Form 8-K - Current report

November 06 2024 - 1:53PM

Edgar (US Regulatory)

false000071439500007143952024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

______________________

Date of Report (Date of earliest event reported): November 6, 2024

GERMAN AMERICAN BANCORP, INC.

(Exact name of registrant as specified in its charter)

Indiana

(State or other jurisdiction of incorporation)

| | | | | | | | |

| 001-15877 | 35-1547518 |

| (Commission File Number) | (IRS Employer Identification No.) |

| 711 Main Street | |

| Jasper, | Indiana | 47546 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (812) 482-1314

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[☐] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[☐] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[☐] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[☐] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act [☐]

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange

on which registered |

| Common Stock, no par value | | GABC | | Nasdaq Global Select Market |

Item 7.01. Regulation FD Disclosure.

D. Neil Dauby, Chairman and Chief Executive Officer, and Bradley M. Rust, President and Chief Financial Officer, of German American Bancorp, Inc. will participate in the 2024 Hovde Group Financial Services Conference being held on November 6 - 7, 2024, by hosting a series of meetings with investors during the conference.

Attached as Exhibit 99.1 is the information that will be provided to meeting participants. Such information is incorporated herein by reference.

The information in this Item 7.01, including the information incorporated herein from Exhibit 99.1, is furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | | | | |

| (d) | Exhibits | | |

| | | |

| Exhibit No. | | Description |

| | | |

| | | German American Bancorp, Inc. Presentation dated November 6-7, 2024. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

* * * * * *

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| GERMAN AMERICAN BANCORP, INC. |

Date: November 6, 2024 | By: | /s/ D. Neil Dauby |

| | D. Neil Dauby, Chairman and Chief Executive Officer |

Symbol: GABC November 6-7, 2024 HOVDE Financial Services Conference German American 1 Scan for electronic presentation

Presented By D. Neil Dauby, Chairman and Chief Executive Officer (812) 482-0707 neil.dauby@germanamerican.com Bradley M. Rust, President and CFO (812) 482-0718 brad.rust@germanamerican.com 2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS When used in this presentation and our oral statements, the words or phrases “believe,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “plans,” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this presentation, and we do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur in the future. By their nature, these statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from those anticipated in the statements. Factors that could cause actual results and performance to vary materially from those expressed or implied by any forward-looking statement include those that are discussed in Item 1, “Business – Forward Looking Statements and Associated Risk,” and Item 1A, “Risk Factors,” in our Annual Report on Form 10-K for 2023 as updated and supplemented by our other SEC reports filed from time to time. 3

Indiana & Kentucky Community-focused Financial Services Organization Who We Are 4 $6.3 Billion Total Banking Assets $3.4 Billion Investment & Trust Assets Under Management ~800 Team Members 74 Banking Offices in Indiana & Kentucky

Out-perform and “out-local” competitors Build long-term, multi-line client relationships based on trust and customer service excellence Deliver the right balance of high touch/high tech customer experience Increase non-interest income Excel at both organic and targeted M&A growth Attract, retain, and develop top talent Accelerate continuous improvement across the organization Our Strategic Position 5 Large enough to serve the most sophisticated clients. Small enough to know our customers by name.

History of Superior Financial Performance 6 Bank Director Magazine - Top 20 of 300 Largest Publicly Traded Banks for 2017 & 2018 Newsweek Best Banks in America (Indiana) 2020, 2021 & 2024 2022 S&P Global Top 20 Best Performing Banks between $3 and $10 Billion 2023 S&P Global Top 30 Best Performing Bank between $3 and $10 Billion Bank Director Magazine – 2023 Best US Banks Top 50 Publicly Traded Bank for $5 - $50 Billion Bauer Financial 5-Star Rating 2023 Forbes America's Best Banks List 2024 Twelve Consecutive Years of Increased Dividends Thirteen of the Past Fourteen Years of Improved Earnings Performance Double-Digit Return on Equity for 21 Consecutive Fiscal Years Raymond James 2012- 2017 and 2019-2021 & 2024 Community Bankers Cup Recipient KBW/Stifel 2010 though 2022 Bank Honor Roll Recipient Piper Sandler Small Cap All-Star 2012- 2013 and 2019-2020 & 2024 Bank Director Magazine – Bank Performance Scorecard Top 15 National Ranking for 2016 – 2019 Publicly Traded Companies for $1 - $5 Billion

FINANCIAL TRENDS 7

Total Assets 8 $4,398 $4,978 $5,609 $6,156 $6,152 $6,261 1.43% 1.32% 1.57% 1.26% 1.43% 1.31% 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 09/30/24 (dollars in millions, except per share amount) Return on Average Assets * 2022 was impacted by acquisition-related expenses and the Day 1 provision for credit losses under the CECL model for the CUB transaction that closed on January 1, 2022 of $18.623 mill ion ($14.097 million or $0.48 per share on an after tax basis). *

Loan Portfolio Trends 9 $3,077 $3,088 $3,004 $3,785 $3,971 $4,061 80% 82% 81% 81% 81% 80% 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 09/30/24 Total Loans, Net of Unearned Income Commercial & Agricultural Loans as % of Total Loans (dollars in millions) 65.00% 58.50% 56.62% 52.07% 56.26% 49.62% 44.89% 31.70% 31.35% 31.86% 31.49% 35.12% 47.23% 43.83% 40.74% 40.04% 39.71% 40.29% 12/31/2019 12/31/2020 12/31/2021 12/31/2022 12/31/2023 9/30/2024 Line of Credit Utilization Trend Ag - Line Utilization Commercial - Line Utilization Equity Express - Line Utilization

Floating 23% Fixed 33% 1 YR Adjustable 10% 3 YR + Adjustable 34% Rate Type Segmentation Diversified Loan Portfolio 10 Construction & Development Loans $ 289.9 million 7% Agricultural Loans $ 425.1 million 10% Commercial & Industrial Loans $ 630.9 million 16% Commerical Real Estate Owner Occupied $ 533.7 million 13% Commercial Real Estate Non- Owner Occupied $ 1,041.7 million 26% Multi-Family Residential Properties $ 361.2 million 9% Consumer Loans $ 71.9 million 2% Home Equity Loans $ 334.1 million 8% Residential Mortgage Loans $ 372.6 million 9% Loan Portfolio Composition & Diversification as of September 30, 2024 Total Loans $ 4,061.1 million

Non-Performing Assets to Total Assets 11 0.33% 0.44% 0.26% 0.23% 0.15% 0.15% 0.45% 0.52% 0.34% 0.29% 0.37% 0.43% 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 09/30/24 GABC Peer Group * *Peer Group (St. Louis Federal Reserve District BHC with Total Assets between $3 and $10 billion) Data as of 6/30/24.

Total Deposits 12 $3,430 $4,107 $4,744 $5,350 $5,253 $5,271 82% 88% 93% 92% 85% 83% 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 09/30/24 Non-Maturity Deposit Accounts as % of Total Deposits (dollars in millions) 2019 0.72% 2020 0.35% 2021 0.11% 2022 0.24% 2023 1.10% YTD 9/30/2024 1.72% Cost of Deposits Per Year

Commercial $1,614 million 31% Public Fund $1,159 million 22% Retail $2,498 million 47% 13 Total Deposit Composition as of 9/30/2024 22% of Total Deposits are Uninsured and Uncollateralized as of 9/30/2024. Average Deposit Account Size equals $25,234. Non-Interest Bearing Demand $1,406 million 27% Interest Bearing Demand, Savings & Money Market $2,955 million 56% Time Deposits > $100,000 $560 million 10% Time Deposits < $100,000 $350 million 7% Total Deposits: $5,271 million

Total Shareholders' Equity 14 $574 $625 $668 $558 $664 $745 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 09/30/24 (dollars in millions)

Regulatory Capital Levels 15 17.22% 15.76% 15.04% 12.30% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% Total Capital (to Risk Weighted Assets) Tier 1 (Core) Capital (to Risk Weighted Assets) Common Tier 1 (CET 1) Capital Ratio (to Risk Weighted Assets) Tier 1 Capital (to Average Assets) 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 09/30/24

Net Interest Income 16 $145,225 $155,243 $160,830 $200,584 $190,433 $144,826 $139,559 3.92% 3.63% 3.31% 3.45% 3.58% 3.63% 3.39% 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 09/30/23 09/30/24 Net Interest Margin (Tax-Equivalent) (dollars in thousands)

Non-Interest Income 17 As of December 31, 2023 Net Gains on Sales of Loans $2.4 million 4% Insurance Revenues $9.6 million 16% Service Charges on Deposit Accounts $11.5 million 19% Wealth Management $11.7 million 19% Interchange Fee Income $17.5 million 29% Other Operating Income $7.6 million 13% Total Non- Interest Income $60.3 million

Non-Interest Expense 18 $114,162 $117,123 $124,007 $154,191 $144,497 $108,763 $110,538 57.4% 54.3% 54.4% 56.6% 55.1% 54.8% 48.0% 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 YTD 9/30/2023 YTD 9/30/2024 Efficiency Ratio * 2022 was impacted by acquisition-related expenses for the CUB transaction that closed on January 1, 2022 of $12,323. * (dollars in thousands)

Net Income & Earnings Per Share 19 $59,222 $62,210 $84,137 $81,825 $85,888 $64,381 $60,600 $2.29 $2.34 $3.17 $2.78 $2.91 $2.18 $2.04 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 09/30/23 09/30/24 Earnings Per Share * 2022 was impacted by acquisition-related expenses and the Day 1 provision for credit losses under the CECL model for the CUB transaction that closed on January 1, 2022 of $18,623 ($14,097 or $0.48 per share on an after tax basis). * (dollars in thousands, except per share amounts)

Why Invest in GABC? 20 $1.07 $1.27 $1.32 $1.43 $1.51 $1.57 $1.77 $1.99 $2.29 $2.34 $3.17 $2.78 $2.91 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 As of 12/31 for years shown * Earnings Per Share adjusted for 3-for-2 stock split completed in 2017 ** 2022 was impacted by acquisition-related expenses and the Day 1 provision for credit losses under the CECL model for the CUB transaction that closed on January 1, 2022 of $18,623,000 ($14,097,000 or $0.48 per share on an after tax basis). ***** *** GABC Earnings Per Share Growth

Why Invest in GABC? 21 $0.40 $0.43 $0.45 $0.48 $0.52 $0.60 $0.68 $0.76 $0.84 $0.92 $1.00 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 *Dividends per share adjusted for 3-for-2 stock split completed in 2017 As of 12/31 for years shown * * * *

Why Invest in GABC? 22 Diversified Footprint of Rural, Suburban, and Urban Markets Providing a Strong Deposit Franchise Base Along with Significant Organic Growth Opportunities Existing Platform for Continuous Improvement and Operating Efficiency Infrastructure in Place for Perpetuating Ongoing EPS Growth Consistent Strong Dividend Yield and Dividend Pay-out Capacity Long Term Focus and Investment in Digital Optimization and Delivery Proven Executive Management Team Track Record of Consistent Top Quartile Financial Performance Experienced in Operating Plan Execution and M & A Transitions

23

v3.24.3

Cover page

|

Nov. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 06, 2024

|

| Entity Registrant Name |

GERMAN AMERICAN BANCORP, INC.

|

| Entity Incorporation, State or Country Code |

IN

|

| Entity File Number |

001-15877

|

| Entity Tax Identification Number |

35-1547518

|

| Entity Address, Address Line One |

711 Main Street

|

| Entity Address, City or Town |

Jasper,

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

47546

|

| City Area Code |

812

|

| Local Phone Number |

482-1314

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, no par value

|

| Trading Symbol |

GABC

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000714395

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

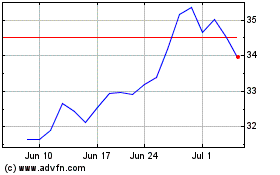

German American Bancorp (NASDAQ:GABC)

Historical Stock Chart

From Oct 2024 to Nov 2024

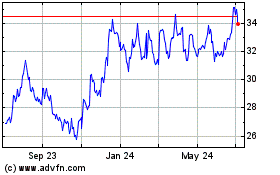

German American Bancorp (NASDAQ:GABC)

Historical Stock Chart

From Nov 2023 to Nov 2024