Update on Roche's Illumina Buy - Analyst Blog

March 15 2012 - 11:19AM

Zacks

Roche Holdings Ltd. (RHHBY) recently announced

that the Federal Trade Commission (FTC) has requested for

additional information regarding the company’s proposed acquisition

of Illumina, Inc. (ILMN). The request, termed as a

‘second request,' seeks additional information about Roche’s

microarray business.

The second request extends the waiting period, imposed by the

Hart-Scott-Rodino Antitrust Improvements Act, by 10 days after

Roche complies with the request. The extension can be increased

voluntarily by Roche or terminated sooner by the FTC.

We note that Roche had first announced its bid earlier this year

in January, to acquire all shares of Illumina at an offer price of

$44.50 per share (aggregate value $5.7 billion) in cash.

Roche had made multiple efforts in the past to strike a deal

with Illumina, but the latter was unwilling to participate in

substantive discussions. This led Roche to commence a tender offer

to purchase Illumina’s outstanding shares.

Post the potential acquisition, Roche intends to combine

Illumina with its Applied Science business, thereby strengthening

its current offerings in the Life Science market. Roche operates

through two segments – Pharmaceuticals and Diagnostics. Applied

Science is a wing under the company’s Diagnostics division.

Roche believes that this acquisition will strengthen its

position in the sequencing and microarrays market. Moreover, it

will help address the growing demand for genetic/genomic

solutions.

We currently have a Zacks #2 Rank (short-term Buy rating) on

Roche. We believe that this transaction will add to the company’s

portfolio, thereby driving long-term growth.

ILLUMINA INC (ILMN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

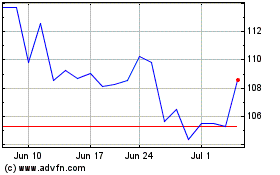

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Jul 2023 to Jul 2024