Life Technologies

(LIFE) is scheduled to release its first quarter fiscal 2011

results on Tuesday, April 26, 2011 after the market closes. The

company is expected to earn 85 cents during the quarter on $920

million of revenues, according to the Zacks Consensus Estimate.

Previous Quarter

Highlights

Life Technologies reported an

adjusted EPS of 90 cents in the fourth quarter of 2010, surpassing

the Zacks Consensus Estimate of 86 cents and 13% higher than 80

cents in the year-ago quarter. Growth in all the divisions of Life

Technologies helped adjusted revenues for the quarter increase 7%

year over year to $934 million, ahead of the Zacks Consensus

Estimate of $928 million. Excluding the impact of currency,

acquisitions and divestitures, revenues grew 5%.

Although revenues increased 7%

during the quarter, EPS growth was higher by 13% due to an

improvement in operating margin (up 50 basis points to 26.3%),

lower interest expense (23.7%), a 58% rise in interest income,

lower effective tax rate (21% versus 26.2%), partially offset by a

2.1% rise in the share count. While gross margin declined

marginally by 40 basis points due to a minor impact from mix,

improvement in operating margin was driven by acquisition-related

synergies.

Life Technologies also provided its

outlook for 2011. The company expects its organic revenues to grow

in mid-single digits resulting in adjusted EPS of $3.80–$3.95.

Agreement of

Analysts

Estimate revision trends among the

analysts have been primarily on the negative side in the last 30

days. Among 17 analysts covering the stock, 8 have lowered their

estimates for the first quarter without any movement in the

positive direction. Moreover, 1 analyst lowered his/her estimate in

the last 7 days. Maintaining the same trend, for fiscal 2011, 9

analysts have lowered their estimates with only 1 upward revision

over the last 30 days. In the past 7 days, 2 analysts have lowered

their estimates for fiscal 2011.

Life Technologies records

approximately 10% of its revenues from Japan. As a result, the

recent earthquake and devastating tsunami in this region is likely

to affect revenues. The extent of the impact on the company’s

revenue stream will become clearer following the results.

According to the company’s

guidance, organic revenue growth in the first quarter of 2011 is

expected to be in the low-single digits as the year-ago period

recorded an exceptionally strong performance with 10% organic

growth.

The robust performance in the first

quarter of 2010 was a result of US and Japanese stimulus programs

and the last installment of the Japanese Police order. Due to lower

revenue growth and the impact of currency, earnings growth is

expected to be flat to down 5% in the quarter. However, excluding

the impact of currency, EPS is expected to grow in the mid- to

high-single digits.

Based on the exchange rates at the

end of 2010, Life Technologies expects no impact from currency on

revenue during the first half. However, gross margin in each of the

first two quarters is likely to be impacted by (160 basis points)

currency. Consequently, EPS will be negatively impacted by 8 cents

in the first quarter and 5 cents in the second quarter. In the

second half of the year, currency is expected to have no material

impact on revenues, gross margins or EPS.

Earlier this month, Life

Technologies introduced Ion OneTouch system, an automated sample

preparation system for the Ion Personal Genome Machine (PGM)

sequencer. The company will begin shipment of the product in late

June.

In December 2010, the company

launched its Ion PGM sequencer, the first product to use

semiconductor sequencing technology. PGM sales are off to a good

start and the company expects significant contribution from Ion

Torrent in the second half of 2011. We expect an update from the

company regarding the sales of PGM.

Magnitude of Estimate

Revisions

The magnitude of revisions has been

modest following fourth quarter results. Overall, estimates for the

first quarter have dropped by 8 cents to the current level of 85

cents per share in the last 90 days. However, estimates for fiscal

2011, have gone up by 2 cents to the current level of $3.87 per

share over the past 3 months.

Surprise

Life Technologies have exceeded

estimates in the past four quarters, at a stretch, resulting in a

four-quarter average of 7.39%. This indicates that on an average,

the company has exceeded the Zacks Consensus Estimate by this

magnitude over the last four quarters.

Our

Recommendation

Life enjoys a strong position in

the life sciences market and we believe robust performance from its

core business along with new product launches will help drive

revenues going forward. Meanwhile, lower expenses and cost cutting

along with increased revenues should help drive the bottom

line.

Additionally, the company is

increasing its focus on emerging markets, which bode well for

long-term growth. We are also impressed by Life’s acquisition of

Ion Torrent, which is expected to contribute significantly to the

top line going ahead. However, the company could face challenges

such as increased competition from players like, Thermo

Fisher Scientific (TMO), Illumina (ILMN)

among others and unfavorable currency movement.

Research funding for life science

research either had a crawling rise in the recent past or declined

in some cases. In addition, some countries have frozen grants due

to the economic stress. Although the global economic condition is

improving gradually, any hiccup in the recovery process could act

as a deterrent.

We are currently ‘Neutral’ on the

stock, which also corresponds to the Zacks #3 Rank (hold) in the

short term.

ILLUMINA INC (ILMN): Free Stock Analysis Report

LIFE TECHNOLOGS (LIFE): Free Stock Analysis Report

THERMO FISHER (TMO): Free Stock Analysis Report

Zacks Investment Research

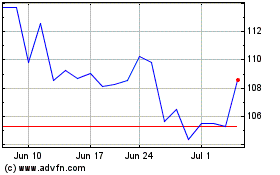

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Jul 2024 to Aug 2024

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Aug 2023 to Aug 2024