Form 8-K - Current report

July 17 2024 - 4:22PM

Edgar (US Regulatory)

SANFILIPPO JOHN B & SON INC false 0000880117 0000880117 2024-07-17 2024-07-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 17, 2024 (July 17, 2024)

JOHN B. SANFILIPPO & SON, INC.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

0-19681 |

|

36-2419677 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification Number) |

1703 North Randall Road, Elgin, Illinois 60123-7820

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (847) 289-1800

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12 (b) of the Act:

|

|

|

|

|

| Title of Each Class |

|

Trading Symbol |

|

Name of Each Exchange on Which Registered |

| Common Stock, $.01 par value per share |

|

JBSS |

|

The NASDAQ Stock Market LLC (NASDAQ Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On July 17, 2024, John B. Sanfilippo & Son, Inc. (the “Company”) issued a press release announcing that its Board of Directors declared a special cash dividend (the “Special Dividend”) of $1.25 per share on all issued and outstanding shares of Common Stock and Class A Common Stock of the Company and an annual cash dividend of $0.85 per share on all issued and outstanding shares of Common Stock and Class A Common Stock of the Company (the “Annual Dividend”). The Special Dividend and Annual Dividend will be paid on September 11, 2024 to stockholders of record as of the close of business on August 20, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

| ITEM 9.01. |

Financial Statements and Exhibits |

(d) Exhibits

The exhibits furnished herewith are listed in the Exhibit Index of this Current Report on Form 8-K.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

JOHN B. SANFILIPPO & SON, INC. |

|

|

|

|

| July 17, 2024 |

|

|

|

By: |

|

/s/ Frank S. Pellegrino |

|

|

|

|

|

|

Frank S. Pellegrino |

|

|

|

|

|

|

Chief Financial Officer, Executive Vice President, Finance and Administration |

Exhibit 99.1

JOHN B. SANFILIPPO & SON, INC. DECLARES $1.25 PER SHARE SPECIAL

DIVIDEND AND A REGULAR ANNUAL DIVIDEND OF $0.85 PER SHARE

Elgin, IL, July 17, 2024 — John B. Sanfilippo & Son, Inc. (NASDAQ: JBSS) (the “Company”) today

announced that its Board of Directors (the “Board”) declared a special cash dividend (the “Special Dividend”) of $1.25 per share on all issued and outstanding shares of Common Stock of the Company and $1.25 per share on all

issued and outstanding shares of Class A Common Stock of the Company. In addition to the Special Dividend, the Board declared a regular annual cash dividend (the “Annual Dividend”) of $0.85 per share on all issued and outstanding

shares of Common Stock of the Company and $0.85 per share on all issued and outstanding shares of Class A Common Stock of the Company. The aggregate payment of both the Special Dividend and Annual Dividend will return approximately

$24.6 million to JBSS stockholders.

The Special Dividend and the Annual Dividend will be paid on September 11, 2024, to stockholders of record

as of the close of business on August 20, 2024.

“We are pleased to announce the $1.25 per share Special Dividend and the $0.85 per share Annual

Dividend,” stated Jeffrey T. Sanfilippo, Chairman and Chief Executive Officer. “Our financial performance over the first three quarters of fiscal 2024 has provided us the opportunity to declare the Special Dividend and increase our Annual

Dividend by $0.05 per share over last year’s Annual Dividend. This year marks the seventh year in a row we have increased our Annual Dividend. These dividends, like our previous dividends, further reinforce our goal of creating long-term

stockholder value through the responsible use of cash. Furthermore, these dividends would not be possible without the hard work and dedication of all our employees,” Mr. Sanfilippo concluded.

ABOUT THE COMPANY

John B. Sanfilippo & Son,

Inc. is a processor, packager, marketer and distributor of nut and dried fruit-based products, snack bars, and dried cheese snacks that are sold under a variety of private brands and under the Company’s Fisher®, Orchard Valley Harvest®, Squirrel Brand®,

Southern Style Nuts®, and Just the Cheese ® brand names.

1

Forward Looking Statements

Some of the statements in this release are forward-looking. These forward-looking statements may be generally identified by the use of forward-looking words

and phrases such as “will”, “intends”, “may”, “believes”, “anticipates”, “should” and “expects” and are based on the Company’s current expectations or beliefs concerning

future events and involve risks and uncertainties. Consequently, the Company’s actual results could differ materially. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements, whether as a

result of new information, future events or other factors that affect the subject of these statements, except where expressly required to do so by law. Among the factors that could cause results to differ materially from current expectations are:

(i) sales activity for the Company’s products, such as a decline in sales to one or more key customers, or to customers or in the nut category generally, in some or all channels, a change in product mix to lower price products, a decline

in sales of private brand products or changing consumer preferences, including a shift from higher margin products to lower margin products; (ii) changes in the availability and costs of raw materials and ingredients and the impact of fixed

price commitments with customers; (iii) the ability to pass on price increases to customers if commodity costs rise and the potential for a negative impact on demand for, and sales of, our products from price increases; (iv) the ability to

measure and estimate bulk inventory, fluctuations in the value and quantity of the Company’s nut inventories due to fluctuations in the market prices of nuts and bulk inventory estimation adjustments, respectively; (v) the Company’s

ability to appropriately respond to, or lessen the negative impact of, competitive and pricing pressures; (vi) losses associated with product recalls, product contamination, food labeling or other food safety issues, or the potential for lost

sales or product liability if customers lose confidence in the safety of the Company’s products or in nuts or nut products in general, or are harmed as a result of using the Company’s products; (vii) the ability of the Company to

control costs (including inflationary costs) and manage shortages in areas such as inputs, transportation and labor; (viii) uncertainty in economic conditions, including the potential for inflation or economic downturn leading to decreased

consumer demand; (ix) the timing and occurrence (or nonoccurrence) of other transactions and events which may be subject to circumstances beyond the Company’s control; (x) the adverse effect of labor unrest or disputes, litigation

and/or legal settlements, including potential unfavorable outcomes exceeding any amounts accrued; (xi) losses due to significant disruptions at any of our production or processing facilities or employee unavailability due to labor shortages;

(xii) the ability to implement our Long-Range Plan, including growing our branded and private brand product sales, diversifying our product offerings (including by the launch of new products) and expanding into alternative sales channels;

(xiii) technology disruptions or failures or the occurrence of cybersecurity incidents or breaches; (xiv) the inability to protect the Company’s brand value, intellectual property or avoid intellectual property disputes; (xv) our

ability to manage the impacts of changing weather patterns on raw material availability due to climate change; and (xvi) our ability to operate and integrate the acquired snack bar related assets of TreeHouse and realize efficiencies and

synergies from such acquisition.

2

|

|

|

| Contacts: |

| Company |

|

Investor Relations |

| Frank S. Pellegrino |

|

John Beisler or Steven Hooser |

| Chief Financial Officer |

|

Three Part Advisors, LLC |

| 847-214-4138 |

|

817-310-8776 |

3

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

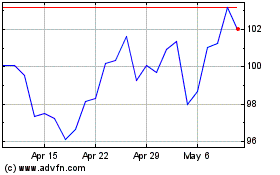

John B Sanfilippo and Son (NASDAQ:JBSS)

Historical Stock Chart

From Oct 2024 to Nov 2024

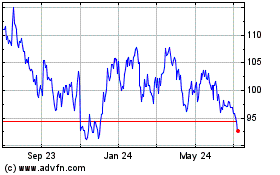

John B Sanfilippo and Son (NASDAQ:JBSS)

Historical Stock Chart

From Nov 2023 to Nov 2024