Innovative Solutions & Support, Inc. (NASDAQ: ISSC) today

announced its financial results for the fiscal 2011 third quarter

ending June 30, 2011.

For the third quarter, the Company reported revenue of $6.0

million. Gross margins in the quarter were a strong 52.9%. For the

quarter, the Company had a modest operating loss and a net loss of

($78,980) or $0.00 per fully diluted share. Cash flow from

operations in the quarter was $0.2 million. For the third quarter

of 2010, the Company reported revenues of $7.8 million and net

income of $1.4 million, or $0.08 per diluted share.

Geoffrey Hedrick, Chairman and Chief Executive Officer of

Innovative Solutions & Support, Inc. said, “Results in the

quarter reflect a continued high level of investment in product

development and a steady operating performance in a very

challenging and uneven market, demonstrating the strength of our

strategy to build products capable of serving the general aviation,

military/defense and commercial air transport markets. Through the

first nine months of the year, we have not only grown revenues and

improved overall financial performance, but also have made

significant progress introducing new products and adding new

customers. Our resilient and flexible organization has enabled us

to strike a balance between the need to maintain financial

discipline in the near term while simultaneously investing to

strengthen our product portfolio and improve our competitive

position. Margins remain healthy. Research and development

investment levels have been maintained to further advance our

technology. Despite the continuing weakness in some of our end

markets and delays in contract awards, we are seeing an improvement

in order intake. Our order book grew in the quarter and order

intake for the quarter was almost equal to that of the first two

quarters combined. We are confident that the introduction of our

Flight Management System and the opening of the B737 market are

indicative of the growing interest in the innovative technical

approaches that have characterized our Company’s products and will

contribute to long term revenue growth. We will discuss new orders

more fully in our conference call tomorrow.”

The Company continues to have a strong balance sheet with cash

of $42.6 million and virtually no debt as of June 30, 2011. Backlog

was approximately $27 million at the end of the third quarter, up

from approximately $25 million at March 2011. The backlog is

comprised of a wider base of customers and broader set of

products.

Nine Month Results

Revenues were $19.2 million for the first three quarters of

2011, up from $17.8 million for the nine months ended June 30,

2010. For the nine months ended June 30, 2011, net income was

$704,952 or $0.04 per share compared to a net loss of ($502,906) or

($0.03) per fully diluted share for the nine months ended June 30,

2010. Cash flow from operations was $1.9 million for the nine

months ended June 30, 2011 compared to $2.6 million for the prior

year comparable period.

Roman Ptakowski, President of ISSC, added, “Recent new contracts

with BAE, Boeing for the KC-46A Air Force Tanker and our first B737

retrofit illustrate the growing market opportunities resulting from

new product development and marketing strategy. IS&S now has

400 B757/B767 aircraft flat panel display retrofits installed or

under contract. We are leveraging this experience to penetrate the

over 1000 aircraft in the B737 classic market. With the very strong

sales of the Company’s recently certified FMS product to Eclipse

Aircraft owners, we have tapped a market eager to accept the

exceptional values of our Company’s product. Strategically, we seek

to expand into new markets where we can leverage our low-cost,

high-quality technology and to broaden our product portfolio. As

the economy rebounds, we expect our recent successes to attract

greater market interest.”

Business Outlook

We expect the fourth quarter to be profitable and to generate

positive operating cash flow, which will result in a second

consecutive full year of profitability. Our ability to provide

specific targets and ranges remains difficult as a result of the

current economic climate. We will provide additional commentary

during our earnings conference call.

The Company will be hosting a conference call Thursday, July 28,

2011 at 10:00 AM EDT to discuss these results and its business

outlook. Please use the following dial in number to register your

name and company affiliation for the conference call: 877-718-5092.

The conference ID# is 6944024. The call will also be carried live

on the Investor Relations page of the Company web site at

www.innovative-ss.com.

About Innovative Solutions &

Support, Inc.

Headquartered in Exton, Pennsylvania, Innovative Solutions &

Support, Inc. (www.innovative-ss.com) is a systems integrator

engaged in the design, manufacture and marketing of Flat Panel

Display Systems, Flight Management Systems, Air Data equipment,

Flight Information Computers, Engine and Fuel Measurement and

Control Computers, and advanced monitoring systems that measure and

display critical flight information. This includes data relative to

aircraft separation, airspeed and altitude as well as fuel and

instrument measurements.

Certain matters contained herein are “forward-looking” (as such

term is defined in the Private Securities Litigation Reform Act of

1995). Because such statements include risks and uncertainties,

actual results may differ materially from those expressed or

implied by such forward-looking statements. Factors that could

cause results to differ materially from those expressed or implied

by such forward-looking statements include, but are not limited to,

those discussed in filings made by the Company with the Securities

and Exchange Commission. Many of the factors that will determine

the Company’s future results are beyond the ability of management

to control or predict. Readers should not place undue reliance on

forward-looking statements, which reflects management’s views only

as of the date hereof. The Company undertakes no obligation to

revise or update any forward-looking statements, or to make any

other forward-looking statements, whether as a result of new

information, future events or otherwise.

Innovative Solutions and Support, Inc.

Consolidated Statement of Operations (unaudited)

Three months ended

Nine months ended June 30 June 30 2011

2010 2011 2010 Sales $ 5,971,494 $

7,813,816 19,247,375 17,794,012 Cost of Sales

2,811,960 3,010,810 8,621,029

8,790,079 Gross Profit 3,159,534 4,803,006

10,626,346 9,003,933 Operating expenses: Research and

development 1,408,794 1,274,872 4,319,228 3,844,282 Selling,

general and administrative 1,855,675 1,938,411

5,794,167 5,965,876 Total

operating expenses 3,264,469 3,213,283 10,113,395 9,810,158

Operating (loss) income (104,935 ) 1,589,723 512,951 (806,225 )

Interest income 26,885 69,164 119,740 119,774 Interest

expense (350 ) (562 ) (1,212 ) (1,840 ) Other income 7

- 150,010 50,000

(Loss) income before income taxes (78,393 ) 1,658,325

781,489 (638,291 ) Income tax (benefit) expense 588

270,293 76,538 (135,385 )

Net (loss) income $ (78,981 ) $ 1,388,032 $ 704,951

$ (502,906 ) Net (loss) income per Common Share Basic

$ (0.00 ) $ 0.08 $ 0.04 $ (0.03 ) Diluted $ (0.00 ) $

0.08 $ 0.04 $ (0.03 ) Weighted Average Shares

Outstanding Basic 16,793,529 16,760,759 16,793,529 16,752,973

Diluted 16,793,529 16,799,157 16,839,817 16,752,973

Innovative Solutions and Support, Inc. Condensed

Consolidated Balance Sheet (unaudited)

June 30, September 30, 2011 2010

ASSETS

Current Assets Cash and cash equivalents $ 42,581,389 $ 40,916,346

Accounts receivable, net 3,064,685 2,529,976 Inventories 4,376,978

4,656,392 Deferred income taxes 418,853 522,352 Prepaid expenses

and other current assets 648,664 982,768

Total current assets 51,090,569 49,607,834

Property and equipment, net 7,557,379 7,761,538 Other assets

243,517 221,150 Total Assets $

58,891,465 $ 57,590,522

LIABILITIES AND

SHAREHOLDERS' EQUITY

Current Liabilities Current portion of capitalized lease

obligations $ 9,908 $ 9,908 Accounts payable 1,091,482 543,877

Accrued expenses 2,288,975 2,585,060 Deferred revenue

336,410 157,933 Total current

liabilities 3,726,775 3,296,778 Long-term portion of

capitalized lease obligations 6,431 15,560 Deferred revenue - 8,688

Deferred income taxes 546,993 649,929 Other liabilities

175,600 151,530 Total Liabilities

4,455,799 4,122,485 Commitments

and contingencies - - Shareholders' Equity

Preferred Stock, 10,000,000 shares

authorized, $.001 par value, of which 200,000 shares are authorized

as Class A Convertible stock. No shares issued and outstanding at

June 30, 2011 and September 30, 2010

- -

Common stock, $.001 par value: 75,000,000

shares authorized, 18,276,039 and 18,244,701 issued at June 30,

2011 and September 30, 2010

18,276 18,245 Additional paid-in capital 47,094,292

46,831,646 Retained earnings 26,614,604 25,909,652

Treasury stock, at cost, 1,482,510 shares

at June 30, 2011 and September 30, 2010

(19,291,506 ) (19,291,506 ) Total

Shareholders' Equity 54,435,666 53,468,037

Total Liabilities and Shareholders' Equity $

58,891,465 $ 57,590,522

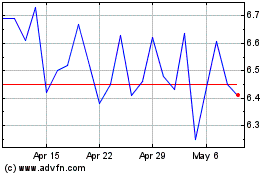

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From May 2024 to Jun 2024

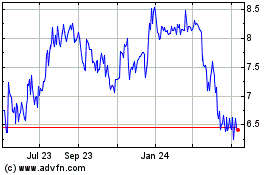

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Jun 2023 to Jun 2024