TIP SHEET: Fidelity Manager Sees Opportunity In Biotech Funding Crunch

December 23 2011 - 8:05AM

Dow Jones News

A funding crunch has descended upon the biotechnology industry

in recent years, which has made the sector less desirable to some

investors.

But Rajiv Kaul, portfolio manager of the Fidelity Select

Biotechnology (FBIOX) fund, sees the pressure on biotech stocks as

an opportunity. It has allowed him to buy what he sees as

higher-quality biotech stocks at cheaper valuations than in the

past.

"If in general companies are having a hard time getting financed

because of debt pressures, some can get unfairly penalized for

that," Kaul said. "That becomes a great opportunity for

investors."

His strategy has paid off this year. The $1.2 billion fund has

posted a year-to-date return of 16.07% through Wednesday, ranking

it third among 134 health funds tracked by Morningstar. Its

category was up 6.16% year to date through Wednesday, while the

S&P 500 index had a return of 0.93% for the period, according

to Morningstar. Morningstar gives the fund a rating of three out of

five stars.

"For investors interested in a biotechnology fund, it's a pretty

good option," said Christopher Davis, analyst with Morningstar. He

added, however, that few investors really need dedicated biotech

funds because they are niche funds that can be volatile.

Davis said Kaul's performance since taking over the Fidelity

fund in 2005 has exceeded that of actively managed biotech

rivals.

Kaul also manages the $72 million Fidelity Advisor Biotechnology

(FBTAX) fund, which is similar to the Select fund but sold through

financial advisers instead of directly to retail investors. The

Advisor fund had a year-to-date return of 16.31% through

Wednesday.

Top holdings in both funds as of Oct. 31 included Amgen Inc.

(AMGN), Biogen Idec Inc. (BIIB), Gilead Sciences Inc. (GILD),

Alexion Pharmaceuticals Inc. (ALXN) and Vertex Pharmaceuticals Inc.

(VRTX), according to Morningstar.

Biogen and Alexion each have posted year-to-date gains above 65%

as of Wednesday's close. Alexion has benefited from continued sales

growth for its drug Soliris, which treats a rare blood disease.

Biogen has risen on improve results from existing drugs plus high

expectations for an experimental multiple sclerosis drug it is

developing.

Both Biogen and Alexion are emblematic of key attributes Kaul

looks for in biotech stocks. Given the funding constraints,

companies with existing products generating cash flows are in a

better position than those that are still in the development stage,

Kaul said.

"There's a clear shakeout in the industry," he said. "Smaller

companies with higher-risk programs and questionable drugs are

finding it much harder to raise money...It's a very tough

environment. Those companies with products already are more

advantaged."

Kaul said he also looks for companies with solid clinical-trial

data for drugs under development. He likes companies selling or

developing drugs that represent meaningful advances in medical

care, as opposed to drugs that aren't much better than what is

already on the market.

He said drugs with meaningful benefits have a better shot at

getting reimbursed by cost-conscious health plans.

Despite the capital constraints, Kaul sees the biotech industry

as being in a "renaissance period," as scientific advancements are

leading to new therapies that can be combined with genetic

diagnostics to increase the odds that certain drugs will work in

certain patients.

"The general direction of the industry is moving forward," he

said. "That creates a fertile, rich environment in looking at new

ideas."

(Peter Loftus covers the pharmaceutical industry for Dow Jones

Newswires. He can be reached at 215-656-8289 or by email at

peter.loftus@dowjones.com.)

(TALK BACK: We invite readers to send us comments on this or

other financial news topics. Please email us at

TalkbackAmericas@dowjones.com. Readers should include their full

names, work or home addresses and telephone numbers for

verification purposes. We reserve the right to edit and publish

your comments along with your name; we reserve the right not to

publish reader comments.)

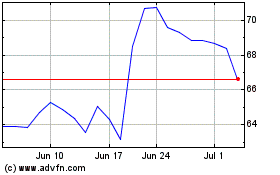

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From May 2024 to Jun 2024

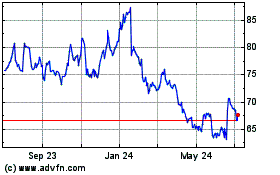

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Jun 2023 to Jun 2024