Life Technologies Remains Neutral - Analyst Blog

February 23 2012 - 10:15AM

Zacks

We reaffirm our Neutral

recommendation on Life Technologies (LIFE)

following its fourth-quarter 2011 results. The company

reported a strong quarter with both revenues and adjusted EPS going

past the Zacks Consensus Estimates.

Life Technologies’ performance has

been adversely affected by a sustained slowdown in government and

academic research funding over the past few quarters, a trend that

is expected to continue in 2012. This is significant since the

company derives almost 45% of its revenues from these

customers.

However, the company is

repositioning itself for a slower growth environment by lowering

its cost structure and increasing its focus on R&D initiatives.

The company has recorded robust revenue (CAGR of 12% to $3.73

billion in 2011) and earnings growth (23% to $3.73 per share) over

the past 3 years. Moreover, free cash flow clocked 33% growth over

the same period.

Over the past couple of years, the

company has been focusing on creating an optimal portfolio of

products through innovations and acquisitions, the latest being Ion

Torrent. The company derives 20% of revenues from proprietary

instruments, which in turn drive demand for the high-margin

consumables that account for the remaining 80%.

We are also encouraged by Life’s

strategy to strengthen its presence in high growth geographic

markets such as Latin America, the Middle-East, China and India.

Life Technologies sniffs immense potential in applied markets where

technologies can facilitate biological research in fast growing

industries such as forensics, food and water testing. Over the next

few years, Life’s focus on developing industry-leading franchises

in high-growth technology areas, applied markets and emerging

geographies will be the key drivers for long-term growth.

We are impressed with the robust

growth recorded by the Ion Personal Genome Machine (“PGM”) that was

launched in December 2010 taking the total number of system

placements to 700 in 2011. Maintaining the upbeat trend, PGM sales

were strong during the reported quarter, growing on a sequential

basis.

The company is satisfied with the

progress made so far with Ion Torrent technologies and expects the

growth momentum to continue. This growth will be supported by more

PGM placements and the scheduled launch of Ion Proton Benchtop

sequencer in the second half. In October 2011, the Ion franchise

was further boosted by the launch of the Ion AmpliSeq Cancer Panel

to help scientists to sequence dozens of genes in cancer research

samples using a simple workflow. With the launch of new products,

contribution of the Ion portfolio is expected to increase over the

next few quarters.

Life Technologies sets much in

store by the scheduled launch of the Ion Proton sequencer in the

second half of 2012 though competition in the DNA sequencing market

is increasing. While Illumina (ILMN) plans to

launch its HiSeq 2500 in the second half, Oxford Nanopore

Technologies’ MinION is also in the queue, which is a disposable

DNA sequencing device the size of a USB memory stick.

Our recommendation is backed by a

Zacks #3 Rank (“Hold”) in the short term.

ILLUMINA INC (ILMN): Free Stock Analysis Report

LIFE TECHNOLOGS (LIFE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

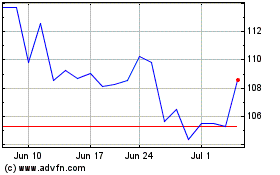

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From May 2024 to Jun 2024

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Jun 2023 to Jun 2024