Roche Upbeat On Outlook As Profit Rises

February 01 2012 - 2:08AM

Dow Jones News

Roche Holding AG (ROG.VX) Wednesday issued an upbeat outlook for

2012 after reporting a rise in full-year net profit due to tight

cost controls and despite a drop in annual sales.

The world's largest maker of cancer drugs said it expects sales

this year to grow at a low to mid-single-digit rate and has set

itself a target of high single-digit core earnings per share growth

despite the ongoing difficult market situation.

Net profit rose to 9.34 billion Swiss francs ($10.19 billion)

from CHF8.67 billion a year earlier, missing analysts' forecasts

for CHF9.52 billion.

The rise in earnings rise came despite sales sliding to CHF42.53

billion from CHF47.47 billion a year earlier, hurt by an absence of

revenue from flu drug Tamiflu and as the strong Swiss franc shaved

off part of the company's revenue. A Dow Jones Newswires survey of

12 analysts had expected full-year sales to be CHF42.71

billion.

"We achieved our sales and earnings targets for the year and

also made significant progress with our pipeline," Roche Chief

Executive Severin Schwan said in a statement.

Roche, which last week launched a hostile $5.7 billion cash

offer for U.S.-based Illumina Inc. (ILMN), said "the planned

acquisition of Illumina will strengthen our presence in the

fast-growing sequencing market and enable the discovery of complex

biomarkers for research and clinical use."

Roche has recently been buoyed by a more promising product

pipeline, but is still struggling with increased regulatory

scrutiny and global austerity programs that have hurt its business,

prompting the Swiss drug maker to launch a multi-billion-dollar

restructuring program, which should be largely completed by the end

of this year. Roche launched a revamp in 2010 after a series of

drug development setbacks.

Still, analysts believe the Basel-based drug maker is returning

to top-line growth which, combined with further cost savings, is

likely to produce a period of consistent earnings-per-share growth.

A key risk to long-term forecasts and the defensive perception of

Roche's future cash flows, however, remains biosimilar and

bio-better competition to super-selling cancer drugs Rituxan and

Herceptin this year and onwards.

Roche is also a leader in targeted therapies, where gene

sequencing is central, allowing scientists to predict a patient's

response to a particular drug during clinical practice and in drug

trials. Roche thus wants Illuminia to extend its leadership in the

area. But Chief Executive Schwan has said the Swiss company has no

intention of raising its offer of $44.50 a share for the San Diego,

Calif.-based group.

Roche lifted its dividend by 3% to CHF6.80 a share.

Roche shares closed Tuesday at CHF155.80.

-By Sten Stovall, Dow Jones Newswires; +44 207 842 9292;

sten.stovall@dowjones.com

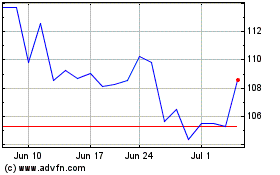

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From May 2024 to Jun 2024

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Jun 2023 to Jun 2024