Illumina In Line with Estimates - Analyst Blog

October 26 2011 - 7:30AM

Zacks

Illumina (ILMN)

reported EPS of 15 cents in the third quarter of 2011, well below

the year-ago quarter EPS of 24 cents. However, after adjusting for

certain one-time items, EPS came in at 22 cents, in line with the

Zacks Consensus Estimate but 26.6% lower than prior-year

quarter.

Revenues dipped 1% year over year

to $235.5 million, and were in line with the Zacks Consensus

Estimate. This was primarily due to a 1.9% decline in the product

revenues, partly offset by a 20.3% rise in service revenues. The

company derives 93.5% of its total revenue from products while the

remaining comes from services.

Product revenues at Illumina are

primarily attributed to the sale of Microarrays and DNA Sequencing

products. Product revenues consist of Consumables and Instruments,

which generated sales of $145 million (annualized growth of 9%) and

$72 million (down 18%), respectively.

While expansion of sequencing

instrument installed base was responsible for the robust growth in

consumables, the decline in instrument revenues was due to the

Genome Analyzer upgrade program, which drove significant instrument

volume in year-ago quarter but failed to do so in the reported

quarter.

Services and other revenues,

comprising genotyping and sequencing services as well as instrument

maintenance contracts, stood at $15.2 million, up 20.3% year over

year driven by the increase in maintenance contracts for the

company’s installed base of sequencing systems.

The company’s gross margin came in

at 66.7% during the reported quarter, up 50 basis points (bps) year

over year. The adjusted gross margin was 68.9% in the third quarter

of 2011 as opposed to 67.8% in the prior-year period. The company’s

selling general and administrative (SG&A) expenses and research

and development expenses increased 20.0% to $66.0 million and 12.5%

to $50.4 million, respectively. As a result, operating margin

contracted 690 bps to 17.3%.

Illumina exited the quarter with

cash and cash equivalents of $229.8 million, compared with $248.9

million at the end of fiscal 2010. The company generated $90.0

million in cash flow from operations versus $54.8 million in the

prior-year period.

Outlook

With the commercialization of the

MiSeq platform, Illumina expects fourth quarter 2011 revenue to

exceed the third quarter level. However, given the

uncertainty related to government budgets for research and

development and the current global economic environment, the

company has not provided any outlook.

However, the company is

implementing a restructuring program to better streamline its

organizational and cost structure. As a result, the company expects

to record restructuring charges of approximately $15-17 million,

the majority of which will be incurred during the fourth quarter of

2011.

Presently, Illumina retains a

short-term Zacks #5 Rank (Strong Sell) which also corresponds to

our ‘Underperform’ recommendation over the long term.

ILLUMINA INC (ILMN): Free Stock Analysis Report

Zacks Investment Research

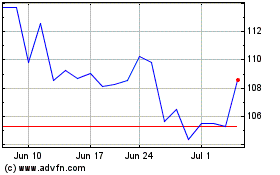

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From May 2024 to Jun 2024

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Jun 2023 to Jun 2024