EZCORP Discontinues Florida Credit Services Business

June 17 2008 - 8:54AM

PR Newswire (US)

AUSTIN, Texas, June 17 /PRNewswire-FirstCall/ -- EZCORP, Inc.

(NASDAQ:EZPW) announced today that it will cease operations in its

eleven EZMONEY credit services stores in Florida. The Florida

Office of Financial Regulation had previously filed an

administrative action against EZCORP alleging that the Florida

business model used in the eleven adjoined EZMONEY stores was in

violation of the state usury law. On March 25, an administrative

law judge recommended that the Office of Financial Regulation issue

a cease and desist order against EZMONEY's credit services

operations in Florida. This was issued on Thursday, June 12, by the

Office of Financial Regulation and a requested Stay was denied on

Monday, June 16, by the First District Court of Appeal. Joe

Rotunda, President & CEO of EZCORP, stated, "We disagree with

the finding of the administrative law judge and the subsequent

Office of Financial Regulation order. On June 13, we filed a Notice

of Appeal with the First District Court of Appeal of Florida. Most

disappointing is that a Motion for Stay Pending Appeal of the

decision was denied. Consequently, we will close our eleven EZMONEY

credit service organization stores in Florida pending the outcome

of our appeal process." Rotunda concluded, "We anticipate taking a

charge in the June quarter of approximately $800,000 associated

with closing these eleven adjoined stores. Even with the charge,

we're confident that we will achieve at least our guidance of 21

cents earnings per share for the quarter. Discontinuing this

business in Florida will not have a material impact on future

earnings and this action will have no effect on our Florida pawn

operation." EZCORP is primarily a lender or provider of credit

services to individuals who do not have cash resources or access to

credit to meet their short-term cash needs. In 294 U.S. EZPAWN and

26 Mexico Empeno Facil locations open on March 31, 2008, the

Company offers non-recourse loans collateralized by tangible

personal property, commonly known as pawn loans. At these

locations, the Company also sells merchandise, primarily collateral

forfeited from its pawn lending operations, to consumers looking

for good value. In 462 EZMONEY locations, including the eleven

Florida stores to be closed, and 73 EZPAWN locations open on March

31, 2008, the Company offers short-term non- collateralized loans,

often referred to as payday loans, or fee based credit services to

customers seeking loans. This announcement contains certain

forward-looking statements regarding the Company's expected

performance for future periods including, but not limited to, the

expected impact of closing these stores and expected future

earnings. Actual results for these periods may materially differ

from these statements. Such forward-looking statements involve

risks and uncertainties such as changing market conditions in the

overall economy and the industry, consumer demand for the Company's

services and merchandise, changes in the regulatory environment,

and other factors periodically discussed in the Company's annual,

quarterly and other reports filed with the Securities and Exchange

Commission. For additional information, contact Dan Tonissen at

(512) 314-2289. DATASOURCE: EZCORP, Inc. CONTACT: Dan Tonissen of

EZCORP, Inc., +1-512-314-2289 Web site: http://www.ezcorp.com/

Copyright

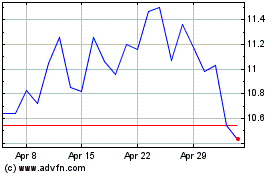

EZCORP (NASDAQ:EZPW)

Historical Stock Chart

From Sep 2024 to Oct 2024

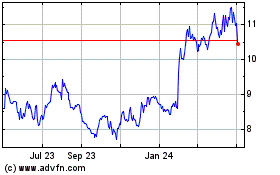

EZCORP (NASDAQ:EZPW)

Historical Stock Chart

From Oct 2023 to Oct 2024