EZCORP and Texas Attorney General Reach Settlement

June 23 2008 - 4:47PM

PR Newswire (US)

AUSTIN, Texas, June 23 /PRNewswire-FirstCall/ -- EZCORP, Inc.

(NASDAQ:EZPW), the parent company of EZPAWN and EZMONEY Loan

Services, announced today that in cooperation with the Texas

Attorney General's office, the parties reached a settlement of the

lawsuit brought by the Attorney General regarding his claim that

the Company failed to adequately protect customers' private

information. The Company disputed and vigorously challenged the

Attorney General's claims. Joe Rotunda, President & CEO of

EZCORP, stated, "After an extended period of factual and legal

debate and negotiations, it became clear that it is in the best

interests of both parties to settle this matter rather than pursue

costly litigation. We mutually agreed to mediate the case and

reached a settlement of $600,000." Rotunda continued, "Despite the

Attorney General's allegations, we are pleased that no customer was

harmed. EZCORP had strong identity protection policies in place,

including a state-of-the-art 'paperless' document system, written

document retention policies, and regular audits prior to the

Attorney General's lawsuit. We invested additional resources in

technology and information security and continue to do so in an

ongoing manner to enhance identity protection and security for our

customers. We regularly evaluate our operations and look for new

ways to protect our customers against identity theft." Rotunda

concluded, "Our public guidance for the June ending quarter is 21

cents in diluted earnings per share versus 16 cents last year. Even

with this charge as well as the charge associated with the closing

of the eleven EZMONEY stores in Florida previously announced, we're

confident that we will achieve at least our public guidance for the

quarter." EZCORP is primarily a lender or provider of credit

services to individuals who do not have cash resources or access to

credit to meet their short-term cash needs. In 294 U.S. EZPAWN and

26 Mexico Empeno Facil locations open on March 31, 2008, the

Company offers non-recourse loans collateralized by tangible

personal property, commonly known as pawn loans. At these

locations, the Company also sells merchandise, primarily collateral

forfeited from its pawn lending operations, to consumers looking

for good value. In 462 EZMONEY locations and 73 EZPAWN locations

open on March 31, 2008, the Company offers short-term

non-collateralized loans, often referred to as payday loans, or fee

based credit services to customers seeking loans. This announcement

contains certain forward-looking statements regarding the Company's

expected performance for future periods including, but not limited

to, the expected impact of the settlement and expected future

earnings. Actual results for these periods may materially differ

from these statements. Such forward-looking statements involve

risks and uncertainties such as changing market conditions in the

overall economy and the industry, consumer demand for the Company's

services and merchandise, changes in the regulatory environment,

and other factors periodically discussed in the Company's annual,

quarterly and other reports filed with the Securities and Exchange

Commission. For additional information, contact Dan Tonissen (512)

314-2289. DATASOURCE: EZCORP, Inc. CONTACT: Dan Tonissen of EZCORP,

Inc., +1-512-314-2289 Web site: http://www.ezcorp.com/

Copyright

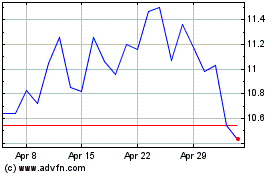

EZCORP (NASDAQ:EZPW)

Historical Stock Chart

From Sep 2024 to Oct 2024

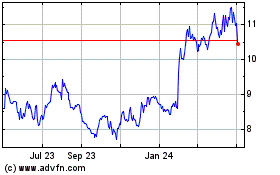

EZCORP (NASDAQ:EZPW)

Historical Stock Chart

From Oct 2023 to Oct 2024