Infinera Corporation (NASDAQ: INFN) ("Infinera" or the “Company”)

today released preliminary financial results for its fourth quarter

ended December 30, 2023.

For the fourth quarter,

- Preliminary revenue is expected to be

$435 million to $452 million, compared to the Company’s prior

outlook of $421 million to $451 million.

- The resulting preliminary GAAP gross margin is expected to be

38.0% to 40.0%, compared to the Company’s prior outlook of 37.3% to

40.4%.

- The resulting preliminary GAAP operating margin is expected to

be 0.0% to 3.0%, compared to the Company’s prior outlook of 0.7% to

5.0%.

- The resulting preliminary GAAP net income (loss) per diluted

share is expected to be ($0.02) to $0.04, compared to the Company’s

prior outlook of ($0.04) to $0.04.

- Preliminary non-GAAP gross margin is expected to be 39.0% to

41.0%, compared to the Company’s prior outlook of 38.0% to 41.0%,

and the preliminary non-GAAP operating margin is expected to be

5.7% to 8.3%, compared to the Company’s prior outlook of 5.5% to

9.5%.

- Preliminary non-GAAP net income per diluted share is expected

to be $0.07 to $0.13, compared to the Company’s prior outlook of

$0.05 to $0.13 per diluted share.

- Preliminary cash and cash equivalents, including restricted

cash, was approximately $174 million.

Infinera CEO David Heard said, “We ended 2023 on a high note

with a strong fourth quarter during which the midpoints of our

preliminary revenue, gross margin, and earnings per share ranges

are all expected to come in above those of our prior outlook

ranges. For the full year of 2023, we expect to deliver our sixth

consecutive year of revenue growth, expand gross margin to a level

approaching 40%, and grow earnings per share on a year-over-year

basis.”

“As we look ahead, like the rest of the industry, we are

expecting a slow first half of the year. Regardless, both the pace

and scale of our design wins are accelerating. Already, in the

first 60 days of 2024, we have achieved major hyperscale-influenced

strategic wins, one of which is among the most significant in the

Company’s history, based on our Systems and Subsystems solutions.

These strategic wins, combined with our design win funnel, position

us well to deliver a stronger second half and place us on a path to

achieve our seventh consecutive year of revenue growth with

continued margin and earnings per share expansion,” continued Mr.

Heard.

Financial Outlook

Infinera's outlook for the quarter ending March 30, 2024,

is as follows:

- Revenue is expected to be $320 million

to $350 million.

- GAAP gross margin is expected to be

35.3% to 37.4%. Non-GAAP gross margin is expected to be 36.0% to

38.0%.

- GAAP operating expenses are expected to

be $157 million to $161 million. Non-GAAP operating expenses

are expected to be $143 million to $147 million.

- GAAP operating margin is expected to be

(13.5%) to (8.2%). Non-GAAP operating margin is expected to be

(8.5%) to (3.5%).

- GAAP net loss per diluted share is

expected to be ($0.25) to ($0.17). Non-GAAP net loss per diluted

share is expected to be ($0.18) to ($0.10).

A further explanation of the use of non-GAAP financial

information and a reconciliation of each of the non-GAAP financial

measures to the most directly comparable GAAP financial measure can

be found at the end of this press release.

On February 29, 2024, the Company filed a Notification of Late

Filing on Form 12b-25 pursuant to which it disclosed it would not

be able to file its Annual Report on Form 10-K for its fiscal year

ended December 30, 2023 (the “Form 10-K”) by February 28, 2024, the

original due date for such filing, without unreasonable effort or

expense due to the circumstances described below.

Subsequent to the filing of the Company’s Form 10-K and

Quarterly Reports on Form 10-Q for the periods ended December 31,

2022, April 1, 2023 and July 1, 2023, respectively, Ernst &

Young LLP (“EY”), the Company’s independent registered public

accounting firm, informed the Company that the Public Company

Accounting Oversight Board had commenced an inspection of EY’s

audit of the Company’s consolidated financial statements for the

fiscal year ended December 31, 2022. Subsequently, EY raised

questions regarding the Company’s stand-alone sales price (“SSP”)

methodology as it relates to revenue allocation between product

revenue, which is recognized upon delivery, and certain components

of services revenue, which is amortized over a period of time. In

addition, EY raised questions regarding the sufficiency of

documentation retained by the Company related to the revenue

portion of its quote to cash cycle (revenue cycle) and its

inventory cycle. As a result of these queries, the Company

reexamined its SSP methodology and engaged in an evaluation of its

review procedures related to its revenue cycle and its inventory

cycle.

Subsequently, the Company’s management concluded that, as of

December 31, 2022, there were material weaknesses in its internal

control over financial reporting related to its revenue cycle,

inventory cycle, and with respect to these, its internal resources,

expertise and policies required to maintain an effective control

environment. As a result, the Company’s internal control over

financial reporting was not effective, as of December 31, 2022, and

continues to be ineffective, and these material weaknesses are

unremediated to date. Furthermore, the Company’s Chief Executive

Officer and Chief Financial Officer have determined that because of

these material weaknesses, the Company’s disclosure controls and

procedures were not effective at a reasonable assurance level as of

December 31, 2022, April 1, 2023, July 1, 2023 and September 30,

2023.

On February 29, 2024, the Company filed a Form 10-K/A for the

period ended December 31, 2022, a Form 10-Q/A for the period ended

April 1, 2023, a Form 10-Q/A for the period ended July 1, 2023 and

a Form 10-Q for the period ended September 30, 2023.

The Company intends to delay the filing of its Form 10-K until

the Company completes its year-end closing procedures in light of

the delays caused by the circumstances described above.

Conference Call Information

Infinera will host a conference call for analysts and investors

to discuss its preliminary results for the fourth quarter of 2023

and its preliminary outlook for the first quarter of 2024 today at

5:00 p.m. Eastern Time (2:00 p.m. Pacific Time). Interested parties

may register for the conference call at

https://registrations.events/direct/Q4I60869206. A live webcast of

the conference call will also be accessible from the Events section

of Infinera’s website at investors.infinera.com. Replay of the

audio webcast will be available at investors.infinera.com

approximately two hours after the end of the live call.

Contacts:

Media:Anna VueTel. +1 (916) 595-8157avue@infinera.com

Investors:Amitabh Passi, Head of Investor RelationsTel. +1 (669)

295-1489apassi@infinera.com

About Infinera

Infinera is a global supplier of innovative open optical

networking solutions and advanced optical semiconductors that

enable carriers, cloud operators, governments, and enterprises to

scale network bandwidth, accelerate service innovation, and

automate network operations. Infinera solutions deliver

industry-leading economics and performance in long-haul, submarine,

data center interconnect, and metro transport applications. To

learn more about Infinera, visit www.infinera.com, follow us on X

and LinkedIn, and subscribe for updates. Infinera and the Infinera

logo are registered trademarks of Infinera Corporation.

Forward-Looking Statements

This press release contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Forward-looking

statements generally relate to future events or Infinera's future

financial or operating performance. In some cases, you can identify

forward-looking statements because they contain words such as

"anticipate," "believe," "could," "estimate," "expect," "intend,"

"may," "should," "will," and "would" or the negative of these words

or similar terms or expressions that concern Infinera's

expectations, strategy, priorities, plans or intentions.

Forward-looking statements in this press release include, but are

not limited to, statements regarding the Company’s future business

plans, strategy and growth opportunities, including progress

against strategic priorities and milestones; expectations regarding

Infinera’s future performance; the Company's expectations related

to the timing of filing of its Form 10-K for the fiscal year ended

December 30, 2023; the Company's expectations related to its

preliminary financial results for the fourth quarter of fiscal

2023; the Company's expectations related to its preliminary outlook

for the first quarter of fiscal 2024; the Company's business

strategy; and the Company's expectations for fiscal 2024, including

revenue growth with continued margin and earnings per share

expansion. Neither Infinera, nor its auditors, has completed the

review of its financial results for the fourth quarter of fiscal

2023.

Infinera’s financial results for the fourth quarter of fiscal

year 2023 are subject to all aspects of the final quarterly and

annual review process and may change as a result of new information

that arises, or new determinations that are made, in this

process.

These forward-looking statements are based on estimates and

information available to Infinera as of the date hereof and are not

guarantees of future performance; actual results could differ

materially from those stated or implied due to risks and

uncertainties. The risks and uncertainties that could cause

Infinera’s results to differ materially from those expressed or

implied by such forward-looking statements include demand growth

for additional network capacity and the level and timing of

customer capital spending and excess inventory held by customers

beyond normalized levels; delays in the development, introduction

or acceptance of new products or in releasing enhancements to

existing products; aggressive business tactics by Infinera’s

competitors and new entrants and Infinera's ability to compete in a

highly competitive market; supply chain and logistics issues,

including delays, shortages, components that have been discontinued

and increased costs, and Infinera's dependency on sole source,

limited source or high-cost suppliers; dependence on a small number

of key customers; product performance problems; the complexity of

Infinera's manufacturing process; Infinera's ability to identify,

attract, upskill and retain qualified personnel; challenges with

our contract manufacturers and other third-party partners; the

effects of customer and supplier consolidation; dependence on

third-party service partners; Infinera’s ability to respond to

rapid technological changes; failure to accurately forecast

Infinera's manufacturing requirements or customer demand; the

effects of public health emergencies; Infinera’s future capital

needs and its ability to generate the cash flow or otherwise secure

the capital necessary to meet such capital needs; the effect of

global and regional economic conditions on Infinera’s business,

including effects on purchasing decisions by customers; the adverse

impact inflation and higher interest rates may have on Infinera by

increasing costs beyond what it can recover through price

increases; restrictions to our operations resulting from loan or

other credit agreements; the impacts of any restructuring plans or

other strategic efforts on our business; our international sales

and operations; the impacts of foreign currency fluctuations; the

effective tax rate of Infinera, which may increase or fluctuate;

potential dilution from the issuance of additional shares of common

stock in connection with the conversion of Infinera's convertible

senior notes; Infinera’s ability to protect its intellectual

property; claims by others that Infinera infringes on their

intellectual property rights; security incidents, such as data

breaches or cyber-attacks; Infinera's ability to comply with

various rules and regulations, including with respect to export

control and trade compliance, environmental, social, governance,

privacy and data protection matters; events that are outside of

Infinera's control, such as natural disasters, violence or other

catastrophic events that could harm Infinera's operations;

Infinera’s ability to remediate its recently disclosed material

weaknesses in internal control over financial reporting in a timely

and effective manner, and other risks and uncertainties detailed in

Infinera’s SEC filings from time to time. More information on

potential factors that may impact Infinera’s business are set forth

in Infinera's periodic reports filed with the SEC, including its

Annual Report on Form 10-K for the year ended December 31, 2022, as

filed with the SEC on February 27, 2023, and amended February 29,

2024, and its Quarterly Report on Form 10-Q for the quarter ended

September 30, 2023, filed with the SEC on February 29, 2024, as

well as subsequent reports filed with or furnished to the SEC from

time to time. These reports are available on Infinera’s website at

www.infinera.com and the SEC’s website at www.sec.gov. Infinera

assumes no obligation to, and does not currently intend to, update

any such forward-looking statements.

Use of Non-GAAP Financial Information

In addition to disclosing financial measures prepared in

accordance with U.S. Generally Accepted Accounting Principles

(GAAP), this press release and the accompanying tables contain

certain non-GAAP financial measures that exclude in certain cases

stock-based compensation expenses, amortization of acquired

intangible assets, and restructuring and other related costs.

Infinera believes these adjustments are appropriate to enhance an

overall understanding of its underlying financial performance and

also its prospects for the future and are considered by management

for the purpose of making operational decisions. In addition, the

non-GAAP financial measures presented in this press release are the

primary indicators management uses as a basis for its planning and

forecasting of future periods. The presentation of this additional

information is not meant to be considered in isolation or as a

substitute for revenue, gross margin, operating expenses, operating

margin, net income (loss) and net income (loss) per common share

prepared in accordance with GAAP. Non-GAAP financial measures are

not based on a comprehensive set of accounting rules or principles

and are subject to limitations.

Infinera has included forward-looking non-GAAP information in

this press release, including an estimate of certain non-GAAP

financial measures for the first quarter of 2024 that excludes

stock-based compensation expense, amortization of acquired

intangible assets, and restructuring and other related costs.

A reconciliation of preliminary GAAP to non-GAAP financials for

the fourth quarter of 2023 and the first quarter of 2024 is

included in the table below.

Infinera

CorporationGAAP to Non-GAAP

Reconciliations(In millions, except

percentages)(Unaudited)

| |

|

Q4'23Preliminary |

|

Q1'24Outlook |

| |

|

Low |

|

High |

|

Low |

|

High |

| Reconciliation of Gross

Margin: |

|

|

|

|

|

|

|

|

|

GAAP |

|

|

38.0 |

% |

|

|

40.0 |

% |

|

|

35.3 |

% |

|

|

37.4 |

% |

| Stock-based compensation

expense(1) |

|

|

0.5 |

% |

|

|

0.5 |

% |

|

|

0.7 |

% |

|

|

0.6 |

% |

| Restructuring and other related

costs(3) |

|

|

0.5 |

% |

|

|

0.5 |

% |

|

|

— |

% |

|

|

— |

% |

| Non-GAAP |

|

|

39.0 |

% |

|

|

41.0 |

% |

|

|

36.0 |

% |

|

|

38.0 |

% |

| |

|

|

|

|

|

|

|

|

| Reconciliation of

Operating Expenses: |

|

|

|

|

|

|

|

|

| GAAP |

|

$ |

165.0 |

|

|

$ |

167.0 |

|

|

$ |

157.0 |

|

|

$ |

161.0 |

|

| Stock-based compensation

expense(1) |

|

|

(13.6 |

) |

|

|

(13.6 |

) |

|

|

(11.4 |

) |

|

|

(11.4 |

) |

| Amortization of acquired

intangible assets(2) |

|

|

(2.3 |

) |

|

|

(2.3 |

) |

|

|

(2.3 |

) |

|

|

(2.3 |

) |

| Restructuring and other related

costs(3) |

|

|

(4.1 |

) |

|

|

(4.1 |

) |

|

|

(0.3 |

) |

|

|

(0.3 |

) |

| Non-GAAP |

|

$ |

145.0 |

|

|

$ |

147.0 |

|

|

$ |

143.0 |

|

|

$ |

147.0 |

|

| |

|

|

|

|

|

|

|

|

| Reconciliation of

Operating Margin: |

|

|

|

|

|

|

|

|

| GAAP |

|

|

— |

% |

|

|

3.0 |

% |

|

(13.5)% |

|

(8.2)% |

| Stock-based compensation

expense(1) |

|

|

3.8 |

% |

|

|

3.4 |

% |

|

|

4.2 |

% |

|

|

3.9 |

% |

| Amortization of acquired

intangible assets(2) |

|

|

0.5 |

% |

|

|

0.5 |

% |

|

|

0.7 |

% |

|

|

0.7 |

% |

| Restructuring and other related

costs(3) |

|

|

1.4 |

% |

|

|

1.4 |

% |

|

|

0.1 |

% |

|

|

0.1 |

% |

| Non-GAAP |

|

|

5.7 |

% |

|

|

8.3 |

% |

|

(8.5)% |

|

(3.5)% |

| |

|

|

|

|

|

|

|

|

|

Reconciliation of Net Income (Loss) per Common Share -

Diluted: |

|

|

| GAAP |

|

$ |

(0.02 |

) |

|

$ |

0.04 |

|

|

$ |

(0.25 |

) |

|

$ |

(0.17 |

) |

| Stock-based compensation

expense(1) |

|

|

0.06 |

|

|

|

0.06 |

|

|

|

0.06 |

|

|

|

0.06 |

|

| Amortization of acquired

intangible assets(2) |

|

|

0.01 |

|

|

|

0.01 |

|

|

|

0.01 |

|

|

|

0.01 |

|

| Restructuring and other related

costs(3) |

|

|

0.02 |

|

|

|

0.02 |

|

|

|

0.00 |

|

|

|

0.00 |

|

| Non-GAAP |

|

$ |

0.07 |

|

|

$ |

0.13 |

|

|

$ |

(0.18 |

) |

|

$ |

(0.10 |

) |

(1) Stock-based compensation expense is calculated in

accordance with the fair value recognition provisions of Financial

Accounting Standards Board Accounting Standards Codification Topic

718, Compensation – Stock Compensation effective January 1,

2006.

(2) Amortization of acquired intangible assets consists of

customer relationships acquired in connection with the acquisition

of Coriant. GAAP accounting requires that acquired intangible

assets are recorded at fair value and amortized over their useful

lives. As this amortization is non-cash, Infinera has excluded it

from its preliminary non-GAAP gross profit, operating expenses and

net income measures. Management believes the amortization of

acquired intangible assets is not indicative of ongoing operating

performance and its exclusion provides a better indication of

Infinera's underlying business performance.

(3) Restructuring and other related costs are primarily

associated with the reduction of operating costs and the reduction

of headcount. Management has excluded the impact of these charges

in arriving at Infinera's non-GAAP results as they are

non-recurring in nature and its exclusion provides a better

indication of Infinera's underlying business performance.

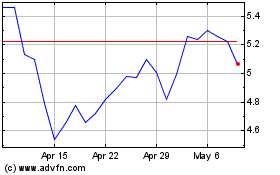

Infinera (NASDAQ:INFN)

Historical Stock Chart

From Oct 2024 to Nov 2024

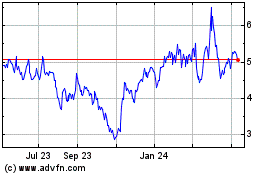

Infinera (NASDAQ:INFN)

Historical Stock Chart

From Nov 2023 to Nov 2024