Roche Extends Hostile Offer For Illumina On Unchanged Terms

February 27 2012 - 4:30AM

Dow Jones News

Roche Holding AG's (ROG.VX) Monday extended its buyout offer for

U.S. diagnostics company Illumina Inc. (ILMN) until March 23

without changing the terms of its hostile bid, a move that was

expected and is consistent with the Swiss pharmaceutical giant's

past M&A strategy.

Roche is bidding $44.50 a share for the San Diego-based group,

an offer it views as "full and fair," but one that Illumina has

dismissed as too low. The Basel-based company said Monday that it

is still offering the same price for Illumina shares, valuing the

buyout at $5.7 billion, with the period now extended to 6:00 p.m.,

New York City time, on March 23.

Roche has a history of success with hostile acquisitions and

also faces little risk of that rival bidders will jump into the

fray.

Earlier buys by the world's leading cancer drug maker, such as

that of diagnostic test-maker Ventana or U.S. biotech group

Genentech, indicate that Roche is content to take its time with

deals and that it will ultimately prevail with a sweetened

offer.

Roche took seven months to buy Ventana for $3.4 billion in 2008.

A year later the Swiss firm fully acquired Genentech, paying $46.8

billion to acquire the 44% of Genentech Inc. that it didn't already

own after a protracted and bumpy takeover process.

"It may take six to 12 months and a sweetened offer," but Roche

will win in the end, Bank Vontobel said Monday.

Most analysts agree and see an eventual deal done in the region

of $60-$65 for each Illumina share.

The California-based target remained frosty toward Roche's

overtures, saying that "the extension by Roche was expected."

Illumina's icy stance might be understandable given that the

company's stock as recently as last summer traded in the region of

$70 a share.

Responding to Roche's tender offer extension, Illumina said that

"an extremely low number of shares have been tendered, consistent

with our view--and that of our stockholders--that Roche's offer

does not reflect Illumina unique leadership position, business

performance and future prospects."

Only around 0.1% of Illumina's stock--some 102,165 shares--have

so far been tendered to Roche, the Swiss company said.

Roche shares at 0850 were down CHF1.1, or 0.6%, at CHF158.30 but

up 15% from year-ago levels.

Illumina shares ended Friday down 0.9% at $51.22.

-By Sten Stovall, Dow Jones Newswires; +44 207 842 9292;

sten.stovall@dowjones.com

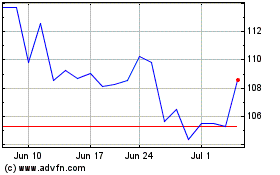

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From May 2024 to Jun 2024

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Jun 2023 to Jun 2024