false

0000050493

0000050493

2024-05-09

2024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported) |

May 9, 2024 |

INGLES MARKETS, INCORPORATED

(Exact name of registrant as specified in its charter)

| North Carolina |

0-14706 |

56-0846267 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

| P.O. Box 6676, Asheville, NC |

28816 |

| (Address of principal executive offices) |

(Zip Code) |

| Registrant’s telephone number, including area code |

(828) 669-2941 |

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Class A Common Stock, $0.05

par value per share

|

IMKTA

|

The NASDAQ Global Select Market

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

Emerging growth company

|

☐

|

| |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

☐

|

Item 2.02 Results of Operations and Financial Condition.

On May 9, 2024, Ingles Markets, Incorporated ("IMKTA") issued a press release announcing financial information for its second quarter ended March 30, 2024. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference in this Item 2.02.

Item 7.01 Regulation FD Disclosure.

The disclosure contained in Item 2.02 of this Current Report on Form 8-K is incorporated into this Item 7.01 by reference.

The information contained in this Current Report on Form 8-K, including Exhibit 99.1 furnished herewith, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section, nor shall it be deemed incorporated by reference into any registration statement or other documents pursuant to the Securities Act of 1933, as amended, or into any filing or other document pursuant to the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

| |

Exhibit Number |

Description of Exhibit |

| |

99.1

|

|

| |

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

INGLES MARKETS, INCORPORATED |

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

| Date: May 9, 2024 |

|

|

|

|

|

By:

|

/s/ Patricia E. Jackson

|

|

|

|

|

Patricia E. Jackson |

|

|

|

|

Chief Financial Officer |

|

Exhibit 99.1

PRESS RELEASE

| Ingles Markets, Inc. |

|

| Contact: Pat Jackson, Chief Financial Officer |

May 9, 2024 |

| pjackson@ingles-markets.com |

For Immediate Release |

| (828) 669-2941 (Ext. 223) |

|

Ingles Markets, Incorporated Reports Results

for Second Quarter and First Six Months of Fiscal 2024

ASHEVILLE, N.C. - Ingles Markets, Incorporated (NASDAQ: IMKTA) today reported sales for the three and six months ended March 30, 2024.

Robert P. Ingle II, Chairman of the Board, stated, “We are pleased with our results and thank all our associates for their continued service to our customers and company.”

Second Quarter 2024 Results

Net sales totaled $1.37 billion for the quarter ended March 30, 2024, a decrease of 0.95% compared with $1.38 billion for the quarter ended March 25, 2023.

Gross profit for the second quarter of fiscal 2024 totaled $321.9 million, or 23.5% of sales. Gross profit for the second quarter of fiscal 2023 was $325.9 million, or 23.6% of sales.

Operating and administrative expenses for the second quarter of fiscal 2024 totaled $284.8 million, as compared with $268.9 million for the second quarter of fiscal 2023.

Interest expense totaled $5.6 million for the second quarter of fiscal 2024, as compared with $5.3 million for the second quarter of fiscal 2023.

Net income totaled $31.9 million for the second quarter of fiscal 2024, as compared with $40.5 million for the second quarter of fiscal 2023. Basic and diluted earnings per share for Class A Common Stock were $1.72 and $1.68, respectively, for the quarter ended March 30, 2024, as compared with $2.18 and $2.13, respectively, for the quarter ended March 25, 2023.

First Half Fiscal 2024 Results

First half fiscal 2024 net sales totaled $2.85 billion, a decrease of 0.88% compared with $2.87 billion in the first half of fiscal 2023.

Gross profit for the six months ended March 30, 2024, totaled $670.7 million, as compared with $697.1 million for the first six months of last fiscal year. Gross profit, as a percentage of sales, was 23.5% for the first half of fiscal 2024, compared with 24.3% for the first half of fiscal 2023.

Operating and administrative expenses totaled $574.6 million for the six months ended March 30, 2024, as compared to $545.1 million for the six months ended March 25, 2023.

PRESS RELEASE

Interest expense increased to $11.3 million for the six-month period ended March 30, 2024, as compared with $10.7 million for the six-month period ended March 25, 2023. Total debt as of March 30, 2024, was $539.1 million compared with $556.7 million as of March 25, 2023.

Net income totaled $75.3 million for the six-month period ended March 30, 2024, as compared with $109.9 million for the six-month period ended March 25, 2023. Basic and diluted earnings per share for Class A Common Stock were $4.05 and $3.96, respectively, for the six months ended March 30, 2024, as compared to $5.92 and $5.79, respectively, for the six months ended March 25, 2023.

Capital expenditures for the first half of fiscal 2024 totaled $98.4 million compared with $91.4 million for the first half of fiscal 2023.

The Company currently has no outstanding borrowings under its $150.0 million line of credit. The Company believes its financial resources, including its line of credit and other internal and external sources of funds, will be sufficient to meet planned capital expenditures, debt service and working capital requirements for the foreseeable future.

About Ingles Markets, Incorporated

Ingles Markets, Incorporated is a leading grocer with operations in six southeastern states. Headquartered in Asheville, North Carolina, the Company operates 198 supermarkets. In conjunction with its supermarket operations, the Company operates neighborhood shopping centers, most of which contain an Ingles supermarket. The Company also owns a fluid dairy facility that supplies Ingles supermarkets and unaffiliated customers. To learn more about Ingles Markets visit ingles-markets.com.

Cautionary Note Regarding Forward-Looking Statements

This press release includes certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may address, among other things, our expected financial and operational results and the related assumptions underlying our expected results. These forward-looking statements are distinguished by use of words such as “anticipate,” “aim,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” and the negative of these terms, and similar references to future periods. These statements are based on management’s current expectations and are subject to uncertainty and changes in circumstances. Actual results may differ materially from these expectations due to, among other things: business and economic conditions generally in the Company’s operating area, including inflation or deflation; shortages of labor, distribution capacity, and some product shortages; inflation in food, labor and gasoline prices; the Company’s ability to successfully implement our expansion and operating strategies; pricing pressures and other competitive factors, including online-based procurement of products the Company sells; sudden or significant changes in the availability of gasoline and retail gasoline prices; the maturation of new and expanded stores; general concerns about food safety; the Company’s ability to manage technology and data security; the availability and terms of financing; and increases in costs, including food, utilities, labor and other goods and services significant to the Company’s operations. Detailed information about these factors and additional important factors can be found in the documents that the Company files with the Securities and Exchange Commission, such as Form 10-K, Form 10-Q and Form 8-K. Forward-looking statements speak only as of the date the statements were made. The Company does not undertake an obligation to update forward-looking information, except to the extent required by applicable law.

PRESS RELEASE

INGLES MARKETS, INCORPORATED

(Amounts in thousands except per share data)

Unaudited Financial Highlights

Condensed Consolidated Statements of Income (Unaudited)

| |

|

Three Months Ended

|

|

|

Six Months Ended

|

|

| |

|

March 30,

|

|

|

March 25,

|

|

|

March 30,

|

|

|

March 25,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$ |

1,367,480 |

|

|

$ |

1,380,604 |

|

|

$ |

2,848,542 |

|

|

$ |

2,873,918 |

|

|

Gross profit

|

|

|

321,885 |

|

|

|

325,940 |

|

|

|

670,686 |

|

|

|

697,095 |

|

|

Operating and administrative expenses

|

|

|

284,762 |

|

|

|

268,890 |

|

|

|

574,589 |

|

|

|

545,069 |

|

|

Gain from sale or disposal of assets

|

|

|

7,686 |

|

|

|

597 |

|

|

|

8,339 |

|

|

|

1,377 |

|

|

Income from operations

|

|

|

44,809 |

|

|

|

57,647 |

|

|

|

104,436 |

|

|

|

153,403 |

|

|

Other income, net

|

|

|

3,381 |

|

|

|

1,734 |

|

|

|

6,988 |

|

|

|

3,176 |

|

|

Interest expense

|

|

|

5,587 |

|

|

|

5,344 |

|

|

|

11,294 |

|

|

|

10,692 |

|

|

Income tax expense

|

|

|

10,704 |

|

|

|

13,497 |

|

|

|

24,838 |

|

|

|

35,976 |

|

|

Net income

|

|

$ |

31,899 |

|

|

$ |

40,540 |

|

|

$ |

75,292 |

|

|

$ |

109,911 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per common share – Class A

|

|

$ |

1.72 |

|

|

$ |

2.18 |

|

|

$ |

4.05 |

|

|

$ |

5.92 |

|

|

Diluted earnings per common share – Class A

|

|

$ |

1.68 |

|

|

$ |

2.13 |

|

|

$ |

3.96 |

|

|

$ |

5.79 |

|

|

Basic earnings per common share – Class B

|

|

$ |

1.56 |

|

|

$ |

1.98 |

|

|

$ |

3.68 |

|

|

$ |

5.38 |

|

|

Diluted earnings per common share – Class B

|

|

$ |

1.56 |

|

|

$ |

1.98 |

|

|

$ |

3.68 |

|

|

$ |

5.38 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional selected information:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization expense

|

|

$ |

29,249 |

|

|

$ |

28,864 |

|

|

$ |

58,023 |

|

|

$ |

57,970 |

|

|

Rent expense

|

|

$ |

2,664 |

|

|

$ |

2,740 |

|

|

$ |

5,057 |

|

|

$ |

5,329 |

|

Condensed Consolidated Balance Sheets (Unaudited)

| |

|

March 30,

|

|

|

Sept. 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

302,018 |

|

|

$ |

328,540 |

|

|

Receivables-net

|

|

|

109,444 |

|

|

|

107,571 |

|

|

Inventories

|

|

|

479,130 |

|

|

|

493,860 |

|

|

Other current assets

|

|

|

26,530 |

|

|

|

22,586 |

|

|

Property and equipment-net

|

|

|

1,480,038 |

|

|

|

1,431,872 |

|

|

Other assets

|

|

|

89,148 |

|

|

|

89,417 |

|

|

TOTAL ASSETS

|

|

$ |

2,486,308 |

|

|

$ |

2,473,846 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Current maturities of long-term debt

|

|

$ |

17,521 |

|

|

$ |

17,527 |

|

|

Accounts payable, accrued expenses and current portion of other long-term liabilities

|

|

|

269,440 |

|

|

|

313,007 |

|

|

Deferred income taxes

|

|

|

63,561 |

|

|

|

67,187 |

|

|

Long-term debt

|

|

|

521,597 |

|

|

|

532,632 |

|

|

Other long-term liabilities

|

|

|

88,747 |

|

|

|

84,521 |

|

|

Total Liabilities

|

|

|

960,866 |

|

|

|

1,014,874 |

|

|

Stockholders' equity

|

|

|

1,525,442 |

|

|

|

1,458,972 |

|

|

TOTAL LIABILITIES AND

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY

|

|

$ |

2,486,308 |

|

|

$ |

2,473,846 |

|

v3.24.1.u1

Document And Entity Information

|

May 09, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

INGLES MARKETS, INCORPORATED

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 09, 2024

|

| Entity, Incorporation, State or Country Code |

NC

|

| Entity, File Number |

0-14706

|

| Entity, Tax Identification Number |

56-0846267

|

| Entity, Address, Address Line One |

P.O. Box 6676

|

| Entity, Address, City or Town |

Asheville

|

| Entity, Address, State or Province |

NC

|

| Entity, Address, Postal Zip Code |

28816

|

| City Area Code |

828

|

| Local Phone Number |

669-2941

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock

|

| Trading Symbol |

IMKTA

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000050493

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

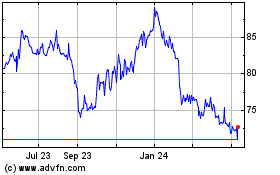

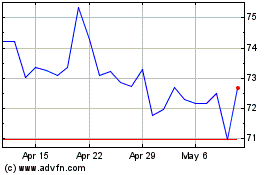

Ingles Markets (NASDAQ:IMKTA)

Historical Stock Chart

From Apr 2024 to May 2024

Ingles Markets (NASDAQ:IMKTA)

Historical Stock Chart

From May 2023 to May 2024