Wal-Mart Alters China Strategy, Taking a Partner -- WSJ

June 21 2016 - 3:05AM

Dow Jones News

By Rick Carew, Alyssa Abkowitz and Sarah Nassauer

Wal-Mart Stores Inc. is switching strategies in China, striking

a deal to forge a partnership with one of the country's largest

e-commerce players rather than continue trying to crack the

fast-growing but competitive market on its own.

Wal-Mart on Monday said it will sell its Yihaodian website to

JD.com Inc. -- the second-largest online retailer in China, after

Alibaba Group Holding Ltd. U.S.-based Wal-Mart will receive a 5%

stake in JD.com, valued at roughly $1.5 billion at recent prices,

and access to JD.com's delivery network and shoppers.

JD.com American depositary shares rose 4.6% to $21.06 on the

Nasdaq Stock Market amid the news, which was reported earlier by

The Wall Street Journal. Wal-Mart shares rose slightly to $71.10 on

the New York Stock Exchange.

The Chinese retail landscape has become cutthroat as the economy

slows and consumer buying behavior shifts online and to

mobile-phone purchases much faster than in the U.S. JD.com and

Alibaba are battling for customers, promising delivery in under an

hour in some cities and pushing into rural towns.

Wal-Mart has struggled to expand in the country, even though it

gets about one-third of its $482.1 billion in annual sales outside

the U.S. The retailer opened its first store in China in 1996 but

only has about 430 there today, or one-tenth as many as in the U.S.

Foot traffic to Wal-Mart's Chinese stores has fallen for nine

quarters straight, though spending per trip is on the rise.

The retailer first invested in Yihaodian in 2012 and took full

control of the business last year. The website has built a niche in

grocery sales but accounts for just 1.5% of China's retail

e-commerce market, according to data from consulting firm

iResearch. JD.com and Alibaba together command about 80% of the

market.

"We have seen high-quality U.S. retailers go into China and not

be that successful," said Charlie O'Shea, Moody's lead retail

analyst. Joining with JD.com "gives Wal-Mart an entree into China

that will be tough for it to do on its own," he said.

The sale allows Wal-Mart to quickly ramp up online sales

nationally in China, said Dan Toporek, a spokesman. Yihaodian is

strong in southern and eastern China, he said, but JD.com "vastly

expands our reach to a much broader set of customers in China and

also provides a physical network for delivery."

As part of the deal, Wal-Mart is giving up its right to start a

new Chinese website, but can continue to operate its local Wal-Mart

and Sam's Club apps and websites, according to financial filings.

The company expects the transaction to boost earnings by a range of

16 cents to 19 cents a share in the current quarter.

Wal-Mart said in July last year that it had taken full control

of Yihaodian from its minority partner, paying $760 million for the

49% stake it didn't already own. Wal-Mart executives have said they

want to move faster to grab a larger piece of the expanding online

and mobile Chinese shopping market, slowing the growth of their

store expansion in the country.

JD.com, like Wal-Mart, has focused on selling directly to

consumers. It has tried to expand its offerings as it competes with

the larger Alibaba, which operates consumer-to-consumer website

Taobao and merchant-to-consumer online marketplace Tmall. Unlike

Alibaba, JD.com has largely built out its own logistics network,

including dozens of warehouses and tens of thousands of delivery

workers.

JD.com has been chipping away at Alibaba's market share, and its

revenue growth has outpaced Alibaba for the past seven quarters.

Still, its market share in sales of products online to consumers is

about 23%, compared with TMall's 58%, according to data from

consulting firm iResearch.

Competition has heated up in Yihaodian's grocery niche as local

Chinese retailers have gone online and many startups have entered

the field to sell things as diverse as imported avocados and

dishwashing detergent. The deal will help JD.com broaden its

selection of imported products using Wal-Mart's supply chain, said

Mr. Toporek, the Wal-Mart spokesman.

JD.com has bolstered its food offerings, for example, through

its investment in FruitDay, a Chinese online produce retailer, and

is expanding imports, including signing deals with Australian milk

companies and U.S. meat and vegetable producers.

Morgan Stanley advised Wal-Mart on the latest deal, while JD.com

didn't have a financial adviser.

--Juro Osawa contributed to this article.

Write to Rick Carew at rick.carew@wsj.com, Alyssa Abkowitz at

alyssa.abkowitz@wsj.com and Sarah Nassauer at

sarah.nassauer@wsj.com

(END) Dow Jones Newswires

June 21, 2016 02:50 ET (06:50 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

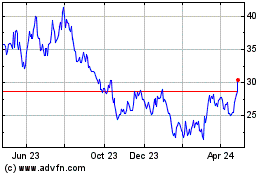

JD com (NASDAQ:JD)

Historical Stock Chart

From Jun 2024 to Jul 2024

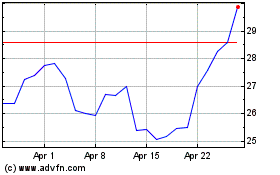

JD com (NASDAQ:JD)

Historical Stock Chart

From Jul 2023 to Jul 2024