

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income (loss)

|

|

$

|

(1,252

|

)

|

|

$

|

156

|

|

|

$

|

(3,409

|

)

|

|

$

|

(407

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. Commitments and Contingencies

As part of our normal course of business, we have minimum inventory purchase commitments totaling $3.3 million for 2008 and $3.8 million for 2009. As of

June 30, 2008, we had purchased approximately $1.1 million toward fulfilling our 2008 purchase commitments.

In addition, there are

potential contingent payments associated with the Biomateriali stock purchase agreement and product distribution agreement that could not be determined beyond a reasonable doubt as of June 30, 2008. These contingent payments could total up to

$2.4 million based upon the exchange rate effective on June 30, 2008. Due to the uncertainly of the future payouts, they have not been recorded as part of the purchase price for Biomateriali. When the contingencies are resolved, they may result

in recognition of an additional cost and the purchase price would be adjusted at that time.

In March 2008, we provided notice of an

indemnity claim to the sellers of Biomateriali, contending that the sellers breached certain representations and warranties in the purchase agreement by failing to adequately disclose material information regarding a customer relationship. In June

2008, we made additional indemnity claims regarding inventory and government subsidies to the sellers of Biomateriali. We have demanded the payment of damages of approximately $1.1 million, based upon the exchange rate effective on

June 30, 2008, and have ceased making certain post-closing payments to the sellers pending resolution of these indemnity claims. As of June 30, 2008, we had not adjusted the purchase accounting related to Biomateriali for these

claims.

11. Segment and Enterprise-Wide Disclosures

SFAS No. 131,

Disclosures about Segments of an Enterprise and Related Information

, establishes standards for reporting information regarding operating segments in annual financial statements. Operating

segments are identified as components of an enterprise about which separate, discrete financial information is available for evaluation by the chief operating decision-maker in making decisions on how to allocate resources and assess performance. We

view our operations and manage our business as one operating segment. No discrete operating information other than product sales is prepared by us, except by geographic location, for local reporting purposes.

Most of our revenues were generated in the United States, Europe, and Japan, and substantially all of our assets are located in the United States. We

analyze our sales using a number of approaches, including sales by legal entity. LeMaitre Vascular GmbH, our German subsidiary, records all sales in Europe and to distributors worldwide, excluding sales in France (LeMaitre Vascular SAS); Italy

(LeMaitre Vascular S.r.l.); Japan, Korea, and Taiwan (LeMaitre Vascular GK); and worldwide sales of Biomateriali S.r.l. products. Net sales to unaffiliated customers by legal entity were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

June 30

|

|

Six months ended

June 30

|

|

|

|

2008

|

|

2007

|

|

2008

|

|

2007

|

|

|

|

(in thousands)

|

|

(in thousands)

|

|

LeMaitre Vascular, Inc.

|

|

$

|

6,802

|

|

$

|

6,074

|

|

$

|

13,256

|

|

$

|

11,996

|

|

LeMaitre Vascular GmbH

|

|

|

4,452

|

|

|

4,036

|

|

|

8,559

|

|

|

7,824

|

|

Other entities

|

|

|

1,485

|

|

|

205

|

|

|

2,771

|

|

|

378

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

12,739

|

|

$

|

10,315

|

|

$

|

24,586

|

|

$

|

20,198

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11

We sell products in three product categories—Endovascular & Dialysis Access, Vascular, and

General Surgery—and have also derived a limited amount of revenue from manufacturing devices under OEM arrangements. Net sales in these product categories were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

June 30

|

|

Six months ended

June 30

|

|

|

|

2008

|

|

2007

|

|

2008

|

|

2007

|

|

|

|

(in thousands)

|

|

(in thousands)

|

|

Endovascular & Dialysis Access

|

|

$

|

4,328

|

|

$

|

3,672

|

|

$

|

7,870

|

|

$

|

7,045

|

|

Vascular

|

|

|

7,290

|

|

|

5,660

|

|

|

14,613

|

|

|

11,234

|

|

General Surgery

|

|

|

1,022

|

|

|

983

|

|

|

1,926

|

|

|

1,919

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12,640

|

|

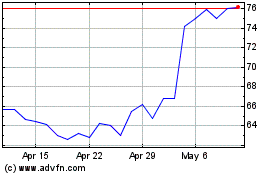

LeMaitre Vascular (NASDAQ:LMAT) Historical Stock Chart From Jun 2024 to Jul 2024

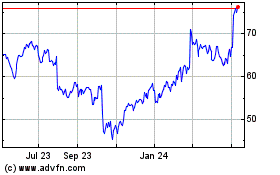

LeMaitre Vascular (NASDAQ:LMAT) Historical Stock Chart From Jul 2023 to Jul 2024

See More Message Board Posts

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.

|