GigaCloud Technology Inc (Nasdaq: GCT) (“GigaCloud” or the

“Company”), a pioneer of global end-to-end B2B technology solutions

for large parcel merchandise, today announced financial results for

the first quarter ended March 31, 2024, including substantial

growth in revenue, gross profit, and net income over the comparable

prior year period.

First Quarter 2024 Financial Highlights

- Total

revenues of $251.1 million, increased 96.5% from

$127.8 million in the first quarter of 2023.

- Gross

profit of $66.5 million, increased 124.7% from

$29.6 million in the first quarter of 2023.Gross

margin grew to 26.5%, up 340 basis points from 23.1% in

the first quarter of 2023.

- Net

income of $27.2 million, increased 71.1% from

$15.9 million in the first quarter of 2023.Net income

margin was 10.8%, down 160 basis points from 12.4% in the

first quarter of 2023.Diluted EPS increased 69.2%

to $0.66, from $0.39 in the first quarter of 2023.

- Adjusted

EBITDA1 increased 74.2% to $34.5 million, from

$19.8 million in the first quarter of 2023.Adjusted

EPS – diluted2 increased 71.4% to $0.84, from $0.49 in the

first quarter of 2023.

- Cash,

Restricted Cash, and Investments totaled

$196.2 million as of March 31, 2024, increased 6.5% from

$184.2 million as of December 31, 2023.

Operational Highlights

- GigaCloud

Marketplace GMV3 increased 64.0% to $907.7 million in

the 12 months ended March 31, 2024, from $553.5 million

in the 12 months ended March 31, 2023.

- 3P seller

GigaCloud Marketplace GMV4 increased 71.8% to

$489.9 million in the 12 months ended March 31, 2024,

from $285.2 million in the 12 months ended March 31,

2023. 3P seller GigaCloud Marketplace GMV represented 54.0% of

total GigaCloud Marketplace GMV in the 12 months ended

March 31, 2024, up from 51.5% in the 12 months ended

March 31, 2023.

- Active 3P

sellers5 increased 43.7% to 865 in the 12 months ended

March 31, 2024, from 602 in the 12 months ended March 31,

2023.

- Active

buyers6 increased 29.1% to 5,493 in the 12 months ended

March 31, 2024, from 4,255 in the 12 months ended

March 31, 2023.

- Spend per

active buyer7 increased 27.0% to $165,239 in the 12 months

ended March 31, 2024, from $130,083 in the 12 months ended

March 31, 2023.

“We are pleased to report exceptional growth in revenue,

accompanied by marked improvements in gross profit margin,” said

Larry Wu, Founder, Chairman and Chief Executive Officer of

GigaCloud. “Additionally, our GigaCloud Marketplace continued its

impressive momentum across all key metrics, while simultaneously

expanding its service offerings. Strategic investments in our

fulfillment infrastructure in support of our expected growth and

foreign exchange fluctuations caused a temporary decline in our net

income margin for the first quarter. We are confident that these

investments will better position GigaCloud to meet surging

Marketplace buyer and seller demands while further enhancing

efficiency.

“The introduction of our Branding-as-a-Service, or BaaS, marked

a pivotal moment for GigaCloud and the furniture industry as a

whole, especially within our marketplace where furniture is a key

category.” Mr. Wu continued, “This program allows qualified sellers

to leverage the well-established Christopher Knight Home brand to

address the longstanding challenges associated with brand building

in the furniture sector. We are observing widespread enthusiasm

from Marketplace sellers as we prepare for inaugural transactions

under the program in the second quarter. This strategic move

underscores our commitment to empower Marketplace buyers and

sellers and is an example of yet another addition to our service

toolbox designed to foster stronger loyalty and engagement among

Marketplace buyers and sellers. We are confident that our sustained

growth will unlock even greater opportunities for our buyers and

sellers, solidifying GigaCloud’s position at the forefront of

streamlining the global supply chain for large parcel merchandise

through our Supplier Fulfilled Retailing model.”

Business Outlook

The Company expects its total revenues to be between

$265 million and $280 million in the second quarter of

2024. This forecast reflects the Company’s current and preliminary

views on the market and operational conditions, which are subject

to change and cannot be predicted with reasonable accuracy as of

the date hereof.

Conference Call

The Company will host a conference call to discuss its financial

results at 8:00 am U.S. Eastern Time (8:00 pm Beijing/Hong Kong

Time) on May 9, 2024. Participants who wish to join the call should

pre-register here at

https://register.vevent.com/register/BI2d6dde94a2864239b696c2e79bc831a5.

Upon registration, participants will receive the dial-in number and

a unique PIN, which can be used to join the conference call. If

participants register and forget their PIN or lose their

registration confirmation email, they may re-register to receive a

new PIN. All participants are encouraged to dial in 15 minutes

prior to the start time.

A live and archived webcast of the conference call will be

accessible on the Company’s investor relations website at:

https://investors.gigacloudtech.com/.

About GigaCloud Technology Inc

GigaCloud Technology Inc is a pioneer of global end-to-end B2B

technology solutions for large parcel merchandise. The Company’s

B2B ecommerce platform, which it refers to as the “GigaCloud

Marketplace,” integrates everything from discovery, payments and

logistics tools into one easy-to-use platform. The Company’s global

marketplace seamlessly connects manufacturers, primarily in Asia,

with resellers, primarily in the U.S., Asia and Europe, to execute

cross-border transactions with confidence, speed and efficiency.

The Company offers a truly comprehensive solution that transports

products from the manufacturer’s warehouse to the end customer’s

doorstep, all at one fixed price. The Company first launched its

marketplace in January 2019 by focusing on the global furniture

market and has since expanded into additional categories such as

home appliances and fitness equipment. For more information, please

visit the Company’s website:

https://investors.gigacloudtech.com/.

Non-GAAP Financial Measures

The Company uses certain non-GAAP financial measures, including

Adjusted EBITDA and Adjusted EPS – diluted, to understand and

evaluate its core operating performance. Adjusted EBITDA is net

income excluding interest, income taxes and depreciation, further

adjusted to exclude share-based compensation expense. Adjusted EPS

– diluted is a financial measure defined as our Adjusted EBITDA

divided by our basic and diluted weighted-average shares

outstanding, respectively. Management uses Adjusted EBITDA and

Adjusted EPS – diluted as measures of operating performance, for

planning purposes, to allocate resources to enhance the financial

performance of our business, to evaluate the effectiveness of our

business strategies and in communications with our Board of

Directors and investors concerning our financial performance.

Non-GAAP financial measures, which may differ from similarly titled

measures used by other companies, are presented to enhance

investors’ overall understanding of our financial performance and

should not be considered a substitute for, or superior to, the

financial information prepared and presented in accordance with

U.S. GAAP.

For more information on the non-GAAP financial measures, please

see the tables captioned “Unaudited Reconciliation of Adjusted

EBITDA” and “Unaudited Reconciliation of Adjusted EPS – diluted”

set forth at the end of this press release.

Forward-Looking Statements

This press release contains “forward-looking statements”.

Forward-looking statements reflect our current view about future

events. These forward-looking statements involve known and unknown

risks and uncertainties and are based on the Company’s current

expectations and projections about future events that the Company

believes may affect its financial condition, results of operations,

business strategy and financial needs. Investors can identify these

forward-looking statements by words or phrases such as “may,”

“will,” “could,” “expect,” “anticipate,” “aim,” “estimate,”

“intend,” “plan,” “believe,” “is/are likely to,” “propose,”

“potential,” “continue” or similar expressions. The Company

undertakes no obligation to update or revise publicly any

forward-looking statements to reflect subsequent occurring events

or circumstances, or changes in its expectations, except as may be

required by law. Although the Company believes that the

expectations expressed in these forward-looking statements are

reasonable, it cannot assure you that such expectations will turn

out to be correct, and the Company cautions investors that actual

results may differ materially from the anticipated results and

encourages investors to review other factors that may affect its

future results in the Company’s registration statement and other

filings with the SEC.

For investor and media inquiries, please

contact:

GigaCloud Technology Inc

Investor Relations

Email: ir@gigacloudtech.com

PondelWilkinson, Inc.

Laurie Berman (Investors) – lberman@pondel.com

George Medici (Media) – gmedici@pondel.com

|

GigaCloud Technology Inc |

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

(In thousands except for share data and per share

data) |

|

|

| |

December 31, |

|

March 31, |

|

|

|

2023 |

|

|

|

2024 |

|

| ASSETS |

|

|

|

| Current

assets |

|

|

|

| Cash |

$ |

183,283 |

|

|

$ |

185,214 |

|

| Restricted cash |

|

885 |

|

|

|

894 |

|

| Investments |

|

— |

|

|

|

10,075 |

|

| Accounts receivable, net |

|

58,876 |

|

|

|

59,400 |

|

| Inventories |

|

132,247 |

|

|

|

186,131 |

|

| Prepayments and other current

assets |

|

17,516 |

|

|

|

18,940 |

|

| Total current

assets |

|

392,807 |

|

|

|

460,654 |

|

| Non-current

assets |

|

|

|

| Operating lease right-of-use

assets |

|

398,922 |

|

|

|

459,033 |

|

| Property and equipment,

net |

|

24,614 |

|

|

|

22,763 |

|

| Intangible assets, net |

|

8,367 |

|

|

|

7,820 |

|

| Goodwill |

|

12,586 |

|

|

|

12,586 |

|

| Deferred tax assets |

|

1,440 |

|

|

|

3,360 |

|

| Other non-current assets |

|

8,173 |

|

|

|

11,392 |

|

| Total non-current

assets |

|

454,102 |

|

|

|

516,954 |

|

| Total

assets |

$ |

846,909 |

|

|

$ |

977,608 |

|

| |

|

|

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

| Current

liabilities |

|

|

|

| Accounts payable (including

accounts payable of VIEs without recourse to the Company |

|

|

|

|

|

|

|

|

of $11,563 and nil as of December 31, 2023 and March 31, 2024,

respectively) |

$ |

69,757 |

|

|

$ |

86,766 |

|

| Contract liabilities

(including contract liabilities of VIEs without recourse to

the |

|

|

|

|

|

|

|

|

Company of $736 and nil as of December 31, 2023 and March 31, 2024,

respectively) |

|

5,537 |

|

|

|

7,554 |

|

| Current operating lease

liabilities (including current operating lease liabilities of

VIEs |

|

|

|

|

|

|

|

|

without recourse to the Company of $1,305 and nil as of December

31, 2023 and March 31, 2024, respectively) |

|

57,949 |

|

|

|

69,400 |

|

| Income tax payable (including

income tax payable of VIEs without recourse to the |

|

|

|

|

|

|

|

|

Company of $3,644 and nil as of December 31, 2023 and March 31,

2024, respectively) |

|

15,212 |

|

|

|

21,387 |

|

| Accrued expenses and other

current liabilities (including accrued expenses and other |

|

|

|

|

|

|

|

|

current liabilities of VIEs without recourse to the Company of

$2,774 and nil as of December 31, 2023 and March 31, 2024,

respectively) |

|

57,319 |

|

|

|

66,572 |

|

| Total current

liabilities |

|

205,774 |

|

|

|

251,679 |

|

| Non-current

liabilities |

|

|

|

| Operating lease liabilities,

non-current (including operating lease liabilities, non-current of

VIEs without recourse to the Company of $553 and nil as of December

31, 2023 and March 31, 2024, respectively) |

|

343,511 |

|

|

|

400,988 |

|

| Deferred tax liabilities |

|

3,795 |

|

|

|

3,683 |

|

| Finance lease obligations,

non-current |

|

111 |

|

|

|

122 |

|

| Non-current income tax

payable |

|

3,302 |

|

|

|

3,357 |

|

| Total non-current

liabilities |

|

350,719 |

|

|

|

408,150 |

|

| Total

liabilities |

$ |

556,493 |

|

|

$ |

659,829 |

|

| Commitments and

contingencies |

|

|

|

| Shareholders’

equity |

|

|

|

| Treasury shares, at cost

(294,029 and 292,637 shares held as of December 31, 2023 and March

31, 2024, respectively) |

$ |

(1,594 |

) |

|

$ |

(1,594 |

) |

| Class A ordinary shares ($0.05

par value, 50,673,268 shares authorized, 31,738,632 and 33,003,452

shares issued as of December 31, 2023 and March 31, 2024,

respectively, 31,455,148 and 32,720,692 shares outstanding as of

December 31, 2023 and March 31, 2024, respectively) |

|

1,584 |

|

|

|

1,648 |

|

| Class B ordinary shares ($0.05

par value, 9,326,732 shares authorized as of December 31, 2023 and

March 31, 2024, respectively, 9,326,732 and 8,076,732 shares issued

and outstanding as of December 31, 2023 and March 31, 2024,

respectively) |

|

466 |

|

|

|

403 |

|

| Additional paid-in

capital |

|

111,736 |

|

|

|

112,015 |

|

| Accumulated other

comprehensive income |

|

526 |

|

|

|

414 |

|

| Retained earnings |

|

177,698 |

|

|

|

204,893 |

|

| Total shareholders’

equity |

|

290,416 |

|

|

|

317,779 |

|

| Total liabilities and

shareholders’ equity |

$ |

846,909 |

|

|

$ |

977,608 |

|

|

GigaCloud Technology Inc |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME |

|

(In thousands except for share data and per share

data) |

| |

| |

Three Months Ended March 31, |

|

|

|

2023 |

|

|

|

2024 |

|

| Revenues |

|

|

|

| Service revenues |

$ |

35,096 |

|

|

$ |

67,415 |

|

| Product revenues |

|

92,701 |

|

|

|

183,662 |

|

| Total

revenues |

|

127,797 |

|

|

|

251,077 |

|

| Cost of

revenues |

|

|

|

| Services |

|

28,767 |

|

|

|

54,431 |

|

| Product sales |

|

69,456 |

|

|

|

130,098 |

|

| Total cost of

revenues |

|

98,223 |

|

|

|

184,529 |

|

|

Gross profit |

|

29,574 |

|

|

|

66,548 |

|

| Operating

expenses |

|

|

|

| Selling and marketing

expenses |

|

6,896 |

|

|

|

14,580 |

|

| General and administrative

expenses |

|

4,150 |

|

|

|

15,389 |

|

| Research and development

expenses |

|

672 |

|

|

|

1,756 |

|

| Losses on disposal of property

and equipment |

|

— |

|

|

|

6 |

|

| Total operating

expenses |

|

11,718 |

|

|

|

31,731 |

|

|

Operating income |

|

17,856 |

|

|

|

34,817 |

|

| Interest expense |

|

(113 |

) |

|

|

(81 |

) |

| Interest income |

|

590 |

|

|

|

1,609 |

|

| Foreign currency exchange

gains (losses), net |

|

1,385 |

|

|

|

(2,709 |

) |

| Government grants |

|

— |

|

|

|

6 |

|

| Others, net |

|

(21 |

) |

|

|

(322 |

) |

|

Income before income taxes |

|

19,697 |

|

|

|

33,320 |

|

| Income tax expense |

|

(3,756 |

) |

|

|

(6,125 |

) |

| Net

income |

$ |

15,941 |

|

|

$ |

27,195 |

|

| Net income

attributable to ordinary shareholders |

|

15,941 |

|

|

|

27,195 |

|

| Foreign currency translation

adjustment, net of nil income taxes |

|

(194 |

) |

|

|

(112 |

) |

| Total other

comprehensive income (loss) |

|

(194 |

) |

|

|

(112 |

) |

| Comprehensive

Income |

$ |

15,747 |

|

|

$ |

27,083 |

|

| Net income per

ordinary share |

|

|

|

|

—Basic |

$ |

0.39 |

|

|

$ |

0.67 |

|

|

—Diluted |

$ |

0.39 |

|

|

$ |

0.66 |

|

| Weighted average

number of ordinary shares outstanding used in computing net income

per ordinary share |

|

|

|

|

—Basic |

|

40,716,501 |

|

|

|

40,788,658 |

|

|

—Diluted |

|

40,716,501 |

|

|

|

40,950,170 |

|

|

GigaCloud Technology Inc |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(In thousands) |

| |

| |

Three Months EndedMarch 31, |

|

|

|

2023 |

|

|

|

2024 |

|

| Cash flows from

operating activities: |

|

|

|

| Net

income |

$ |

15,941 |

|

|

$ |

27,195 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

Allowance for doubtful accounts |

|

55 |

|

|

|

63 |

|

|

Inventory write-down |

|

242 |

|

|

|

304 |

|

|

Deferred tax |

|

(145 |

) |

|

|

(2,034 |

) |

|

Share-based compensation |

|

247 |

|

|

|

275 |

|

|

Depreciation and amortization |

|

380 |

|

|

|

2,081 |

|

|

Loss from disposal of property and equipment |

|

— |

|

|

|

6 |

|

|

Operating lease |

|

450 |

|

|

|

8,806 |

|

|

Interest income |

|

— |

|

|

|

(75 |

) |

|

Unrealized foreign currency exchange gains |

|

(419 |

) |

|

|

(686 |

) |

|

Others |

|

— |

|

|

|

1,859 |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

Accounts receivable |

|

(2,705 |

) |

|

|

(632 |

) |

|

Inventories |

|

(2,344 |

) |

|

|

(56,047 |

) |

|

Prepayments and other assets |

|

(2,266 |

) |

|

|

(2,289 |

) |

|

Accounts payable |

|

1,738 |

|

|

|

16,881 |

|

|

Contract liabilities |

|

125 |

|

|

|

2,045 |

|

|

Income tax payable |

|

3,697 |

|

|

|

6,552 |

|

|

Accrued expenses and other current liabilities |

|

5,350 |

|

|

|

11,005 |

|

| Net cash provided by

operating activities |

|

20,346 |

|

|

|

15,309 |

|

| Cash flows from

investing activities: |

|

|

|

|

Cash paid for purchase of property and equipment |

|

(137 |

) |

|

|

(3,993 |

) |

|

Cash received from disposal of property and equipment |

|

— |

|

|

|

1,525 |

|

|

Purchases of investments |

|

— |

|

|

|

(10,000 |

) |

| Net cash used in

investing activities |

|

(137 |

) |

|

|

(12,468 |

) |

| Cash flows from

financing activities: |

|

|

|

|

Repayment of finance lease obligations |

|

(840 |

) |

|

|

(595 |

) |

|

Repayment of bank loans |

|

(76 |

) |

|

|

— |

|

| Net cash used in

financing activities |

|

(916 |

) |

|

|

(595 |

) |

| Effect of foreign currency

exchange rate changes on cash and restricted cash |

|

(159 |

) |

|

|

(306 |

) |

| Net increase in cash

and restricted cash |

|

19,134 |

|

|

|

1,940 |

|

| Cash and restricted cash at

the beginning of the period |

|

145,076 |

|

|

|

184,168 |

|

| Cash and restricted

cash at the end of the period |

|

164,210 |

|

|

|

186,108 |

|

| Supplemental

disclosure of cash flow information |

|

|

|

| Cash paid for interest

expense |

|

113 |

|

|

|

81 |

|

| Cash paid for income

taxes |

$ |

204 |

|

|

$ |

1,596 |

|

|

GigaCloud Technology Inc |

|

UNAUDITED RECONCILIATION OF ADJUSTED EBITDA |

|

(In thousands, except for per share data) |

|

|

|

| |

Three Months EndedMarch 31, |

|

|

|

2023 |

|

|

|

2024 |

|

| Net

Income |

$ |

15,941 |

|

|

$ |

27,195 |

|

| Add: Income tax expense |

|

3,756 |

|

|

|

6,125 |

|

| Add: Interest expense |

|

113 |

|

|

|

81 |

|

| Less: Interest income |

|

(590 |

) |

|

|

(1,609 |

) |

| Add: Depreciation and

amortization |

|

380 |

|

|

|

2,081 |

|

| Add: Share-based compensation

expenses |

|

247 |

|

|

|

275 |

|

| Add: Non-recurring

items(1) |

|

— |

|

|

|

349 |

|

| Adjusted

EBITDA |

$ |

19,847 |

|

|

$ |

34,497 |

|

_____________________(1) During

the three months ended March 31, 2024, one of our fulfillment

centers in Japan experienced a fire. As a result of the fire, we

recognized losses of $1.8 million. Based on the provisions of our

insurance policy, we have determined that partial recovery of the

incurred losses is probable as of March 31, 2024 and therefore

recorded an insurance recovery of $1.5 million. We do not believe

such losses to be recurring or frequent in nature.

|

UNAUDITED RECONCILIATION OF ADJUSTED EPS –

DILUTED |

| |

| |

Three Months EndedMarch 31, |

|

|

|

2023 |

|

|

|

2024 |

|

| Net income per

ordinary share – diluted |

$ |

0.39 |

|

|

$ |

0.66 |

|

| Adjustments, per ordinary

share: |

|

|

|

| Add: Income tax expense |

|

0.09 |

|

|

|

0.15 |

|

| Add: Interest expense |

|

— |

|

|

|

— |

|

| Less: Interest income |

|

(0.01 |

) |

|

|

(0.04 |

) |

| Add: Depreciation and

amortization |

|

0.01 |

|

|

|

0.05 |

|

| Add: Share-based compensation

expenses |

|

0.01 |

|

|

|

0.01 |

|

| Add: Non-recurring

items(1) |

|

— |

|

|

|

0.01 |

|

| Adjusted EPS –

diluted |

$ |

0.49 |

|

|

$ |

0.84 |

|

| |

|

|

|

| Weighted average number of

ordinary shares outstanding - diluted |

|

40,716,501 |

|

|

|

40,950,170 |

|

_____________________(1) During

the three months ended March 31, 2024, one of our fulfillment

centers in Japan experienced a fire. As a result of the fire, we

recognized losses of $1.8 million. Based on the provisions of our

insurance policy, we have determined that partial recovery of the

incurred losses is probable as of March 31, 2024 and therefore

recorded an insurance recovery of $1.5 million. We do not believe

such losses to be recurring or frequent in nature.

_____________________

1 Adjusted EBITDA is a non-GAAP financial measure.

For more information on the non-GAAP financial measure, please see

the section of “Non-GAAP Financial Measure” and the table captioned

“Unaudited Reconciliation of Adjusted EBITDA” set forth at the end

of this press release.

2 Adjusted EPS – diluted is a non-GAAP financial

measure. For more information on the non-GAAP financial measure,

please see the section of “Non-GAAP Financial Measure” and the

table captioned “Unaudited Reconciliation of Adjusted EPS –

diluted” set forth at the end of this press release.

3 GigaCloud Marketplace GMV means the total gross

merchandise value of transactions ordered through our GigaCloud

Marketplace including GigaCloud 3P and GigaCloud 1P, before any

deductions of value added tax, goods and services tax, shipping

charges paid by buyers to sellers and any refunds.

4 3P seller GigaCloud Marketplace GMV means the total

gross merchandise value of transactions sold through our GigaCloud

Marketplace by 3P sellers, before any deductions of value added

tax, goods and services tax, shipping charges paid by buyers to

sellers and any refunds.

5 Active 3P sellers means sellers who have sold a

product in GigaCloud Marketplace within the last 12-month period,

irrespective of cancellations or returns.

6 Active buyers means buyers who have purchased a

product in the GigaCloud Marketplace within the last 12-month

period, irrespective of cancellations or returns.

7 Spend per active buyer is calculated by dividing

the total GigaCloud Marketplace GMV within the

last 12-month period by the number of active buyers as of

such date.

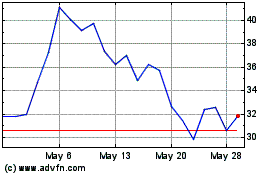

GigaCloud Technology (NASDAQ:GCT)

Historical Stock Chart

From Apr 2024 to May 2024

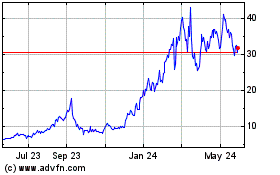

GigaCloud Technology (NASDAQ:GCT)

Historical Stock Chart

From May 2023 to May 2024