UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Schedule

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment

No. )

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2))

☐

Definitive Proxy Statement

☒

Definitive Additional Materials

☐

Soliciting Material Under §240.14a-12

GUARDION

HEALTH SCIENCES, INC.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| ☐ |

Fee

paid previously with preliminary materials. |

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11 |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 23, 2024

GUARDION

HEALTH SCIENCES, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38861 |

|

47-4428421 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

2925

Richmond Avenue, Suite 1200

Houston,

Texas 77098

(Address

of principal executive offices, including zip code)

Registrant’s

telephone number, including area code: (800) 873-5141

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

GHSI |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.07 Submission of Matters to a Vote of Security Holders

On

May 23, 2024, Guardion Health Sciences, Inc. (the “Company”) held a special meeting of stockholders (the “Special Meeting”).

At the Special Meeting, the Company’s stockholders considered the following proposals: (i) the sale of all of the outstanding equity

interests (the “Transaction”) of Activ Nutritional, LLC (“Activ”), a Delaware limited liability company which

owns the Viactiv® brand and business and is the wholly-owned subsidiary of Viactiv Nutritionals, Inc (“Viactiv”), a Delaware

corporation and a wholly-owned subsidiary of the Company, pursuant to an Equity Purchase Agreement with Doctor’s Best Inc., a Delaware

corporation (“Doctor’s Best”), dated January 30, 2024 (the “Purchase Agreement”); and (ii) the grant of

discretionary authority to the Board of Directors of the Company (the “Board”) to adjourn the Special Meeting to a later

date (the “Adjournment Proposal”), to allow for the solicitation of additional proxies only in the event that there are insufficient

shares present virtually or represented by proxy voting in favor of the Transaction or the voluntary dissolution and liquidation of the

Company (the “Dissolution”) pursuant to a Plan of Dissolution (the “Plan of Dissolution”), which, if approved,

will authorize the Company to liquidate and dissolve the Company in accordance with the Plan of Dissolution, but subject to the Company’s

ability to abandon or delay the Plan of Dissolution in accordance with the terms thereof (the “Dissolution Proposal”) .

Stockholders

of record at the close of business on April 5, 2024 (the “Record Date”) were entitled to notice of and one vote for each

share of common stock held by such stockholder. On the Record Date, there were 1,284,156 shares of common stock issued and outstanding,

of which 690,059 shares of common stock were represented at the Special Meeting, or approximately 53.73% of the total outstanding shares

of common stock on the Record Date, which was sufficient to constitute a quorum pursuant to the Company’s Second Amended and Restated

Bylaws, as amended, and to transact business.

Set

forth below are the final voting results for the proposals:

Proposal

No. 1 – Sale of Activ

The

Transaction was approved by the stockholders. The voting results were as follows:

| Votes For | |

Votes Against | | |

Abstentions | | |

Broker Non-Votes | |

| 652,867 | |

| 36,822 | | |

| 370 | | |

| 0 | |

Proposal

No. 3 – Adjournment of Special Meeting

As

there were not sufficient votes to approve the Dissolution Proposal (Proposal No. 2), the Dissolution Proposal was not presented to the

stockholders for their consideration at the Special Meeting. Consequently, the Adjournment Proposal (Proposal 3) was presented to the

stockholders for their consideration at the Special Meeting and was approved. The voting results were as follows:

| Votes For | |

Votes Against | | |

Abstentions | | |

Broker Non-Votes | |

| 635,846 | |

| 52,190 | | |

| 2,023 | | |

| 0 | |

In

accordance with the authority granted pursuant to the Adjournment Proposal, the Special Meeting was adjourned to 11:00 a.m. Central Time

on May 31, 2024, to allow management to solicit additional proxies in favor of the Dissolution Proposal.

Item

8.01 Other Events.

In

connection with stockholder approval of the Transaction and the Adjournment Proposal obtained at the Special Meeting, on May 23, 2024,

the Company issued a press release announcing stockholder approval of the Transaction and adjournment of the Special Meeting to 11:00

a.m. Central Time on May 31, 2024.

The

information in this Item 8.01 and Exhibit 99.1 hereto shall not be deemed “filed” for the purposes of or otherwise subject

to the liabilities under Section 18 of the Securities Exchange Act of 1934, as amended. Unless expressly incorporated into a filing of

the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, the information contained

in this Item 2.02 and Exhibit 99.1 hereto shall not be incorporated by reference into any Company filing, whether made before or after

the date hereof, regardless of any general incorporation language in such filing.

Additional

Information and Where to Find It

On

January 30, 2024, the Company the Purchase Agreement with Doctor’s Best for the sale of all of the outstanding equity interests

of Activ for aggregate cash consideration of $17.2 million, of which $1.7 million was placed in a third-party escrow account pursuant

to the terms of the Purchase Agreement. Doctor’s Best Inc. is a wholly-owned subsidiary of Kingdomway USA Corp., the U.S. subsidiary

holding company of Xiamen Kingdomway Group Company, which is publicly listed on the Shenzhen Stock Exchange.

In

the event that the transaction closes, the Company would be left with minimal operations. Accordingly, the Board has determined that

it is advisable and in the best interests of the Company and its stockholders to approve a voluntary dissolution and liquidation of the

Company pursuant to a Plan of Liquidation and Dissolution, which, if approved, would authorize the Company to liquidate and dissolve

in accordance with its terms, but such decision would be subject to the Company’s ability to abandon or delay the Plan of Liquidation

and Dissolution in the event that the Board determines that another transaction would be in the best interests of the Company’s

stockholders. Assuming the approval of the Plan of Liquidation and Dissolution by the Company’s stockholders, the decision as to

whether or not to proceed with the dissolution and when to file the Certificate of Dissolution will be made by the Board in its sole

discretion.

In

connection with the Purchase Agreement and the proposed transactions, the Company filed a definitive proxy statement with the SEC, which

was distributed to the stockholders of the Company in connection with its solicitation of proxies for the vote by its stockholders with

respect to the proposed transactions and other matters as may be described in the definitive proxy statement. BEFORE MAKING ANY VOTING

DECISION, INVESTORS AND STOCKHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING

THE COMPANY’S DEFINITIVE PROXY STATEMENT AND ACCOMPANYING PROXY CARD, AND ANY SUPPLEMENTS THERETO, WHEN THEY BECOME AVAILABLE,

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and stockholders are able to obtain a copy of the definitive proxy statement

and other relevant documents filed by the Company with the SEC free of charge from the SEC’s website, www.sec.gov., or by visiting

the investor relations section of the Company’s website, investors.guardionhealth.com. Stockholders may also request copies of

proxy statements and any of the documents incorporated by reference by directing a request by mail to Guardion Health Sciences, Inc.,

Attention: Investor Relations, at 2925 Richmond Avenue, Suite 1200, Houston, Texas 77098.

Participants

in the Solicitation

The

Company and its executive officers, directors, other members of management, and employees may be deemed, under SEC rules, to be participants

in the solicitation of proxies from the Company’s stockholders with respect to the proposed transaction. Information regarding

the executive officers and directors of the Company is set forth in the Proxy Statement filed with the SEC on April 8, 2024.

Forward-Looking

Statements

The

matters described herein may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements contain information

about our expectations, beliefs, plans or intentions regarding our product development and commercialization efforts, research and development

efforts, business, financial condition, results of operations, strategies or prospects, and other similar matters. Statements preceded

by, followed by or that otherwise include the words “believes,” “expects,” “anticipates,” “intends,”

“projects,” “estimates,” “plans,” “hopes” and similar expressions or future or conditional

verbs such as “will,” “should,” “would,” “may” and “could” are generally

forward-looking in nature and not historical facts, although not all forward-looking statements include the foregoing.

These

statements are based on management’s current expectations and assumptions about future events, which are inherently subject to

uncertainties, risks and changes in circumstances that are difficult to predict, and involve unknown risks and uncertainties that may

individually or materially impact the matters discussed herein for a variety of reasons that are outside the control of the Company,

including, but not limited to, the approval by the stockholders of the Plan of Liquidation and Dissolution of the Company, the successful

completion of the sale of Activ to Doctor’s Best Inc., the successful completion of the Company’s Plan of Liquidation and

Dissolution if approved by the Company’s stockholders, the use of the proceeds received from the sale, the Company’s ability

to continue to fund or wind-down its operations, including its ocular healthcare business, subsequent to the sale, any replacement and

integration of new management team members if needed, the implementation of new financial, management, accounting and business software

systems, supply chain disruptions, key retail and e-commerce disruptions, inflation and a potential recession on the Company’s

business, operations and the economy in general, the Company’s ability to successfully develop and commercialize its proprietary

products and technologies, and the Company’s ability to maintain compliance with Nasdaq’s continued listing requirements.

Readers

are cautioned not to place undue reliance on these forward-looking statements, as actual results could differ materially from those described

in the forward-looking statements contained herein. Readers are urged to read the risk factors set forth in the Company’s filings

with the SEC, which are available at the SEC’s website (www.sec.gov). The Company disclaims any intention or obligation to update

or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

GUARDION

HEALTH SCIENCES, INC.

(Registrant) |

| Date:

May 23, 2024 |

|

|

| |

By: |

/s/

Jan Hall |

| |

Name: |

Jan

Hall |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

Guardion

Health Sciences Announces Approval by Stockholders of Proposed Sale of Viactiv Business

Adjourns

Special Meeting to May 31, 2024 in order to Solicit Additional Proxies in Support of its Plan of Liquidation and Dissolution

HOUSTON,

TEXAS – May 23, 2024 (GLOBE NEWSWIRE) – Guardion Health Sciences, Inc. (Nasdaq: GHSI) (“Guardion” or the “Company”),

a clinical nutrition company that offers a portfolio of science-based, clinically-supported products

designed to support the health needs of consumers, healthcare professionals and providers and their patients, announced today

that its stockholders approved the previously announced sale of its Viactiv business at a special meeting (the “Meeting”)

held earlier today. Following this approval, the Company then adjourned the Meeting to 11:00 a.m. Central Time on May 31, 2024 in order

to give the Company’s management additional time to solicit proxies from its stockholders of record on April 5, 2024 to vote in

favor of the proposal to adopt the Company’s Plan of Liquidation and Dissolution, as described in the Company’s definitive

proxy statement filed with the United States Securities and Exchange Commission on April 8, 2024. The Company needs to obtain approval

from a majority of its shares of common stock issued and outstanding for the proposal to pass.

Robert

N. Weingarten, Chairman of the Board of Directors, stated: “We appreciate the support of our stockholders in approving the sale

of our Viactiv business. We continue to work toward the closing of the Viactiv transaction and expect that the closing will occur by

June 30, 2024. We also appreciate the support of our stockholders who have voted overwhelmingly in support of our Plan of Liquidation

and Dissolution and are hopeful this additional week to solicit votes will cause our stockholders who have not yet voted to vote in favor

of this proposal. We continue to believe that the closing of the Viactiv transaction, followed by an orderly and efficient wind-down

of the Company, so we can distribute the expected accumulated cash to our stockholders, is the best result for our stockholders. As described

in our definitive proxy statement, under the Plan of Liquidation and Dissolution, the Board maintains the flexibility to abandon the

dissolution if an alternative transaction proposal becomes available that would be a better result for our stockholders.”

If

stockholders wish to vote or have any questions or need assistance, please call the Company’s proxy solicitor:

Kingsdale

Advisors

North

American Toll-Free Phone: 1-866-229-8874

Email:

contactus@kingsdaleadvisors.com

745

Fifth Avenue, 5th Floor, New York, New York 10151

Agreement

to Sell Activ Nutritional, LLC

As

previously announced, on January 30, 2024, the Company entered into an Equity Purchase Agreement (the “Purchase Agreement”)

with Doctor’s Best Inc., a Delaware corporation, for the sale of all of the outstanding equity interests of Activ Nutritional,

LLC (“Activ”) for aggregate cash consideration of $17,200,000, of which $1,700,000 was placed in a third-party escrow account

pursuant to the terms of the Purchase Agreement. Doctor’s Best Inc. is a wholly-owned subsidiary of Kingdomway USA Corp., the U.S.

subsidiary holding company of Xiamen Kingdomway Group Company (“XKDW”), which is publicly listed on the Shenzhen Stock Exchange.

This transaction is the result of a broad review of strategic alternatives by the Company’s Board of Directors over the past year.

Potential

Dissolution

In

the event that the transaction closes, the Company would be left with minimal operations. The Board of Directors has additionally determined

that it is in the best interests of the Company and its stockholders to approve a voluntary dissolution and liquidation of the Company

pursuant to a Plan of Liquidation and Dissolution, which would authorize the Company to liquidate and dissolve in accordance with its

terms. However, such decision would be subject to the Company’s ability to abandon or delay the Plan of Liquidation and Dissolution

in the event that the Board of Directors determines that another transaction would be in the best interests of the Company’s stockholders.

Views

and Recommendations of the Board of Directors

If

both of these proposals are approved and the Viactiv transaction closes in accordance with its terms, stockholders would receive one

or more liquidating cash distributions, which combined are expected to be between $9.00 and $11.00 per share of common stock as described

in the Company’s Current Report on Form 8-K dated May 21, 2024.

If

the dissolution proposal is not approved and/or the Viactiv transaction does not close in accordance with its terms, we believe that

there is substantial risk to the value of the Company’s shares.

Accordingly,

the Board of Directors unanimously and strongly recommends that stockholders vote FOR the dissolution proposal. The transaction remains

on track for completion by June 30, 2024, subject to satisfaction or waiver of customary closing conditions.

If

stockholders approve the sale of Activ but do not approve the Plan of Liquidation and Dissolution, the Company believes it will be more

difficult for the Company to expeditiously distribute the maximal amount of cash from that sale to our stockholders, since the Company

will need to retain cash to continue to fund the considerable on-going expenses it has as a public company and to operate its remaining

ocular healthcare business while the Board of Directors considers strategic alternatives.

The

Company’s common stock is listed and traded on the Nasdaq Capital Market (“Nasdaq”) under the symbol “GHSI”.

However, if the sale of Activ is approved but the Plan of Liquidation and Dissolution of the Company is not approved, we believe that

maintaining our listing on Nasdaq will be difficult and uncertain.

Shares

that are not voted are the same as a “NO” vote for each proposal, so every vote matters, regardless of how many shares a

stockholder may own.

About

Guardion Health Sciences, Inc.

Guardion

Health Sciences, Inc. (Nasdaq: GHSI) is a clinical nutrition company that offers a portfolio of science-based, clinically supported products

designed to support the health needs of consumers, healthcare professionals and providers and their patients. Information and risk factors

with respect to Guardion and its business may be obtained in the Company’s filings with the SEC at www.sec.gov.

Additional

Information and Where to Find it

In

connection with the proposed sale of Activ and the Plan of Liquidation and Dissolution, the Company filed with the SEC a Definitive Proxy

Statement and other relevant documents, including a form of proxy card, on April 8, 2024, which were mailed to the Company’s stockholders

of record on April 5, 2024. Stockholders are urged to read the Definitive Proxy Statement and any other documents filed with the SEC

in connection with the proposed sale of Activ and the Plan of Liquidation and Dissolution, or incorporated by reference in the Definitive

Proxy Statement because they contain important information. The Company’s filings with the SEC may be obtained without charge at

www.sec.gov.

Participants

in the Solicitation

The

Company and its executive officers, directors, other members of management, and employees may be deemed, under SEC rules, to be participants

in the solicitation of proxies from the Company’s stockholders with respect to the proposed transactions. Information regarding

the executive officers and directors of the Company is set forth in the Company’s definitive proxy statement.

Forward-Looking

Statements

The

matters described herein may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements contain information

about our expectations, beliefs, plans or intentions regarding our product development and commercialization efforts, research and development

efforts, business, financial condition, results of operations, strategies or prospects, and other similar matters. Statements preceded

by, followed by or that otherwise include the words “believes,” “expects,” “anticipates,” “intends,”

“projects,” “estimates,” “plans,” “hopes” and similar expressions or future or conditional

verbs such as “will,” “should,” “would,” “may” and “could” are generally

forward-looking in nature and not historical facts, although not all forward-looking statements include the foregoing.

These

statements are based on management’s current expectations and assumptions about future events, which are inherently subject to

uncertainties, risks and changes in circumstances that are difficult to predict, and involve unknown risks and uncertainties that may

individually or materially impact the matters discussed herein for a variety of reasons that are outside the control of the Company,

including, but not limited to, the approval by the stockholders of the Plan of Liquidation and Dissolution of the Company, the successful

completion of the sale of Activ to Doctor’s Best Inc., the successful completion of the Company’s Plan of Liquidation and

Dissolution if approved by the Company’s stockholders, the use of the proceeds received from the sale, the Company’s ability

to continue to fund or wind-down its operations, including its ocular healthcare business, subsequent to the sale, any replacement and

integration of new management team members if needed, the implementation of new financial, management, accounting and business software

systems, supply chain disruptions, key retail and e-commerce disruptions, inflation and a potential recession on the Company’s

business, operations and the economy in general, the Company’s ability to successfully develop and commercialize its proprietary

products and technologies, and the Company’s ability to maintain compliance with Nasdaq’s continued listing requirements.

Readers

are cautioned not to place undue reliance on these forward-looking statements, as actual results could differ materially from those described

in the forward-looking statements contained herein. Readers are urged to read the risk factors set forth in the Company’s filings

with the SEC, which are available at the SEC’s website (www.sec.gov). The Company disclaims any intention or obligation

to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

For

more information about Guardion Health Sciences, Inc., Contact:

investors@guardionhealth.com

Phone:

1-800 873-5141 Ext 208

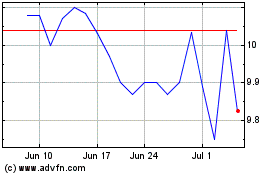

Guardion Health Sciences (NASDAQ:GHSI)

Historical Stock Chart

From May 2024 to Jun 2024

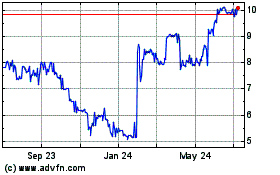

Guardion Health Sciences (NASDAQ:GHSI)

Historical Stock Chart

From Jun 2023 to Jun 2024