BURLINGTON, Mass., Nov. 5 /PRNewswire-FirstCall/ -- LeMaitre

Vascular, Inc. (NASDAQ:LMAT) (the "Company"), a provider of

peripheral vascular devices and implants, today announced Q3 2007

financial results. Revenues for Q3 2007 were $10.1 million, an

increase of 19% over Q3 2006. Q3 2007 revenues increased 33% in the

Company's Endovascular and Dialysis Access category, 15% in the

Vascular category, and 3% in the General Surgery category. Sales

growth was driven by the continued acceleration of the endovascular

procedure market, relatively strong sales within the vascular

category, productivity gains from recently hired sales

representatives, and the distribution of the Powerlink stent graft

in Europe. For Q3 2007, the Company reported a gross margin of

74.7%, versus 73.3% in Q3 2006. The Company ended Q3 2007 with

$25.6 million in cash and marketable securities, compared with

$27.9 million at the end of Q2 2007. On September 20, 2007, the

Company acquired the assets of Vascular Architects, a company that

marketed and sold a suite of five instruments for Remote

Endarterectomy ("RE"), as well as a helical covered stent. RE is a

minimally invasive procedure for the removal of plaque, typically

in the superficial femoral artery in the thigh. The $2.8 million

all-cash purchase price represents a 1.6 multiple of Vascular

Architects' annual revenues of $1.8 million. Also during Q3 2007,

LeMaitre Vascular announced plans to launch a direct sales force in

Italy in January 2008. The Company has sold its products in Italy

through Serom Medical Technologies srl since 1993. LeMaitre

Vascular and Serom agreed to terminate Serom's exclusive rights

effective January 25, 2008, in exchange for the payment of an

undisclosed sum. The Company believes that Serom's hospital-level

sales of LeMaitre Vascular products were approximately 1.9 million

euros in 2006. George W. LeMaitre, Chairman and CEO said, "This was

another solid quarter for LeMaitre Vascular. We continued to post

strong top-line growth while keeping operating expenses under

control. Additionally, we completed a meaningful acquisition and

furthered our European 'go-direct' strategy. With regard to

Vascular Architects, we are happy to combine a suite of unique

vascular products with our dedicated vascular surgery sales force.

Going direct in Italy will allow us to control our sales channel in

the fifth largest vascular market in the world." The operating loss

for Q3 2007 was $1,541,000, compared to operating income of

$342,000 for Q3 2006. The Q3 2007 operating loss was due to a

$1,054,000 charge related to distributor buyouts, increased sales

force and R&D expenditures, and the costs associated with being

a public company. The Company reported a net loss of $1,354,000, or

$0.09 per basic and diluted share for Q3 2007, compared to net

income of $221,000, or $0.01 per basic and diluted share, for Q3

2006. The Q3 2007 net loss benefited from interest income of

$359,000, as well as a $221,000 foreign exchange gain. Sales and

marketing expenses for Q3 2007 increased 30% to $4,583,000 from

$3,525,000 for Q3 2006. The Company ended Q3 2007 with 58 sales

representatives, compared to 36 at the end of Q3 2006. For Q3 2007,

general and administrative expenses increased by 52% over Q3 2006,

from $1,536,000 to $2,341,000, primarily due to the higher costs

associated with being a publicly traded company. Q3 2006 was the

Company's last full quarter as a private company. R & D

expenses increased 42% to $1,144,000 for Q3 2007, compared to

$805,000 for Q3 2006. The increase was driven largely by the hiring

of additional product development engineers and related product

development expenses. Business Outlook The Company narrowed its

2007 revenue guidance from $39.8-$41.3 million to $40.5-$41.3

million. The Company continues to expect a net loss in 2007 due to

investments in its sales force and R&D. The Company expects to

employ 55 to 60 sales representatives in Q1 2008. The Company will

give its annual 2008 guidance at its next quarterly conference

call. LeMaitre Vascular's guidance for future financial performance

does not include the impact of any potential acquisitions.

Conference Call Reminder Management will conduct a conference call

at 5:00 p.m. EST today to review the Company's financial results

and its expectations regarding future financial performance and

business outlook. The conference call will be broadcast live over

the internet. Individuals who are interested in listening to the

webcast should log on to the Company's website at

http://www.lemaitre.com/investor. The conference call may also be

accessed by dialing 866-831-6272 (1-617-213-8859 for international

callers) using passcode 85202968. For interested individuals unable

to join the live conference call, a replay will be available on the

Company's website. About LeMaitre Vascular LeMaitre Vascular is a

provider of devices for the treatment of peripheral vascular

disease. We develop, manufacture, and market disposable and

implantable vascular devices to address the needs of vascular

surgeons and interventionalists. The Company's devices and implants

are used to treat peripheral vascular disease; a condition that we

estimate affects more than 20 million people worldwide. Well-known

to vascular surgeons, the Company's diversified portfolio of

peripheral vascular devices and implants consists of brand-name

products, including the EndoFit and UniFit stent grafts, the

Expandable LeMaitre Valvulotome, the Pruitt-Inahara Carotid Shunt,

and the AnastoClip Vessel Closure System. LeMaitre and the LeMaitre

Vascular logo are trademarks of LeMaitre Vascular, Inc., registered

in the U.S. and other countries. This press release contains other

trademarks and trade names of the Company and other third parties,

which are the properties of their respective owners. For more

information about the Company, please visit

http://www.lemaitre.com/. Forward-Looking Statements This press

release contains forward-looking statements within the meaning of

the U.S. Private Securities Litigation Reform Act of 1995.

Statements in this press release regarding the Company's business

that are not historical facts may be "forward-looking statements"

that involve risks and uncertainties. Specifically, statements

regarding the Company's financial guidance for 2007 and 2008, its

operational objectives for 2007, its acquisition of Vascular

Architects, and its direct sales strategy in Italy and the rest of

Europe are forward-looking statements involving risks and

uncertainties. The Company's Q3 2007 interim financial statements,

as discussed in this release, are preliminary and unaudited, and

subject to adjustment. Forward-looking statements are based on

management's current, preliminary expectations and are subject to

risks and uncertainties that could cause actual results to differ

from the results predicted. These risks and uncertainties include,

but are not limited to, the demand for and market acceptance of the

Company's products; the significant competition the Company faces

from other companies, technologies, and alternative medical

procedures; the Company's ability to expand its sales force,

particularly in Italy and other markets where the Company thinks it

is currently underrepresented; the extent to which the Company is

able to retain the existing customer base and sales network in

countries in which the Company converts from a distribution model

to a direct sales approach; the Company's ability to expand its

product offerings through internal development or acquisition and

to integrate acquired products into its business; the Company's

ability to realize the anticipated benefits of its acquisition of

Vascular Architects and other acquisitions; disruption at the

Company's single manufacturing facility; the general uncertainty

related to seeking regulatory approvals for the Company's products,

particularly in the United States; potential claims of third

parties that the Company's products infringe their intellectual

property rights; and the risks and uncertainties described in the

Company's Annual Report on Form 10-K for the year ended December

31, 2006, under the heading "Risk Factors," which has been filed

with the SEC and is available on the Company's investor relations

website at http://www.lemaitre.com/ and on the SEC's website at

http://www.sec.gov/, and in subsequent SEC filings. Undue reliance

should not be placed on forward-looking statements, which speak

only as of the date they are made. The Company undertakes no

obligation to update publicly any forward-looking statements to

reflect new information, events, or circumstances after the date

they were made, or to reflect the occurrence of unanticipated

events. Financial Statements LEMAITRE VASCULAR, INC (NASDAQ:LMAT)

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS (amounts in

thousands, except share data) (unaudited) For the three months For

the nine months ended: ended: September 30 September 30 2007 2006

2007 2006 Net sales $10,144 $8,540 $30,342 $25,871 Cost of sales

2,563 2,279 7,778 7,205 Gross profit 7,581 6,261 22,564 18,666

Operating expenses: Sales and marketing 4,583 3,525 14,131 10,639

General and administrative 2,341 1,536 6,917 5,050 Research and

development 1,144 805 3,416 2,586 Distributor termination costs

1,054 - 1,054 - Restructuring charges - 53 5 231 Impairment charge

- - 7 406 Total operating expenses 9,122 5,919 25,530 18,912 Income

(loss) from operations (1,541) 342 (2,966) (246) Other income

(expense): Interest income (expense) 359 (175) 1,054 (275) Other

income 221 21 275 152 Total other income (loss) 580 (154) 1,329

(123) Income (loss) before income taxes (961) 188 (1,637) (369)

Provision (benefit) for income taxes 393 (33) 119 129 Net income

(loss) $(1,354) $221 $(1,756) $(498) Net income (loss) per share of

common stock: Basic $(0.09) $0.01 $(0.11) $(0.09) Diluted $(0.09)

$0.01 $(0.11) $(0.09) Weighted average shares outstanding: Basic

15,410 8,497 15,376 8,497 Diluted 15,410 8,904 15,376 8,497

LEMAITRE VASCULAR, INC (NASDAQ:LMAT) CONDENSED CONSOLIDATED BALANCE

SHEETS (amounts in thousands) September 30, December 31, 2007 2006

(unaudited) (audited) Assets Current assets: Cash and cash

equivalents $7,752 $15,391 Marketable securities 17,885 15,417

Accounts receivable, net 6,221 5,060 Inventories 8,146 6,081 Other

current assets 1,096 1,692 Total current assets 41,100 43,641

Property and equipment, net 2,435 2,389 Goodwill 11,096 8,853 Other

intangibles, net 2,302 1,930 Other assets 162 150 Total assets

$57,095 $56,963 Liabilities and Stockholders' Equity Current

liabilities: Accounts payable $1,349 $818 Accrued expenses 5,391

4,528 Current portion of capital leases 0 32 Total current

liabilities 6,740 5,378 Deferred tax liabilities 833 833 Other

long-term liabilities 17 53 Total liabilities 7,590 6,264

Stockholders' equity: Common stock 155 153 Additional paid-in

capital 61,014 60,504 Accumulated deficit (11,702) (9,946)

Accumulated other comprehensive income 123 73 Less: Treasury stock

(85) (85) Total stockholders' equity 49,505 50,699 Total

liabilities and stockholders' equity $57,095 $56,963 LEMAITRE

VASCULAR, INC (NASDAQ:LMAT) SELECTED NET SALES INFORMATION (amounts

in thousands) (unaudited) For the three months ended: September 30

2007 2006 Net Sales by Product Category: $ % $ % Endovascular &

Dialysis $3,211 32% $2,412 28% Vascular 5,982 59% 5,203 61% General

Surgery 951 9% 925 11% $10,144 100% $8,540 100% Net Sales by

Geography: United States and Canada $6,236 61% $5,478 64% Outside

the United States and Canada 3,908 39% 3,062 36% $10,144 100%

$8,540 100% For the nine months ended: September 30 2007 2006 Net

Sales by Product Category: $ % $ % Endovascular & Dialysis

$10,256 34% $7,260 28% Vascular 17,216 57% 15,702 61% General

Surgery 2,870 9% 2,909 11% $30,342 100% $25,871 100% Net Sales by

Geography: United States and Canada $18,232 60% $16,595 64% Outside

the United States and Canada 12,110 40% 9,276 36% $30,342 100%

$25,871 100% DATASOURCE: LeMaitre Vascular, Inc. CONTACT: J.J.

Pellegrino, Chief Financial Officer of LeMaitre Vascular, Inc.,

+1-781-221-2266, ext. 106, Web site: http://www.lemaitre.com/

Copyright

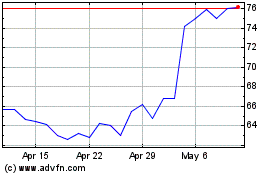

LeMaitre Vascular (NASDAQ:LMAT)

Historical Stock Chart

From Jun 2024 to Jul 2024

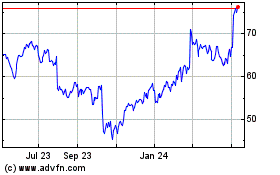

LeMaitre Vascular (NASDAQ:LMAT)

Historical Stock Chart

From Jul 2023 to Jul 2024