iHeartMedia, Inc. (Nasdaq: IHRT) today reported financial

results for the quarter ended June 30, 2024.

Financial Highlights:1

Q2 2024 Consolidated

Results

- Q2 Revenue of $929 million, up 1.0%; above guidance of

approximately flat

- Excluding Q2 Political Revenue, Q2 Revenue flat

- GAAP Operating loss of $910 million vs. $897 million in Q2

2023, including non-cash impairment charges of $920 million in Q2

2024 and $961 million in Q2 2023

- Consolidated Adjusted EBITDA of $150 million, within previously

disclosed guidance range of $140 million to $160 million, compared

to $191 million in Q2 2023

- Cash provided by operating activities of $27 million

- Free Cash Flow of $6 million

- Cash balance and total available liquidity2 of $365 million and

$791 million, respectively, as of June 30, 2024

Q2 2024 Digital Audio Group

Results

- Digital Audio Group Revenue of $286 million up 10%

- Podcast Revenue of $105 million up 8%

- Digital Revenue excluding Podcast of $181 million up 10%

- Segment Adjusted EBITDA of $92 million up 9%

- Digital Audio Group Adjusted EBITDA margin of 32.2%

Q2 2024 Multiplatform Group

Results

- Multiplatform Group Revenue of $576 million down 3%

- Excluding Multiplatform Group Q2 Political Revenue,

Multiplatform Group Q2 Revenue down 4%

- Segment Adjusted EBITDA of $104 million down 36%

- Multiplatform Group Adjusted EBITDA margin of 18.1%

Guidance

- Q3 Consolidated Revenue expected to increase in the mid-single

digits

- Full Year 2024 Consolidated Revenue expected to increase in the

mid-single digits

- Q3 Consolidated Adjusted EBITDA3 expected to be $200 million to

$220 million

- Full Year 2024 Consolidated Adjusted EBITDA3 expected to be

$760 million to $800 million

- Remain committed to long term target of approximately 4x Net

Debt to Adjusted EBITDA ("net leverage")3

Statement from Senior Management

“Our second quarter results mark the first quarter that our

consolidated revenues increased year-over-year since Q4 2022. We

continue to see strong momentum in our podcast business, our

Digital ex. Podcast business, and have seen sequential improvement

of our Multiplatform Group’s year-over-year revenue performance,”

said Bob Pittman, Chairman and CEO of iHeartMedia, Inc. “This

performance is built on iHeartMedia’s strong and unparalleled

audience and demonstrates the progress we are making in maximizing

the monetization of it.”

“We continue to see signs of improvement throughout our business

and the broader advertising marketplace, and our second quarter

2024 results were in line with, and in the cases of revenue,

slightly above guidance. Our high-growth Digital Audio Group

revenues were up 10% year over year, and represented 31% of our

company’s revenues, and our Multiplatform Group revenues exceeded

our previously provided guidance,” said Rich Bressler, President,

COO and CFO of iHeartMedia, Inc. “Our full year 2024 political

revenues are currently pacing approximately 20% higher than the

last presidential election cycle, which gives us confidence that

this will be a record political year for us, and we expect to see a

significant year-over-year improvement in our full year Adjusted

EBITDA performance.”

Consolidated Results of

Operations

Second Quarter 2024 Consolidated

Results

Our consolidated revenue increased $9.1 million, or 1.0%, during

the three months ended June 30, 2024 compared to the same period of

2023. Digital Audio revenue increased $24.8 million, or 9.5%,

driven primarily by continuing increases in demand for digital

advertising. Multiplatform revenue decreased $20.0 million, or

3.4%, primarily resulting from a decrease in broadcast advertising

in connection with continued uncertain market conditions, partially

offset by an increase in non-cash trade revenues and political

revenues as 2024 is a presidential election year. Audio & Media

Services revenue increased $4.3 million, or 6.5%, primarily as a

result of higher political revenue.

Consolidated direct operating expenses increased $27.0 million,

or 7.6%, during the three months ended June 30, 2024 compared to

the same period of 2023. The increase was primarily driven by

higher variable content costs, including higher profit sharing

expenses and third-party digital costs related to the increase in

digital revenues and an increase in music license fees, as well as

an increase in event costs related to the timing of the 2024

iHeartRadio Music Awards which was in the second quarter of 2024

and the first quarter of 2023.

Consolidated Selling, General & Administrative ("SG&A")

expenses increased $37.8 million, or 9.6%, during the three months

ended June 30, 2024 compared to the same period of 2023. The

increase was driven primarily by higher non-cash trade expense due

to the timing of the 2024 iHeartRadio Music Awards which was in the

second quarter of 2024 and the first quarter of 2023 and an

increase in costs incurred in connection with executing on our cost

savings initiatives, partially offset by lower bad debt expense and

lower bonus expense based on results.

Our consolidated GAAP Operating loss was $909.7 million compared

to $897.2 million in the second quarter of 2023, primarily due to

the increase in direct operating and SG&A expenses as discussed

above, partially offset by lower non-cash impairment charges of

$920.2 million recognized in the second quarter of 2024 compared to

the $960.6 million recognized in the prior year period. The

non-cash impairment charges primarily related to goodwill and FCC

license impairments in both periods.

Adjusted EBITDA decreased to $150.2 million compared to $191.2

million in the prior-year period.

Cash provided by operating activities was $26.7 million,

compared to $56.8 million in the prior-year period primarily due to

a decrease in revenue from our Multiplatform Group, partially

offset by an improvement in the timing of receivable collections.

Free Cash Flow was $5.6 million, compared to $34.0 million in the

prior year period.

Business Segments: Results of

Operations

Second Quarter 2024 Multiplatform Group

Results

(In thousands)

Three Months Ended

June 30,

%

Six Months Ended

June 30,

%

2024

2023

Change

2024

2023

Change

Revenue

$

575,907

$

595,944

(3.4

)%

$

1,069,370

$

1,124,957

(4.9

)%

Operating expenses1

471,644

433,542

8.8

%

887,925

875,503

1.4

%

Segment Adjusted EBITDA

$

104,263

$

162,402

(35.8

)%

$

181,445

$

249,454

(27.3

)%

Segment Adjusted EBITDA margin

18.1

%

27.3

%

17.0

%

22.2

%

1 Operating expenses consist of Direct

operating expenses and SG&A expenses, excluding Restructuring

expenses.

Revenue from our Multiplatform Group decreased $20.0 million, or

3.4% YoY, primarily due to a decrease in broadcast advertising in

connection with continued uncertain market conditions, partially

offset by an increase in non-cash trade revenue and political

revenues. Broadcast revenue declined $3.7 million, or 0.9% YoY,

driven by lower spot revenue, partially offset by an increase in

non-cash trade revenues and political advertising. Networks

declined $15.6 million, or 12.8% YoY due primarily to the impact of

non-returning advertisers. Revenue from Sponsorship and Events

increased by $0.9 million, or 2.4% YoY.

Operating expenses increased $38.1 million, or 8.8% YoY, driven

primarily by higher non-cash trade expense and live event costs due

to the timing of the 2024 iHeartRadio Music Awards which was in Q2

in 2024 and Q1 in 2023 and higher broadcast music license fees.

Segment Adjusted EBITDA Margin decreased YoY to 18.1% from

27.3%.

Second Quarter 2024 Digital Audio Group

Results

(In thousands)

Three Months Ended

June 30,

%

Six Months Ended

June 30,

%

2024

2023

Change

2024

2023

Change

Revenue

$

285,614

$

260,854

9.5

%

$

524,582

$

484,250

8.3

%

Operating expenses1

193,744

176,272

9.9

%

364,585

345,549

5.5

%

Segment Adjusted EBITDA

$

91,870

$

84,582

8.6

%

$

159,997

$

138,701

15.4

%

Segment Adjusted EBITDA margin

32.2

%

32.4

%

30.5

%

28.6

%

1 Operating expenses consist of Direct

operating expenses and SG&A expenses, excluding Restructuring

expenses.

Revenue from our Digital Audio Group increased $24.8 million, or

9.5% YoY, driven by Digital, excluding Podcast revenue, which grew

$16.9 million, or 10.3% YoY, to $181.1 million, driven by an

increase in demand for digital advertising, and Podcast revenue,

which increased $7.8 million, or 8.1% YoY, to $104.5 million,

driven primarily by increased demand for podcasting from

advertisers and higher non-cash trade revenue.

Operating expenses increased $17.5 million, or 9.9% YoY,

primarily driven by higher variable content costs, including higher

profit sharing agreements and third-party digital costs related to

the increase in revenues.

Segment Adjusted EBITDA Margin decreased YoY to 32.2% from

32.4%.

Second Quarter 2024 Audio & Media

Services Group Results

(In thousands)

Three Months Ended

June 30,

%

Six Months Ended

June 30,

%

2024

2023

Change

2024

2023

Change

Revenue

$

70,082

$

65,804

6.5

%

$

139,250

$

127,155

9.5

%

Operating expenses1

46,233

47,305

(2.3

)%

91,706

93,312

(1.7

)%

Segment Adjusted EBITDA

$

23,849

$

18,499

28.9

%

$

47,544

$

33,843

40.5

%

Segment Adjusted EBITDA margin

34.0

%

28.1

%

34.1

%

26.6

%

1 Operating expenses consist of Direct

operating expenses and SG&A expenses, excluding Restructuring

expenses.

Revenue from our Audio & Media Services Group increased $4.3

million, or 6.5% YoY, primarily due to higher political revenue as

2024 is a presidential election year.

Operating expenses decreased $1.1 million, or 2.3% YoY,

primarily as a result of a favorable shift in the sales mix toward

services and a decrease in employee compensation expense.

Segment Adjusted EBITDA Margin increased YoY to 34.0% from

28.1%.

GAAP and Non-GAAP Measures: Consolidated

(In thousands)

Three Months Ended

June 30,

Six Months Ended

June 30,

2024

2023

2024

2023

Revenue

$

929,092

$

920,014

$

1,728,130

$

1,731,253

Operating loss

(909,667

)

(897,194

)

$

(944,375

)

$

(946,056

)

Adjusted EBITDA1

150,207

191,181

$

254,824

$

284,605

Net loss

(981,989

)

(882,982

)

$

(1,000,097

)

$

(1,105,345

)

Cash provided by (used for) operating

activities2

26,729

56,772

$

(32,548

)

$

(37,211

)

Free cash flow1,2

5,557

33,999

$

(75,302

)

$

(99,149

)

______________________________

1

See the end of this press release for

reconciliations of (i) Adjusted EBITDA to Operating loss, (ii)

Adjusted EBITDA to Net loss, (iii) Free Cash Flow to Cash provided

by (used for) operating activities, (iv) revenue, excluding

political advertising revenue, to revenue, and (v) Net Debt to

Total Debt. See also the definitions of Adjusted EBITDA, Free Cash

Flow, Adjusted EBITDA margin, and Net Debt under the Supplemental

Disclosure Regarding Non-GAAP Financial Information section in this

release.

2

We made cash interest payments of $88.2

million in the three months ended June 30, 2024, compared to $93.7

million in the three months ended June 30, 2023.

Certain prior period amounts have been reclassified to conform

to the 2024 presentation of financial information throughout the

press release.

Liquidity and Financial

Position

As of June 30, 2024, we had $364.7 million of cash on our

balance sheet. For the six months ended June 30, 2024, cash used

for operating activities was $32.5 million, cash provided by

investing activities was $55.9 million and cash used for financing

activities was $4.8 million.

Capital expenditures for the six months ended June 30, 2024 were

$42.8 million compared to $61.9 million in the six months ended

June 30, 2023. Capital expenditures during the six months ended

June 30, 2024 decreased primarily due to lower spending on real

estate optimization initiatives.

As of June 30, 2024, the Company had $5,218.8 million of total

debt and $4,854.1 million of Net Debt. The terms of our capital

structure include no material maintenance covenants, and there are

no material debt maturities prior to May 2026.

Cash balance and total available liquidity4 were $364.7 million

and $791 million, respectively, as of June 30, 2024.

Revenue Streams

The tables below present the comparison of our historical

revenue streams (including political revenue) for the periods

presented:

(In thousands)

Three Months Ended

June 30,

%

Six Months Ended

June 30,

%

2024

2023

Change

2024

2023

Change

Broadcast Radio

$

425,490

$

429,152

(0.9

)%

$

784,828

$

812,390

(3.4

)%

Networks

106,591

122,168

(12.8

)%

208,642

230,122

(9.3

)%

Sponsorship and Events

39,121

38,210

2.4

%

66,950

70,797

(5.4

)%

Other

4,705

6,414

(26.6

)%

8,950

11,648

(23.2

)%

Multiplatform Group1

575,907

595,944

(3.4

)%

1,069,370

1,124,957

(4.9

)%

Digital ex. Podcast

181,093

164,147

10.3

%

329,437

310,732

6.0

%

Podcast

104,521

96,707

8.1

%

195,145

173,518

12.5

%

Digital Audio Group

285,614

260,854

9.5

%

524,582

484,250

8.3

%

Audio & Media Services

Group1

70,082

65,804

6.5

%

139,250

127,155

9.5

%

Eliminations

(2,511

)

(2,588

)

(5,072

)

(5,109

)

Revenue, total1

$

929,092

$

920,014

1.0

%

$

1,728,130

$

1,731,253

(0.2

)%

1

Excluding the impact of political revenue,

Revenue from the Multiplatform Group and Consolidated Revenue

decreased by 4.0% and 0.1% for the three months ended June 30, 2024

compared to the three months ended June 30, 2023, respectively.

Excluding the impact of political revenue, Revenue from Audio &

Media Services increased by 0.1% for the three months ended June

30, 2024 compared to the three months ended June 30, 2023. See the

end of this press release for a reconciliation of revenue,

excluding political advertising revenue, to revenue.

Conference Call iHeartMedia,

Inc. will host a conference call to discuss results and business

outlook on August 8, 2024, at 8:30 a.m. Eastern Time. The

conference call number is (888) 596-4144 (U.S. callers) and +1

(646) 968-2525 (International callers) and the passcode for both is

8885116. A live audio webcast of the conference call will also be

available on the Investors homepage of iHeartMedia's website

investors.iheartmedia.com. After the live conference call, a replay

will be available for a period of thirty days. The replay numbers

are (800) 770-2030 (U.S. callers) and +1 (609) 800-9909

(International callers) and the passcode for both is 8885116. An

archive of the webcast will be available beginning 24 hours after

the call for a period of thirty days.

About iHeartMedia, Inc.

iHeartMedia (Nasdaq: IHRT) is the number one audio company in

the United States, reaching nine out of 10 Americans every month.

It consists of three business groups.

With its quarter of a billion monthly listeners, the iHeartMedia

Multiplatform Group has a greater reach than any other media

company in the U.S. Its leadership position in audio extends across

multiple platforms, including more than 860 live broadcast stations

in over 160 markets nationwide; its National Sales organization;

and the Company’s live and virtual events business. It also

includes Premiere Networks, the industry’s largest Networks

business, with its Total Traffic and Weather Network (TTWN); and

BIN: Black Information Network, the first and only 24/7 national

and local all news audio service for the Black community.

iHeartMedia also leads the audio industry in analytics, targeting

and attribution for its marketing partners with its SmartAudio

suite of data targeting and attribution products using data from

its massive consumer base.

The iHeartMedia Digital Audio Group includes the Company’s

fast-growing podcasting business -- iHeartMedia is the number one

podcast publisher in downloads, unique listeners, revenue and

earnings -- as well as its industry-leading iHeartRadio digital

service, available across more than 500+ platforms and thousands of

devices; the Company’s digital sites, newsletters, digital services

and programs; its digital advertising technology companies; and its

audio industry-leading social media footprint.

The Company’s Audio & Media Services reportable segment

includes Katz Media Group, the nation’s largest media

representation company, and RCS, the world's leading provider of

broadcast and webcast software.

Certain statements herein constitute “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Such forward-looking statements involve known

and unknown risks, uncertainties and other important factors which

may cause the actual results, performance or achievements of

iHeartMedia, Inc. and its subsidiaries to be materially different

from any future results, performance or achievements expressed or

implied by such forward-looking statements. The words or phrases

“guidance,” “believe,” “expect,” “anticipate,” “estimates,”

“forecast” and similar words or expressions are intended to

identify such forward-looking statements. In addition, any

statements that refer to expectations or other characterizations of

future events or circumstances, such as statements about

positioning in uncertain economic environment and future economic

recovery, driving shareholder value, our anticipated growth and

year-over-year financial performance, our anticipated political

advertising revenues for 2024; our expected costs savings and other

capital and operating expense reduction initiatives, utilizing new

technologies and programmatic platforms, developing new consumer

and revenue opportunities; improving operational efficiency, future

advertising demand, trends in the advertising industry, including

on other media platforms; strategies and initiatives, and our

anticipated financial performance, including our outlook as to

third quarter and full year 2024 consolidated and operating segment

results, anticipated capital expenditures and other impacts on our

free cash flow, including our outlook as to third quarter and full

year 2024 consolidated and operating segment results, anticipated

capital expenditures and other impacts on our free cash flow,

liquidity, and net leverage are forward-looking statements. These

statements are not guarantees of future performance and are subject

to certain risks, uncertainties and other important factors, some

of which are beyond our control and are difficult to predict.

Various risks that could cause future results to differ from those

expressed by the forward-looking statements included in this press

release include, but are not limited to: risks related to weak or

uncertain global economic conditions and our dependence on

advertising revenues; competition, including increased competition

from alternative media platforms and technologies; dependence upon

our brand and the performance of on-air talent, program hosts and

management; fluctuations in operating costs; technological and

industry changes and innovations; shifts in population and other

demographics; risks related to our use of artificial intelligence,

impact of acquisitions, dispositions and other strategic

transactions; risks related to our indebtedness; legislative or

regulatory requirements; impact of legislation, ongoing

litigation or royalty audits on music licensing and royalties;

regulations and concerns regarding privacy and data protection and

breaches of information security measures; risks related to

scrutiny of environmental, social and governance matters, risks

related to our Class A common stock; and regulations impacting our

business and the ownership of our securities. Other unknown or

unpredictable factors also could have material adverse effects on

the Company’s future results, performance or achievements. In light

of these risks, uncertainties, assumptions and factors, the

forward-looking events discussed in this press release may not

occur. You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date stated,

or if no date is stated, as of the date hereof. Additional risks

that could cause future results to differ from those expressed by

any forward-looking statement are described in the Company’s

reports filed with the U.S. Securities and Exchange Commission,

including in the section entitled “Part I, Item 1A. Risk Factors”

of iHeartMedia, Inc.’s Annual Reports on Form 10-K and “Part II,

Item 1A. Risk Factors” of iHeartMedia, Inc.’s Quarterly Reports on

Form 10-Q. The Company does not undertake any obligation to

publicly update or revise any forward-looking statements because of

new information, future events or otherwise.

APPENDIX

TABLE 1 - Comparison of operating

performance

(In thousands)

Three Months Ended

June 30,

%

Six Months Ended

June 30,

%

2024

2023

Change

2024

2023

Change

Revenue

$

929,092

$

920,014

1.0

%

$

1,728,130

$

1,731,253

(0.2

)%

Operating expenses:

Direct operating expenses (excludes

depreciation and amortization)

382,049

355,061

7.6

%

723,409

699,681

3.4

%

Selling, general and administrative

expenses (excludes depreciation and amortization)

431,614

393,773

9.6

%

816,758

796,574

2.5

%

Depreciation and amortization

104,356

108,065

209,518

216,577

Impairment charges

920,224

960,570

921,732

964,517

Other operating (income) expense, net

516

(261

)

1,088

(40

)

Operating loss

$

(909,667

)

$

(897,194

)

$

(944,375

)

$

(946,056

)

Depreciation and amortization

104,356

108,065

209,518

216,577

Impairment charges

920,224

960,570

921,732

964,517

Other operating (income) expense, net

516

(261

)

1,088

(40

)

Restructuring expenses

27,558

10,789

51,161

30,243

Share-based compensation expense

7,220

9,212

15,700

19,364

Adjusted EBITDA1

$

150,207

$

191,181

(21.4

)%

$

254,824

$

284,605

(10.5

)%

1See the end of this press release for

reconciliations of (i) Adjusted EBITDA to Operating loss, (ii)

Adjusted EBITDA to Net loss, (iii) Free Cash Flow to Cash provided

by (used for) operating activities, (iv) revenue, excluding

political advertising revenue, to revenue, and (v) Net Debt to

Total Debt. See also the definitions of Adjusted EBITDA, Free Cash

Flow, Adjusted EBITDA margin and Net Debt under the Supplemental

Disclosure section in this release.

TABLE 2 - Statements of

Operations

(In thousands)

Three Months Ended

June 30,

Six Months Ended

June 30,

2024

2023

2024

2023

Revenue

$

929,092

$

920,014

$

1,728,130

$

1,731,253

Operating expenses:

Direct operating expenses (excludes

depreciation and amortization)

382,049

355,061

723,409

699,681

Selling, general and administrative

expenses (excludes depreciation and amortization)

431,614

393,773

816,758

796,574

Depreciation and amortization

104,356

108,065

209,518

216,577

Impairment charges

920,224

960,570

921,732

964,517

Other operating (income) expense, net

516

(261

)

1,088

(40

)

Operating loss

(909,667

)

(897,194

)

(944,375

)

(946,056

)

Interest expense, net

95,577

98,693

191,092

194,150

Gain (loss) on investments, net

(412

)

(6,038

)

91,582

(12,543

)

Equity in loss of nonconsolidated

affiliates

(61

)

(44

)

(106

)

(4

)

Gain on extinguishment of debt

—

22,902

—

27,527

Other expense, net

(231

)

(272

)

(727

)

(371

)

Loss before income taxes

(1,005,948

)

(979,339

)

(1,044,718

)

(1,125,597

)

Income tax benefit

23,959

96,357

44,621

20,252

Net loss

(981,989

)

(882,982

)

(1,000,097

)

(1,105,345

)

Less amount attributable to noncontrolling

interest

(331

)

1,488

69

1,385

Net loss attributable to the Company

$

(981,658

)

$

(884,470

)

$

(1,000,166

)

$

(1,106,730

)

TABLE 3 - Selected Balance Sheet

Information

Selected balance sheet information for June 30, 2024 and

December 31, 2023:

(In millions)

June 30, 2024

December 31, 2023

Cash

$

364.7

$

346.4

Total Current Assets

1,422.3

1,506.9

Net Property, Plant and Equipment

511.3

558.9

Total Assets

5,769.2

6,952.6

Current Liabilities (excluding current

portion of long-term debt)

738.4

848.1

Long-term Debt (including current portion

of long-term debt)

5,218.8

5,215.2

Stockholders' Deficit

(1,374.6

)

(384.8

)

Supplemental Disclosure Regarding

Non-GAAP Financial Information

The following tables set forth the Company’s Adjusted EBITDA,

Adjusted EBITDA margin, revenues excluding political advertising

revenue, and Free Cash Flow for the three and six months ended June

30, 2024 and 2023, and Net Debt as of June 30, 2024. Adjusted

EBITDA is defined as consolidated Operating loss adjusted to

exclude restructuring expenses included within Direct operating

expenses and SG&A expenses, and share-based compensation

expenses included within SG&A expenses, as well as the

following line items presented in our Statements of Operations:

Depreciation and amortization, Impairment charges, and Other

operating (income) expense, net. Alternatively, Adjusted EBITDA is

calculated as Net loss, adjusted to exclude Income tax benefit,

Interest expense, net, Depreciation and amortization, (Gain) loss

on investments, net, Gain on extinguishment of debt, Other expense,

net, Equity in loss of nonconsolidated affiliates, Impairment

charges, Other operating (income) expense, net, Share-based

compensation expense, and restructuring expenses. Restructuring

expenses primarily include expenses incurred in connection with

cost-saving initiatives, as well as certain expenses, which, in the

view of management, are outside the ordinary course of business or

otherwise not representative of the Company's operations during a

normal business cycle. Adjusted EBITDA margin is calculated as

Adjusted EBITDA divided by Revenue.

The Company uses Adjusted EBITDA and Adjusted EBITDA margin,

among other measures, to evaluate the Company’s operating

performance. Adjusted EBITDA is among the primary measures used by

management for the planning and forecasting of future periods, as

well as for measuring performance for compensation of executives

and other members of management. We believe this measure is an

important indicator of the Company’s operational strength and

performance of its business because it provides a link between

operational performance and operating income. It is also a primary

measure used by management in evaluating companies as potential

acquisition targets.

The Company believes the presentation of these measures is

relevant and useful for investors because it allows investors to

view performance in a manner similar to the method used by the

Company’s management. The Company believes it helps improve

investors’ ability to understand the Company’s operating

performance and makes it easier to compare the Company’s results

with other companies that have different capital structures or tax

rates. In addition, the Company believes this measure is also among

the primary measures used externally by the Company’s investors,

analysts and peers in its industry for purposes of valuation and

comparing the operating performance of the Company to other

companies in its industry.

Since Adjusted EBITDA is not a measure calculated in accordance

with GAAP, it should not be considered in isolation of, or as a

substitute for, Operating loss as an indicator of operating

performance and may not be comparable to similarly titled measures

employed by other companies. Adjusted EBITDA is not necessarily a

measure of the Company’s ability to fund its cash needs. As it

excludes certain financial information compared with Operating

loss, the most directly comparable GAAP financial measure, users of

this financial information should consider the types of events and

transactions which are excluded.

We define Free Cash Flow as Cash provided by (used for)

operating activities less capital expenditures, which is disclosed

as Purchases of property, plant and equipment in the Company's

Consolidated Statements of Cash Flows. We use Free Cash Flow, among

other measures, to evaluate the Company’s liquidity and its ability

to generate cash flow. We believe that Free Cash Flow is meaningful

to investors because it provides them with a view of the Company's

liquidity after deducting capital expenditures, which are

considered to be a necessary component of ongoing operations. In

addition, we believe that Free Cash Flow helps improve investors'

ability to compare our liquidity with that of other companies.

Since Free Cash Flow is not a measure calculated in accordance

with GAAP, it should not be considered in isolation of, or as a

substitute for, Cash provided by (used for) operating activities

and may not be comparable to similarly titled measures employed by

other companies. Free Cash Flow is not necessarily a measure of our

ability to fund our cash needs.

The Company presents revenue, excluding the effects of political

revenue. Due to the cyclical nature of the electoral system and the

seasonality of the related political revenue, management believes

presenting revenue, excluding the effects of political revenue,

provides additional information to investors about the Company’s

revenue growth from period to period.

We define Net Debt as Total Debt less Cash and cash equivalents.

We define net leverage as Net Debt divided by Adjusted EBITDA. The

Company uses net leverage and Net Debt to evaluate the Company's

liquidity. We believe these measures are an important indicator of

the Company's ability to service its long-term debt

obligations.

Since these non-GAAP financial measures are not calculated in

accordance with GAAP, they should not be considered in isolation

of, or as a substitute for, the most directly comparable GAAP

financial measures as an indicator of operating performance or

liquidity.

As required by the SEC rules, the Company provides

reconciliations below to the most directly comparable measures

reported under GAAP, including (i) Adjusted EBITDA to Operating

loss, (ii) Adjusted EBITDA to Net loss, (iii) Free Cash Flow to

Cash provided by (used for) operating activities, (iv) revenue,

excluding political advertising revenue, to revenue, and (v) Net

Debt to Total Debt.

We have provided forecasted Consolidated Revenue and Adjusted

EBITDA guidance for the quarter ending September 30, 2024 and the

full year 2024 and long-term net leverage guidance, which reflects

targets for Adjusted EBITDA and net debt. Our Earnings Call on

August 8, 2024 may present additional guidance that includes

Adjusted EBITDA. A full reconciliation of the forecasted Adjusted

EBITDA, net debt and net leverage on a non-GAAP basis to the

respective most-directly comparable GAAP metrics cannot be provided

without unreasonable efforts due to the inherent difficulty in

forecasting and quantifying with reasonable accuracy significant

items required for the reconciliations, including gains or losses

on investments, extinguishment of debt, equity in nonconsolidated

affiliates, impairment charges, stock based compensation, and

restructuring as well as the Company's cash and cash equivalent

balance.

Reconciliation of Operating loss to Adjusted EBITDA

(In thousands)

Three Months Ended

June 30,

Six Months Ended

June 30,

Three Months Ended March

31,

2024

2023

2024

2023

2024

Operating loss

$

(909,667

)

$

(897,194

)

$

(944,375

)

$

(946,056

)

$

(34,708

)

Depreciation and amortization

104,356

108,065

209,518

216,577

105,162

Impairment charges

920,224

960,570

921,732

964,517

1,508

Other operating (income) expense, net

516

(261

)

1,088

(40

)

572

Restructuring expenses

27,558

10,789

51,161

30,243

23,603

Share-based compensation expense

7,220

9,212

15,700

19,364

8,480

Adjusted EBITDA

$

150,207

$

191,181

$

254,824

$

284,605

$

104,617

Reconciliation of Net loss to EBITDA and Adjusted

EBITDA

(In thousands)

Three Months Ended

June 30,

Six Months Ended

June 30,

Three Months Ended March

31,

2024

2023

2024

2023

2024

Net loss

$

(981,989

)

$

(882,982

)

$

(1,000,097

)

$

(1,105,345

)

$

(18,108

)

Income tax benefit

(23,959

)

(96,357

)

(44,621

)

(20,252

)

(20,662

)

Interest expense, net

95,577

98,693

191,092

194,150

95,515

Depreciation and amortization

104,356

108,065

209,518

216,577

105,162

EBITDA

$

(806,015

)

$

(772,581

)

$

(644,108

)

$

(714,870

)

$

161,907

(Gain) loss on investments, net

412

6,038

(91,582

)

12,543

(91,994

)

Gain on extinguishment of debt

—

(22,902

)

—

(27,527

)

—

Other expense, net

231

272

727

371

496

Equity in loss of nonconsolidated

affiliates

61

44

106

4

45

Impairment charges

920,224

960,570

921,732

964,517

1,508

Other operating (income) expense, net

516

(261

)

1,088

(40

)

572

Restructuring expenses

27,558

10,789

51,161

30,243

23,603

Share-based compensation expense

7,220

9,212

15,700

19,364

8,480

Adjusted EBITDA

$

150,207

$

191,181

$

254,824

$

284,605

$

104,617

Reconciliation of Cash provided by (used for) operating

activities to Free Cash Flow

(In thousands)

Three Months Ended

June 30,

Six Months Ended

June 30,

2024

2023

2024

2023

Cash provided by (used for) operating

activities

$

26,729

$

56,772

$

(32,548

)

$

(37,211

)

Purchases of property, plant and

equipment

(21,172

)

(22,773

)

(42,754

)

(61,938

)

Free cash flow

$

5,557

$

33,999

$

(75,302

)

$

(99,149

)

Reconciliation of Revenue to Revenue excluding Political

Advertising

(In thousands)

Three Months Ended

June 30,

%

Change

Six Months Ended

June 30,

%

Change

2024

2023

2024

2023

Consolidated revenue

$

929,092

$

920,014

1.0

%

$

1,728,130

$

1,731,253

(0.2

)%

Excluding: Political revenue

(14,907

)

(6,665

)

(26,534

)

(10,268

)

Consolidated revenue, excluding

political

$

914,185

$

913,349

0.1

%

$

1,701,596

$

1,720,985

(1.1

)%

Multiplatform Group revenue

$

575,907

$

595,944

(3.4

)%

$

1,069,370

$

1,124,957

(4.9

)%

Excluding: Political revenue

(8,025

)

(4,344

)

(15,688

)

(7,829

)

Multiplatform Group revenue, excluding

political

$

567,882

$

591,600

(4.0

)%

$

1,053,682

$

1,117,128

(5.7

)%

Digital Audio Group revenue

$

285,614

$

260,854

9.5

%

$

524,582

$

484,250

8.3

%

Excluding: Political revenue

(1,210

)

(846

)

(1,481

)

(1,346

)

Digital Audio Group revenue, excluding

political

$

284,404

$

260,008

9.4

%

$

523,101

$

482,904

8.3

%

Audio & Media Group Services

revenue

$

70,082

$

65,804

6.5

%

$

139,250

$

127,155

9.5

%

Excluding: Political revenue

(5,672

)

(1,475

)

(9,365

)

(1,093

)

Audio & Media Services Group revenue,

excluding political

$

64,410

$

64,329

0.1

%

$

129,885

$

126,062

3.0

%

Reconciliation of Total Debt to Net Debt

(In thousands)

June 30, 2024

Current portion of long-term debt

$

621

Long-term debt

5,218,194

Total debt

$

5,218,815

Less: Cash and cash equivalents

364,744

Net debt

$

4,854,071

Segment Results

The following tables present the Company's segment results for

the Company for the periods presented:

Segments

(In thousands)

Multiplatform Group

Digital Audio Group

Audio & Media Services

Group

Corporate and other reconciling

items

Eliminations

Consolidated

Three Months Ended June 30,

2024

Revenue

$

575,907

$

285,614

$

70,082

$

—

$

(2,511

)

$

929,092

Operating expenses(1)

471,644

193,744

46,233

69,775

(2,511

)

778,885

Adjusted EBITDA

$

104,263

$

91,870

$

23,849

$

(69,775

)

$

—

$

150,207

Adjusted EBITDA margin

18.1

%

32.2

%

34.0

%

16.2

%

Depreciation and amortization

(104,356

)

Impairment charges

(920,224

)

Other operating expense, net

(516

)

Restructuring expenses

(27,558

)

Share-based compensation expense

(7,220

)

Operating loss

$

(909,667

)

Operating margin

(97.9

)%

Segments

(In thousands)

Multiplatform Group

Digital Audio Group

Audio & Media Services

Group

Corporate and other reconciling

items

Eliminations

Consolidated

Three Months Ended June 30,

2023

Revenue

$

595,944

$

260,854

$

65,804

$

—

$

(2,588

)

$

920,014

Operating expenses(1)

433,542

176,272

47,305

74,302

(2,588

)

728,833

Adjusted EBITDA

$

162,402

$

84,582

$

18,499

$

(74,302

)

$

—

$

191,181

Adjusted EBITDA margin

27.3

%

32.4

%

28.1

%

20.8

%

Depreciation and amortization

(108,065

)

Impairment charges

(960,570

)

Other operating income, net

261

Restructuring expenses

(10,789

)

Share-based compensation expense

(9,212

)

Operating loss

$

(897,194

)

Operating margin

(97.5

)%

(1) Operating expenses consist of Direct

operating expenses and SG&A expenses, excluding Restructuring

expenses and share-based compensation expenses.

Segments

(In thousands)

Multiplatform Group

Digital Audio Group

Audio & Media Services

Group

Corporate and other reconciling

items

Eliminations

Consolidated

Six Months Ended June 30, 2024

Revenue

$

1,069,370

524,582

$

139,250

$

—

$

(5,072

)

$

1,728,130

Operating expenses(1)

887,925

364,585

91,706

134,162

(5,072

)

1,473,306

Adjusted EBITDA

$

181,445

$

159,997

$

47,544

$

(134,162

)

$

—

$

254,824

Adjusted EBITDA margin

17.0

%

30.5

%

34.1

%

14.7

%

Depreciation and amortization

(209,518

)

Impairment charges

(921,732

)

Other operating expense, net

(1,088

)

Restructuring expenses

(51,161

)

Share-based compensation expense

(15,700

)

Operating loss

$

(944,375

)

Operating margin

(54.6

)%

Segments

(In thousands)

Multiplatform Group

Digital Audio Group

Audio & Media Services

Group

Corporate and other reconciling

items

Eliminations

Consolidated

Six Months Ended June 30, 2023

Revenue

$

1,124,957

$

484,250

$

127,155

$

—

$

(5,109

)

$

1,731,253

Operating expenses(1)

875,503

345,549

93,312

137,393

(5,109

)

1,446,648

Adjusted EBITDA

$

249,454

$

138,701

$

33,843

$

(137,393

)

$

—

$

284,605

Adjusted EBITDA margin

22.2

%

28.6

%

26.6

%

16.4

%

Depreciation and amortization

(216,577

)

Impairment charges

(964,517

)

Other operating income, net

40

Restructuring expenses

(30,243

)

Share-based compensation expense

(19,364

)

Operating loss

$

(946,056

)

Operating margin

(54.6

)%

(1) Operating expenses consist of Direct

operating expenses and SG&A expenses, excluding Restructuring

expenses and share-based compensation expenses.

______________________________

1 Unless otherwise noted, all results are

based on year over year comparisons.

2 Total available liquidity is defined as

cash and cash equivalents plus available borrowings under our ABL

Facility. We use total available liquidity to evaluate our capacity

to access cash to meet obligations and fund operations.

3 A full reconciliation of forecasted

Adjusted EBITDA, net debt and net leverage on a non-GAAP basis to

the respective most-directly comparable GAAP metrics cannot be

provided without unreasonable efforts due to the inherent

difficulty in forecasting and quantifying with reasonable accuracy

significant items required for the reconciliations, including gains

or losses on investments, extinguishment of debt, equity in

nonconsolidated affiliates, impairment charges, stock based

compensation, and restructuring as well as the Company’s cash and

cash equivalents balance.

4 Total available liquidity is defined as

cash and cash equivalents plus available borrowings under our ABL

Facility. We use total available liquidity to evaluate our capacity

to access cash to meet obligations and fund operations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808585847/en/

Media Wendy Goldberg Chief

Communications Officer (212) 377-1105

wendygoldberg@iheartmedia.com

Investors Mike McGuinness EVP,

Deputy CFO, and Head of Investor Relations (212) 377-1336

mbm@iheartmedia.com

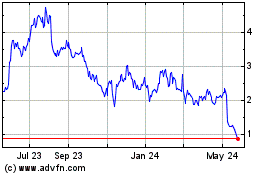

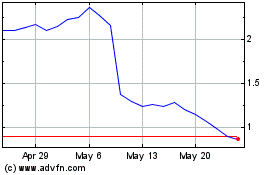

iHeartMedia (NASDAQ:IHRT)

Historical Stock Chart

From Oct 2024 to Nov 2024

iHeartMedia (NASDAQ:IHRT)

Historical Stock Chart

From Nov 2023 to Nov 2024