Hanmi Financial Corporation (NASDAQ:HAFC) (�we,� �our� or �Hanmi�),

the holding company for Hanmi Bank (the �Bank�), today reported a

fourth-quarter 2007 net loss of $100.0 million, or ($2.15) per

share, which includes a non-cash goodwill impairment charge of

$102.9 million, compared to net income of $17.3 million, or $0.35

per diluted share, for the comparable period in 2006. In addition,

fourth-quarter 2007 results include a $1.1 million

other-than-temporary impairment charge on a Community Reinvestment

Act (�CRA�) preferred security, $1.7 million separation expenses

associated with the former Chief Executive Officer�s retirement,

and a $20.7 million provision for credit losses. For the year, we

reported a net loss of $60.5 million, or ($1.27) per share,

compared to net income of $65.6 million, or $1.33 per diluted

share, in 2006. Excluding three unusual charges - goodwill

impairment charge, other-than-temporary impairment charge and

separation expenses, 2007 net income was $44.1 million, or $0.92

per diluted share. �The goodwill impairment charge was occasioned

by the decline in the market value of our common stock, which we

believe reflects, in part, recent turmoil in the financial markets

that has adversely affected the market value of the common stock of

many banks,� stated Chung Hoon Youk, Chief Credit Officer and

Interim Chief Executive Officer. �It is important to note that the

fourth-quarter loss, attributable primarily to the goodwill

impairment charge, does not affect our tangible equity or our

liquidity position. Further, our regulatory capital ratios are

unaffected by this goodwill write-off, and we believe that we

continue to have a level of capital that is sufficient to support

current operations and foreseeable future growth.� For the fourth

quarter and full year ended December 31, 2007, we believe the

following components to be of significance with regard to the net

loss: � Three Months Ended December 31, 2007 � Year Ended December

31, 2007 � � Weighted- � � Weighted- � Income Average Per Income

Average Per (Loss) Shares Share (Loss) Shares Share (Numerator)

(Denominator) Amount (Numerator) (Denominator) Amount � (Dollars in

Thousands, Except Per Share Amounts) � GAAP Net Loss $ (99,986 )

46,465,973 $ (2.15 ) $ (60,520 ) 47,787,213 $ (1.27 ) � Impairment

Loss on Goodwill 102,891 102,891 Other-Than-Temporary Impairment

Loss on Securities 1,074 1,074 Separation Expenses for Former CEO�s

Retirement 1,683 1,683 Tax Effect (1,009 ) (1,009 ) � Dilutive

Securities - Options and Warrants � 180,751 $ 2.25 � � 306,504 $

2.19 � � � � � Non-GAAP Net Income, Excluding Impairment Loss on

Goodwill, Other-Than-Temporary Impairment Loss on Securities, Net

of Taxes, and Separation Expenses for Former CEO�s Retirement, Net

of Taxes $ 4,653 � 46,646,724 $ 0.10 � $ 44,119 � 48,093,717 $ 0.92

� Mr. Youk noted, �In the fourth quarter, the economic conditions

in the markets in which our borrowers operate continued to

deteriorate and the levels of loan delinquency and default

experienced by the Bank continued at higher than historical levels.

In response, the Bank has increased its allowance for loan losses

and significantly expanded its portfolio monitoring activities well

beyond the normal level of portfolio monitoring to attempt to

identify potential weaknesses in performing loans. For loans with

identified weaknesses, we have created individual action plans to

mitigate, to the extent possible, such weaknesses. This intensive

effort resulted, in part, in additional downgrades in the

classification of loans, primarily to �special mention.� We will

continue our intensive monitoring of the loan portfolio until the

Bank�s credit risk profile returns to a normalized level. The

fourth-quarter provision for credit losses reflects the increased

migration of loans into more adverse risk rating categories and

increases in net charge-offs and non-performing loans during the

quarter.� �Although the direction of the economy is beyond our

control,� said Mr. Youk, �we are committed to increasing

profitability and reducing the volatility of our own financial

performance. In addition to taking a very prudent stance towards

the assessment of credit quality we recently inaugurated a campaign

to increase core deposits with the objective of stronger margins.�

NET INTEREST INCOME AND MARGIN For the fourth quarter of 2007,

average loans increased $148.7 million, or 4.7%, compared to the

prior quarter, and increased $402.7 million, or 14.0%, compared to

the same quarter in the previous year. Average deposits increased

$13.7 million, or 0.5%, compared to the prior quarter, and

increased $76.6 million, or 2.6%, compared to the same quarter in

the previous year. In order to fill the funding gap, the Bank

utilized FHLB advances and other borrowings, which increased to

$487 million from $169 million a year ago. Despite the growth in

loans, net interest income in the fourth quarter of 2007 was

essentially flat at $37.7 million compared to $37.9 million last

quarter and $38.8 million in the fourth quarter of 2006 due to

compression in the net interest margin. As a result of the Federal

Reserve Bank lowering short-term interest rates and intense

competition for loans and deposits, the Bank�s net interest margin

has decreased relative to prior periods. The Bank�s net interest

margin was 4.08% for the fourth quarter of 2007, compared to 4.26%

in the prior quarter and 4.59% a year ago. NON-INTEREST INCOME

Non-interest income increased in the fourth quarter to $10.9

million from $9.5 million in the prior quarter, excluding the

fourth-quarter pre-tax non-cash impairment charge of $1.1 million

on the CRA preferred security, but lower than the $11.1 million

reported in the fourth quarter of 2006, due largely to fluctuations

in gain on sales of loans. For the year, non-interest income

increased to $40.0 million from $37.0 million in 2006, due mainly

to an increase in insurance commissions from the acquisition of two

insurance companies in January 2007. NON-INTEREST EXPENSE

Non-interest expense for the fourth-quarter and year ended 2007

were $126.2 million and $189.9 million, respectively, which

includes the goodwill impairment charge and separation expenses.

Excluding the goodwill impairment charge and separation expenses,

fourth-quarter non-GAAP non-interest expenses were $21.6 million,

and full-year non-GAAP non-interest expenses were $85.4 million,

compared to $19.9 million and $77.3 million, respectively for the

prior year periods. These increases were mainly derived from an

increase in operating expenses from the acquisition of two

insurance companies. � Three Months Ended December 31, 2007 � Year

Ended December 31, 2007 (In Thousands) � GAAP Non-Interest Expenses

$ 126,221 $ 189,929 � Impairment Loss on Goodwill (102,891 )

(102,891 ) Separation Expenses for Former CEO�s Retirement � (1,683

) � (1,683 ) � Non-GAAP Non-Interest Expenses, Excluding Impairment

Loss on Goodwill and Separation Expenses for Former CEO�s

Retirement $ 21,647 � $ 85,355 � GOODWILL IMPAIRMENT As previously

noted, in the fourth quarter we recorded a charge of $102.9 million

for impairment of goodwill. Generally accepted accounting

principles in the United States (�GAAP�) require that when a

company�s fair value becomes less than the carrying amount of

stockholders� equity, an assessment of impairment of goodwill must

be performed. The Bank�s goodwill was primarily associated with the

acquisition of Pacific Union Bank in April 2004. The twelve

branches acquired continue to be significant contributors to our

operations and have been integrated into our core operations. GAAP

requires that we use the most readily available indicator of market

value, which is the market price of our stock, as part of our

assessment of goodwill impairment. While we believe that our

current market trading value is in part indicative of concerns in

the economy and financial markets generally, we decided that the

current fair value of our stock was not sufficient to support the

carrying value of goodwill. This charge is not expected to affect

our ongoing operations. ASSET QUALITY The total provision for

credit losses for the three months ended December 31, 2007 was

$20.7 million. By comparison, the provision for credit losses was

$8.5 million for the three months ended September 30, 2007 and $1.6

million for the three months ended December 31, 2006. The increase

in the provision for credit losses is attributable to increases in

net charge-offs, non-performing loans and criticized and classified

loans. The provision for credit losses, net of the charge-offs,

increased the allowance for loan losses to $43.6 million, or 1.33%,

of the gross loan portfolio, at December 31, 2007. We also have an

allowance for off-balance sheet exposure, primarily unfunded loan

commitments, of $1.8 million (recorded in other liabilities). Based

on management�s evaluation and analysis of portfolio credit quality

and prevailing economic conditions, we believe these reserves are

adequate for losses inherent in the loan portfolio and off-balance

sheet exposure at December 31, 2007. CAPITAL Our capital exceeds

the levels defined as �well capitalized� by our regulators. Hanmi

Bank�s Tier 1 leverage ratio, Tier 1 risk-based capital ratio and

total risk-based capital ratios were 8.47%, 9.31% and 10.58%,

respectively, at December 31, 2007. Hanmi Financial�s Tier 1

leverage ratio, Tier 1 risk-based capital ratio and total

risk-based capital ratios were 8.52%, 9.38% and 10.63%,

respectively, at December 31, 2007. ABOUT HANMI FINANCIAL

CORPORATION Headquartered in Los Angeles, Hanmi Bank, a wholly

owned subsidiary of Hanmi Financial Corporation, provides services

to the multi-ethnic communities of California, with 24 full-service

offices in Los Angeles, Orange, San Bernardino, Santa Clara, San

Francisco and San Diego counties, and eight loan production offices

in California, Colorado, Georgia, Illinois, Texas, Virginia and

Washington. Hanmi Bank specializes in commercial, SBA and trade

finance lending, and is a recognized community leader. Hanmi Bank�s

mission is to provide a full range of quality products and premier

services to its customers and to maximize shareholder value.

Additional information is available at www.hanmifinancial.com. This

release includes non-GAAP net income, non-GAAP earnings per share

data, shares used in non-GAAP earnings per share calculation and

non-GAAP non-interest expenses. These non-GAAP measures are not in

accordance with, or an alternative for measures prepared in

accordance with, GAAP and may be different from non-GAAP measures

used by other companies. In addition, these non-GAAP measures are

not based on any comprehensive set of accounting rules or

principles. We believe that non-GAAP measures have limitations in

that they do not reflect all of the amounts associated with our

results of operations as determined in accordance with GAAP and

that these measures should only be used to evaluate our results of

operations in conjunction with the corresponding GAAP measures. We

believe that the presentation of non-GAAP net income, non-GAAP

earnings per share data, shares used in non-GAAP earnings per share

calculation and non-GAAP non-interest expenses, when shown in

conjunction with the corresponding GAAP measures, provides useful

information to investors and management regarding financial and

business trends relating to its financial condition and results of

operations. In addition, we believe that the presentation of

non-GAAP income provides useful information to investors and

management regarding operating activities for the periods

presented. For the internal budgeting process, our management uses

financial statements that do not include impairment losses on

goodwill, other-than-temporary impairment losses on securities and

separation expenses. Our management also uses the foregoing

non-GAAP measures, in addition to the corresponding GAAP measures,

in reviewing our financial results. FORWARD-LOOKING STATEMENTS This

release contains forward-looking statements, which are included in

accordance with the �safe harbor� provisions of the Private

Securities Litigation Reform Act of 1995. In some cases, you can

identify forward-looking statements by terminology such as �may,�

�will,� �should,� �could,� �expects,� �plans,� �intends,�

�anticipates,� �believes,� �estimates,� �predicts,� �potential,� or

�continue,� or the negative of such terms and other comparable

terminology. Although we believe that the expectations reflected in

the forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance or achievements.

These statements involve known and unknown risks, uncertainties and

other factors that may cause our actual results, levels of

activity, performance or achievements to differ from those

expressed or implied by the forward-looking statement. These

factors include the following: general economic and business

conditions in those areas in which we operate; demographic changes;

competition for loans and deposits; fluctuations in interest rates;

risks of natural disasters related to our real estate portfolio;

risks associated with SBA loans; changes in governmental

regulation; credit quality; the ability of borrowers to perform

under the terms of their loans and other terms of credit

agreements; our ability to successfully integrate acquisitions we

may make; the availability of capital to fund the expansion of our

business; and changes in securities markets. In addition, we set

forth certain risks in our reports filed with the Securities and

Exchange Commission, including our Annual Report on Form 10-K for

the fiscal year ended December 31, 2006, which could cause actual

results to differ from those projected. We undertake no obligation

to update such forward-looking statements except as required by

law. HANMI FINANCIAL CORPORATION AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS (UNAUDITED) (Dollars in Thousands) � �

� � � December 31, September 30, % December 31, % � 2007 � � 2007 �

Change � 2006 � Change ASSETS Cash and Due from Banks $ 105,898 $

103,789 2.0 % $ 97,501 8.6 % Federal Funds Sold � 16,500 � � � � �

� � 41,000 � (59.8 )% Cash and Cash Equivalents � 122,398 � �

103,789 � 17.9 % � 138,501 � (11.6 )% Term Federal Funds Sold � � �

5,000 (100.0 )% Investment Securities 350,457 357,616 (2.0 )%

391,579 (10.5 )% Loans: Gross Loans, Net of Deferred Loan Fees

3,284,708 3,219,871 2.0 % 2,864,947 14.7 % Allowance for Loan

Losses � (43,611 ) � (34,503 ) 26.4 % � (27,557 ) 58.3 % Loans

Receivable, Net � 3,241,097 � � 3,185,368 � 1.7 % � 2,837,390 �

14.2 % Customers� Liability on Acceptances 5,387 5,357 0.6 % 8,403

(35.9 )% Premises and Equipment, Net 20,800 20,597 1.0 % 20,075 3.6

% Accrued Interest Receivable 17,500 17,619 (0.7 )% 16,919 3.4 %

Other Real Estate Owned 287 287 � � � Deferred Income Taxes 34,573

13,480 156.5 % 13,064 164.6 % Servicing Assets 4,336 4,328 0.2 %

4,579 (5.3 )% Goodwill 107,100 209,991 (49.0 )% 207,646 (48.4 )%

Other Intangible Assets 6,909 7,457 (7.3 )% 6,312 9.5 % Federal

Reserve Bank and Federal Home Loan Bank Stock 33,479 25,525 31.2 %

24,922 34.3 % Bank-Owned Life Insurance 24,524 24,285 1.0 % 23,592

4.0 % Other Assets � 25,371 � � 35,916 � (29.4 )% � 27,261 � (6.9

)% TOTAL ASSETS $ 3,994,218 � $ 4,011,615 � (0.4 )% $ 3,725,243 �

7.2 % � LIABILITIES AND SHAREHOLDERS� EQUITY Liabilities: Deposits:

Noninterest-Bearing $ 680,282 $ 690,513 (1.5 )% $ 728,347 (6.6 )%

Interest-Bearing � 2,321,417 � � 2,357,044 � (1.5 )% � 2,216,368 �

4.7 % Total Deposits 3,001,699 3,047,557 (1.5 )% 2,944,715 1.9 %

Accrued Interest Payable 21,828 20,449 6.7 % 22,582 (3.3 )%

Acceptances Outstanding 5,387 5,357 0.6 % 8,403 (35.9 )% FHLB

Advances and Other Borrowings 487,164 361,344 34.8 % 169,037 188.2

% Junior Subordinated Debentures 82,406 82,406 � 82,406 � Other

Liabilities � 24,189 � � 11,593 � 108.7 % � 10,983 � 120.2 % Total

Liabilities 3,622,673 3,528,706 2.7 % 3,238,126 11.9 %

Shareholders� Equity � 371,545 � � 482,909 � (23.1 )% � 487,117 �

(23.7 )% TOTAL LIABILITIES AND SHAREHOLDERS� EQUITY $ 3,994,218 � $

4,011,615 � (0.4 )% $ 3,725,243 � 7.2 % HANMI FINANCIAL CORPORATION

AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(Dollars in Thousands, Except Per Share Data) � � Three Months

Ended � � Year Ended Dec. 31, � Sept. 30, � % � Dec. 31, � % Dec.

31, � Dec. 31, � % � 2007 � 2007 Change 2006 Change � � 2007 � 2006

Change INTEREST INCOME: Interest and Fees on Loans $ 67,505 $

66,714 1.2 % $ 63,666 6.0 % $ 261,992 $ 239,075 9.6 % Interest on

Investments 4,309 4,422 (2.6 )% 4,762 (9.5 )% 17,867 19,710 (9.4 )%

Interest on Federal Funds Sold 69 61 13.1 % 654 (89.4 )% 1,032

1,402 (26.4 )% Interest on Term Federal Funds Sold � � � � � � � �

2 (100.0 )% � 5 � � 2 150.0 % Total Interest Income � 71,883 � �

71,197 1.0 % � 69,084 4.1 % � 280,896 � � 260,189 8.0 % � INTEREST

EXPENSE: Interest on Deposits 27,446 27,882 (1.6 )% 26,346 4.2 %

108,100 93,036 16.2 % Interest on FHLB Advances and Other

Borrowings 5,074 3,785 34.1 % 2,278 122.7 % 13,949 6,977 99.9 %

Interest on Junior Subordinated Debentures � 1,670 � � 1,675 (0.3

)% � 1,682 (0.7 )% � 6,644 � � 6,416 3.6 % Total Interest Expense �

34,190 � � 33,342 2.5 % � 30,306 12.8 % � 128,693 � � 106,429 20.9

% � NET INTEREST INCOME BEFORE PROVISION FOR CREDIT LOSSES 37,693

37,855 (0.4 )% 38,778 (2.8 )% 152,203 153,760 (1.0 )% � � �

Provision for Credit Losses � 20,704 � � 8,464 144.6 % � 1,631

1,169.4 % � 38,323 � � 7,173 434.3 % � NET INTEREST INCOME AFTER

PROVISION FOR CREDIT LOSSES � 16,989 � � 29,391 (42.2 )% � 37,147

(54.3 )% � 113,880 � � 146,587 (22.3 )% � NON-INTEREST INCOME:

Service Charges on Deposit Accounts 4,672 4,463 4.7 % 4,471 4.5 %

18,061 17,134 5.4 % Insurance Commissions 1,419 1,131 25.5 % 124

1,044.4 % 4,954 770 543.4 % Trade Finance Fees 944 1,082 (12.8 )%

1,153 (18.1 )% 4,493 4,567 (1.6 )% Remittance Fees 546 512 6.6 %

519 5.2 % 2,049 2,056 (0.3 )% Other Service Charges and Fees 646

691 (6.5 )% 620 4.2 % 2,527 2,359 7.1 % Bank-Owned Life Insurance

Income 240 234 2.6 % 225 6.7 % 933 879 6.1 % Increase in Fair Value

of Derivatives 162 207 (21.7 )% 351 (53.8 )% 683 1,074 (36.4 )%

Other Income 479 457 4.8 % 248 93.1 % 1,702 1,157 47.1 % Gain on

Sales of Loans 1,767 523 237.9 % 3,367 (47.5 )% 5,452 6,917 (21.2

)% Gain on Sales of Other Real Estate Owned � 226 (100.0 )% � � 226

48 370.8 % Gain on Sales of Securities Available for Sale � � � � �

� 2 (100.0 )% Other-Than-Temporary Impairment Loss on Securities �

(1,074 ) � � � � � � � � � (1,074 ) � � � � Total Non-Interest

Income � 9,801 � � 9,526 2.9 % � 11,078 (11.5 )% � 40,006 � �

36,963 8.2 % � NON-INTEREST EXPENSES: Salaries and Employee

Benefits 13,075 11,418 14.5 % 10,303 26.9 % 47,036 40,512 16.1 %

Occupancy and Equipment 2,754 2,657 3.7 % 2,521 9.2 % 10,494 9,643

8.8 % Data Processing 1,622 1,540 5.3 % 1,543 5.1 % 6,390 5,857 9.1

% Advertising and Promotion 1,137 943 20.6 % 875 29.9 % 3,630 2,997

21.1 % Supplies and Communications 596 704 (15.3 )% 543 9.8 % 2,592

2,391 8.4 % Professional Fees 782 565 38.4 % 360 117.2 % 2,468

1,910 29.2 % Amortization of Other Intangible Assets 548 570 (3.9

)% 564 (2.8 )% 2,324 2,379 (2.3 )% Decrease in Fair Value of

Embedded Option � 37 (100.0 )% 290 (100.0 )% 233 582 (60.0 )% Other

Operating Expenses 2,816 2,815 � 2,916 (3.4 )% 11,871 11,042 7.5 %

Impairment Loss on Goodwill � 102,891 � � � � � � � � � � 102,891 �

� � � � Total Non-Interest Expenses � 126,221 � � 21,249 494.0 % �

19,915 533.8 % � 189,929 � � 77,313 145.7 % � INCOME (LOSS) BEFORE

PROVISION FOR INCOME TAXES (99,431 ) 17,668 (662.8 )% 28,310 (451.2

)% (36,043 ) 106,237 (133.9 )% Provision for Income Taxes � 555 � �

6,580 (91.6 )% � 11,000 (95.0 )% � 24,477 � � 40,588 (39.7 )% � NET

INCOME (LOSS) $ (99,986 ) $ 11,088 (1,001.7 )% $ 17,310 (677.6 )% $

(60,520 ) $ 65,649 (192.2 )% � EARNINGS (LOSS) PER SHARE: Basic $

(2.15 ) $ 0.23 (1,034.8 )% $ 0.35 (714.3 )% $ (1.27 ) $ 1.34 (194.8

)% Diluted $ (2.15 ) $ 0.23 (1,034.8 )% $ 0.35 (714.3 )% $ (1.27 )

$ 1.33 (195.5 )% � WEIGHTED-AVERAGE SHARES OUTSTANDING: Basic

46,465,973 47,355,143 48,969,795 47,787,213 48,850,221 Diluted

46,465,973 47,536,078 49,567,778 47,787,213 49,435,128 � SHARES

OUTSTANDING AT PERIOD-END 45,860,941 46,986,341 49,076,613

45,860,941 49,076,613 HANMI FINANCIAL CORPORATION AND SUBSIDIARIES

SELECTED FINANCIAL DATA (UNAUDITED) (Dollars in Thousands) � Three

Months Ended � � Year Ended Dec. 31, � Sept. 30, � % � Dec. 31, � %

Dec. 31, � Dec. 31, � % � 2007 � � 2007 � Change � 2006 � Change �

� 2007 � � 2006 � Change � AVERAGE BALANCES: Average Gross Loans,

Net of Deferred Loan Fees $ 3,284,222 $ 3,135,531 4.7 % $ 2,881,515

14.0 % $ 3,080,544 $ 2,747,922 12.1 % Average Investment Securities

350,147 360,626 (2.9 )% 395,313 (11.4 )% 368,144 414,672 (11.2 )%

Average Interest-Earning Assets 3,669,436 3,526,493 4.1 % 3,349,911

9.5 % 3,494,758 3,214,761 8.7 % Average Total Assets 4,053,474

3,915,517 3.5 % 3,735,578 8.5 % 3,882,891 3,602,181 7.8 % Average

Deposits 3,029,804 3,016,118 0.5 % 2,953,226 2.6 % 2,989,806

2,881,448 3.8 % Average Borrowings 496,513 367,605 35.1 % 255,700

94.2 % 355,819 221,347 60.8 % Average Interest-Bearing Liabilities

2,845,775 2,683,930 6.0 % 2,480,902 14.7 % 2,643,296 2,367,389 11.7

% Average Shareholders� Equity 485,607 487,006 (0.3 )% 482,486 0.6

% 492,637 458,227 7.5 % Average Tangible Equity 269,496 269,255 0.1

% 268,201 0.5 % 275,036 242,362 13.5 % � � PERFORMANCE RATIOS:

Return on Average Assets (9.79 )% 1.12 % 1.84 % (1.56 )% 1.82 %

Return on Average Shareholders� Equity (81.69 )% 9.03 % 14.23 %

(12.28 )% 14.33 % Return on Average Tangible Equity (147.19 )%

16.34 % 25.61 % (22.00 )% 27.09 % Efficiency Ratio 265.76 % 44.85 %

39.95 % 98.81 % 40.54 % Net Interest Margin 4.08 % 4.26 % 4.59 %

4.36 % 4.78 % � � ALLOWANCE FOR LOAN LOSSES: Balance at the

Beginning of Period $ 34,503 $ 32,190 7.2 % $ 28,276 22.0 % $

27,557 $ 24,963 10.4 % Provision Charged to Operating Expense

20,736 8,397 146.9 % 1,631 1,171.4 % 38,688 7,173 439.4 %

Charge-Offs, Net of Recoveries � (11,628 ) � (6,084 ) 91.1 % �

(2,350 ) 394.8 % � (22,634 ) � (4,579 ) 394.3 % Balance at the End

of Period $ 43,611 � $ 34,503 � 26.4 % $ 27,557 � 58.3 % $ 43,611 �

$ 27,557 � 58.3 % � Allowance for Loan Losses to Total Gross Loans

1.33 % 1.07 % 0.96 % 1.33 % 0.96 % Allowance for Loan Losses to

Total Non-Performing Loans 80.05 % 77.19 % 193.86 % 80.05 % 193.86

% � � ALLOWANCE FOR OFF-BALANCE SHEET ITEMS: Balance at the

Beginning of Period $ 1,797 $ 1,730 3.9 % $ 2,130 (15.6 )% $ 2,130

$ 2,130 � Provision Charged to Operating Expense � (32 ) � 67 �

(147.8 )% � � � � � � (365 ) � � � � � Balance at the End of Period

$ 1,765 � $ 1,797 � (1.8 )% $ 2,130 � (17.1 )% $ 1,765 � $ 2,130 �

(17.1 )% HANMI FINANCIAL CORPORATION AND SUBSIDIARIES SELECTED

FINANCIAL DATA (UNAUDITED) (Continued) (Dollars in Thousands) � � �

� � Dec. 31, Sept. 30, % Dec. 31, % � 2007 � � 2007 � Change � 2006

� Change NON-PERFORMING ASSETS: Non-Accrual Loans $ 54,252 $ 44,497

21.9 % $ 14,213 281.7 % Loans 90 Days or More Past Due and Still

Accruing � 227 � � 199 � 14.1 % � 2 � 11,250.0 % Total

Non-Performing Loans 54,479 44,696 21.9 % 14,215 283.3 % Other Real

Estate Owned � 287 � � 287 � � � � � � � � Total Non-Performing

Assets $ 54,766 � $ 44,983 � 21.7 % $ 14,215 � 285.3 % � Total

Non-Performing Loans/Total Gross Loans 1.66 % 1.39 % 0.50 % Total

Non-Performing Assets/Total Assets 1.37 % 1.12 % 0.38 % Total

Non-Performing Assets/Allowance for Loan Losses 125.6 % 130.4 %

51.6 % � DELINQUENT LOANS $ 45,086 � $ 54,954 � (18.0 )% $ 19,616 �

129.8 % � Delinquent Loans/Total Gross Loans 1.37 % 1.71 % 0.68 % �

LOAN PORTFOLIO: Real Estate Loans $ 1,101,907 $ 1,099,100 0.3 % $

1,041,393 5.8 % Commercial and Industrial Loans 2,094,719 2,033,009

3.0 % 1,726,434 21.3 % Consumer Loans � 90,449 � � 90,416 � � � �

100,121 � (9.7 )% Total Gross Loans 3,287,075 3,222,525 2.0 %

2,867,948 14.6 % Deferred Loan Fees � (2,367 ) � (2,654 ) (10.8 )%

� (3,001 ) (21.1 )% Gross Loans, Net of Deferred Loan Fees

3,284,708 3,219,871 2.0 % 2,864,947 14.7 % Allowance for Loan

Losses � (43,611 ) � (34,503 ) 26.4 % � (27,557 ) 58.3 % Loans

Receivable, Net $ 3,241,097 � $ 3,185,368 � 1.7 % $ 2,837,390 �

14.2 % � LOAN MIX: Real Estate Loans 33.5 % 34.1 % 36.3 %

Commercial and Industrial Loans 63.7 % 63.1 % 60.2 % Consumer Loans

� 2.8 % � 2.8 % � 3.5 % Total Gross Loans � 100.0 % � 100.0 % �

100.0 % � DEPOSIT PORTFOLIO: Noninterest-Bearing $ 680,282 $

690,513 (1.5 )% $ 728,347 (6.6 )% Savings 93,099 94,150 (1.1 )%

99,255 (6.2 )% Money Market Checking and NOW Accounts 445,806

476,257 (6.4 )% 438,267 1.7 % Time Deposits of $100,000 or More

1,441,683 1,474,764 (2.2 )% 1,383,358 4.2 % Other Time Deposits �

340,829 � � 311,873 � 9.3 % � 295,488 � 15.3 % Total Deposits $

3,001,699 � $ 3,047,557 � (1.5 )% $ 2,944,715 � 1.9 % � DEPOSIT

MIX: Noninterest-Bearing 22.7 % 22.7 % 24.7 % Savings 3.1 % 3.1 %

3.4 % Money Market Checking and NOW Accounts 14.9 % 15.6 % 14.9 %

Time Deposits of $100,000 or More 48.0 % 48.4 % 47.0 % Other Time

Deposits � 11.3 % � 10.2 % � 10.0 % Total Deposits � 100.0 % �

100.0 % � 100.0 % HANMI FINANCIAL CORPORATION AND SUBSIDIARIES

AVERAGE BALANCES, AVERAGE YIELDS EARNED AND AVERAGE RATES PAID

(UNAUDITED) (Dollars in Thousands) � � Three Months Ended � Year

Ended December 31, 2007 � September 30, 2007 � December 31, 2006

December 31, 2007 � December 31, 2006 Average Balance � Interest

Income/ Expense � Average Yield/ Rate Average Balance � Interest

Income/ Expense � Average Yield/ Rate � Average Balance � Interest

Income/ Expense � Average Yield/ Rate Average Balance � Interest

Income/ Expense � Average Yield/ Rate � Average Balance � Interest

Income/ Expense � Average Yield/ Rate � INTEREST-EARNING ASSETS �

LOANS: Real Estate Loans: Commercial Property $ 787,721 $ 15,483

7.80 % $ 775,605 $ 15,678 8.02 % $ 756,961 $ 15,724 8.24 % $ �

771,386 $ 61,863 8.02 % $ 756,771 $ 61,773 8.16 % Construction

235,851 5,471 9.20 % 227,779 4,814 8.38 % 189,948 4,662 9.74 %

223,017 20,359 9.13 % 176,265 17,047 9.67 % Residential Property �

89,184 � � 1,160 5.16 % � 87,864 � � 1,124 5.08 % � 80,762 � �

1,066 5.24 % � � 87,180 � � 4,537 5.20 % � 84,381 � � 4,369 5.18 %

Total Real Estate Loans 1,112,756 22,114 7.88 % 1,091,248 21,616

7.86 % 1,027,671 21,452 8.28 % 1,081,583 86,759 8.02 % 1,017,417

83,189 8.18 % Commercial and Industrial Loans 2,081,945 43,658 8.32

% 1,951,478 43,169 8.78 % 1,758,498 39,986 9.02 % 1,905,625 166,802

8.75 % 1,637,133 146,803 8.97 % Consumer Loans � 91,378 � � 1,624

7.05 % � 94,751 � � 1,798 7.53 % � 98,570 � � 2,222 8.94 % � �

95,463 � � 7,611 7.97 % � 97,015 � � 8,441 8.70 % Total Gross Loans

3,286,079 67,396 8.14 % 3,137,477 66,583 8.42 % 2,884,739 63,660

8.76 % 3,082,671 261,172 8.47 % 2,751,565 238,433 8.67 % Prepayment

Penalty Income � 109 � � 131 � 6 � � 820 � � 642 � Unearned Income

on Loans, Net of Costs � (1,857 ) � � � � � (1,946 ) � � � � �

(3,224 ) � � � � � � (2,127 ) � � � � � (3,643 ) � � � � Gross

Loans, Net $ 3,284,222 � $ 67,505 8.15 % $ 3,135,531 � $ 66,714

8.44 % $ 2,881,515 � $ 63,666 8.77 % $ � 3,080,544 � $ 261,992 8.51

% $ 2,747,922 � $ 239,075 8.70 % � INVESTMENT SECURITIES: Municipal

Bonds $ 72,097 $ 765 4.24 % $ 70,984 $ 764 4.31 % $ 72,670 $ 766

4.22 % $ 71,937 $ 3,055 4.25 % $ 72,694 $ 3,087 4.25 % U.S.

Government Agency Securities 110,194 1,188 4.31 % 119,704 1,286

4.30 % 118,103 1,261 4.27 % 116,701 4,963 4.25 % 122,503 5,148 4.20

% Mortgage-Backed Securities 97,566 1,190 4.88 % 101,688 1,237 4.87

% 123,283 1,461 4.74 % 107,356 5,148 4.80 % 132,845 6,248 4.70 %

Collateralized Mortgage Obligations 52,883 570 4.31 % 55,619 612

4.40 % 68,368 744 4.35 % 58,189 2,530 4.35 % 73,765 3,178 4.31 %

Corporate Bonds 12,709 154 4.85 % 7,811 89 4.56 % 7,914 89 4.50 %

9,084 422 4.65 % 7,908 357 4.51 % Other Securities � 4,698 � � 84

7.15 % � 4,820 � � 84 6.97 % � 4,975 � � 84 6.75 % � � 4,877 � �

336 6.89 % � 4,957 � � 337 6.80 % Total Investment Securities $

350,147 � $ 3,951 4.51 % $ 360,626 � $ 4,072 4.52 % $ 395,313 � $

4,405 4.46 % $ � 368,144 � $ 16,454 4.47 % $ 414,672 � $ 18,355

4.43 % � OTHER INTEREST-EARNING ASSETS: Equity Securities (FHLB and

FRB Stock) $ 29,149 $ 358 4.91 % $ 25,431 $ 350 5.51 % $ 24,877 $

357 5.74 % $ 26,228 $ 1,413 5.39 % $ 24,684 $ 1,354 5.49 % Federal

Funds Sold 5,918 69 4.66 % 4,905 61 4.97 % 48,043 654 5.45 % 19,746

1,032 5.23 % 27,410 1,402 5.11 % Term Federal Funds Sold � � � � �

� 163 2 4.91 % 96 5 5.21 % 41 2 4.88 % Interest-Earning Deposits �

� � � � � � � � � � � � � � � � � � � � � � � � � � � � � 32 � � 1

4.01 % Total Other Interest-Earning Assets $ 35,067 � $ 427 4.87 %

$ 30,336 � $ 411 5.42 % $ 73,083 � $ 1,013 5.54 % $ � 46,070 � $

2,450 5.32 % $ 52,167 � $ 2,759 5.29 % � TOTAL INTEREST-EARNING

ASSETS $ 3,669,436 � $ 71,883 7.77 % $ 3,526,493 � $ 71,197 8.01 %

$ 3,349,911 � $ 69,084 8.18 % $ � 3,494,758 � $ 280,896 6.31 % $

3,214,761 � $ 260,189 6.35 % � INTEREST-BEARING LIABILITIES �

INTEREST-BEARING DEPOSITS: Savings $ 93,413 $ 622 2.64 % $ 95,147 $

567 2.36 % $ 98,892 $ 451 1.81 % $ 97,173 $ 2,152 2.21 % $ 107,811

$ 1,853 1.72 % Money Market Checking and NOW Accounts 478,501 3,996

3.31 % 471,756 4,164 3.50 % 442,747 3,675 3.29 % 452,825 15,298

3.38 % 471,780 14,539 3.08 % Time Deposits of $100,000 or More

1,465,551 18,977 5.14 % 1,438,711 19,263 5.31 % 1,392,240 18,650

5.31 % 1,430,603 75,516 5.28 % 1,286,202 64,184 4.99 % Other Time

Deposits � 311,797 � � 3,851 4.90 % � 310,711 � � 3,888 4.96 % �

291,323 � � 3,570 4.86 % � � 306,876 � � 15,134 4.93 % � 280,249 �

� 12,460 4.45 % Total Interest-Bearing Deposits $ 2,349,262 � $

27,446 4.64 % $ 2,316,325 � $ 27,882 4.78 % $ 2,225,202 � $ 26,346

4.70 % $ � 2,287,477 � $ 108,100 4.73 % $ 2,146,042 � $ 93,036 4.34

% � BORROWINGS: FHLB Advances and Other Borrowings $ 414,107 $

5,074 4.86 % $ 285,199 $ 3,785 5.27 % $ 173,294 $ 2,278 5.22 % $

273,413 $ 13,949 5.10 % $ 138,941 $ 6,977 5.02 % Junior

Subordinated Debentures � 82,406 � � 1,670 8.04 % � 82,406 � �

1,675 8.06 % � 82,406 � � 1,682 8.10 % � � 82,406 � � 6,644 8.06 %

� 82,406 � � 6,416 7.79 % Total Borrowings $ 496,513 � $ 6,744 5.39

% $ 367,605 � $ 5,460 5.89 % $ 255,700 � $ 3,960 6.14 % $ � 355,819

� $ 20,593 5.79 % $ 221,347 � $ 13,393 6.05 % � TOTAL

INTEREST-BEARING LIABILITIES $ 2,845,775 � $ 34,190 4.77 % $

2,683,930 � $ 33,342 4.93 % $ 2,480,902 � $ 30,306 4.85 % $ �

2,643,296 � $ 128,693 4.87 % $ 2,367,389 � $ 106,429 4.50 % � NET

INTEREST INCOME $ 37,693 $ 37,855 $ 38,778 $ 152,203 $ 153,760 �

NET INTEREST SPREAD 3.00 % 3.08 % 3.33 % 1.44 % 1.86 % � NET

INTEREST MARGIN 4.08 % 4.26 % 4.59 % 4.36 % 4.78 %

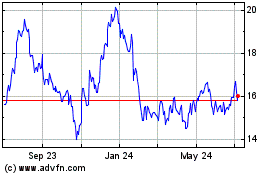

Hanmi Financial (NASDAQ:HAFC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hanmi Financial (NASDAQ:HAFC)

Historical Stock Chart

From Jul 2023 to Jul 2024