Vertex Hepatitis Drug Seen Successful, But Numbers Are Key

May 13 2010 - 3:27PM

Dow Jones News

Vertex Pharmaceuticals Inc. (VRTX) will report late-stage data

on its hepatitis C treatment in coming weeks from the first of

three key studies, and Wall Street will be watching the numbers to

gauge how telaprevir will fare in a competitive market.

Many expect the study to be positive, based on extensive prior

clinical data on the drug, and the stock is pricing in a lot of

success for telaprevir. But the data from the so-called Advance

trial, due by the end of June, could provide further gains as

confidence grows in the drug's role in the lucrative but

increasingly competitive hepatitis C market.

"Expectations are relatively high, but I think there is a

reasonable amount of money on the sidelines," said analyst Brian

Abrahams of Oppenheimer & Co., projecting telaprevir sales of

$1.47 billion by 2013. Abrahams said the study will reduce the

perceived risk in developing telaprevir and help investors feel

more comfortable in investing in the company.

Vertex plans to market the drug itself in North America. Johnson

& Johnson (JNJ) will help sell telaprevir overseas, with

Mitsubishi Tanabe Pharma Corp. (4508.TO) holding rights in Japan

and some Asian countries.

Although it has several promising pipeline products, Vertex's

$7.7 billion market valuation is primarily tied to the success of

telaprevir.

The stock, recently trading at $38.64, has largely traded

between $38 and $44 since early November when an earlier trial of

the drug showed positive results. Analysts project the stock moving

into the mid-$40s on positive data, but that reaction will depend

on the nuances of the data.

Unlike many clinical trials, the issue with the Advance

study--along with the other two trials coming later this year--is

not whether it succeeds, but the level of the success. Failure is

seen as highly unlikely because of the success of multiple earlier

studies, but such a development would be a major setback.

Hepatitis C is a blood-transmitted virus that causes liver

inflammation and can lead to cirrhosis, cancer and liver

failure.

There is no cure for the disease, but sustained virologic

response, or SVR--when the virus isn't detected in the blood for

six months after treatment--is pretty close and relapse is

rare.

Last year, Johnson & Johnson projected the hepatitis C

market would grow from $3.3 billion in 2008 to $7 billion in 2013,

driven by sales of drugs like telaprevir.

The standard therapy, a combination of interferon injections and

ribavirin pills over 48 weeks, achieves an SVR in up to about 50%

of patients, according to the Centers for Disease Control. When

telaprevir is used with those drugs, which can have severe side

effects, it can cut the length of therapy to 24 weeks in most

patients.

In mid-stage clinical trials that use a similar treatment

regimen to the coming data, telaprevir showed an SVR rate of 61% to

69%, compared to 41% to 46% among patients taking a placebo, said

Vertex Chief Medical Officer Robert Kauffman.

Another midstage study had more than 80% of patients achieving

an SVR. That study, dubbed C-208, included more measures to manage

a rash that can occur in some patients and used "response-guided

therapy" that assesses whether patients should use the drug for a

longer duration based on their initial response.

The results may have also been boosted because that study

occurred in Europe, where patients SVRs are higher for unknown

reasons, Dr. Kauffman said.

The Phase III program includes response-guided therapy and

rash-related changes, but are being conducted in both the U.S. and

Europe. Those factors have analysts generally expecting the SVR

rate in the Advance trial to exceed 70%.

"Above 75%, things start to get interesting," RBC Capital

Markets analyst Jason Kantor said, noting that such a high level

would give "the bears very little to talk about."

But if the rate comes in below 70% it could prove to be

disappointing to investors, even though the approval process for

the drug will be still be able to move forward. The company expects

to file for approval by the end of the year, Dr. Kauffman said, and

hopes to get a six-month review from the Food and Drug

Adminstration.

"From a regulatory perspective and changing clinical

practice...a 68% SVR rate would be a slam dunk; however, one of the

issues with Vertex is future competition," Kantor said.

Telaprevir is likely to face competition from Merck & Co.'s

(MRK) boceprivir, which is on a similar development time line, and

many companies are developing hepatitis C treatments, including

Bristol-Myers Squibb Co. (BMY), Gilead Sciences Inc. (GILD) and

Roche Holding AG (RHHBY, ROG.VX).

-By Thomas Gryta, Dow Jones Newswires; 212-416-2169;

thomas.gryta@dowjones.com

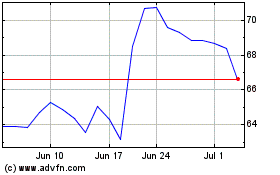

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From May 2024 to Jun 2024

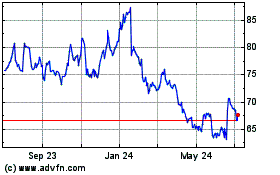

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Jun 2023 to Jun 2024